Emancipation is when a minor has achieved independence from his or her parents, such as by getting married before reaching age 18 or by becoming fully self-supporting. It may be possible for a child to petition a court for emancipation to free the minor child from the control of parents and allow the minor to live on his/her own or under the control of others. It usually applies to adolescents who leave the parents' household by agreement or demand.

A decree nisi (from the Latin nisi, meaning "unless") is a court order that does not have any force until such time that a particular condition is met, such as a subsequent petition to the court or the passage of a specified period of time.

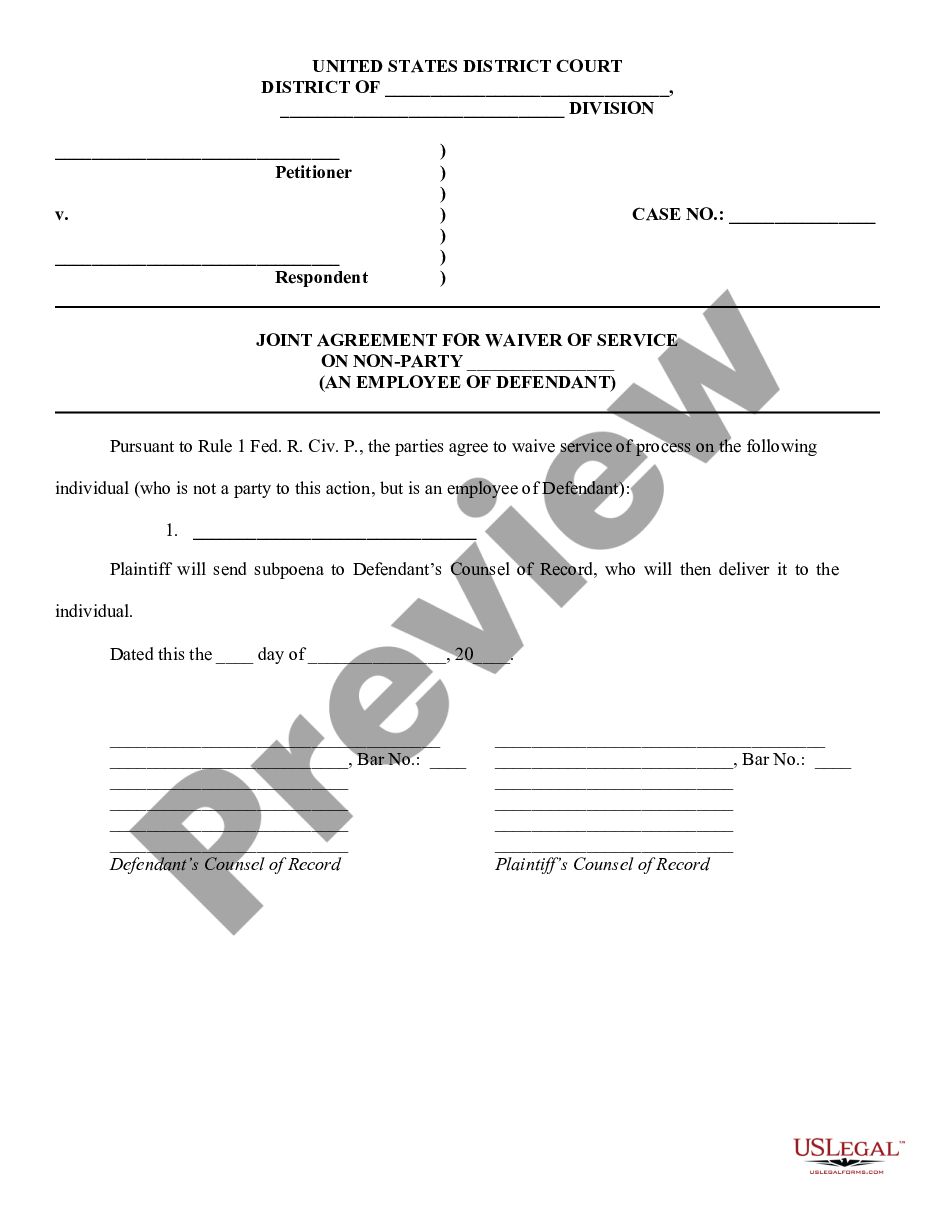

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.