An escrow agreement involved a legal document or property held by a third party for a specific time or until the happening of a condition, at which time the document or property is to be handed over by the third party to the promisee.

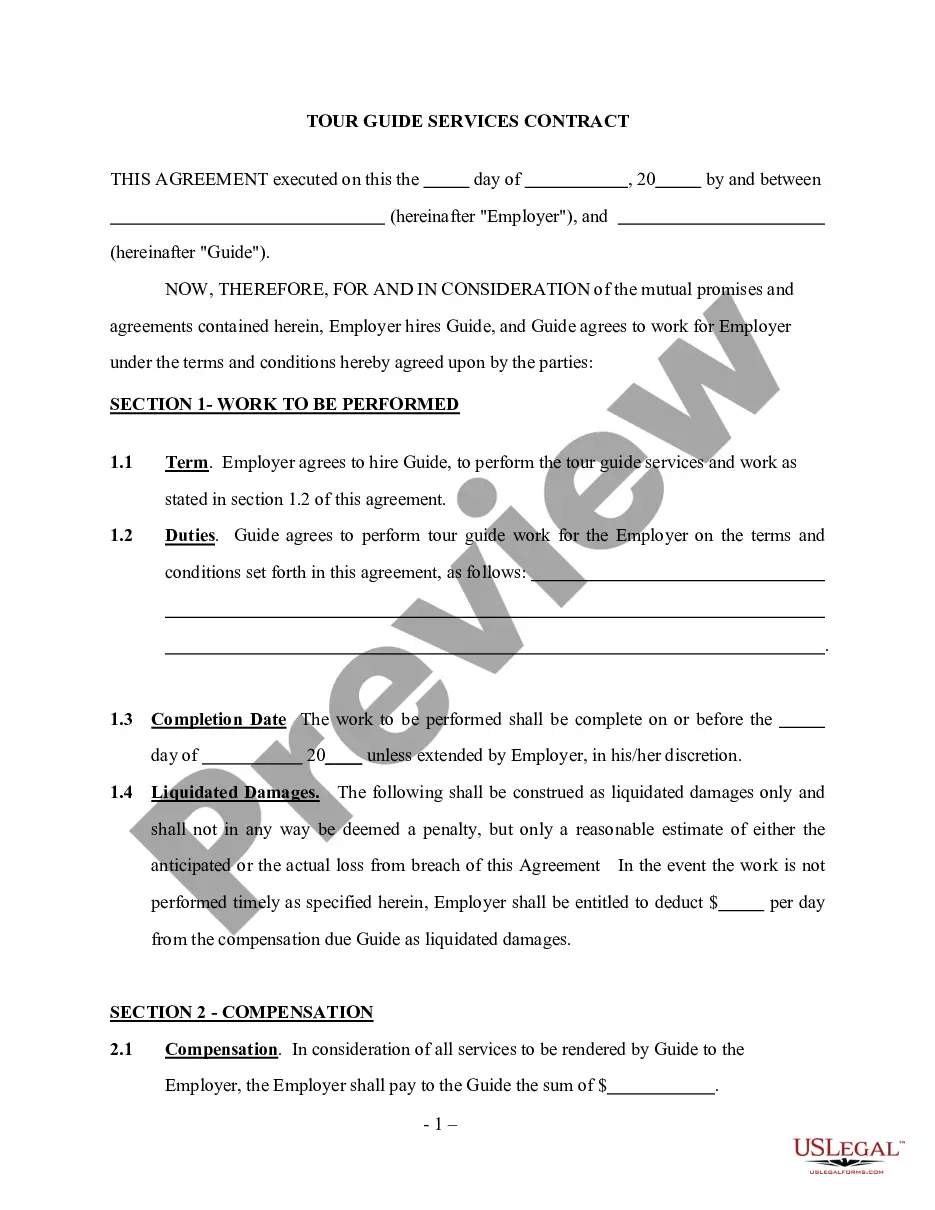

If a party to a contract has certain duties to perform under that contract and then transfers these duties to another person who is to perform them, there is a delegation of duties. In such a case, the original person who is to perform the duties remains liable if the person to whom he transfers the duties fails to adequately perform the duties. In other words, the party to the contract who delegated the duties remains liable in case of default of the person doing the work just as if no delegation had been made.