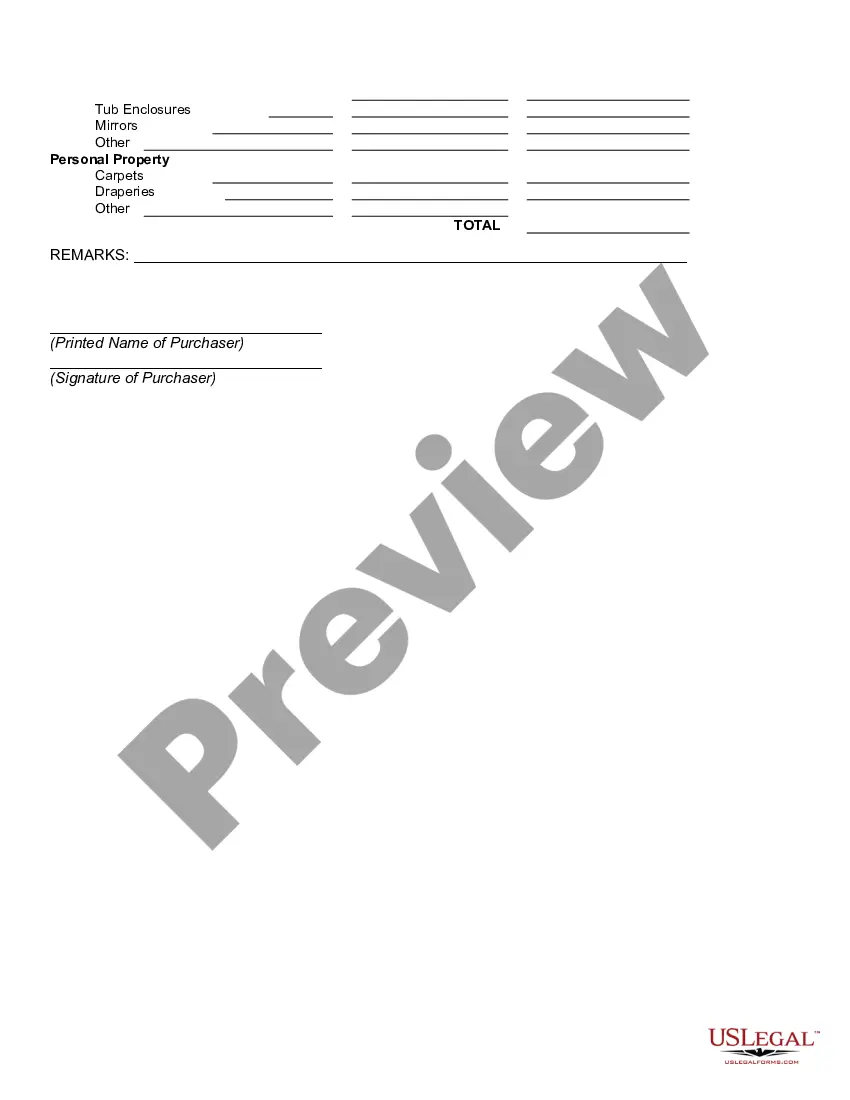

Philadelphia Pennsylvania Buyer's Property Inspection Report

Description

Home Inspection Checklist Comparisons: All home inspections are different and can vary dramatically from state to state, as well as across counties and cities. Much depends on the home inspector and which association, if any, to which the home inspector belongs.

How to fill out Buyer's Property Inspection Report?

Generating documentation for a business or individual obligations is consistently a significant responsibility.

When formulating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the relevant area. However, smaller counties and even towns also have legislative protocols that must be taken into account.

All these factors contribute to making it demanding and time-intensive to create a Philadelphia Buyer's Property Inspection Report without expert help.

Ensure that the template meets legal standards and click Buy Now. Choose the subscription package, then Log In or register for an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the selected document in your preferred format, print it, or fill it out electronically. The remarkable aspect of the US Legal Forms library is that all the documents you've ever obtained remain accessible - you can retrieve them in your profile at any time within the My documents tab. Join the platform and effortlessly acquire verified legal documents for any circumstance with just a few clicks!

- It's feasible to prevent unnecessary expenses on lawyers for drafting your paperwork and produce a legally sound Philadelphia Buyer's Property Inspection Report independently by utilizing the US Legal Forms online library.

- This is the most comprehensive online directory of state-specific legal templates that are professionally validated, assuring you of their legitimacy when selecting a template for your region.

- Previously subscribed users only need to Log In to their accounts to retrieve the desired form.

- If you do not yet hold a subscription, follow the step-by-step guide below to acquire the Philadelphia Buyer's Property Inspection Report.

- Browse the page you have accessed and confirm if it includes the template you need.

- To do this, utilize the form description and preview if these features are available.

- To find one that suits your requirements, make use of the search tab in the header of the page.

Form popularity

FAQ

Under the law, home inspectors are required to maintain errors and omissions and general liability insurance with coverage of not less than $100,000 per occurrence and $500,000 in the aggregate. The law is scheduled to take effect in December 2001.

10 tips for how to have a good negotiation after a home inspection Review the report with your real estate agent.Prioritize repairs by cost and severity.Don't sweat the small stuff.Request concessions for major items.Get quotes from contractors.Take the market into consideration.Know what as-is means.

Here are 13 things that warrant extra attention during your home inspection. 274f Oil tank.274f HVAC system.274f Roof.274f Structural integrity of the chimney.274f Water drainage and disbursement.274f Electricity system.274f Foundation.274f Quality of the flooring.

Prices are $300 on average for home inspectors in Philadelphia, PA.

10 tips for how to have a good negotiation after a home inspection Review the report with your real estate agent.Prioritize repairs by cost and severity.Don't sweat the small stuff.Request concessions for major items.Get quotes from contractors.Take the market into consideration.Know what as-is means.

Because the walk through typically occurs a day or two before the final closing, it is possible for a buyer to back out after final walk through. This can be for a variety of reasons: the appraisal value comes back too low, the home inspection reveals too many issues, or financing falls through.

Once the time limit has expired on the contingencies, you can still walk away from the house right up until closing, although you may lose your deposit. This is called liquidated damages. The seller could potentially sue you for specific performance, which means that you would be required to complete the contract.

Ask the seller to reduce the price of the home to accommodate for the cost of the repairs. Ask for an alternate compensation, such as asking the seller to leave behind some appliances and furniture.

You can realistically negotiate for anything after a home inspection, but getting the seller to agree to your terms is the real trick. You will need plenty of evidence such as pictures and repair estimates, as often a seller will actually be unaware of the defect in question.

We'll say it again: there's no hard and fast rule for when to walk away from a home after an inspection. It completely depends on how much you want the home and how willing you are to make the repairs yourself if the seller isn't willing to negotiate.