Wayne Michigan Notice of Returned Check

Description

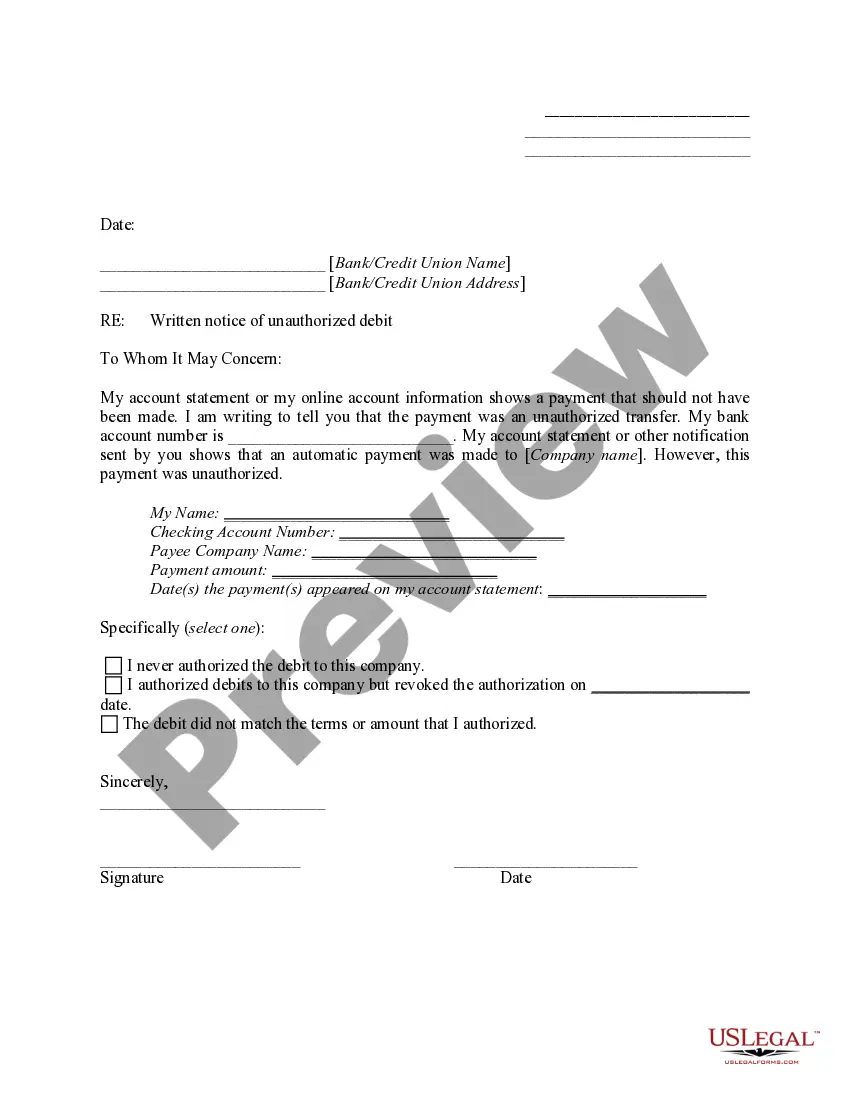

How to fill out Notice Of Returned Check?

Laws and statutes in every field differ across the nation.

If you're not a lawyer, it's simple to become disoriented by a range of standards when it comes to creating legal documents.

To prevent expensive legal help when drafting the Wayne Notice of Returned Check, you require a validated template applicable to your locale.

Utilize the Buy Now button to purchase the template once you identify the right one.

- That's when utilizing the US Legal Forms platform proves to be so beneficial.

- US Legal Forms is a reliable online collection used by millions, featuring over 85,000 state-specific legal templates.

- It's an excellent resource for professionals and individuals looking for do-it-yourself templates for various personal and business situations.

- All documents can be reused multiple times: once you select a sample, it stays available in your profile for future use.

- Therefore, when you possess an account with an active subscription, you can simply Log In and re-download the Wayne Notice of Returned Check from the My documents section.

- For first-time users, a few additional steps are needed to obtain the Wayne Notice of Returned Check.

- Review the page content to confirm you've identified the correct template.

- Make use of the Preview feature or examine the form description if one is present.

- Seek out another document if any of your specifications are not met.

Form popularity

FAQ

If a check deposited clears, it technically cannot be reversed. Once the recipient cashes the check, there is little a payer can do to reverse the funds being transferred.

Unable to Locate Account UTL Unable to Locate When a check or draft is returned with the Unable to Locate or UTL stamp, this means the bank cannot find any account with that account number in its records. This is most likely a check by phone or check draft where the wrong information was entered or provided.

Generally, a returned check is one that a bank declines to honor typically because there's not enough money in the check writer's account to cover the amount of the payment. You might know this situation as a bounced check, while the bank calls it nonsufficient funds, or NSF.

A returned check means that the check payment did not clear the bank account of the payer.

Generally, a returned check is one that a bank declines to honor typically because there's not enough money in the check writer's account to cover the amount of the payment. You might know this situation as a bounced check, while the bank calls it nonsufficient funds, or NSF.

When a check you deposit is returned due to insufficient funds, you face the possibility of lost income as well as bank fees. You can redeposit a bounced check. However, you should confirm that the money is available before submitting the check to your bank.

Written by Kevin Eberly. This return response means that the account holder has disputed the transaction as unauthorized and the funds were returned back to the account holder.

This return response means that based on the account information provided at the time the payment was submitted, the issuing bank was not able to locate the bank account and the payment could not be processed. This is typically caused by an invalid bank account number.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank.

If you now have the correct amount of money in your account, you can ask the recipient to redeposit the check. A returned check can be deposited again, but generally only once.