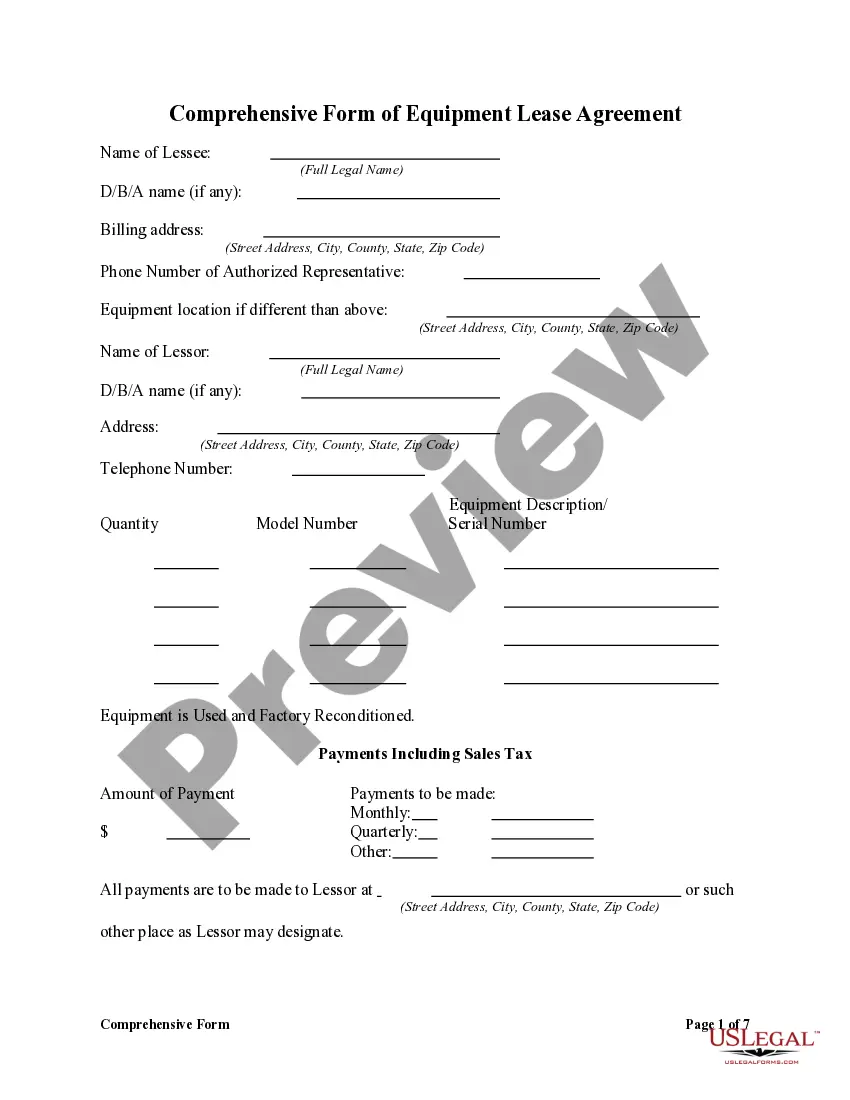

Phoenix Arizona Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

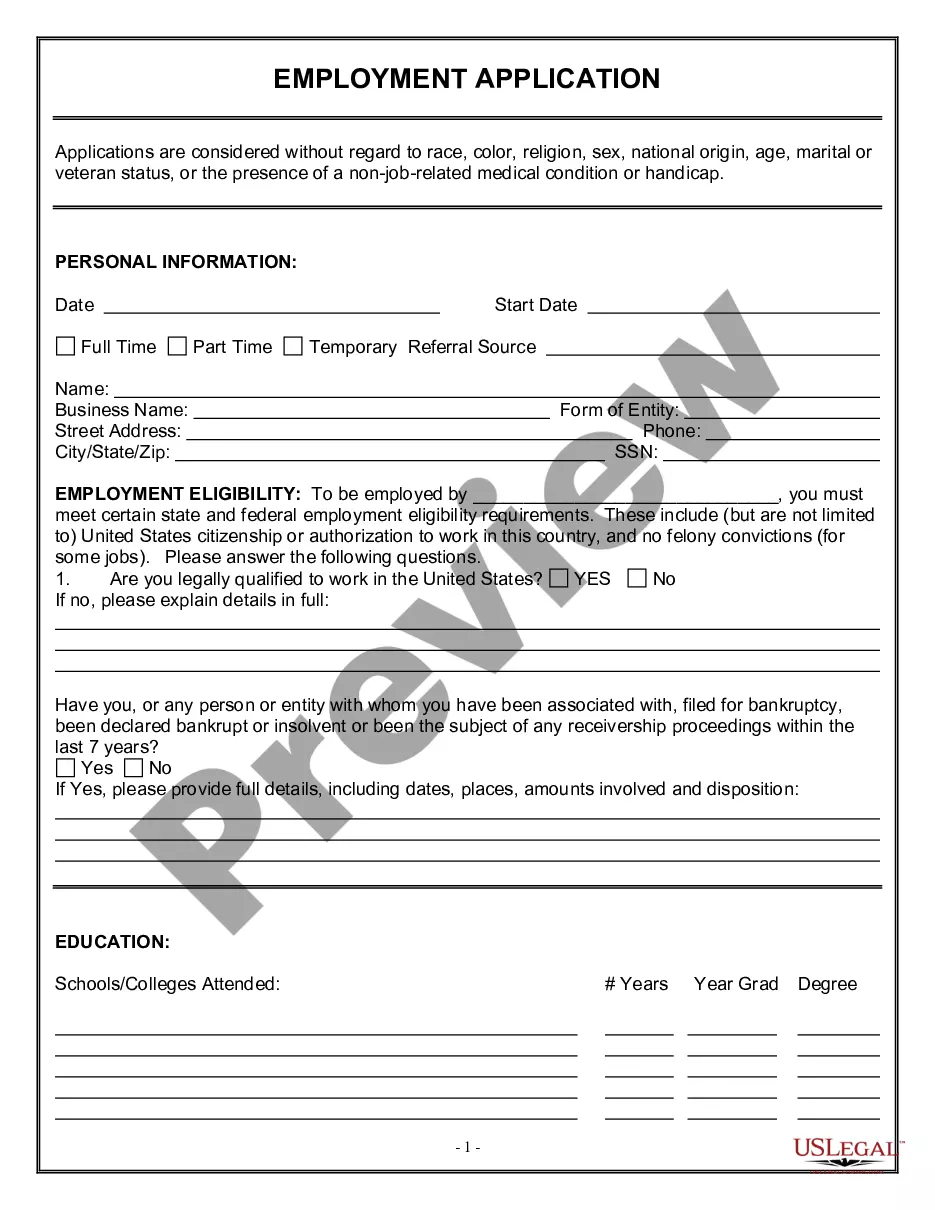

How to fill out Consultant Agreement With Sharing Of Software Revenues?

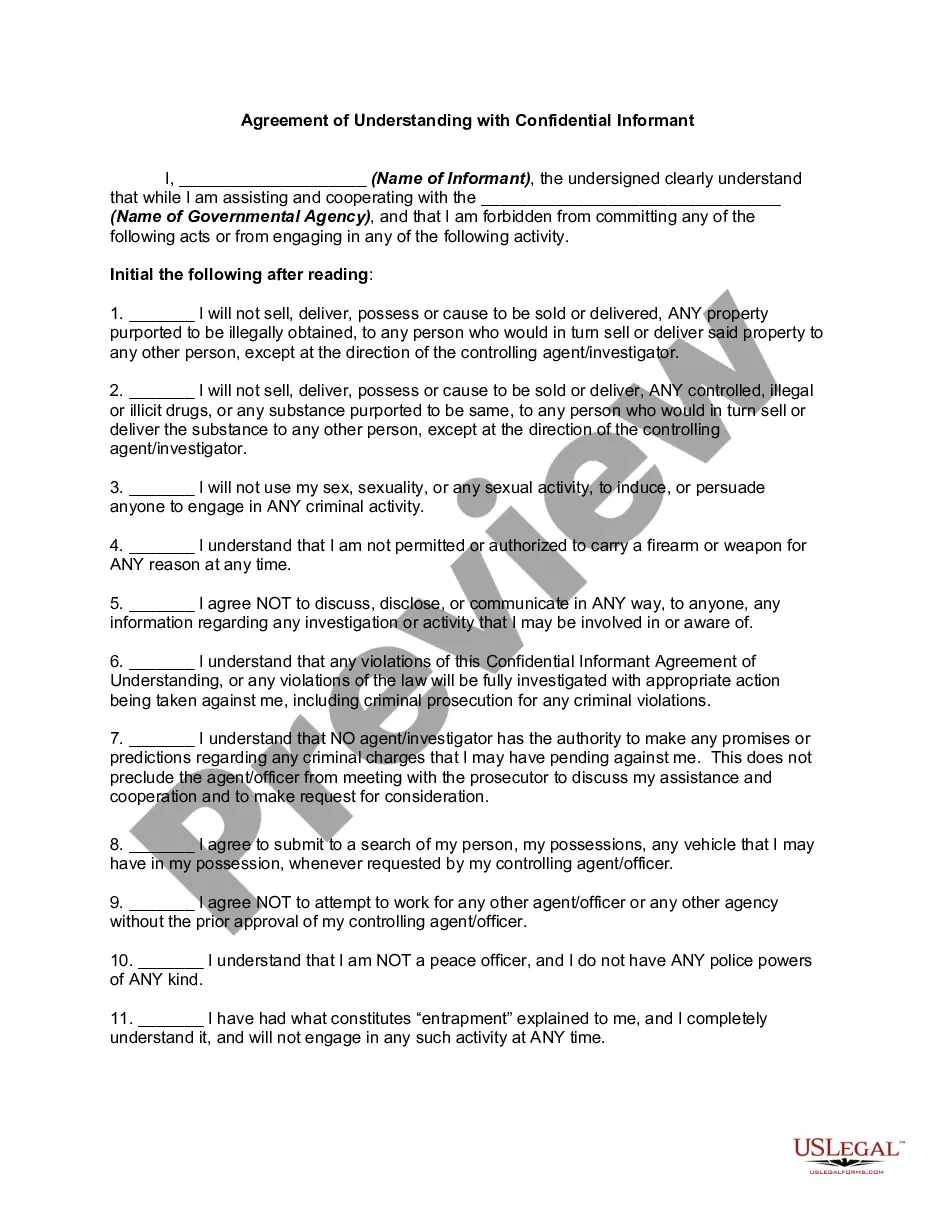

Laws and guidelines in every domain differ from jurisdiction to jurisdiction.

If you're not a legal professional, it can be simple to become confused by a variety of standards when it comes to creating legal documents.

To prevent expensive legal help when drafting the Phoenix Consultant Agreement with Revenue Sharing of Software, you need an approved template valid for your area.

This is the simplest and most cost-effective method to acquire current templates for any legal situations. Discover them within clicks and keep your paperwork organized with US Legal Forms!

- Check the page details to confirm you have located the correct sample.

- Utilize the Preview feature or examine the form description if available.

- Look for an alternative document if there are discrepancies with your needs.

- Use the Buy Now button to obtain the document once you identify the correct one.

- Select one of the subscription options and Log In or establish an account.

- Decide how you want to pay for your subscription (using a credit card or PayPal).

- Choose the format you want to save the file as and click Download.

- Complete and sign the document on paper after printing it, or handle the entire process electronically.

Form popularity

FAQ

In Arizona, certain services enjoy sales tax exemptions, including healthcare services, educational services, and certain consulting services. If your agreement involves services covered by a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, those may be exempt from sales tax. For complete clarity, consider consulting legal resources or professionals.

Software as a Service (SaaS) is generally not taxable in Arizona. Since it is often considered a service rather than a sale of tangible products, SaaS avoids sales tax implications. When drafting a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, it is crucial to understand this non-taxable status for accurate compliance.

In Arizona, licensing requirements for consultants can depend on the specific field of consultation. While some fields require specific professional licenses, many consulting roles do not. If you’re preparing a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, make sure to confirm whether your particular area necessitates licensure.

SaaS typically is not subject to sales tax in Arizona, but certain conditions might apply. Since it is considered a service rather than a sale of goods, it often enjoys tax-exempt status. When entering into a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, it's important to clarify whether your services align with this non-taxable classification.

Software as a Service (SaaS) falls into a unique category under Arizona tax law. Generally, SaaS is treated as a service rather than tangible personal property and is often exempt from sales tax. If you plan to draft a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, ensure it reflects the non-taxable nature of SaaS.

In Arizona, whether software is taxable depends on its delivery method. Custom software, for example, is typically exempt from sales tax, while pre-packaged software sold as a tangible product may incur tax. If you're engaging in a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, understanding these distinctions is vital to ensure compliance.

In Arizona, specific services remain exempt from sales tax. Generally, services related to healthcare, certain educational services, and professional consulting services, including those defined by a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, are not taxed. It’s essential to consult a tax professional or the Arizona Department of Revenue for comprehensive guidance.

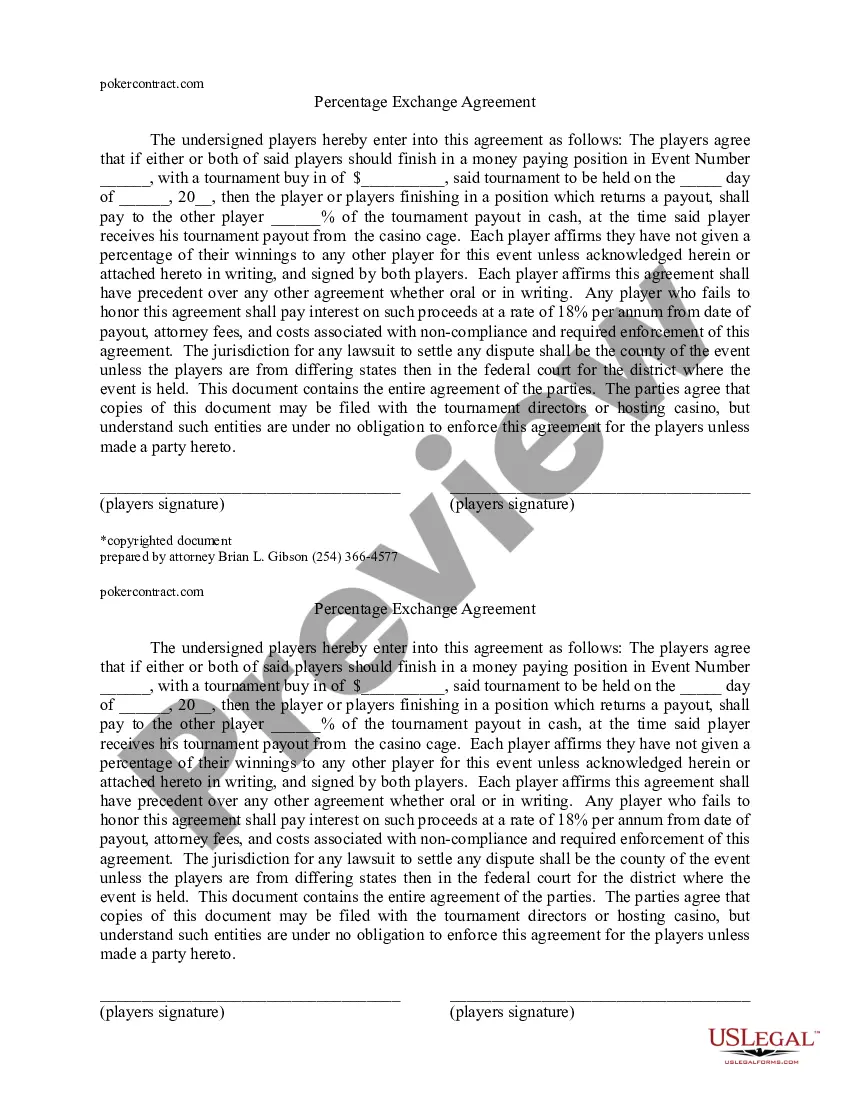

Structuring a revenue sharing agreement requires careful thought about various factors, including payment terms and the duration of the agreement. Start with outlining the specific revenue streams that will be shared and the percentages involved. In the context of a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, incorporate contingencies for performance metrics and potential changes in business conditions. This careful planning enhances trust and reduces future disputes.

An example of a revenue sharing agreement could involve a software consultant who develops a tool for a business. The agreement would stipulate that the consultant receives 30% of the software's revenue generated within the first year. This type of Phoenix Arizona Consultant Agreement with Sharing of Software Revenues illustrates how both parties can benefit from a successful collaboration. Real-world examples help provide clarity on how these agreements function.

Writing a profit sharing agreement starts by clearly outlining the terms of the profit division, including the percentage each party will receive. In a Phoenix Arizona Consultant Agreement with Sharing of Software Revenues, it's essential to describe the revenue sources accurately and define each party's roles. Additionally, consider including clauses for dispute resolution and duration of the agreement. This thoroughness protects all involved and fosters a smooth partnership.