Philadelphia Pennsylvania Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Whether you intend to launch your enterprise, engage in a contract, apply for your identification renewal, or address familial legal matters, you must prepare specific documentation that complies with your regional laws and regulations.

Locating the appropriate documents may consume a significant amount of time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 expertly crafted and validated legal papers for any individual or business situation. All documents are organized by state and area of utilization, making it quick and straightforward to select a copy such as the Philadelphia Resolution of Meeting of LLC Members to Dissolve the Company.

Documents provided by our library are reusable. With an active subscription, you can access all of your previously purchased paperwork at any time in the My documents section of your account. Stop wasting time on a continuous search for current official documentation. Register for the US Legal Forms platform and organize your paperwork with the most extensive online form collection!

- Ensure the sample meets your personal requirements and state legal stipulations.

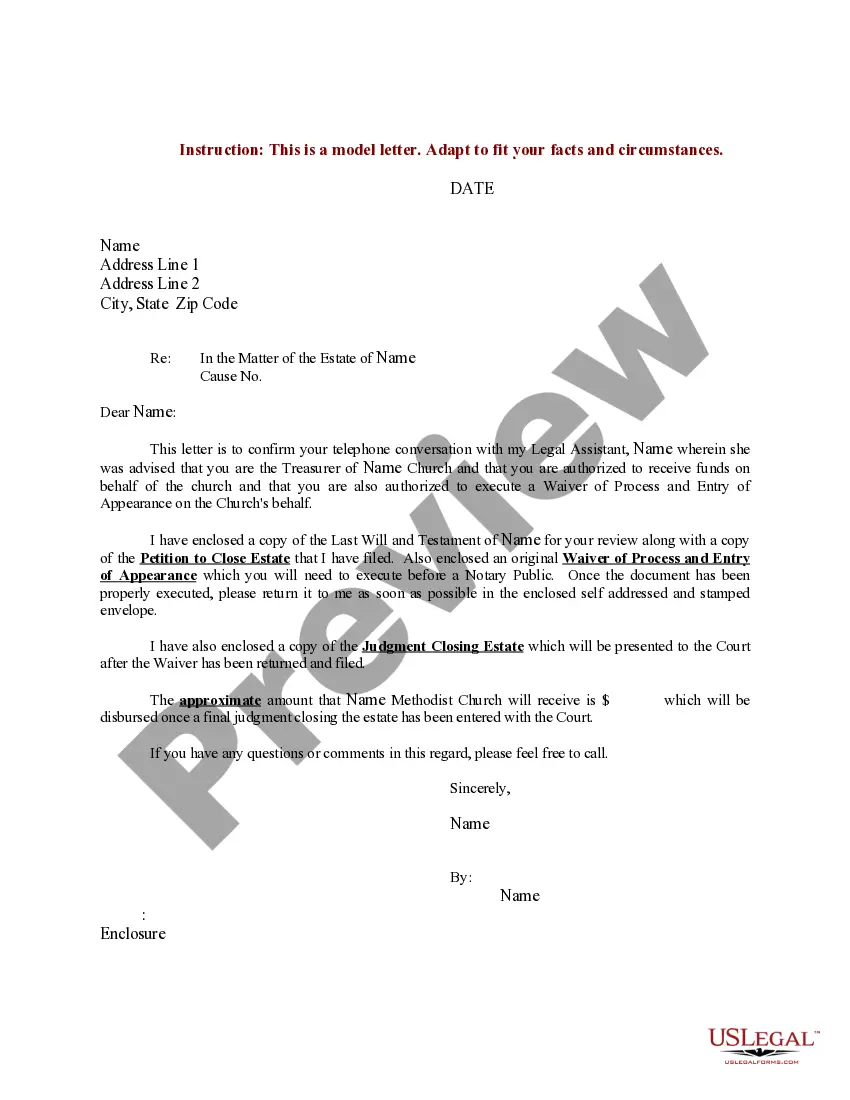

- Read the form description and view the Preview if available on the page.

- Utilize the search bar above to specify your state for finding another template.

- Click Buy Now to acquire the document once you identify the right one.

- Select the subscription plan that best fits your needs to move forward.

- Log in to your account and pay for the service with a credit card or PayPal.

- Download the Philadelphia Resolution of Meeting of LLC Members to Dissolve the Company in your preferred file format.

- Print the document or complete it and sign it electronically through an online editor to conserve time.

Form popularity

FAQ

Dissolving an LLC in California requires a formal process that ends the limited liability company's existence as a business entity registered with the state. If your LLC is currently suspended, you must bring it into good standing before pursuing dissolution.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.

How to Close an Inactive Business Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved.Pay Any Outstanding Bills.Cancel Any Business Licenses or Permits.File Your Final Federal and State Tax Returns.

A certified copy of a resolution to dissolve a corporation is an important document to maintain when it comes time to dissolve a company. This form is required by the IRS along with Form 966.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

To dissolve an LLC in Pennsylvania, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts.... Step 1: Follow Your Pennsylvania LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president. It gives authority to an individual or group to act on behalf of the corporation.

You need to dissolve your entity with the secretary of state or the corporations division in your state by filing a form or two. By dissolving your entity, you ensure that you are no longer liable for paying annual fees, filing annual reports, and paying business taxes.