Aurora Colorado Corporate Cross Purchase Agreement

Category:

State:

Multi-State

City:

Aurora

Control #:

US-0920BG

Format:

Word;

Rich Text

Instant download

Description

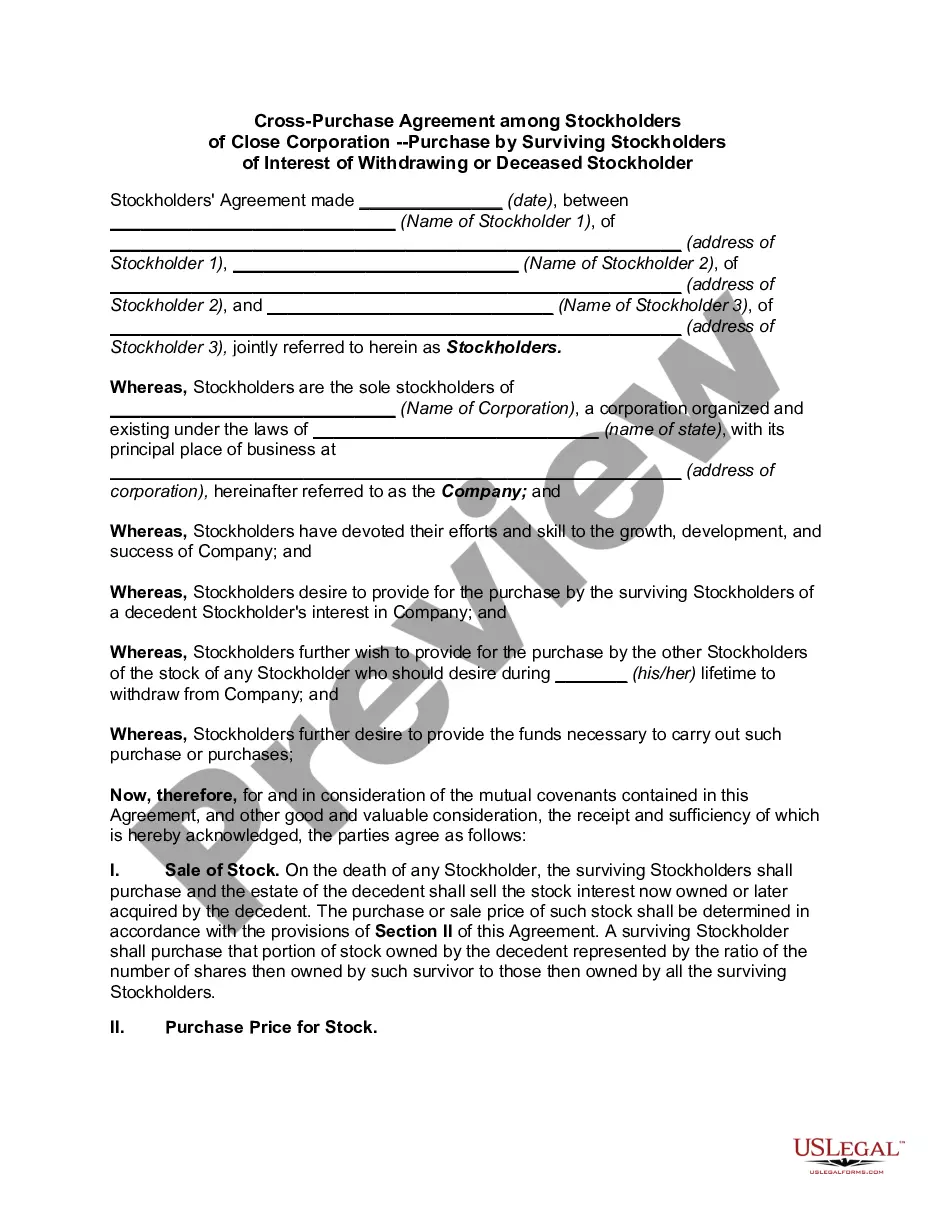

A cross-purchase agreement sets forth how ownership in a business transfers if the owner dies, retires or becomes disabled. The parties to a cross-purchase agreement always include a seller and a buyer. Cross-purchase agreements aim to ensure that sellers (or their beneficiaries) receive and buyers pay a fair price for their interests.

Some cross-purchase agreements use a dollar amount to calculate the buy-out price, while others use a formula. A valuation of the interest that is the subject of the agreement should be made periodically.

Some cross-purchase agreements use a dollar amount to calculate the buy-out price, while others use a formula. A valuation of the interest that is the subject of the agreement should be made periodically.

Free preview