Riverside California Assignment of Interest in Joint Venture

Description

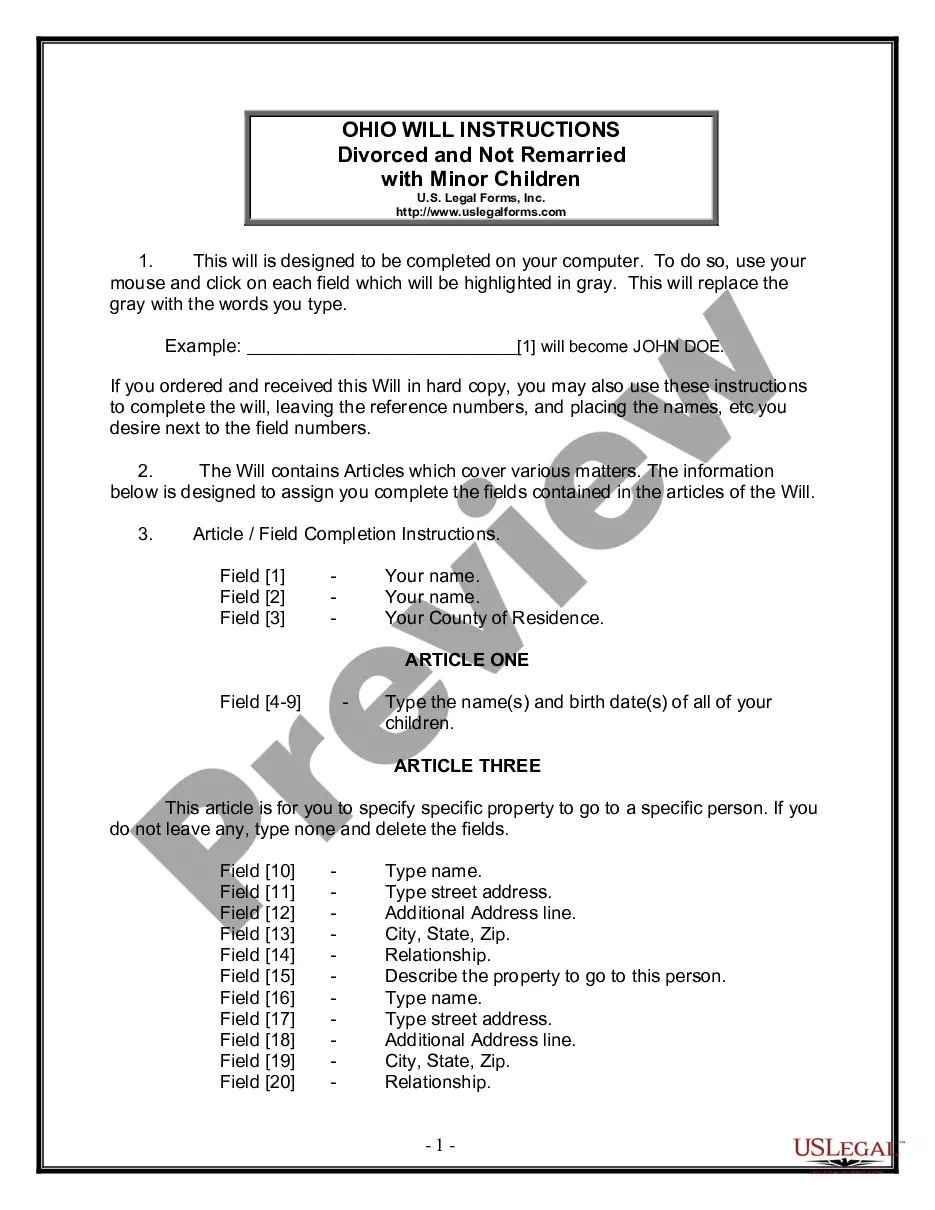

How to fill out Assignment Of Interest In Joint Venture?

Legislation and rules in each domain differ from jurisdiction to jurisdiction.

If you are not a lawyer, it's simple to become confused amidst a range of policies when it comes to creating legal documents.

To prevent costly legal fees when drafting the Riverside Assignment of Interest in Joint Venture, you need a validated template acceptable for your locality.

This is the most straightforward and cost-effective method to access current templates for any legal situations. Find them easily and keep your documents organized with US Legal Forms!

- Examine the content on the page to confirm you have located the right sample.

- Utilize the Preview feature or read the form description if one is provided.

- Search for another document if there are discrepancies with any of your needs.

- Press the Buy Now button to acquire the document once you discover the suitable one.

- Choose one of the subscription packages and Log In or create an account.

- Decide how you want to pay for your subscription (via credit card or PayPal).

- Choose the format you wish to save the document in and click Download.

- Complete and sign the document on paper after printing it or perform all actions digitally.

Form popularity

FAQ

The state of California levies a transfer tax of $0.55 per every $500 of home value.

You may make your payment online via Epay-It (external site ) with a credit or debit card, use a credit card over the phone, mail in a check, or go to any Riverside County Court location that is open to the public.

What is Documentary Transfer Tax? A tax collected when an interest in real property is conveyed. Collected by the County Recorder at the time of recording. A Transfer Tax Declaration must appear on each deed. There is a County tax and in some cases, a City tax.

The California Revenue and Taxation Code has set this tax for all counties at $1.10 per $1,000 (or $0.55 per $500.00 to be exact per the Code) of the transfer value (sales price) of the property to be transferred.

A tax rate area (TRA) is a geographic area within the jurisdiction of a unique combination of cities, schools, and revenue districts that utilize the regular city or county assessment roll, per Government Code 54900.

The Riverside County Assessor-County Clerk-Recorder's Office is pursuing Documentary Transfer Tax on unrecorded documents when there is a change in ownership that involves real property within Riverside County.

It is based on the property's sale price and is paid by the buyer, seller, or both parties upon transfer of real property. Agents Compete, You Win. Enter a city and state separated by a comma or a 5-digit ZIP code.

Transfer tax is collected on sales, exchanges, legal entity changes of control and leases of more than 35 years (including options) among other forms of transfers. In Northern California the seller of the property customarily pays the transfer tax during the escrow process.