Tarrant Texas Assignment of Partnership Interest with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

Statutes and guidelines in every field differ from one jurisdiction to another. If you aren't a lawyer, it can be challenging to navigate the various standards when it comes to creating legal documents.

To steer clear of expensive legal fees while preparing the Tarrant Assignment of Partnership Interest with Consent of Remaining Partners, you require a validated template that is suitable for your county. This is where the US Legal Forms platform proves to be invaluable.

US Legal Forms is an online repository trusted by millions, housing over 85,000 state-specific legal documents. It serves as an excellent resource for both professionals and individuals seeking do-it-yourself templates for various life and business situations. All documents are reusable: once you acquire a template, it will remain in your profile for future access. Hence, if you possess an account with an active subscription, you can easily Log In and re-download the Tarrant Assignment of Partnership Interest with Consent of Remaining Partners from the My documents section.

This is the easiest and most economical method to acquire contemporary templates for any legal situations. Discover them in just a few clicks and manage your documentation effectively with the US Legal Forms!

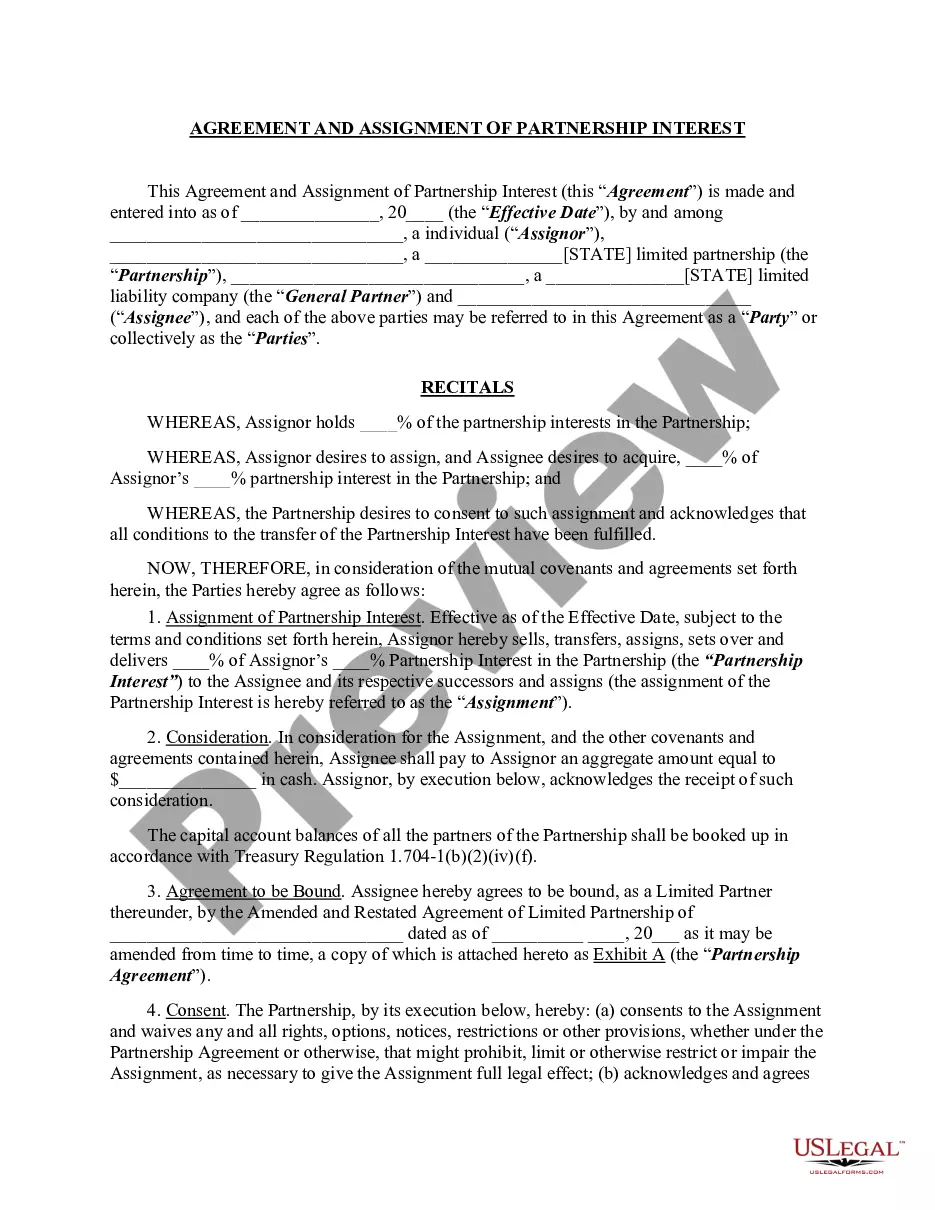

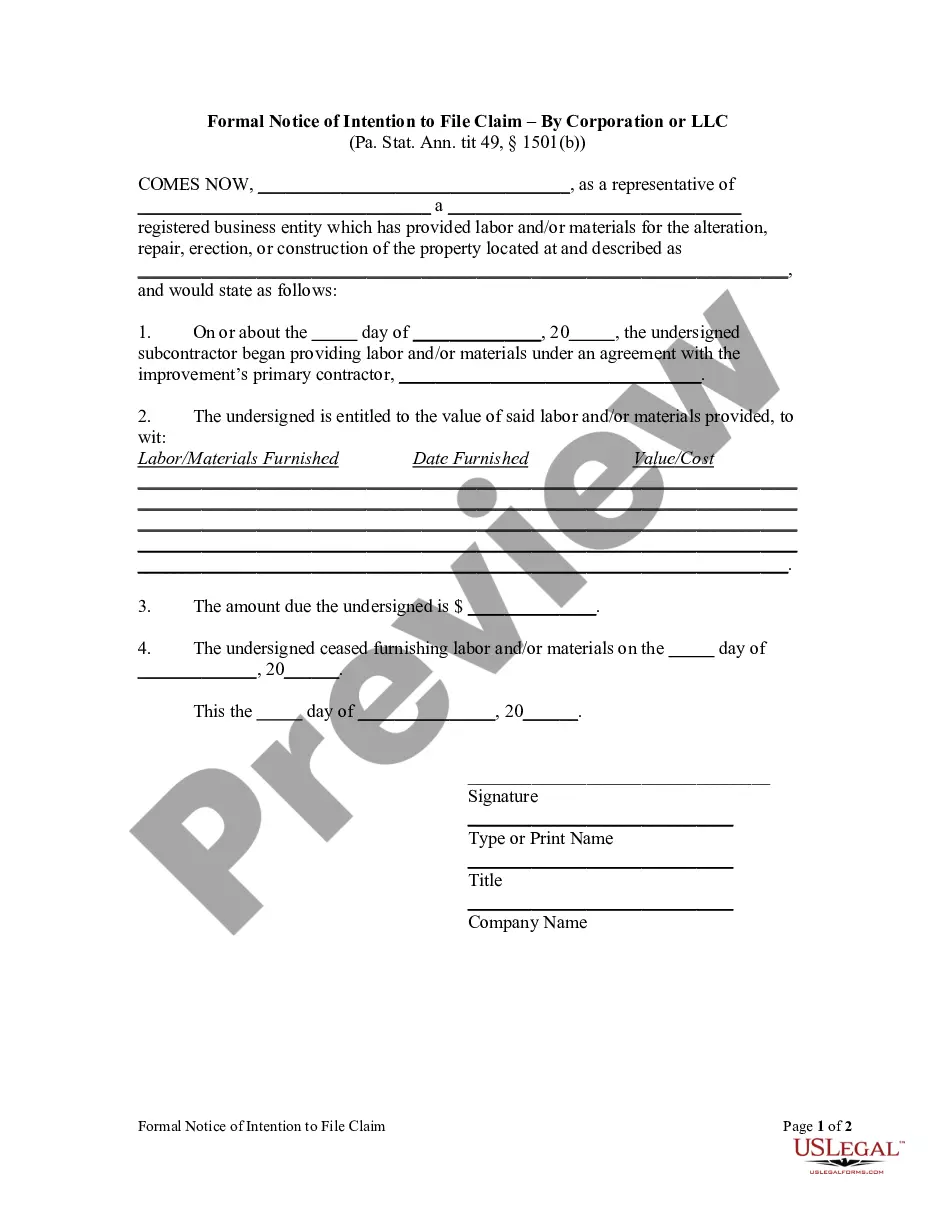

- Review the page content to confirm you've located the correct sample.

- Use the Preview functionality or read the form description if it's available.

- Look for another document if there are discrepancies with any of your needs.

- Click on the Buy Now button to obtain the template once you identify the suitable one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you would like to pay for your subscription (via credit card or PayPal).

- Select the desired format to save the file and hit Download.

- Complete and sign the template on paper after printing it, or do it all digitally.

Form popularity

FAQ

The four main types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has its own structure, liability limitations, and operational guidelines. Understanding these differences is essential for anyone considering a Tarrant Texas assignment of partnership interest with the consent of remaining partners.

A partner typically assigns their interests in a partnership when they want to transfer their rights and obligations to another party. This may occur due to personal reasons, financial needs, or changes in business strategy. In Tarrant Texas, the assignment of partnership interest often requires the consent of the remaining partners to ensure continuity and alignment within the partnership.

A partner's interest in a partnership is considered personal property that may be assigned to other persons.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Limited Partnership Interest means the ownership interest of a Limited Partner in the Partnership at any particular time, including the right of such Limited Partner to any and all benefits to which such Limited Partner may be entitled as provided in this Agreement and in the Act, together with the obligations of such

A partner's interest in a partnership is considered personal property that may be assigned to other persons. If assigned, however, the person receiving the assigned interest does not become a partner.

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes.

A partner's interest in the partnership may be assigned by the partner. However, the assignee does not become a partner without the consent of the other partners.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).