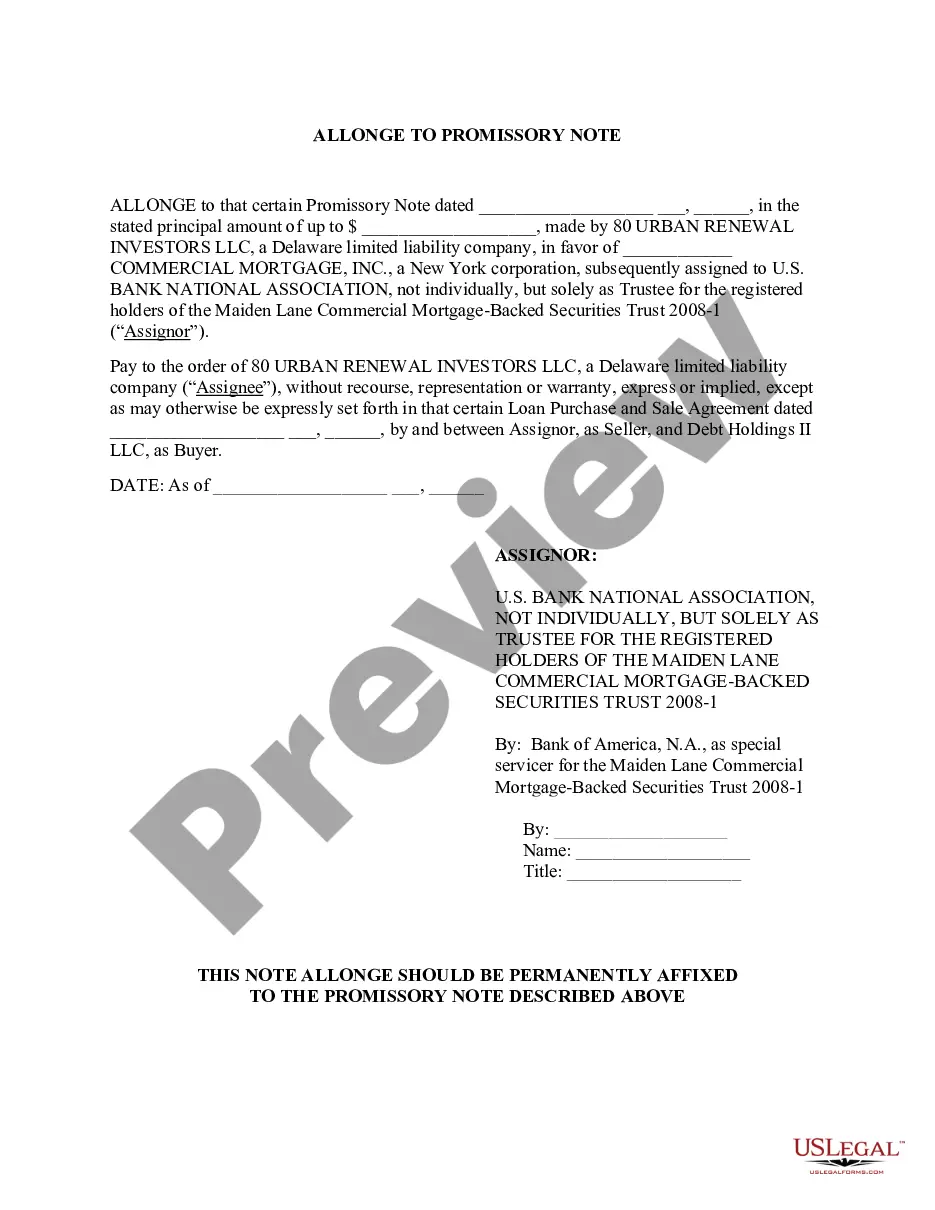

Nassau New York Allonge

Description

How to fill out Allonge?

Laws and statutes in every field differ from jurisdiction to jurisdiction.

If you're not a lawyer, it can be simple to become confused in numerous standards when it comes to producing legal documents.

To prevent expensive legal aid when assembling the Nassau Allonge, you require a validated template applicable to your area.

Look for another document if you find any discrepancies with your requirements. Use the Buy Now button to purchase the template once you've identified the correct one. Choose one of the subscription plans and log in or create an account. Select your preferred method to pay for your subscription (using a credit card or PayPal). Choose the format in which you want to save the document and click Download. Fill out and sign the template on paper after printing it or complete everything electronically. This is the easiest and most cost-effective way to obtain up-to-date templates for any legal purposes. Find them all with just a few clicks and maintain your documentation organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reliable online collection of over 85,000 state-specific legal templates trusted by millions.

- It serves as an excellent option for professionals and individuals seeking DIY templates for various personal and business situations.

- All the forms can be reused multiple times: once you acquire a sample, it remains stored in your account for later use.

- Thus, if you have an account with an active subscription, you can easily Log In and re-download the Nassau Allonge from the My documents section.

- For new users, several additional steps are necessary to acquire the Nassau Allonge.

- Review the page content to confirm you have located the correct sample.

- Utilize the Preview feature or read the form description if available.

Form popularity

FAQ

"Should you need any further information, or wish to purchase a certified copy of your deed, you may contact the Suffolk County Clerk's Office at 310 Center Drive in Riverhead or online at .

Most households with an income below $168,900 are automatically eligible. Those who earn more have to prove they've been hurt financially as a result of the pandemic. To apply go to the county website at NassauCountyNY.Gov/HAP.

You can request a certified or uncertified copy of property records online or in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page. There is no charge for ACRIS copies printed from a personal computer.

A title search can take anywhere from a few hours up to five days to complete. There are several factors that can affect the time frame, including: The number and availability of documents that need to be reviewed. The age and transaction history of the property.

You can challenge your Assessed Value by appealing with the NYC Tax Commission, an independent agency....What to Do if You Believe Your Notice of Property Value (NOPV) Has the Wrong Information reduce your property's assessment; change its tax class; adjust exemptions.

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.

1. File for an Exemption Contact your local town assessor's office and inquire on what exemptions you may qualify for. STAR (Basic & Enhanced) Veteran. Senior Citizen & Low Income. Home Improvement. Disability & Low Income. Agricultural Commitment. Religious & Non-Profit. First-Time Homeowners.

New York City - the Assessment Review Commission meets throughout the year, but complaints must be filed by March 15 for Class One properties and March 1 for all other properties. Nassau County - the Assessment Review Commission meets throughout the year, but complaints must be filed by March 1.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

The easiest way to lower your assessment is to apply for a STAR exemption. STAR is New York State's School Tax Relief Program that includes a school property tax rebate program and a partial property tax exemption from school taxes.