Riverside California Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

How long does it typically take you to draft a legal document.

Considering that each state has its laws and regulations for every life situation, finding a Riverside Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children that meets all local criteria can be daunting, and obtaining it from a professional attorney is frequently costly.

Several online platforms provide the most prevalent state-specific templates for download, but utilizing the US Legal Forms database is the most advantageous.

Click Buy Now when you’re confident in the selected document.

- US Legal Forms is the largest online collection of templates, organized by states and areas of application.

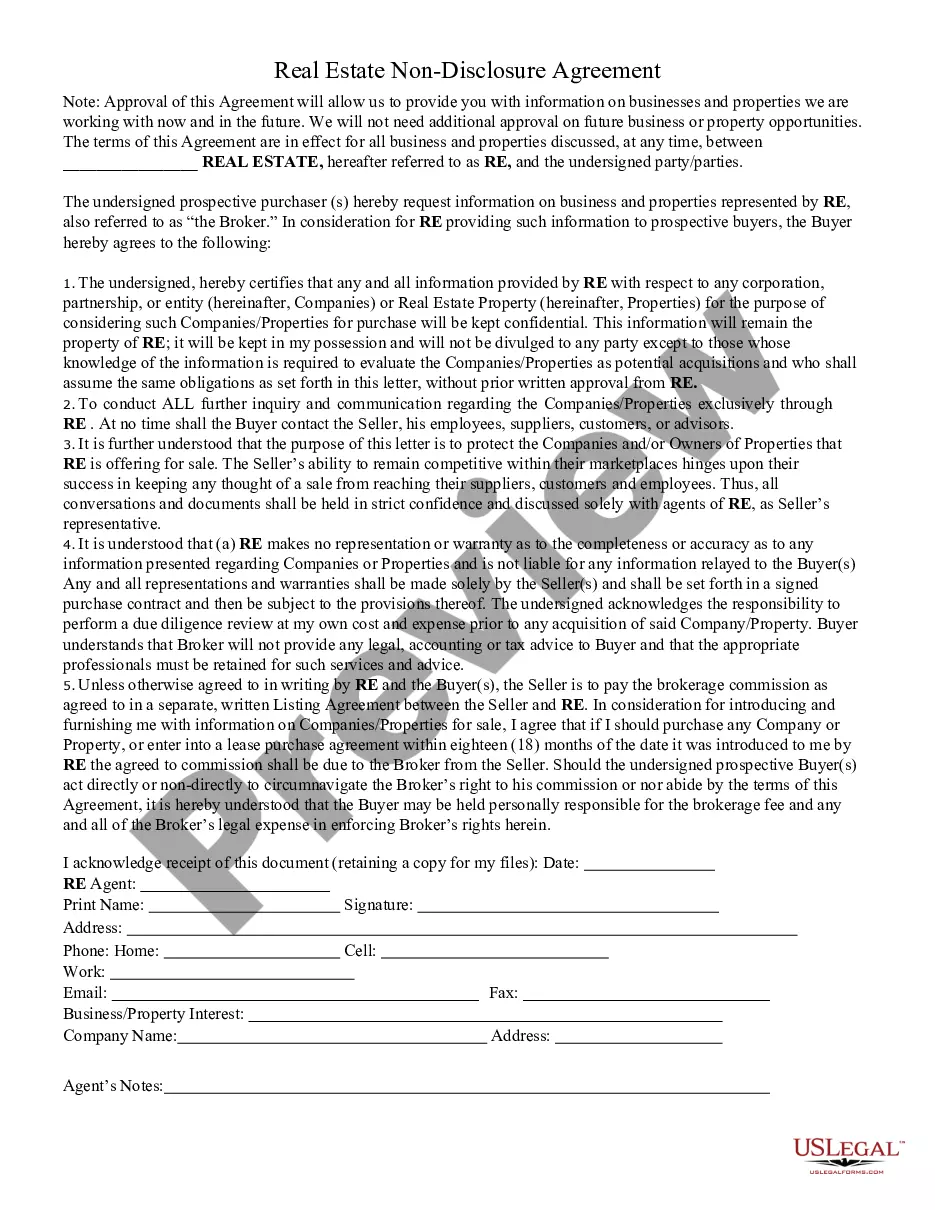

- In addition to the Riverside Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, you can acquire any particular form for managing your business or personal matters, adhering to your local regulations.

- Experts review all samples for their relevance, assuring you can prepare your documents accurately.

- Using the service is fairly easy.

- If you already have an account on the site and your subscription is active, you simply need to Log In, select the required form, and download it.

- You can access the document in your profile at any later time.

- However, if you are new to the site, there will be additional steps to complete before obtaining your Riverside Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Review the content of the page you’re currently on.

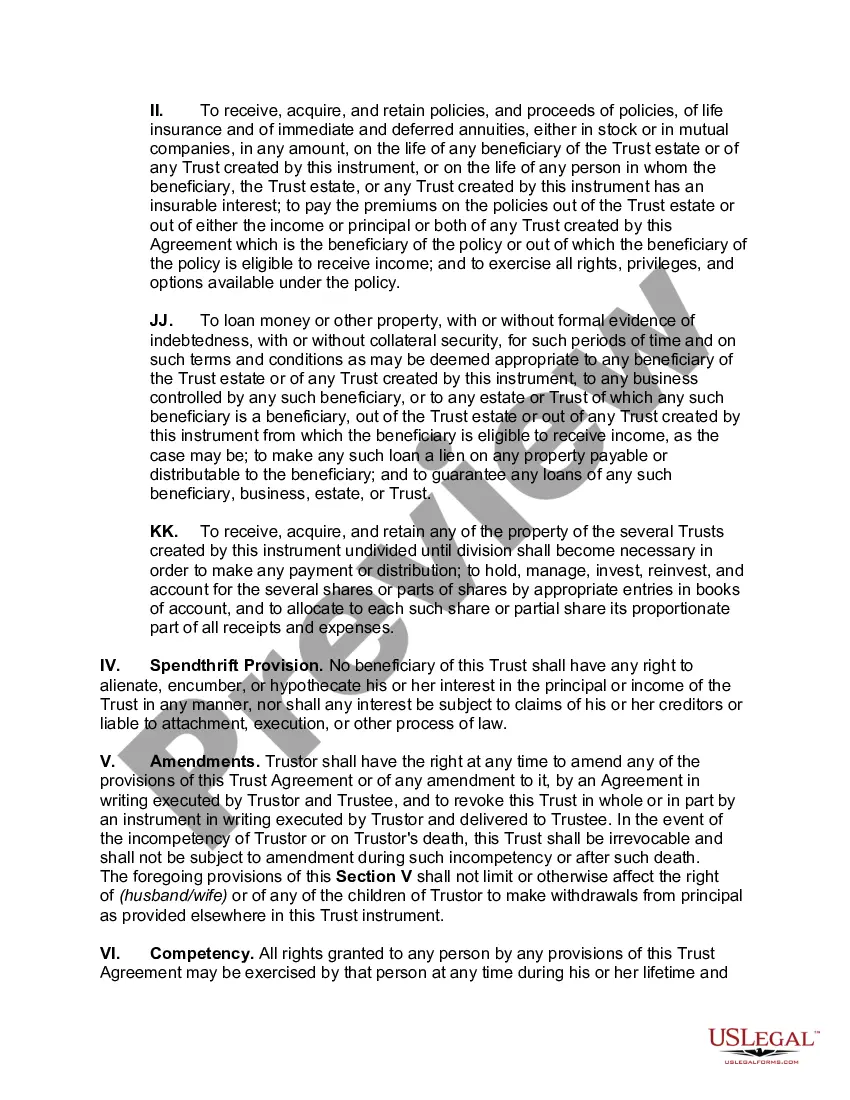

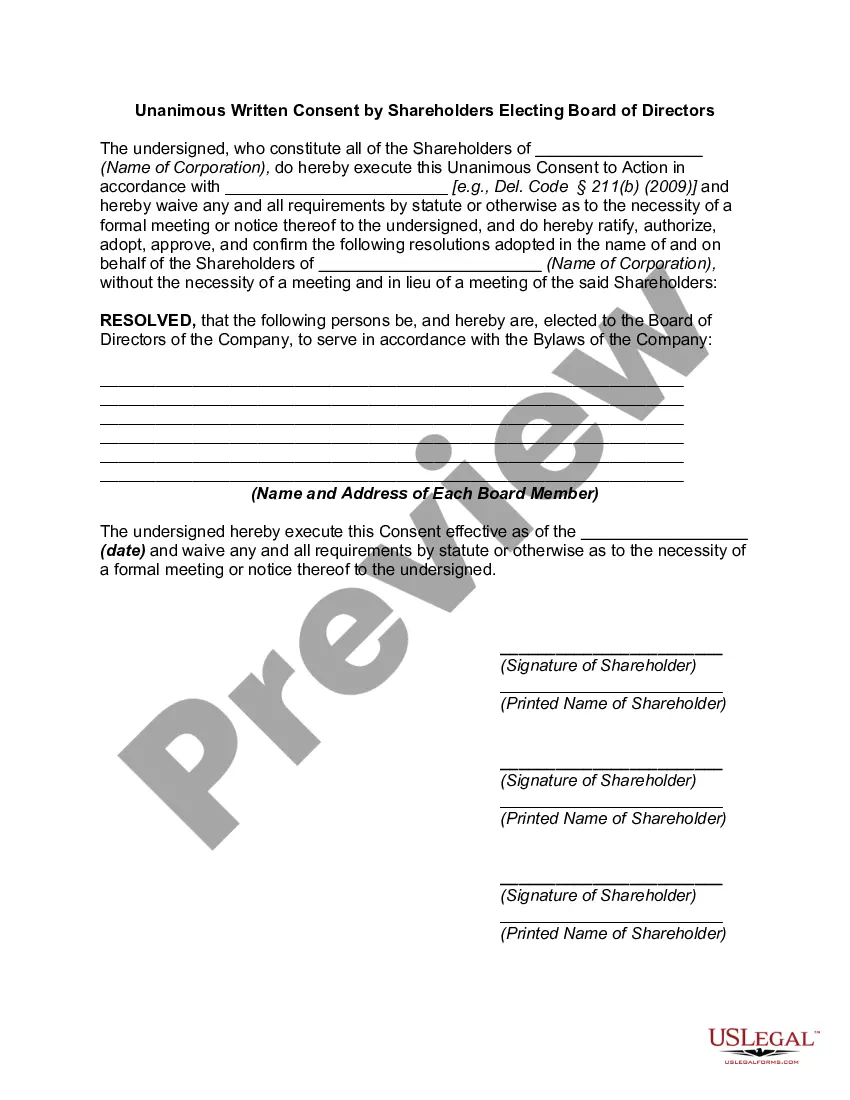

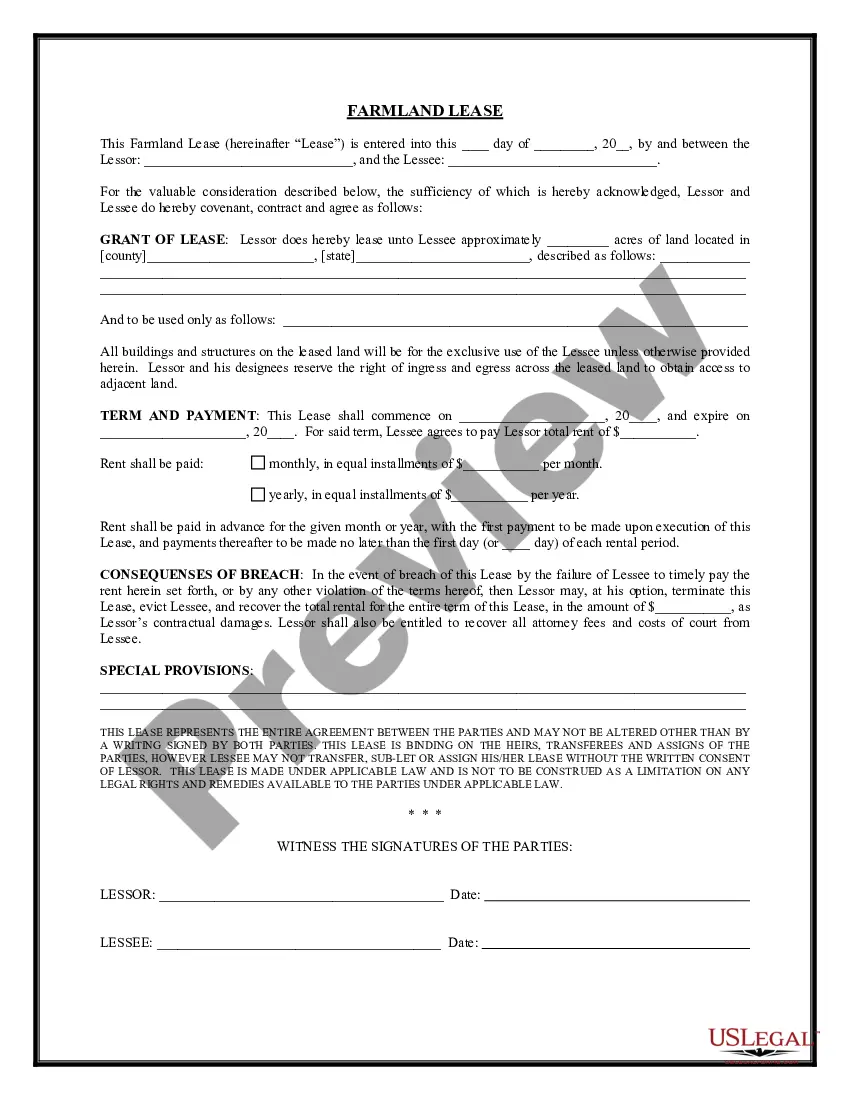

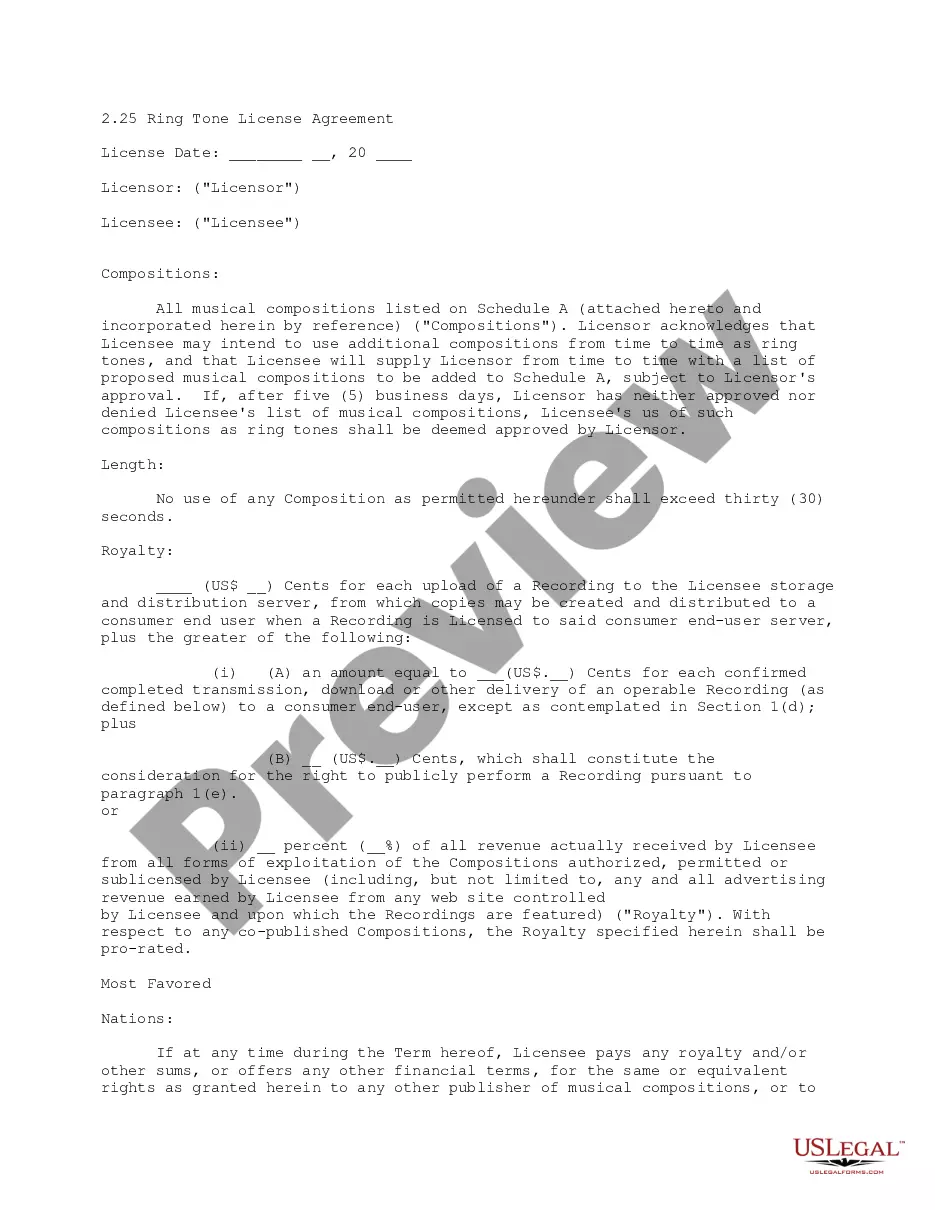

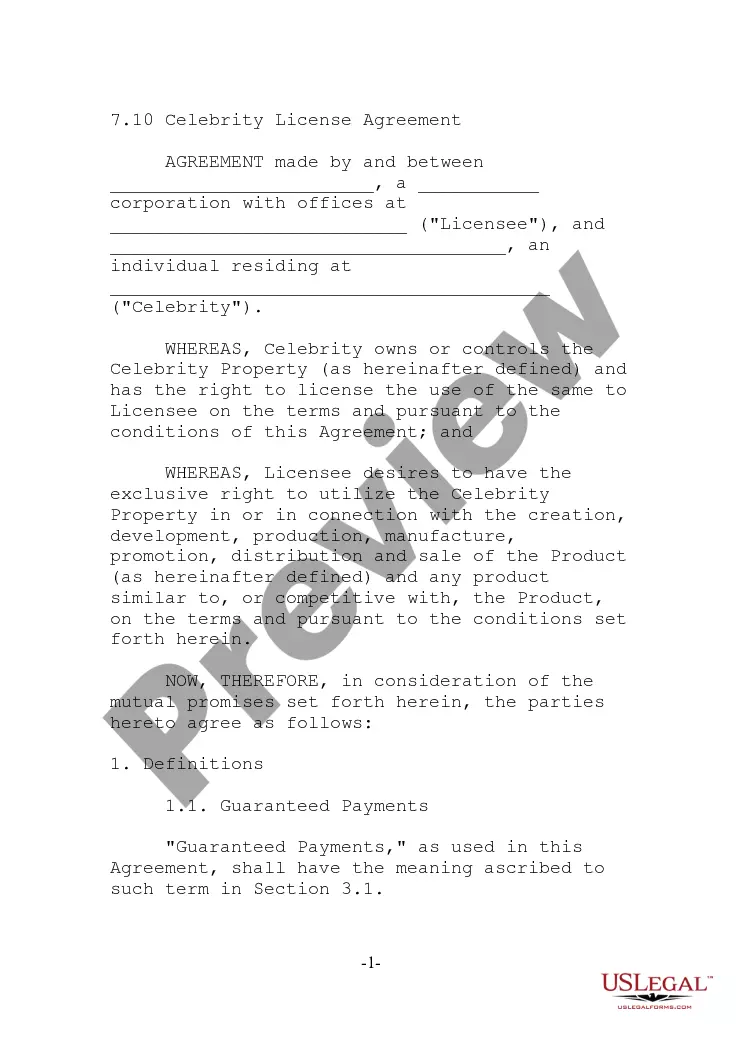

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

Form popularity

FAQ

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

A lifetime trust can apply to any trust you create and will last for the lifetime of the beneficiary or beneficiaries. It can be applied to an irrevocable trust, a revocable living trust or a testamentary trust.

If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change. If the beneficiary dies after the settlor dies and the trust still holds property on behalf of the beneficiary, the property often passes to the beneficiary's estate.

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

A SLAT is an irrevocable trust, which means it generally can't be changed once created. It enables one spouse to make a gift that can benefit the other spouse even while the spouse who made the gift is still alive.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

The Spousal Lifetime Access Trust (SLAT) As the name suggests, a SLAT is an irrevocable trust where one spouse makes a gift into a trust to benefit the other spouse (and potentially other family members) while removing the assets from their combined estates.

A SLAT allows the donor spouse to transfer up to the donor spouse's available exemption amount without a gift tax. When the donor spouse dies, the value of the assets in the SLAT is excluded from the donor spouse's gross estate and are not subjected to the federal estate tax.

The deceased spouse's assets are either put completely into a Family Trust, or split between a Family Trust and a Marital Trust. The Family Trust will no longer be considered part of the surviving spouse's estate upon death.