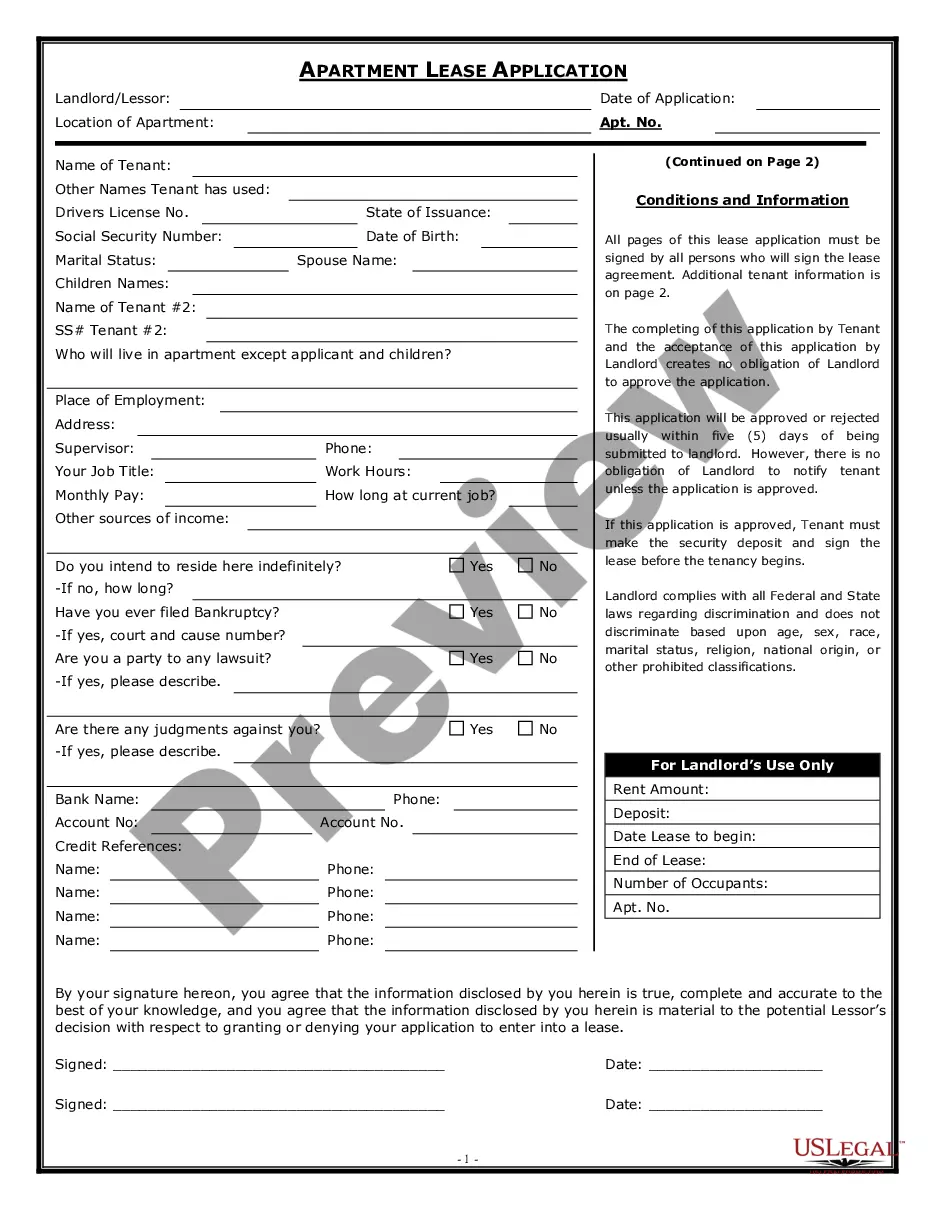

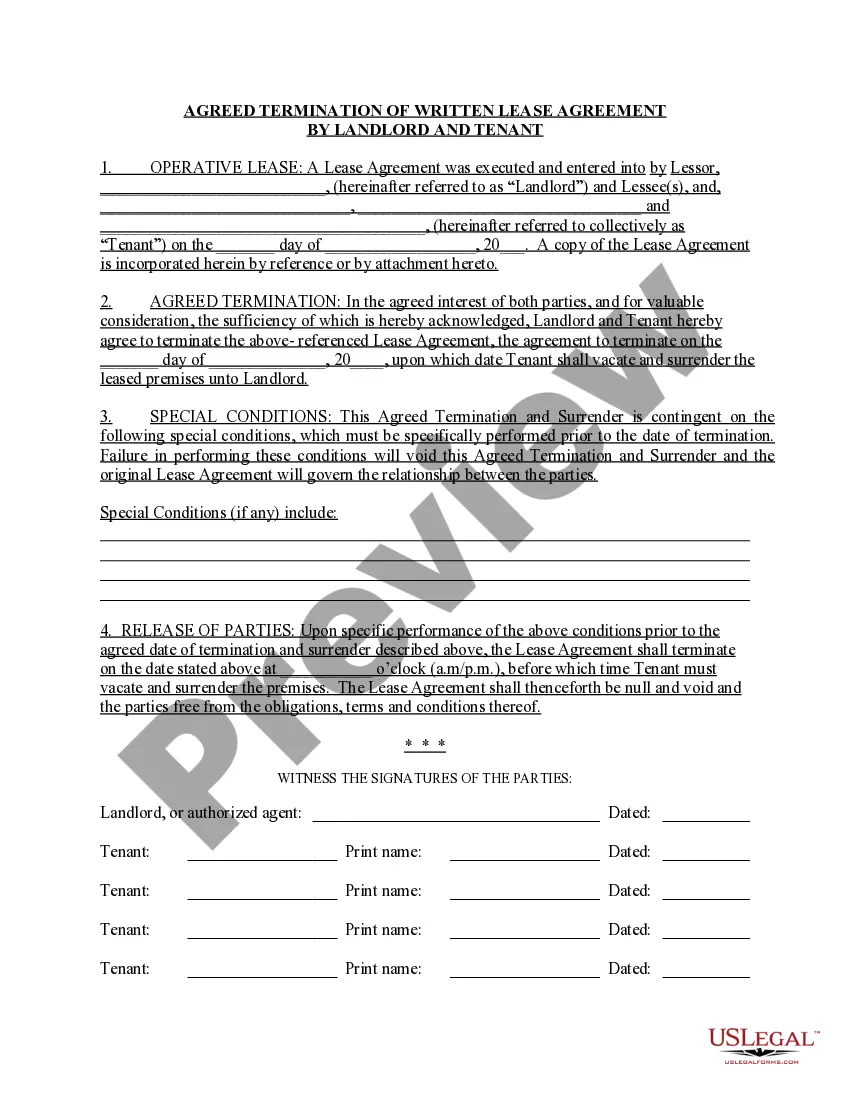

This form is intended for a major commercial office complex. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hillsborough Florida Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses

Description

How to fill out Detailed Office Space Lease With Lessee To Pay Pro-rata Share Of Expenses?

Legislation and guidelines in every domain vary across the nation.

If you are not a lawyer, navigating different regulations can be overwhelming when it comes to drafting legal documents.

To prevent costly legal fees when preparing the Hillsborough Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses, you require a verified template valid for your locality.

That's the most straightforward and economical method to acquire up-to-date templates for any legal purposes. Find all of them easily and maintain your documentation in order with the US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a resource relied upon by millions, offering a repository of over 85,000 state-specific legal documents.

- It serves as an excellent option for professionals and individuals seeking do-it-yourself templates for various personal and business needs.

- All forms can be reused: once you acquire a template, it remains accessible in your account for additional use.

- Thus, when you possess an account with an active subscription, you can simply Log In and re-download the Hillsborough Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses from the My documents section.

- For first-time users, a few extra steps are required to obtain the Hillsborough Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses.

- Review the page details to confirm you've located the correct sample.

- Utilize the Preview function or examine the form description if it is available.

Form popularity

FAQ

Prorate derives from the term "pro rata," which means proportionally. The proration of real estate describes the division of real estate expenses according to the proportion of ownership or rental.

Which of the following statements best describes the owner's and tenant's responsibility for operating expenses when there is an expense stop clause in the lease contract? The owner is responsible for operating expenses up to the expense stop; expenses above the expense stop become the responsibility of the tenant .

Expense stops. when the tenant pays increases in operating expenses.

In general, the tenant's proportionate share is determined by taking the building's rentable square footage and dividing it by the tenant's rentable square footage.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

Your pro rata share of household operating expenses is the average monthly household operating expenses (based on a reasonable estimate if exact figures are not available) divided by the number of people in the household, regardless of age.

For example, if someone buys an insurance policy that's quoted at a certain price for a full year of coverage, but that person only signs on for half a year's worth of coverage, they would pay the insurance company on a pro rata basis that would come out to half the value of the full policy.

Gross Lease/Full Service Lease In a gross lease, the tenant's rent covers all property operating expenses. These expenses can include, but aren't limited to, property taxes, utilities, maintenance, etc.

A mechanism in a Full Service Gross Lease, the Expense Stop is a fixed amount of operating expense above which the tenant is responsible to pay. Thus, the landlord is responsible to pay for all operating expenses below the Expense Stop, while the tenant is responsible for any amount above the Expense Stop.

Also known as tenant's pro rata share. The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.