Clark Nevada Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

Organizing documentation for the enterprise or individual requirements is invariably a significant obligation.

When drafting a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state laws and rules of the particular locality.

Nevertheless, small municipalities and even towns also have legislative measures that you need to take into account.

The advantage of the US Legal Forms library is that all the documents you've ever acquired are never lost - you can access them in your profile within the My documents tab at any time. Join the platform and effortlessly obtain verified legal templates for any circumstance with just a few clicks!

- All these factors render it challenging and time-intensive to compile a Clark Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement without expert help.

- It's simple to prevent squandering funds on attorneys for preparing your documents and formulate a legally acceptable Clark Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement independently, by utilizing the US Legal Forms online repository.

- It is the finest online compilation of state-specific legal templates that are professionally validated, ensuring their legitimacy when you choose a sample for your area.

- Prior subscribed members only need to Log In to their accounts to retrieve the necessary document.

- If you do not yet have a subscription, follow the sequential instructions below to acquire the Clark Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

- Browse the page you've opened and confirm if it contains the document you need.

- To achieve this, utilize the form description and preview if those options are available.

Form popularity

FAQ

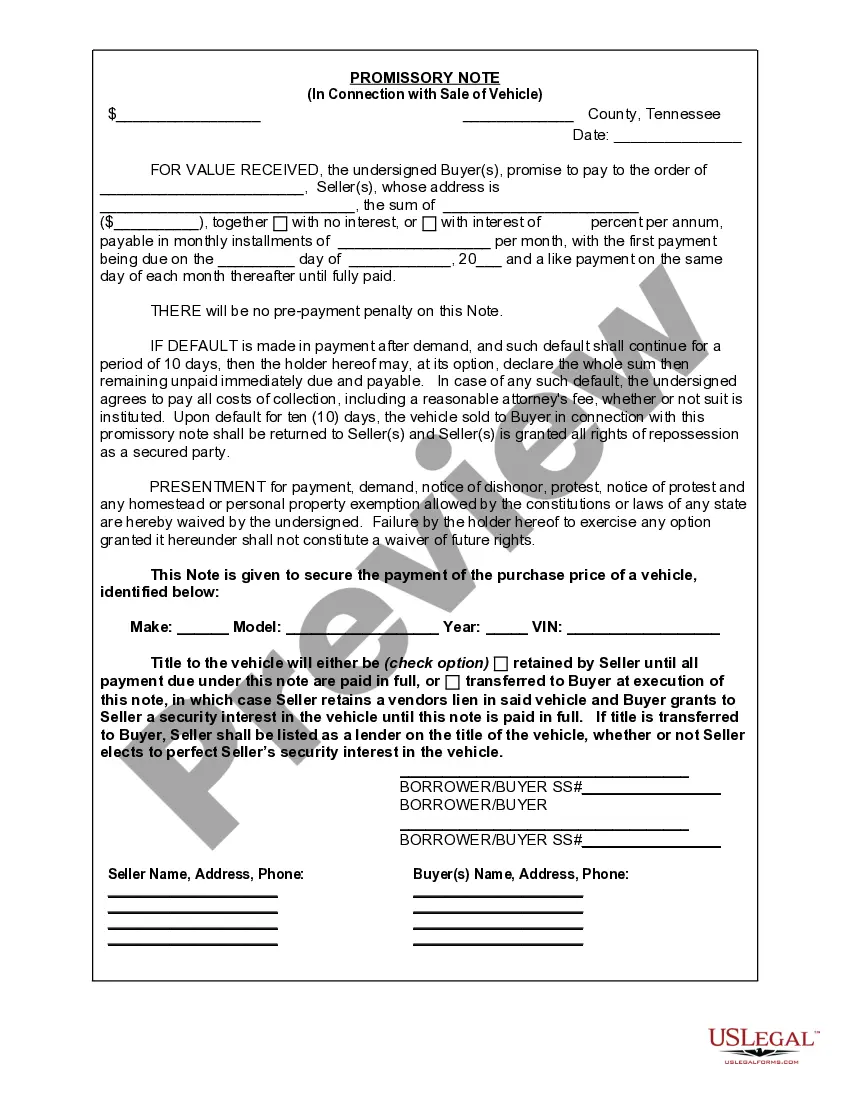

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender.

When placing the car loan, you also sign a security agreement. This security agreement gives the bank a Security Interest in the Collateral or Security Property (the car). The security agreement gives the bank the right to go against the collateral (car) if you default.

A transaction in which a security interest is granted is called a secured transaction. Granting a security interest is the norm for loans such as auto loans, business loans, and mortgages, collectively called secured loans. Credit cards, however, are classified as unsecured loans.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

FINANCE CODE CHAPTER 353. COMMERCIAL MOTOR VEHICLE INSTALLMENT SALES. (C) a motor vehicle that will be part of a fleet of five or more vehicles owned by the same person. (C) one or more payments owed under the retail installment contract, in the event of the disability of the retail buyer.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Also known as security documents. The loan documents in a secured loan transaction which secure the borrower's obligations to the lender under the loan agreement.