Middlesex Massachusetts Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

Whether you intend to launch your enterprise, engage in an agreement, request your identification renewal, or address family-related legal issues, you must organize specific documents in accordance with your local statutes and regulations.

Locating the appropriate paperwork may consume a significant amount of time and effort unless you utilize the US Legal Forms library.

The service offers users over 85,000 expertly crafted and validated legal documents for any personal or business situation. All documents are categorized by state and area of application, making it straightforward and effortless to choose a document like the Middlesex Qualifying Subchapter-S Revocable Trust Agreement.

Documents offered by our library are reusable. With an active subscription, you can access all of your previously acquired documents at any time from the My documents section of your account. Stop squandering time on a perpetual quest for current formal paperwork. Join the US Legal Forms platform and organize your documents with the most extensive online form library!

- Ensure the template fulfills your personal requirements and complies with state legislation.

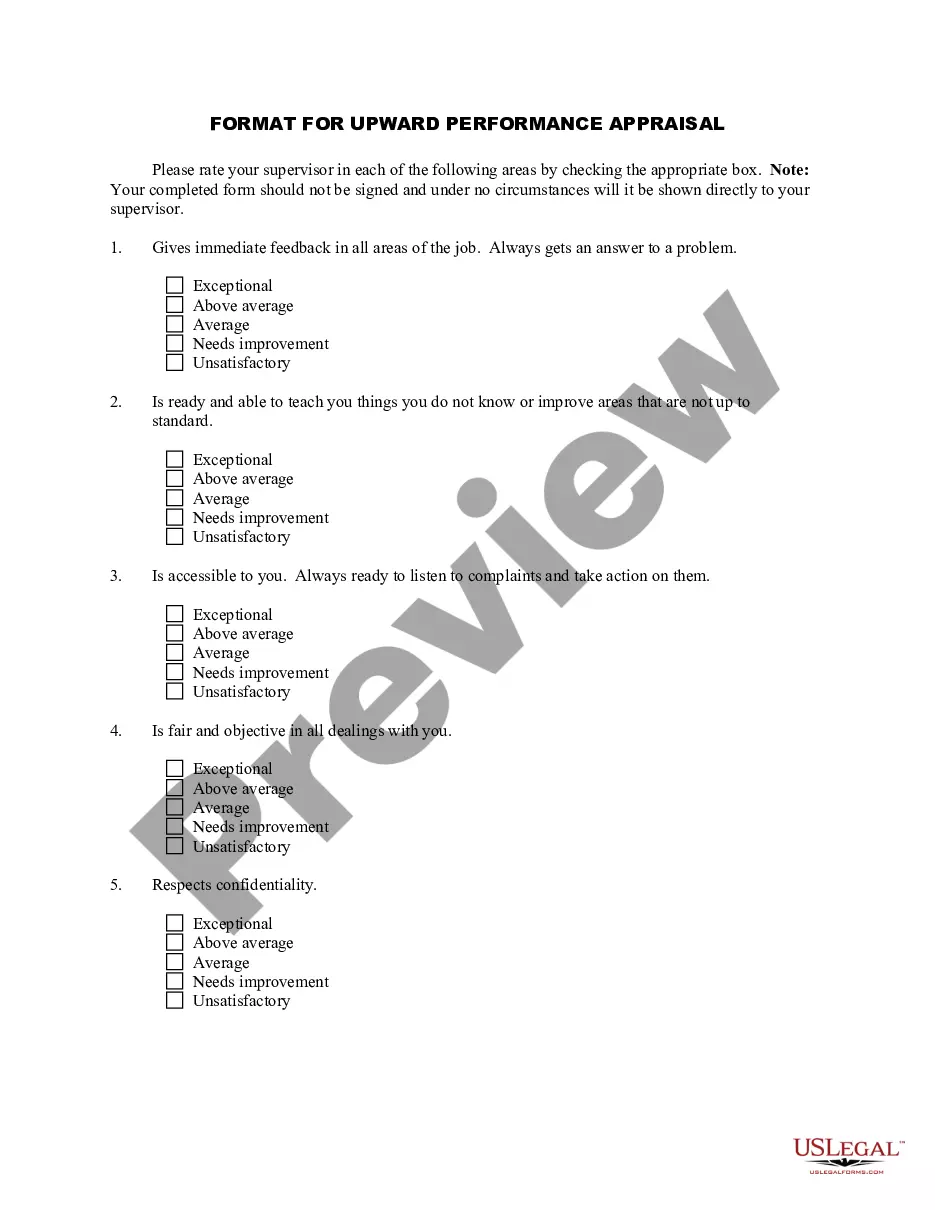

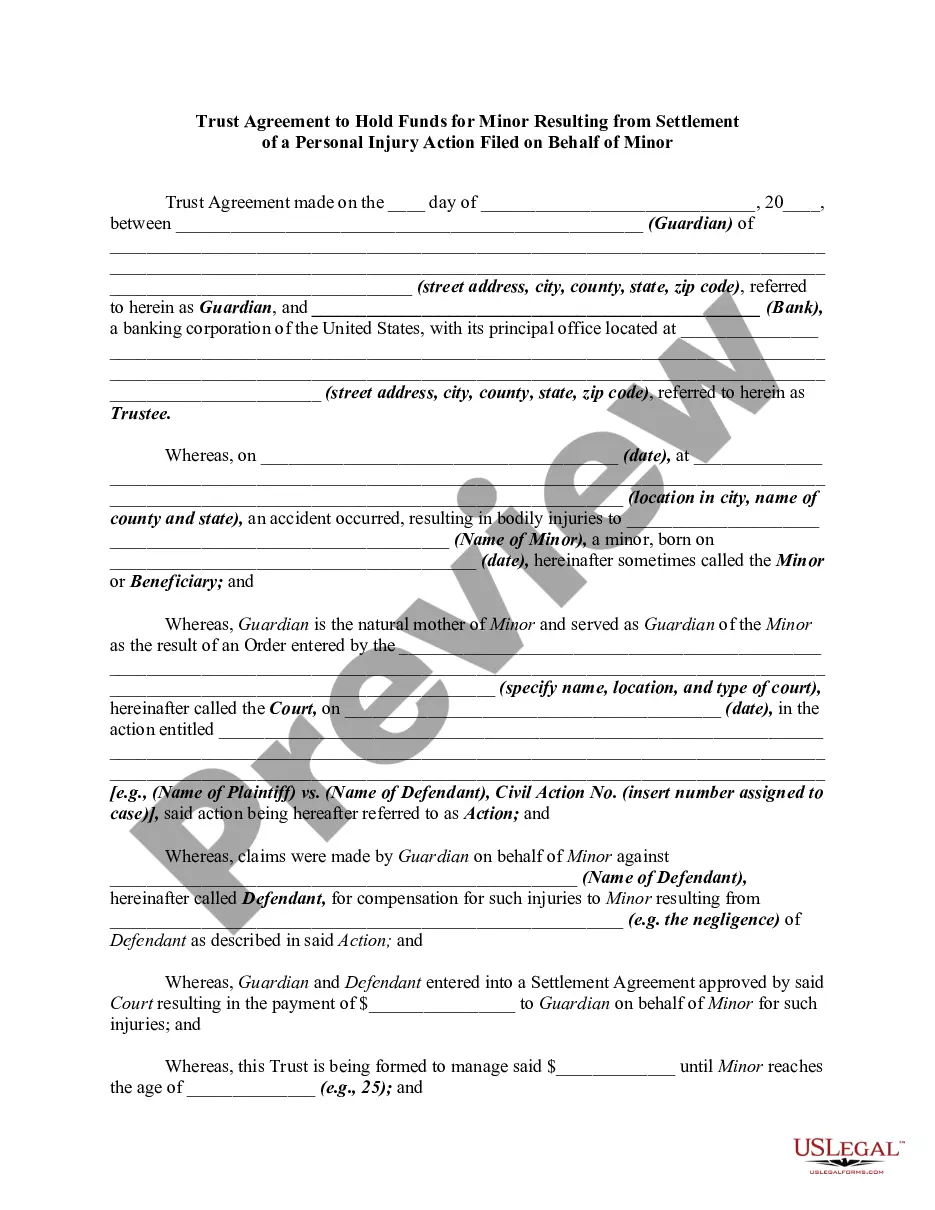

- Review the form description and examine the Preview if available on the webpage.

- Utilize the search bar indicating your state above to locate an alternative template.

- Click Buy Now to obtain the document once you identify the appropriate one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and settle the payment using a credit card or PayPal.

- Download the Middlesex Qualifying Subchapter-S Revocable Trust Agreement in your desired file format.

- Print the document or complete it and sign it electronically with an online editor to save time.

Form popularity

FAQ

This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Testamentary trusts. This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

If a trust is a grantor trust, a QSST, or an ESBT, it can be a qualified shareholder in an S corporation.

In the most common scenario, in order for a grantor trust, such as a joint revocable trust, to remain an S-corporation shareholder, the trust should allow for the distribution of the S-corporation stock to a permissible shareholder within two years after your death.

The Internal Revenue Code specifies broad categories of trusts that qualify as S shareholders. One of these, the qualified Subchapter S trust (QSST), is modeled after the grantor trust. It is eligible to hold stock in an S corporation, and, under the S corporation rules, it is treated as a Subpart E trust (Sec.

As an initial matter, as long as the business owner is living, his or her revocable trust is treated as a grantor trust for income tax purposes, and as such, is an eligible S corporation shareholder.

In an estate planning context, it's critical that any trusts that will receive S corporation stock through operation of your estate plan be eligible shareholders. Which trusts are eligible? Grantor trusts.Testamentary trusts.QSSTs.ESBTs.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Three commonly used types of ongoing trusts qualify as S corporation shareholders: grantor trusts, qualified subchapter S trusts (QSSTs) and electing small business trusts (ESBTs).

An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.