Mecklenburg North Carolina Declaration of Gift with Signed Acceptance by Donee

Description

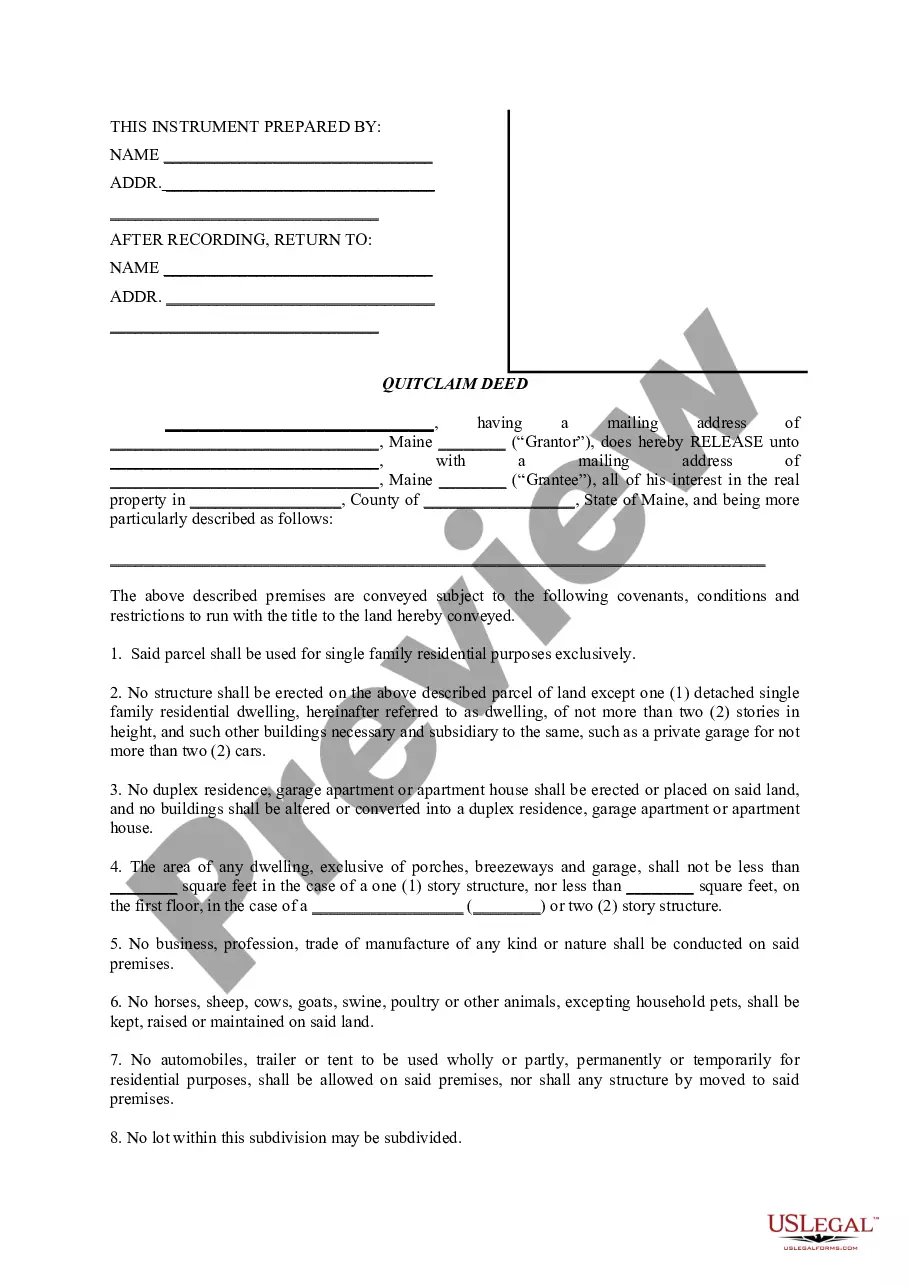

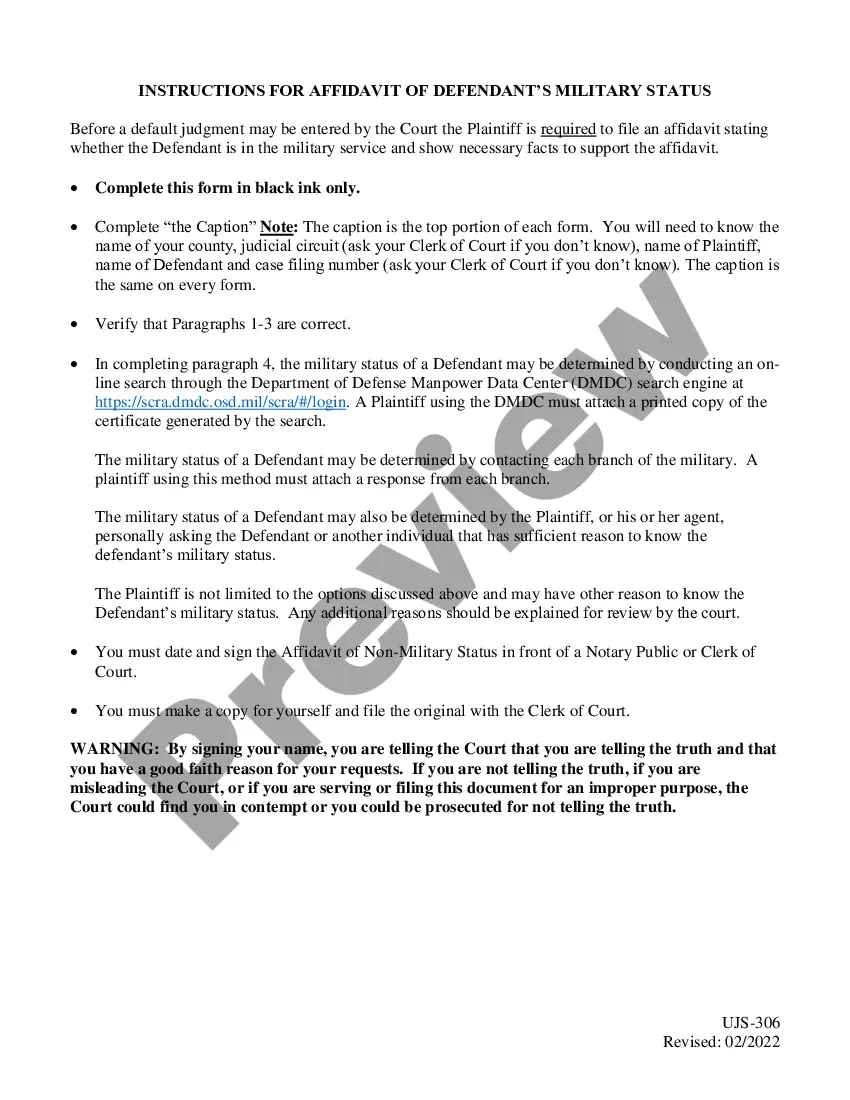

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

Are you seeking to swiftly create a legally-enforceable Mecklenburg Declaration of Gift with Signed Acceptance by Donee, or perhaps another document to manage your personal or business affairs.

You have two choices: employ a specialist to craft a legal document for you or compose it entirely by yourself. Fortunately, there's a third choice - US Legal Forms. This service will assist you in obtaining well-drafted legal documents without incurring excessive charges for legal assistance.

Begin the search anew if the document does not meet your expectations by using the search box in the header.

Select the plan that most aligns with your requirements and proceed to payment. Choose the format in which you wish to receive your document and download it. Print it, fill it out, and sign where indicated. If you have already registered an account, you can easily Log In to it, locate the Mecklenburg Declaration of Gift with Signed Acceptance by Donee template, and download it. To re-download the document, simply go to the My documents tab. It is straightforward to purchase and download legal documents using our catalog. Furthermore, the forms we provide are regularly updated by legal experts, enhancing your confidence in managing legal affairs. Try US Legal Forms today and witness the difference!

- US Legal Forms provides a vast assortment of over 85,000 state-compliant form templates, including the Mecklenburg Declaration of Gift with Signed Acceptance by Donee and related form packages.

- We have templates for various scenarios: from divorce documentation to real estate forms.

- With over 25 years of experience, we've established an impeccable reputation among our clients.

- Here's how you can join them and acquire the necessary template without hassle.

- First, thoroughly check if the Mecklenburg Declaration of Gift with Signed Acceptance by Donee conforms to your state or county regulations.

- If the form contains a description, ensure it states what it's intended for.

Form popularity

FAQ

A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan. The person who gave you the money must write and sign the gift letter as well as provide their personal information.

A Gift Affidavit is a sworn statement that can be used to document the gifting of property. If you've received or given a gift, you might have to prove it wasn't a loan or financial transaction with a Gift Affidavit.

Here's what your gift letter should include: The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date the funds were transferred. A statement from the donor that no repayment is expected. The donor's signature. The address of the property being purchased.

Here's what your gift letter should include: The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date the funds were transferred. A statement from the donor that no repayment is expected. The donor's signature. The address of the property being purchased.

A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan. The person who gave you the money must write and sign the gift letter as well as provide their personal information.

When you apply for a mortgage, lenders need to know the money you use for your down payment is yours, not a loan. You'll need to get a gift letter from the person who gives you money. A gift letter assures your lender that the sudden influx of cash in your account is a gift and not a loan.

Contain the name of the person who signed the letter. Contain the name of the person receiving the gift. Confirm the gift amount. Confirm that the gift is unconditional, non repayable and non refundable.

A gift letter (a written statement that includes, among other things, the amount of the gift and confirmation that it doesn't have to be paid back) Evidence of the transfer of funds.

It also means that you aren't borrowing a higher percentage of the property value. Most banks will want those giving the cash gift to write a letter, or, complete a statutory declaration confirming the funds are a non-refundable gift.

More specifically, if the combined fair market value of all gifts in a year to any one person is $14,000 or less, most gifts need not be reported on a federal gift tax return.