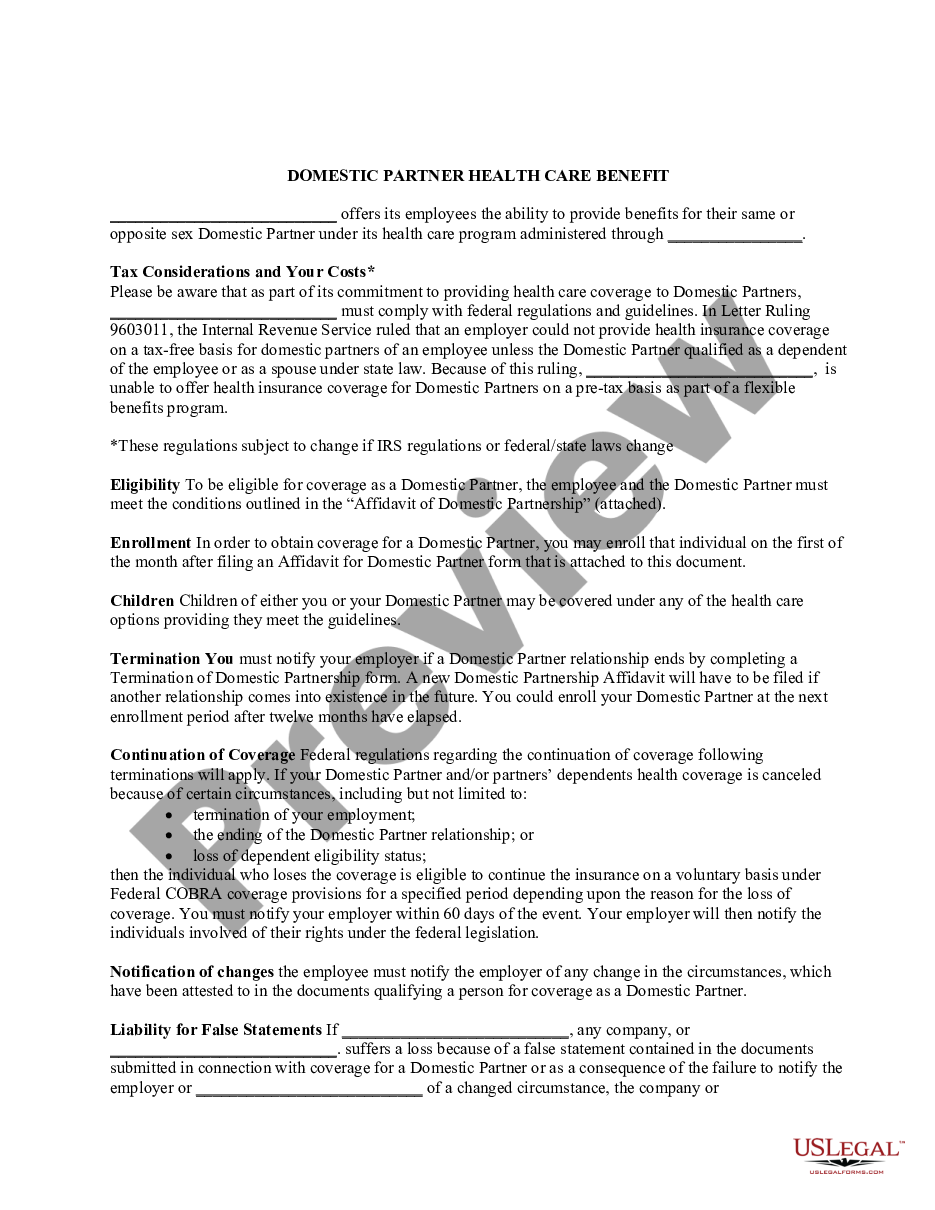

Fulton Georgia Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

Laws and statutes in various domains fluctuate across the nation.

If you're not a lawyer, it can be challenging to navigate a range of regulations concerning the preparation of legal documents.

To prevent costly legal fees when completing the Fulton Domestic Partnership Dependent Certification Form, you require an authenticated template valid for your county.

Select another document if there are discrepancies with any of your requirements. Proceed to click the Buy Now button to acquire the template once you identify the suitable one. Pick one of the subscription plans and log in or establish an account. Decide on your subscription payment method (whether by credit card or PayPal). Choose the desired format for saving the file and click Download. Complete and sign the document on paper after printing it or perform the process electronically. This represents the simplest and most economical method to obtain current templates for any legal needs. Discover them all with just a few clicks and maintain your documentation organized with US Legal Forms!

- That's where utilizing the US Legal Forms platform becomes highly beneficial.

- US Legal Forms boasts a reliable online repository of over 85,000 state-specific legal documents trusted by millions.

- It serves as an excellent resource for professionals and individuals looking for do-it-yourself templates for various personal and business situations.

- All forms are reusable: as soon as you acquire a sample, it remains accessible in your profile for future use.

- Thus, if you possess an account with an active subscription, you can simply Log In and redownload the Fulton Domestic Partnership Dependent Certification Form from the My documents section.

- For new users, a few additional steps are necessary to procure the Fulton Domestic Partnership Dependent Certification Form.

- Review the page content to confirm you have located the correct sample.

- Utilize the Preview feature or examine the form description if it exists.

Form popularity

FAQ

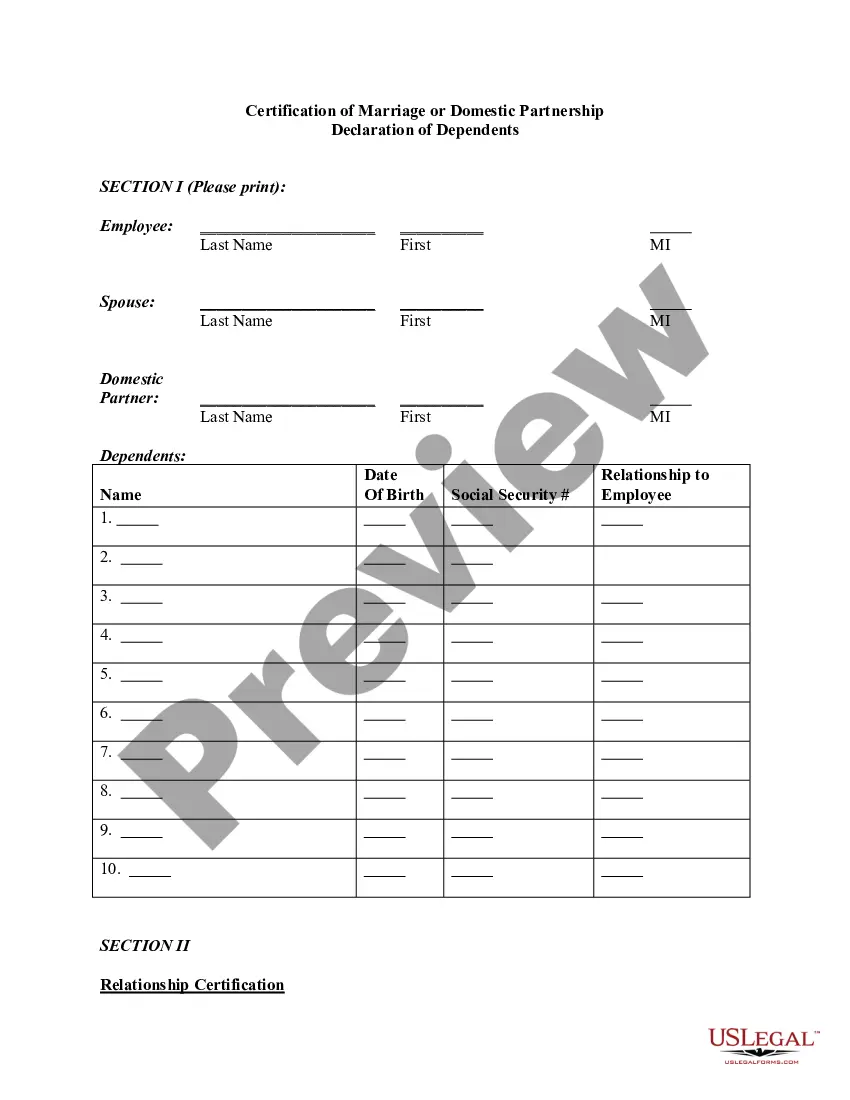

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

Besides your child and spouse, you can include other relatives as dependents under certain conditions, namely: If no one else has named them as a dependent. If their gross annual income is less than $3,000. If you are responsible for providing more than half of the financial support they rely on.

To claim your domestic partner as a dependent on your taxes, your partner must meet the requirements of a qualifying dependent. Your partner must have lived with you the entire year and you must have paid at least half of your partner's support.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

For example, if you will be including your spouse in your medical coverage and designating him or her as a recipient of your life insurance, then your spouse is both a dependent and a beneficiary.

Domestic partners and same sex spouses, therefore, can submit only state tax returns based on the rules of the state where they are domiciled. Also, even if domestic partners can file a joint state tax return, they can only file individual federal tax returns unless they are legally married.

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.

The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. The only way to claim a domestic partner as a dependent and also file under the Head of Household filing status is also to have another qualifying dependent on your return.

To register, you need to provide a government-issued photo ID listing your address or other proof that you reside together, such as a utility bill. You must also assert that you are at least 18 years old, are not currently in another domestic partnership agreement, and are not legally married or separated.