Kings New York LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Laws and statutes in every field differ across the nation.

If you're not an attorney, it's simple to become confused by various regulations when it comes to creating legal documents.

To evade costly legal support when drafting the Kings LLC Operating Agreement for S Corp, you require a verified template applicable to your area.

- That's when utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reliable online repository favored by millions, containing over 85,000 specific legal forms for various states.

- It's an outstanding resource for professionals and individuals looking for do-it-yourself templates for different life and business situations.

- All the forms can be reused multiple times: once you acquire a sample, it stays available in your account for further access.

- Thus, if you possess an account with an active subscription, you can simply Log In and re-download the Kings LLC Operating Agreement for S Corp from the My documents section.

- For new users, it's essential to follow a few additional steps to obtain the Kings LLC Operating Agreement for S Corp.

- Examine the page content to ensure you have located the appropriate sample.

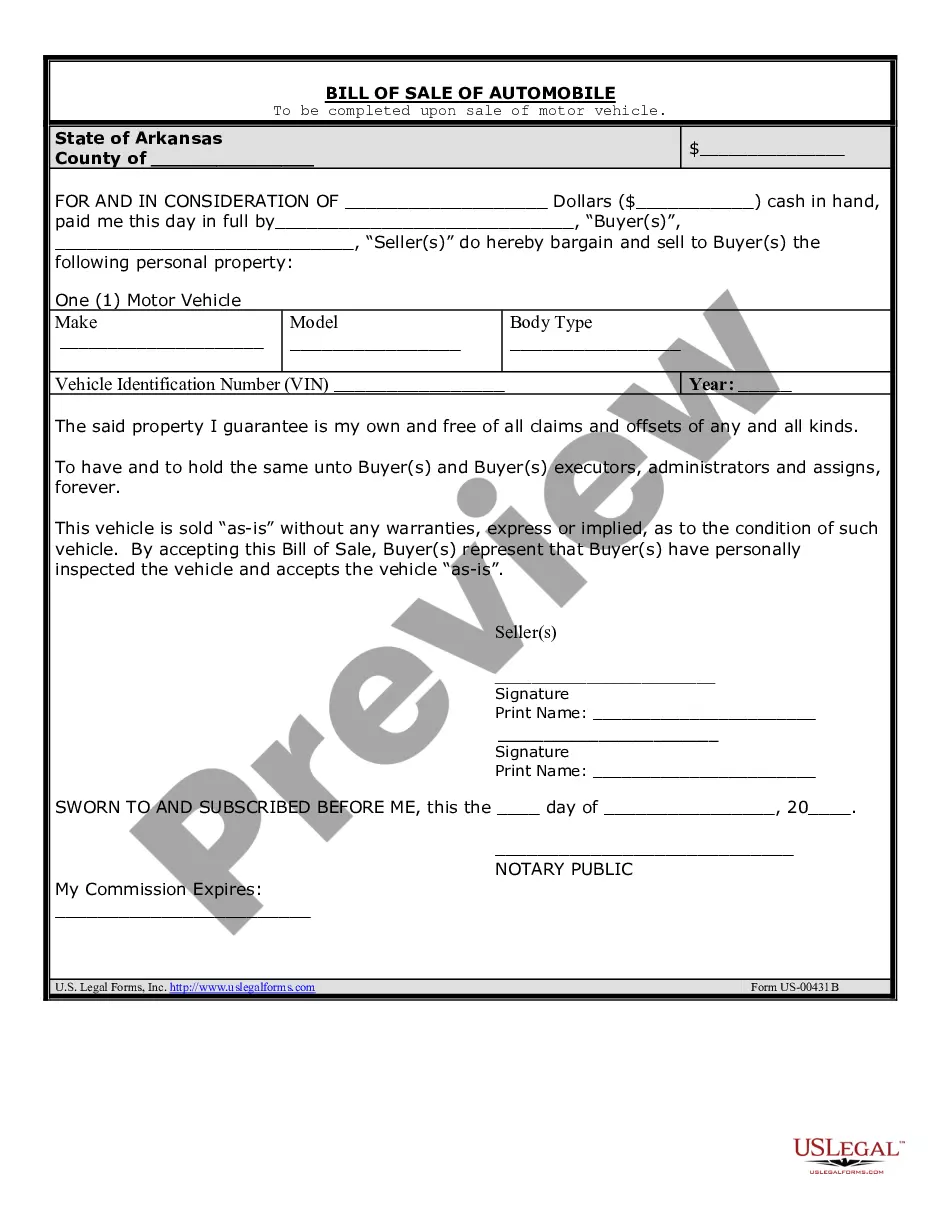

- Utilize the Preview feature or read the form description if available.

Form popularity

FAQ

Bylaws are internal governing documents for corporations, while an operating agreement lays out internal operating procedures for an LLC.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

After you get an S corp entity, you need to register it with state authorities, and you would need to file an articles of incorporation document and establish bylaws, which would be similar to an operating agreement filed with LLCs. Such documentation establishes the operating parameters of a newly-created business.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

What should an LLC operating agreement include? Basic company information. Member and manager information. Additional provisions. Protect your LLC status. Customize the division of business profits. Prevent conflicts among owners. Customize your governing rules. Clarify the business's future.

How do you change the operating agreement for an LLC? An LLC can change its operating agreement at any time. The operating agreement itself should include a process for making changes. A single-member LLC owner can work with their attorney to make the changes, making sure that the date of the changes is documented.

member LLC operating agreement is a legal contract that outlines the agreedupon ownership structure and sets forth the governing terms for a multimember LLC. In addition, it sets clear expectations about each member's powers, roles, and responsibilities.

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders.Have no more than 100 shareholders. Have only one class of stock.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.