Nassau New York LLC Operating Agreement for Shared Vacation Home

Description

How to fill out LLC Operating Agreement For Shared Vacation Home?

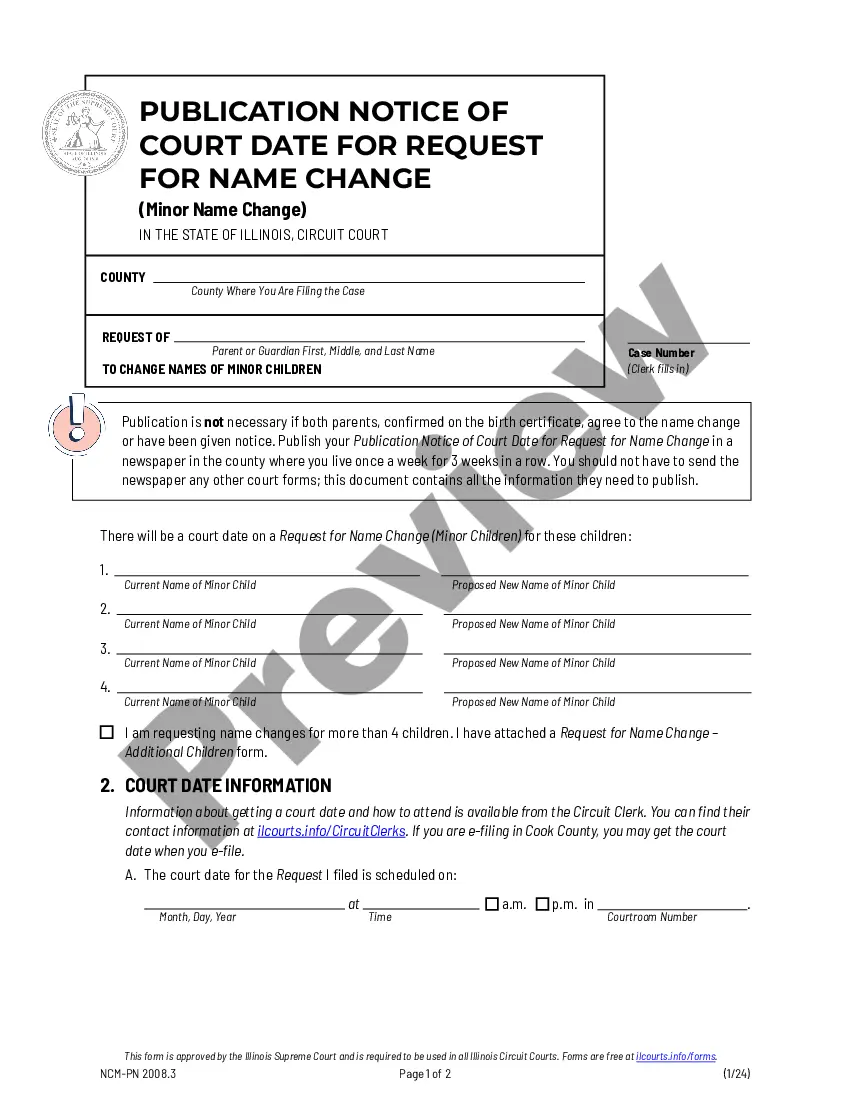

Whether you plan to establish your enterprise, engage in a contract, request an update for your identification, or address familial legal issues, it's essential to gather certain documentation that complies with your regional statutes and guidelines.

Locating the appropriate documents can consume significant time and energy unless you utilize the US Legal Forms library.

The service offers users access to over 85,000 expertly prepared and verified legal templates for any personal or business situation. All files are organized by state and application area, making it quick and straightforward to select a form like Nassau LLC Operating Agreement for Shared Vacation Home.

Documents available on our website are reusable. With an active subscription, you can access all your previously obtained documents anytime in the My documents section of your profile. Stop expending time on a continuous search for current official paperwork. Register for the US Legal Forms platform and maintain your documents in order with the most extensive online form repository!

- Ensure the template aligns with your personal requirements and state law stipulations.

- Review the form description and inspect the Preview if available on the site.

- Utilize the search feature provided above with your state to find an alternative template.

- Click Buy Now to obtain the document once you identify the correct one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Nassau LLC Operating Agreement for Shared Vacation Home in your preferred file format.

- Print the document or complete and sign it electronically through an online editor to save time.

Form popularity

FAQ

LLC Operating Agreement (template + instructions) - YouTube YouTube Start of suggested clip End of suggested clip The name and address of the registered office and registered agent the general business purpose ofMoreThe name and address of the registered office and registered agent the general business purpose of the LLC. The members percentages of ownership. And the names of the members. And their addresses.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

If the property is a rental, by default rental income or loss is considered passive. Generally, passive losses can only be used to offset other passive income in any given year.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

LLCs for Airbnb: The Bottom Line Yes, absolutely. Starting an LLC can protect your personal assets in the long run, but it will cost a bit of investment in the short-term.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

You might put property into an LLC for two main reasons: To capitalize your business. A new business needs assets to get off the ground, and owners typically make capital contributions that might consist of cash, personal property, or real estate.For liability protection when you own investment real estate.

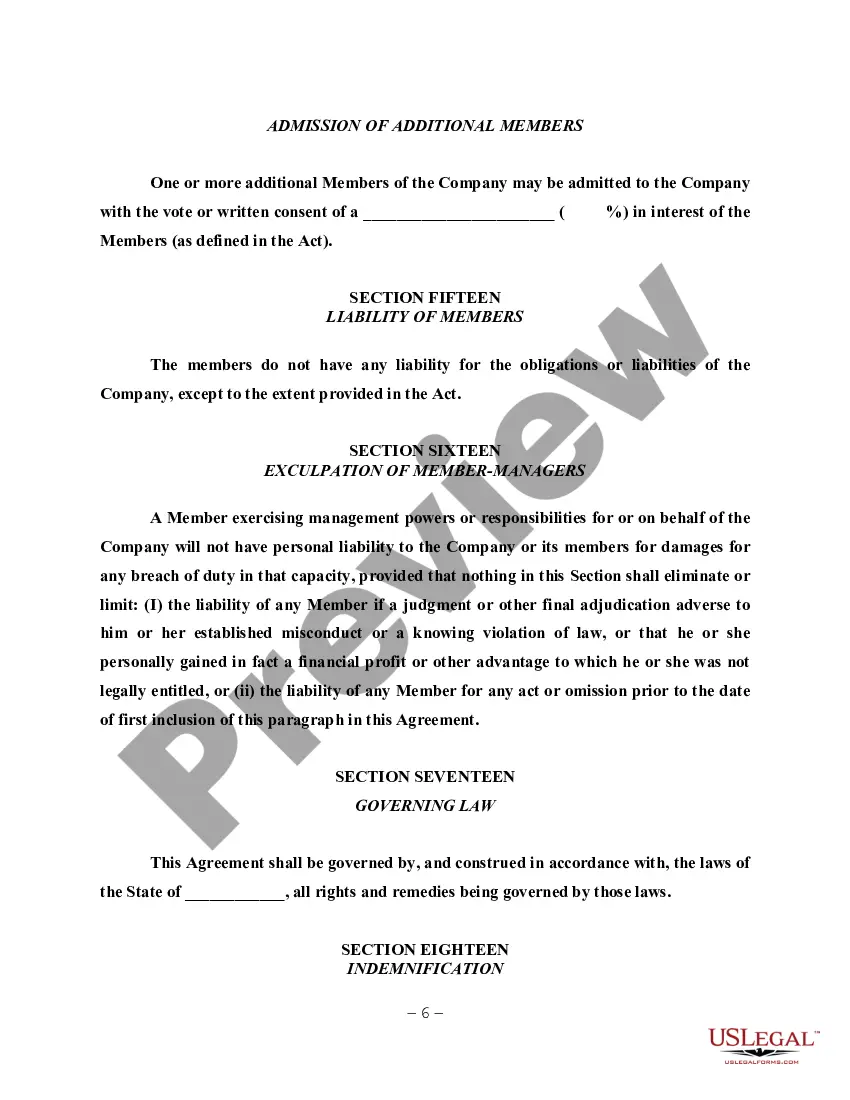

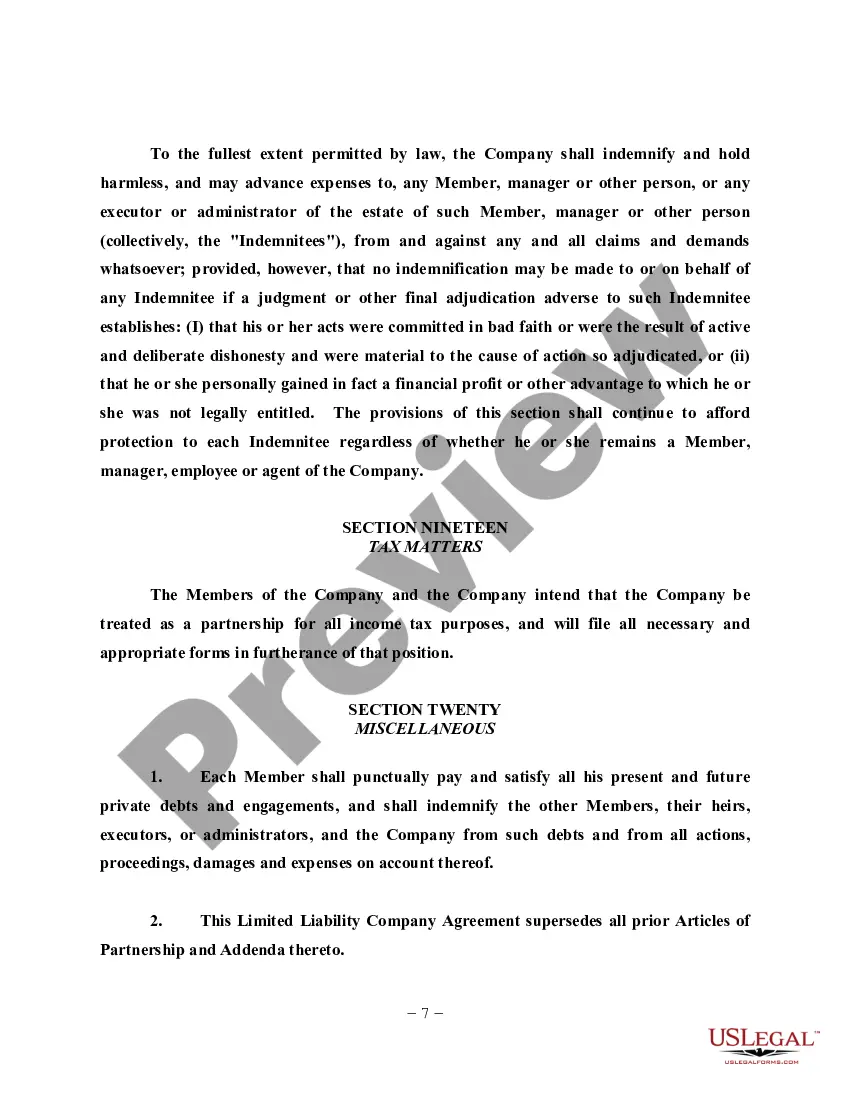

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

What should an LLC operating agreement include? Basic company information. Member and manager information. Additional provisions. Protect your LLC status. Customize the division of business profits. Prevent conflicts among owners. Customize your governing rules. Clarify the business's future.

Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision. Where should operating agreements be kept? Operating agreements should be kept with the core records of your business.