Santa Clara California Comprehensive Agreement Between Board Member and Corporation

Description

How to fill out Comprehensive Agreement Between Board Member And Corporation?

Handling legal documents is essential in the modern world. Nevertheless, professional assistance is not always necessary to draft some of them from scratch, including the Santa Clara Comprehensive Agreement Between Board Member and Corporation, using a service like US Legal Forms.

US Legal Forms features over 85,000 templates across various categories, ranging from living wills to real estate documents to divorce filings. All forms are classified by their corresponding state, simplifying the search process.

You can also access information resources and guidance on the website, making any tasks associated with paperwork completion more straightforward.

If you are already a subscriber to US Legal Forms, you can find the desired Santa Clara Comprehensive Agreement Between Board Member and Corporation, Log In to your account, and download it. Naturally, our platform cannot fully substitute a legal expert. If you encounter a particularly complicated issue, we recommend consulting a lawyer to review your document before signing and filing it.

With more than 25 years in the business, US Legal Forms has become the preferred platform for a wide variety of legal forms for millions of users. Join them today and obtain your state-compliant documents effortlessly!

- Review the document's preview and outline (if available) to obtain a general understanding of what you will receive after downloading it.

- Ensure that the document you choose is tailored to your state/county/region, as state regulations can affect the legitimacy of certain records.

- Examine the related forms or restart your search to locate the correct document.

- Click Buy now and set up your account. If you already have one, choose to Log In.

- Select the pricing {plan, then a required payment option, and purchase the Santa Clara Comprehensive Agreement Between Board Member and Corporation.

- Choose to save the form template in any available file type.

- Navigate to the My documents tab to re-download the document.

Form popularity

FAQ

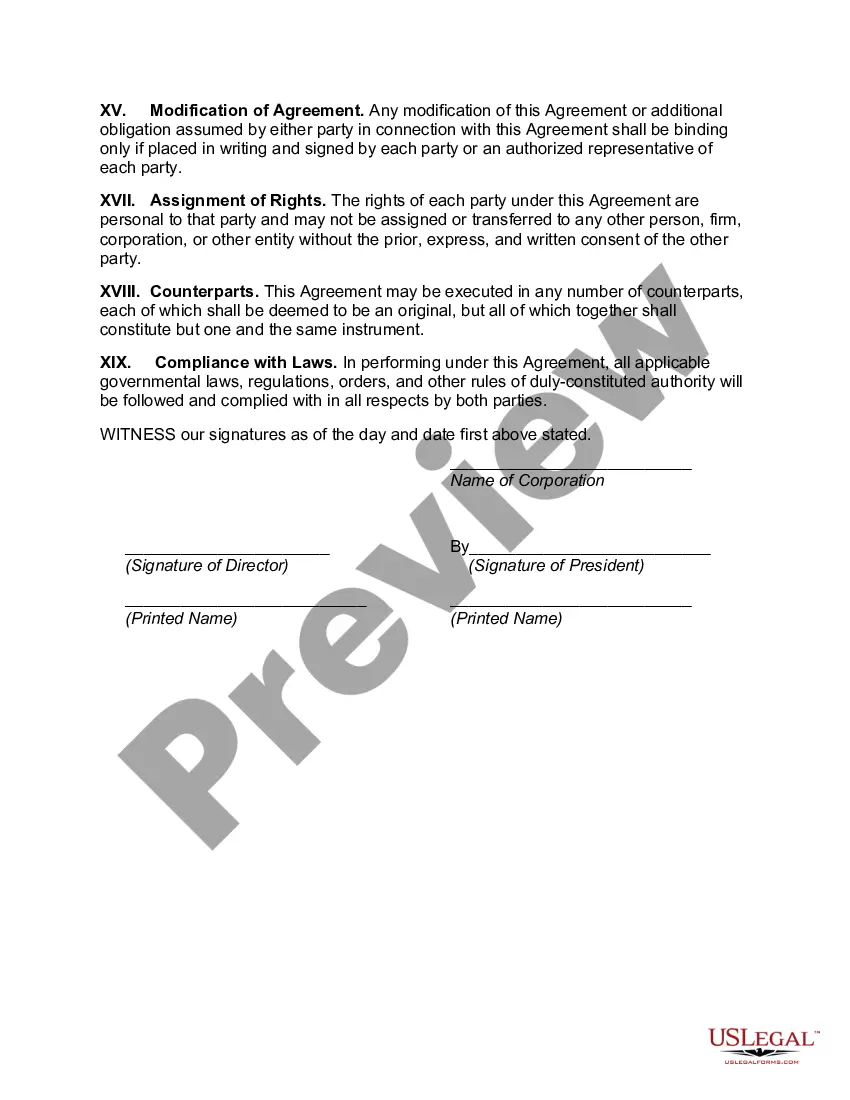

An agreement to join the board of directors is a formal document that specifies the terms under which a person accepts a position on the board. This includes the scope of their duties, rights, and potential liabilities. For smooth governance, it is critical to have a Santa Clara, California comprehensive agreement between board member and corporation in place.

Joining the board of directors means becoming part of a governing body responsible for overseeing the management of a corporation. It involves making strategic decisions, setting policies, and ensuring the organization meets its legal obligations. The Santa Clara, California comprehensive agreement between board member and corporation provides a framework for these responsibilities.

In some cases, the probate process in California can take as little as nine months, but that is rare. It typically takes anywhere from half a year to eighteen months, and complicated cases may take as long as two years or more.

The California Probate Code says that a Petition for Order for Final Distribution should be filed within 1 year from issuance of letters of administration, in an estate where no federal tax return is required.... TYPE OF FILINGDEADLINESCal. Prob. CodeAccount· 1 year after issuance of letters§1095039 more rows ?

File the original claim with the probate filing clerk. You must file the claim with the court before the LATER of (a) four months after the date letters (authority to act for the estate) were first issued to the personal representative, or (b) sixty days after the date the Notice of Administration was sent to you.

Distributions to heirs and beneficiaries: 2 to 4 months After all the decedent's debts and bills have been paid, the remaining assets can be dutifully divided amongst the heirs and beneficiaries, according to the will. If there is no will, then the assets can be divided equally amongst living heirs.

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate. The Grant of Probate is the document obtained from the court which gives the legal authority for you to deal with the estate.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.