Travis Texas Affidavit of Domicile

Description

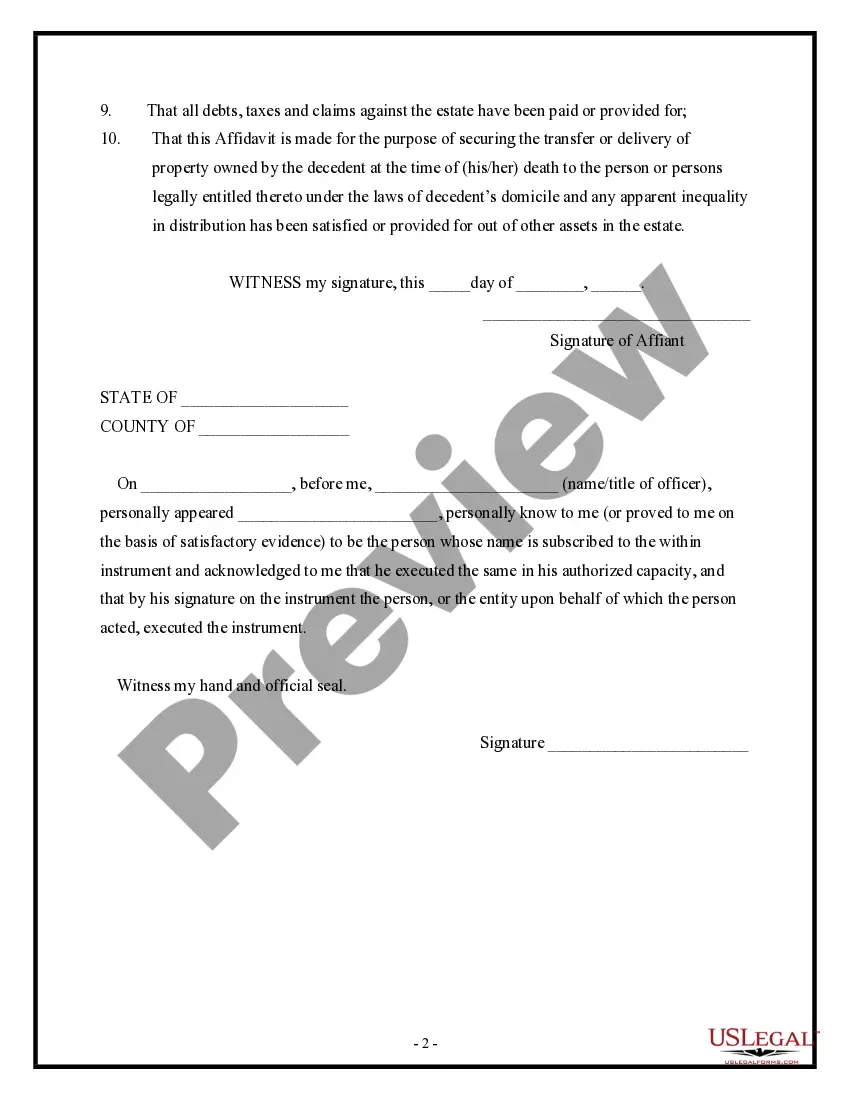

How to fill out Affidavit Of Domicile?

Whether you intend to launch your enterprise, engage in a contract, request an ID update, or settle family-related legal matters, you must organize specific documentation that complies with your local statutes and regulations.

Locating the appropriate documents can consume a significant amount of time and energy unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally crafted and validated legal templates for any personal or business situation. All documents are categorized by state and purpose, making it simple and quick to choose a form like the Travis Affidavit of Domicile.

Documents available on our website are reusable. With an active subscription, you can access all your previously purchased paperwork anytime in the My documents section of your account. Stop squandering time on an endless quest for up-to-date formal documentation. Register for the US Legal Forms platform and maintain your paperwork organized with the largest online collection of forms!

- Ensure the sample aligns with your personal requirements and state legal stipulations.

- Review the form description and examine the Preview if available on the page.

- Utilize the search bar above to specify your state and find another template.

- Click Buy Now to acquire the document once you identify the right one.

- Choose the subscription plan that best fits your needs to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Travis Affidavit of Domicile in the format you require.

- Print the copy or complete it and sign digitally through an online editor to save time.

Form popularity

FAQ

The original will can be filed with the Clerk's Office in the following three ways: Mailed via USPS to Travis County Clerk, ATTN: Probate Clerk, P.O. Box 149325, Austin, TX 78714.Certified mail to 5501 Airport Blvd., Austin, TX 78751.Hand Delivered to the Clerk's Office at 200 W.

Probate Division Main Phone. Email. Postal Mail. Travis County Clerk. P.O. Box 149325. Austin, TX 78714. Commercial Carrier. Probate Division. Travis County Clerk. 5501 Airport Boulevard. Austin, TX 78751.

The amount of the exemption may vary from $5,000 to $12,000 depending on documentation from the VA.

To calculate property taxes in Travis County, property value must first be assessed by the county. The tax is based on the taxable value of the property, which is the assessed value minus any deductions or exemptions. Each county has a central authority that is responsible for appraising the value of property.

Travis County property owners can view the current exemptions on their property, review a list of available homestead exemptions, and download or complete exemption application forms online at . The TCAD Homestead Helpline can be reached at 512-873-1560.

School taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school taxes. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a residence homestead is allowed to receive a $3,000 exemption for this tax.

Tax Code Section 11.13(b) requires school districts to provide a $40,000 exemption on a residence homestead and Tax Code Section 11.13(n) allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a property's appraised value.

Although you can file your will at the courthouse, it is not required. And most people don't bother doing it. Whether you file it or not though, it is important to let the right person or people know where it can be found. Your will won't do you and your family any good if you pass away and no one knows where it is.

In Texas, the residential homestead exemption entitles the homeowner to a $25,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

Travis County offers a 20% homestead exemption, the maximum allowed by law. The Commissioners Court also offers an additional $85,500 exemption for homesteads of those 65 years and older or are disabled.