Cook Illinois Financial Record Storage Chart

Description

How to fill out Financial Record Storage Chart?

Drafting legal documents is essential in the current era.

Nonetheless, you don't always have to seek expert assistance to create some of them from the beginning, including the Cook Financial Record Storage Chart, utilizing a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from in various categories like living wills, real estate documents, and divorce forms. All templates are categorized based on their applicable state, simplifying the search process.

If you are already a subscriber of US Legal Forms, you can find the required Cook Financial Record Storage Chart, Log In to your account, and download it. It’s important to note that our platform cannot fully replace a lawyer. If you face a particularly complex case, we recommend consulting an attorney to review your document before signing and submitting it.

With over 25 years in the field, US Legal Forms has established itself as a trusted service for various legal forms, serving millions of users. Join today and easily manage your state-specific documentation!

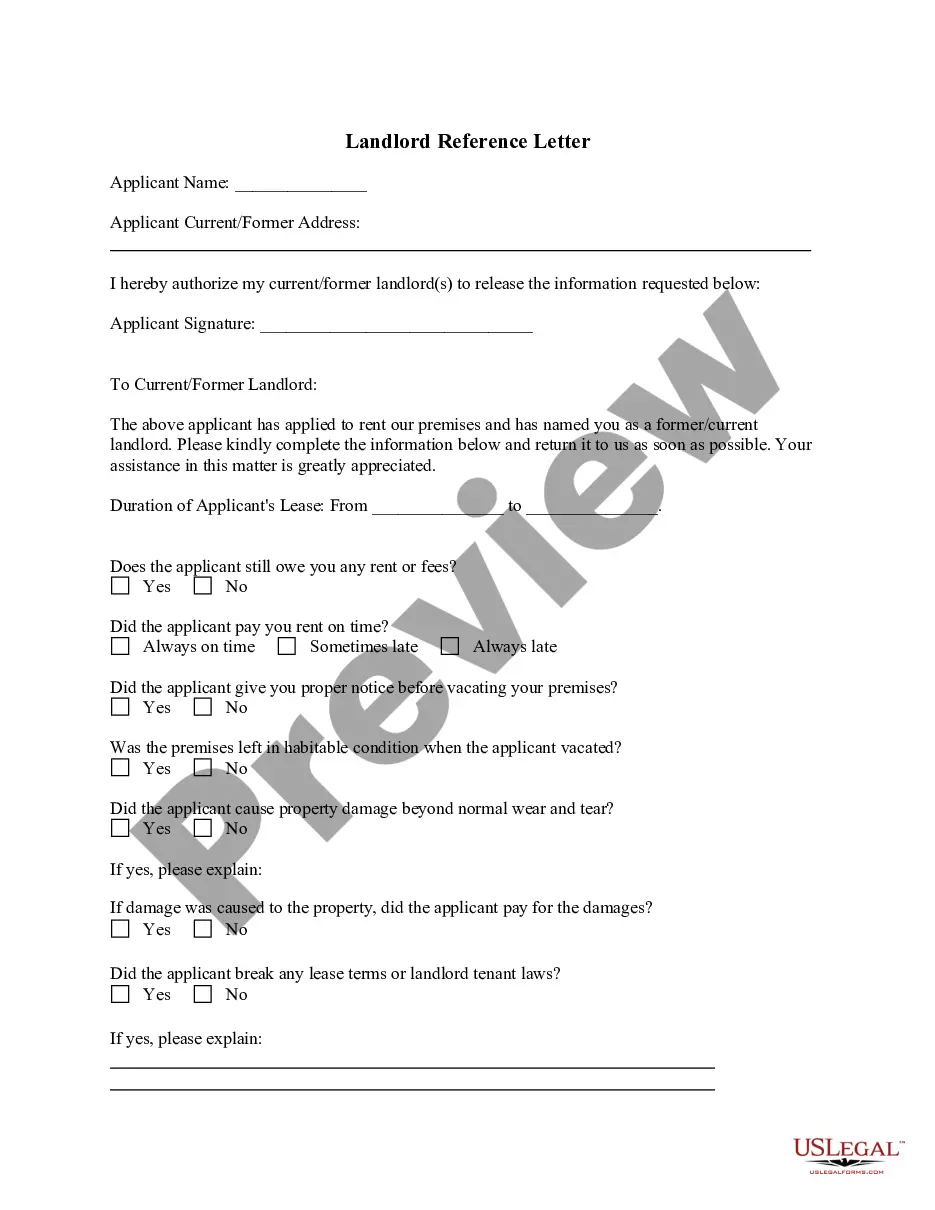

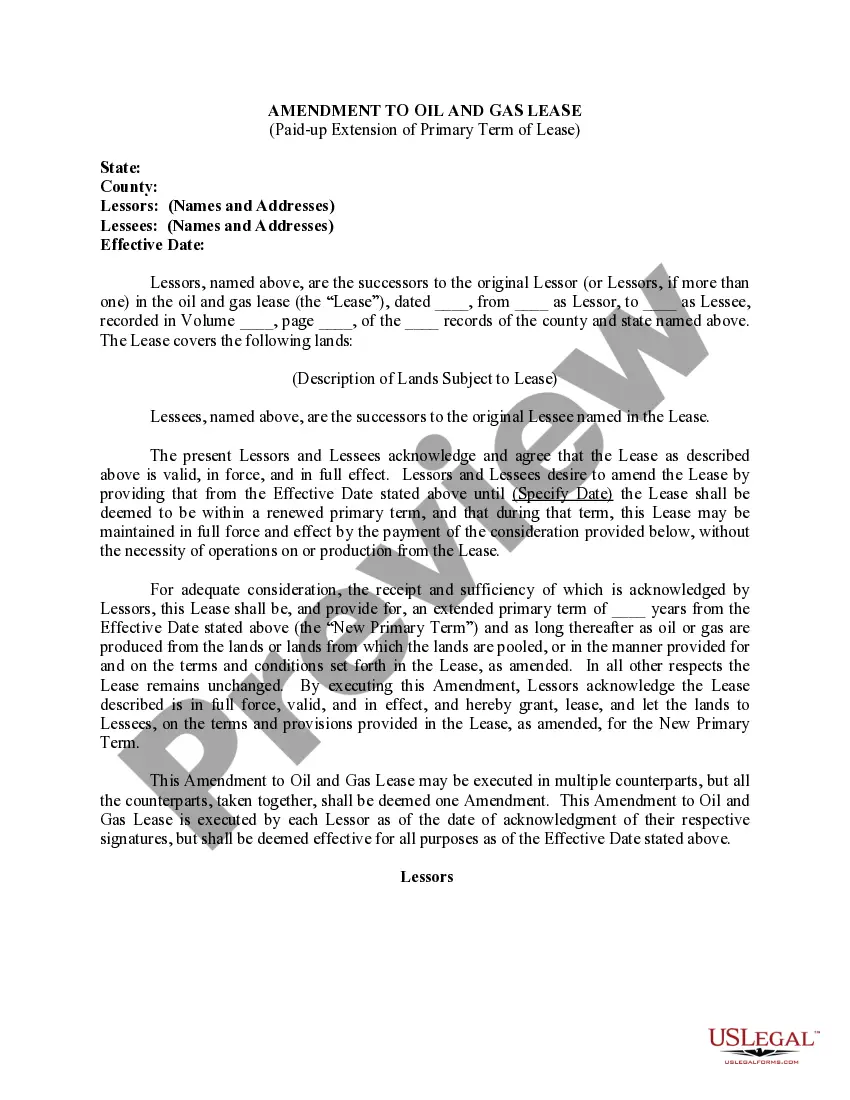

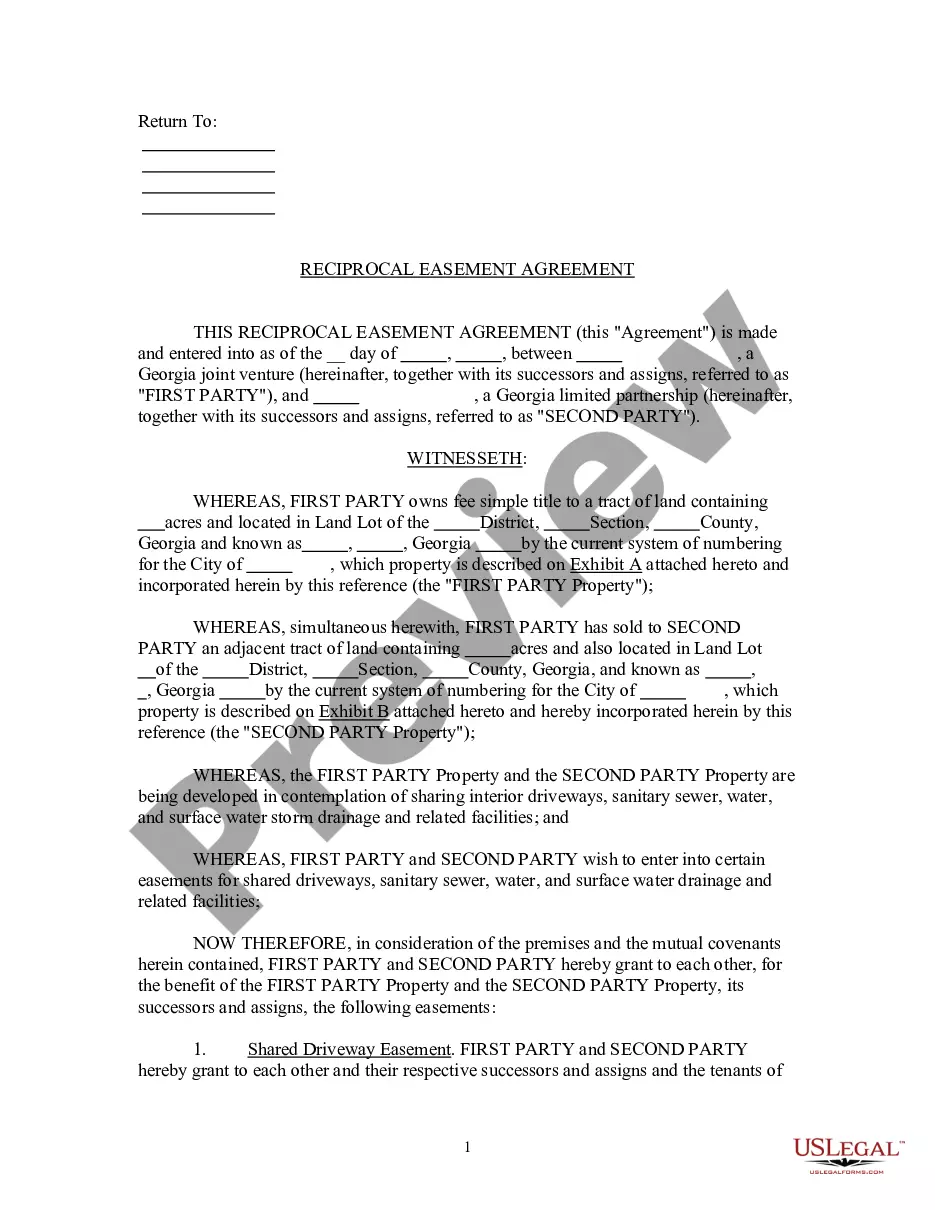

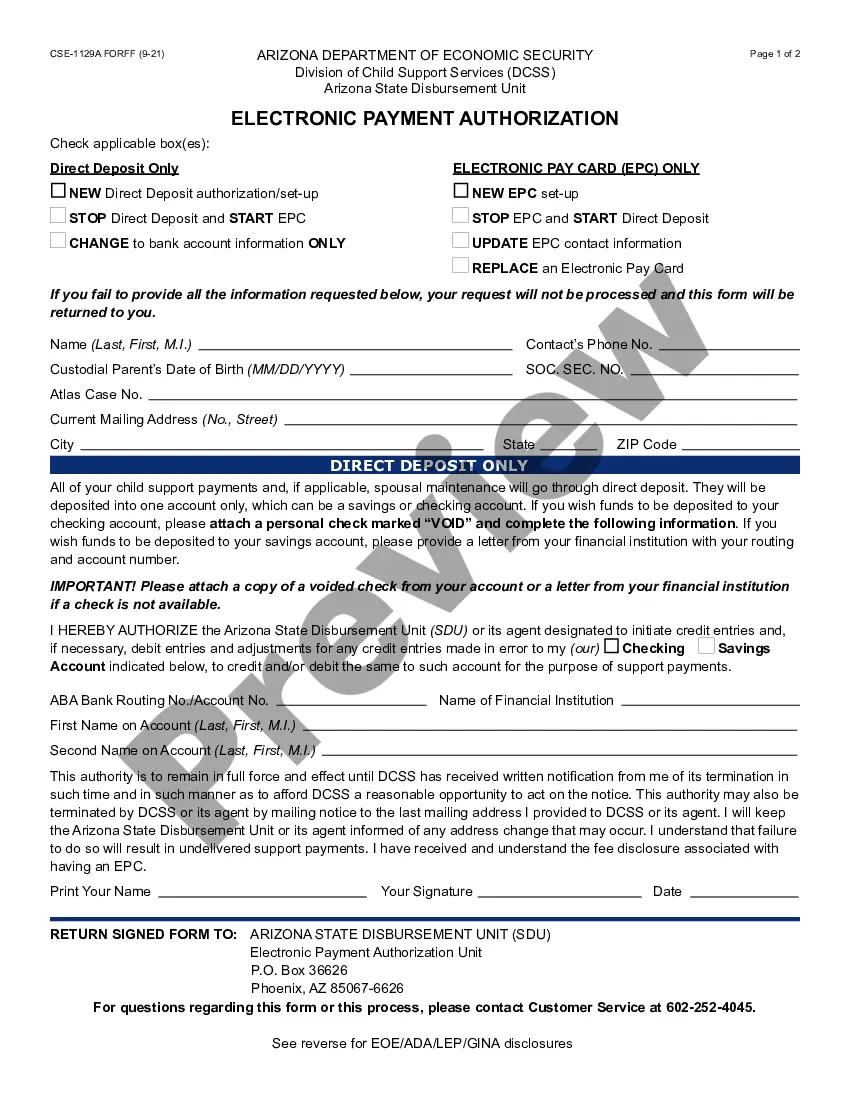

- Examine the document's preview and description (if accessible) to gain fundamental understanding of what you will receive upon downloading the template.

- Ensure that the template you select is tailored to your state/county/region as state laws can influence the legality of certain records.

- Investigate related document templates or restart your search to find the correct file.

- Click Buy now and create your account. If you already possess an account, opt to Log In.

- Select the payment method and finalize the purchase of the Cook Financial Record Storage Chart.

- Decide to store the form template in any available format.

- Visit the My documents section to download the file again.

Form popularity

FAQ

To dispose of records in Illinois, you should shred documents containing sensitive information to prevent identity theft. You can consider using a professional shredding service for safe disposal. For more detailed guidance on this process, referring to the Cook Illinois Financial Record Storage Chart can provide clarity on appropriate methods.

The Generally Accepted Accounting Principles (GAAP) suggest that financial records should be retained for a minimum of seven years. This policy helps businesses stay compliant with auditing standards and financial reporting. To navigate GAAP requirements effectively, check the Cook Illinois Financial Record Storage Chart for tailored advice.

The responsibility for storing financial records usually lies with the business owner or the designated accountant. It’s crucial to ensure that these documents are kept secure yet accessible. Tools and resources like the Cook Illinois Financial Record Storage Chart can help clarify proper storage practices and responsibilities.

Financial documents typically should be kept for three to seven years, depending on the specific type of document. For example, payroll records and tax returns have different retention periods. Always refer to the Cook Illinois Financial Record Storage Chart for a detailed breakdown so you can manage your documents effectively.

Financial document retention guidelines state that you should keep records based on their relevance to tax liabilities and legal requirements. These guidelines often suggest retaining documents ranging from three to seven years depending on the type. For a clear and detailed structure, consult the Cook Illinois Financial Record Storage Chart, which serves as a valuable resource.

You should retain financial records such as tax returns, bank statements, and any documentation supporting income and deductions for at least seven years. This practice helps protect you in case of an IRS audit or financial review. Keep these records organized and easily accessible with the help of the Cook Illinois Financial Record Storage Chart.

General ledger records should generally be kept for a minimum of seven years. This timeframe aligns with IRS requirements for document retention, ensuring you have documentation in case of an audit. To assist you in managing these records effectively, refer to the Cook Illinois Financial Record Storage Chart, which provides comprehensive guidelines.

The IRS guidelines for document retention say you should keep your tax records for at least three years after you file your return. If you omit income that exceeds 25% of what's reported, the IRS suggests keeping records for six years. To stay fully informed, consider utilizing the Cook Illinois Financial Record Storage Chart to determine the specific durations for various documents.

Documents that typically need to be kept for seven years include financial records such as invoices, receipts, and tax returns. This timeframe is critical for ensuring you can handle any inquiries from tax authorities or audits. The Cook Illinois Financial Record Storage Chart elaborates on these retention requirements, offering you a comprehensive guide. Successfully managing these records protects your business and simplifies your financial review process.

Certain records related to employee health and safety must be retained for up to 30 years. This includes records of exposure to hazardous materials and any related medical examinations. The Cook Illinois Financial Record Storage Chart is an invaluable tool to help you identify these long-term retention requirements. Proper management of these records is critical for compliance and employee safety.