Philadelphia Pennsylvania Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Whether you intend to launch your enterprise, engage in a transaction, request your identification renewal, or address family-related legal issues, you must prepare certain documentation that adheres to your local statutes and ordinances.

Finding the appropriate documents can require significant time and effort unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 professionally crafted and verified legal documents for any personal or business scenario. All files are categorized by state and use area, making it quick and simple to select a template such as Philadelphia Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Documents available from our library are reusable. With an active subscription, you can access all your previously purchased documents at any time in the My documents tab of your account. Stop squandering time on an endless quest for up-to-date legal documents. Subscribe to the US Legal Forms platform and maintain your paperwork organized with the most extensive online form collection!

- Ensure the sample meets your specific needs and complies with state regulations.

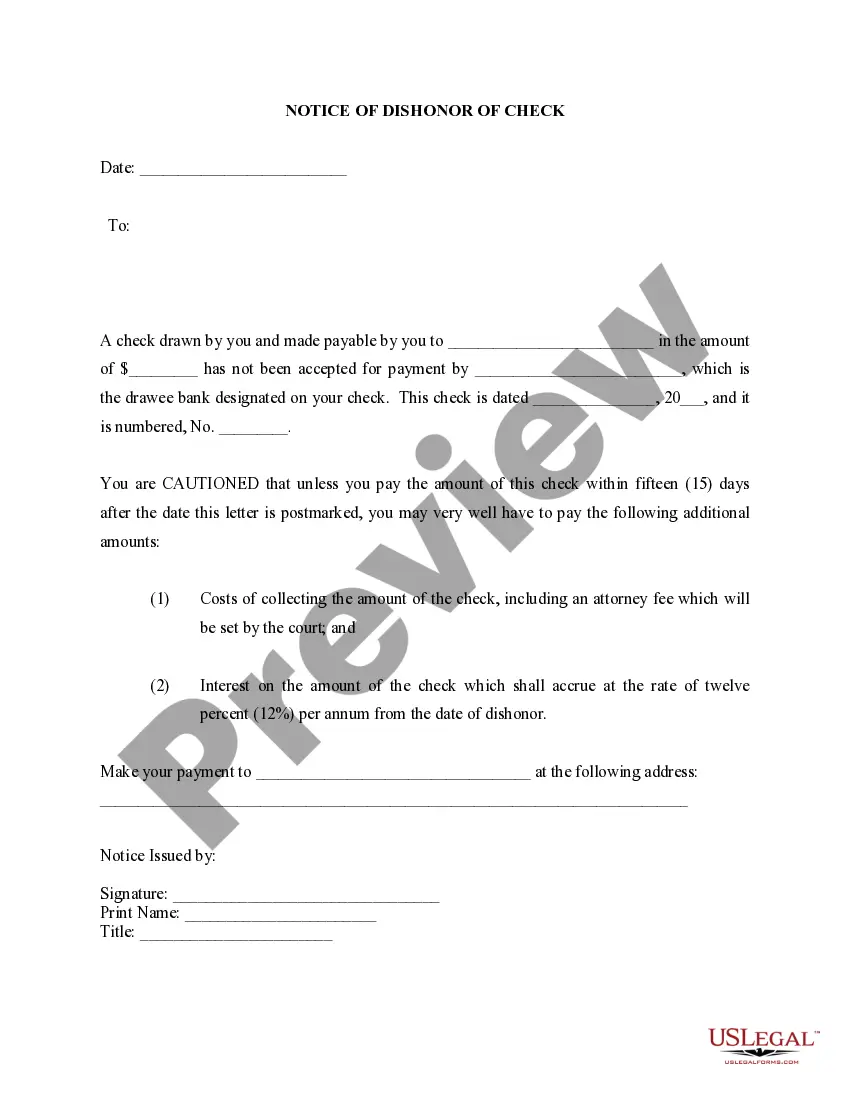

- Review the form description and check the Preview if available on the page.

- Utilize the search bar by entering your state above to find an alternative template.

- Click Buy Now to acquire the sample once you identify the one you need.

- Select the subscription plan that best fits your requirements to proceed.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Philadelphia Articles of Incorporation, Not for Profit Organization, with Tax Provisions in the desired file format.

- Print the document or complete it and sign it digitally via an online editor to conserve time.

Form popularity

FAQ

To create articles of incorporation for a nonprofit in Pennsylvania, you must include specific information such as your organization's name, purpose, and the names of the initial directors. This document is a critical step in forming your nonprofit organization and ensures compliance with state laws. Utilizing resources like uslegalforms can simplify this process and help you prepare the necessary Philadelphia Pennsylvania Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

You'll want to identify at least three board members to meet IRS requirements. Pennsylvania law requires every nonprofit corporation to have a President, Treasurer, and Secretary (i.e. officers who perform comparable duties) and a single person may hold all three offices.

How to Start a Nonprofit in Pennsylvania Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.Publish Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.

Most states file all articles of incorporation via the secretary of state. Visit the government website for the state in which the business has its principal office. If you do not know where the main office is located, go to the government website for any state in which the company has any business office.

Under California law, a nonprofit board may be composed of as few as one director, but the IRS may take issue with granting recognition of 501(c)(3) status to a nonprofit with only one director. It is commonly recommended that nonprofits have between three and 25 directors.

Mail: You can obtain a copy of the required form by downloading it at the Corporations and Organizations website. You can also order a copy of the form by calling (717) 787-1057. You can send your forms to the Pennsylvania Department of State, PO Box 8722, Harrisburg, PA, 17105-8722.

Copies and certifications of most filed documents may be obtained online at . Typewritten is preferred. If not typed, the form must be legible and completed in black or blue-black ink in order to permit reproduction. The fees vary based on the document requested and number of pages.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

A Pennsylvania limited liability company (LLC) may be formed for any lawful purpose, including a nonprofit purpose. However, there is no specific entity called a Pennsylvania nonprofit LLC.

Copies and certifications of most filed documents may be obtained online at . Typewritten is preferred. If not typed, the form must be legible and completed in black or blue-black ink in order to permit reproduction.