Bronx New York Assignment of Partnership Interest with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

Preparing documents, such as the Bronx Assignment of Partnership Interest with Consent of Remaining Associates, to address your legal issues can be a challenging and lengthy undertaking.

Numerous situations necessitate the involvement of a lawyer, which subsequently renders this process costly.

Nonetheless, you can take charge of your legal concerns and handle them independently.

The onboarding procedure for new clients is quite simple! Here’s what you need to accomplish prior to obtaining the Bronx Assignment of Partnership Interest with Consent of Remaining Associates: Ensure your document adheres to your state/county regulations, since the criteria for creating legal documents may differ from one jurisdiction to another.

- US Legal Forms is here to provide assistance.

- Our site features over 85,000 legal documents designed for various cases and life circumstances.

- We ensure every document complies with the regulations of each state, eliminating your worries about possible legal issues related to compliance.

- If you're familiar with our offerings and have a subscription with US, you're aware of how straightforward it is to obtain the Bronx Assignment of Partnership Interest with Consent of Remaining Associates form.

- Simply Log In to your account, download the form, and customize it to fit your needs.

- Lost your document? No problem. You can retrieve it in the My documents section of your account - whether on desktop or mobile.

Form popularity

FAQ

(a) A limited partner's interest in the partnership is personal property and is assignable. (b) A substituted limited partner is a person admitted to all the rights of a limited partner who has died or has assigned his interest in a partnership.

The gift of a partnership interest generally does not result in the recognition of gain or loss by the donor or the donee. A gift is, however, subject to gift tax unless the gift qualifies for the annual gift tax exclusion or reduces the donor's lifetime gift tax applicable exclusion amount.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

A partner's interest in a partnership is considered personal property that may be assigned to other persons. If assigned, however, the person receiving the assigned interest does not become a partner.

A partner's interest in a partnership is considered personal property that may be assigned to other persons.

According to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

Assigning Partner means a Partner who has assigned a beneficial interest in that Partner's partnership interest, the Assignee of which has not become a "Substituted Limited Partner."

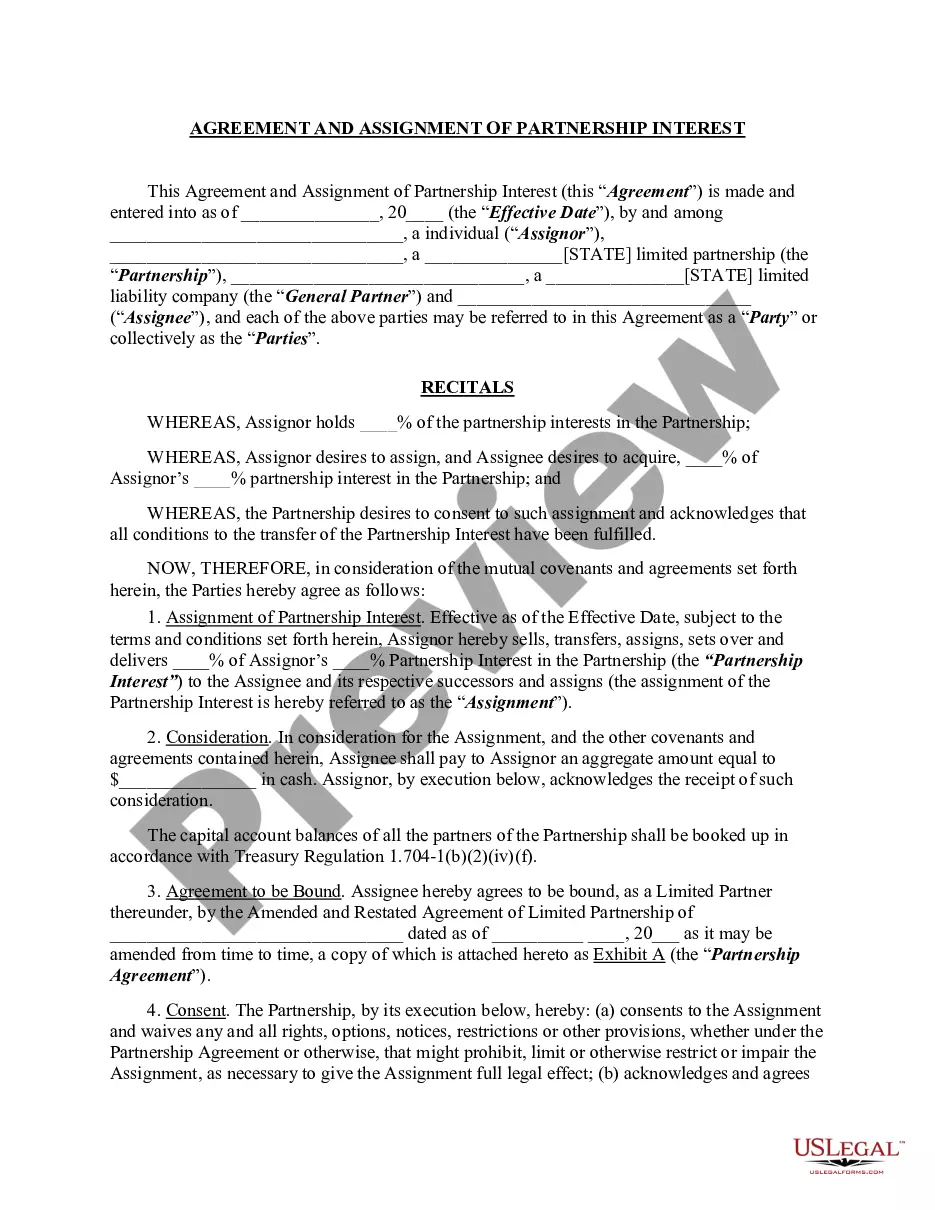

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.