Wake North Carolina Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

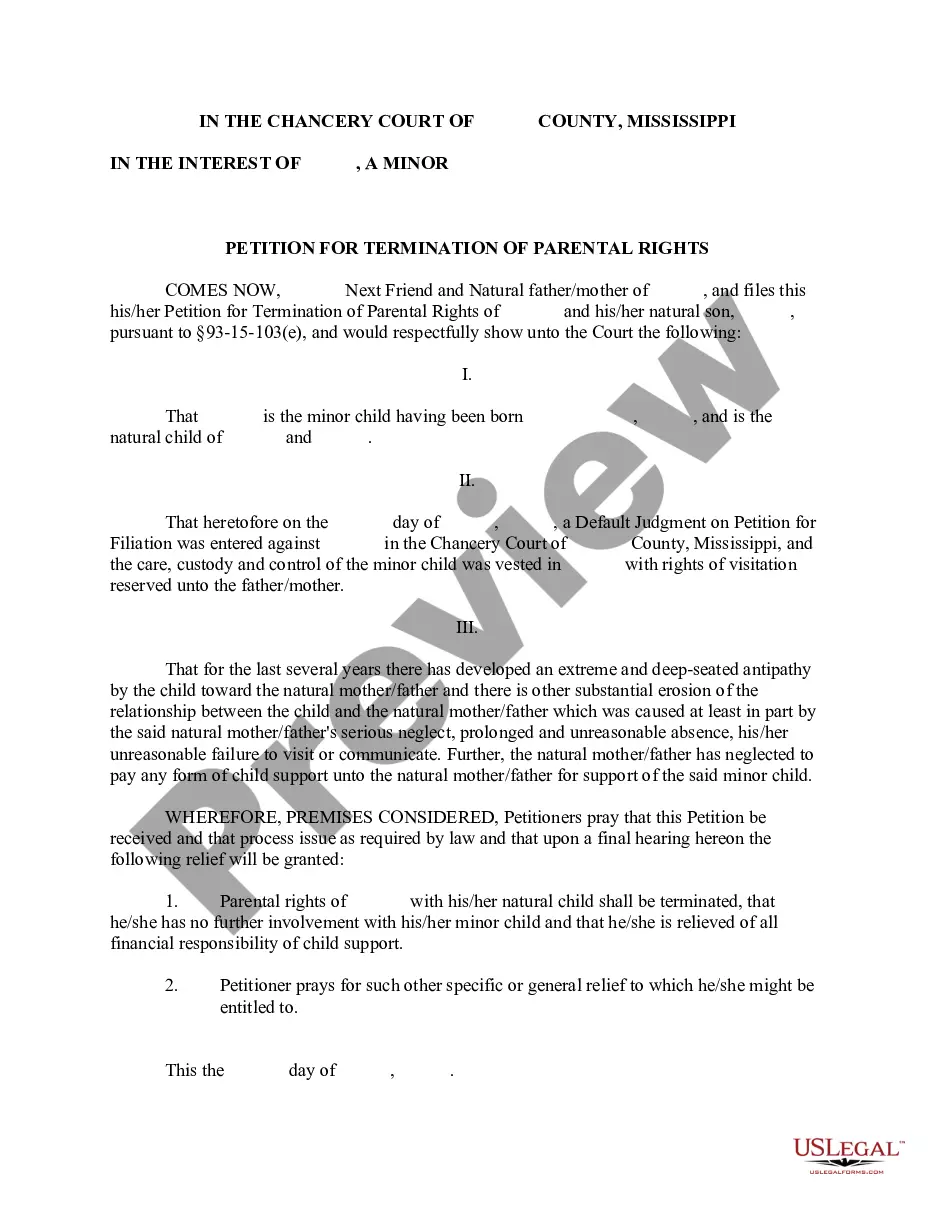

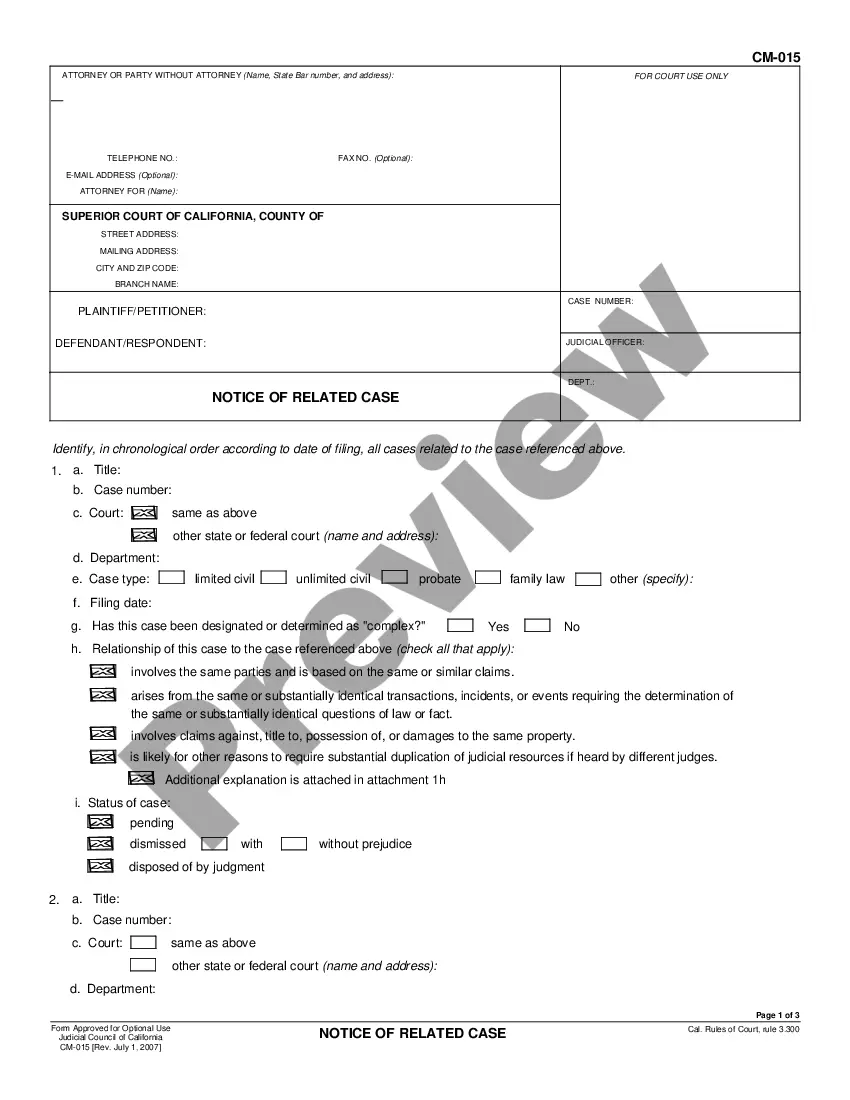

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

An official document procedure is consistently linked with every legal endeavor you undertake.

Launching a venture, applying for or accepting a job opportunity, shifting ownership, and numerous other life scenarios require you to prepare formal documentation that varies across the nation.

That’s the reason keeping everything consolidated in one location is incredibly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

This is the simplest and most dependable method to acquire legal documents. All the templates in our library are skillfully prepared and verified for compliance with local laws and regulations. Organize your documentation and manage your legal matters efficiently with US Legal Forms!

- On this site, you can effortlessly search for and acquire a document for any personal or business purpose relevant to your area, such as the Wake Notice of Default under Security Agreement in Purchase of Mobile Home.

- Finding templates on the site is exceptionally straightforward.

- If you already possess a subscription to our platform, Log In to your account, locate the sample using the search function, and click Download to store it on your device.

- Later, the Wake Notice of Default under Security Agreement in Purchase of Mobile Home will be accessible for ongoing use in the My documents section of your profile.

- If this is your first time using US Legal Forms, follow this straightforward guide to obtain the Wake Notice of Default under Security Agreement in Purchase of Mobile Home.

- Ensure you are on the correct page with your localized form.

- Utilize the Preview mode (if offered) and browse through the template.

- Review the description (if available) to confirm the form matches your requirements.

- Look for an alternative document using the search tab if the sample does not satisfy your needs.

- Click Buy Now when you identify the necessary template.

Form popularity

FAQ

A security interest is a type of lien. A lien is a debt that is specifically attached to an asset and provides the lien holder with a security interest in that asset. A security interest generally arises at the time of lending money through agreement.

Lenders will look at your creditworthiness, or how you've managed debt and whether you can take on more. One way to do this is by checking what's called the five C's of credit: character, capacity, capital, collateral and conditions.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Security Obligations means the collective reference to the unpaid principal of and interest on the Securities and all other payment obligations and liabilities of the Lessor to the Securityholders under the Securities, the Indenture and any of the other Operative Agreements.

Perfection Overview While granting a security interest gives a creditor rights against the borrower to seize the collateral property, perfecting a security interest gives the creditor superior rights to other creditors.

Perfection of a security interest gives a secured party priority over other creditors or a bankruptcy trustee. A secured party often perfects an interest in collateral by filing a document known simply as a financing statement.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

When a security interest in property is superior to other interests and claims to the property, it is said to be perfected. In other words, to secure protection against third parties' claims to the collateral, the secured party must perfect the security interest.

Loan against Property (LAP) is a secured form of loan borrowed from a loan provider. As the name itself reveals, it is a loan given against property, which should be physical and immovable (residential/ commercial). A loan provider or lender can be a bank, NBFC or HFC (Housing Finance Company).

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.