Palm Beach Florida Affidavit of Death of Joint Tenant

Description

How to fill out Affidavit Of Death Of Joint Tenant?

Navigating legal documents is essential in the contemporary world. Nevertheless, you don't necessarily have to seek expert assistance to create some forms from the beginning, such as Palm Beach Affidavit of Death of Joint Tenant, utilizing a service like US Legal Forms.

US Legal Forms offers more than 85,000 documents to choose from across a variety of categories including living wills, property documents, and divorce papers. All documents are categorized by their respective state, making the search process easier.

You can also find educational resources and guides on the site to simplify any tasks related to document fulfillment.

If you are already a US Legal Forms subscriber, you can locate the correct Palm Beach Affidavit of Death of Joint Tenant, Log In to your account, and download it. Naturally, our platform cannot fully replace a lawyer. If you face an exceptionally complex issue, we recommend engaging an attorney to review your document before signing and filing.

With over 25 years in the industry, US Legal Forms has become a preferred provider of various legal documents for millions of clients. Join them today and easily obtain your state-specific documents!

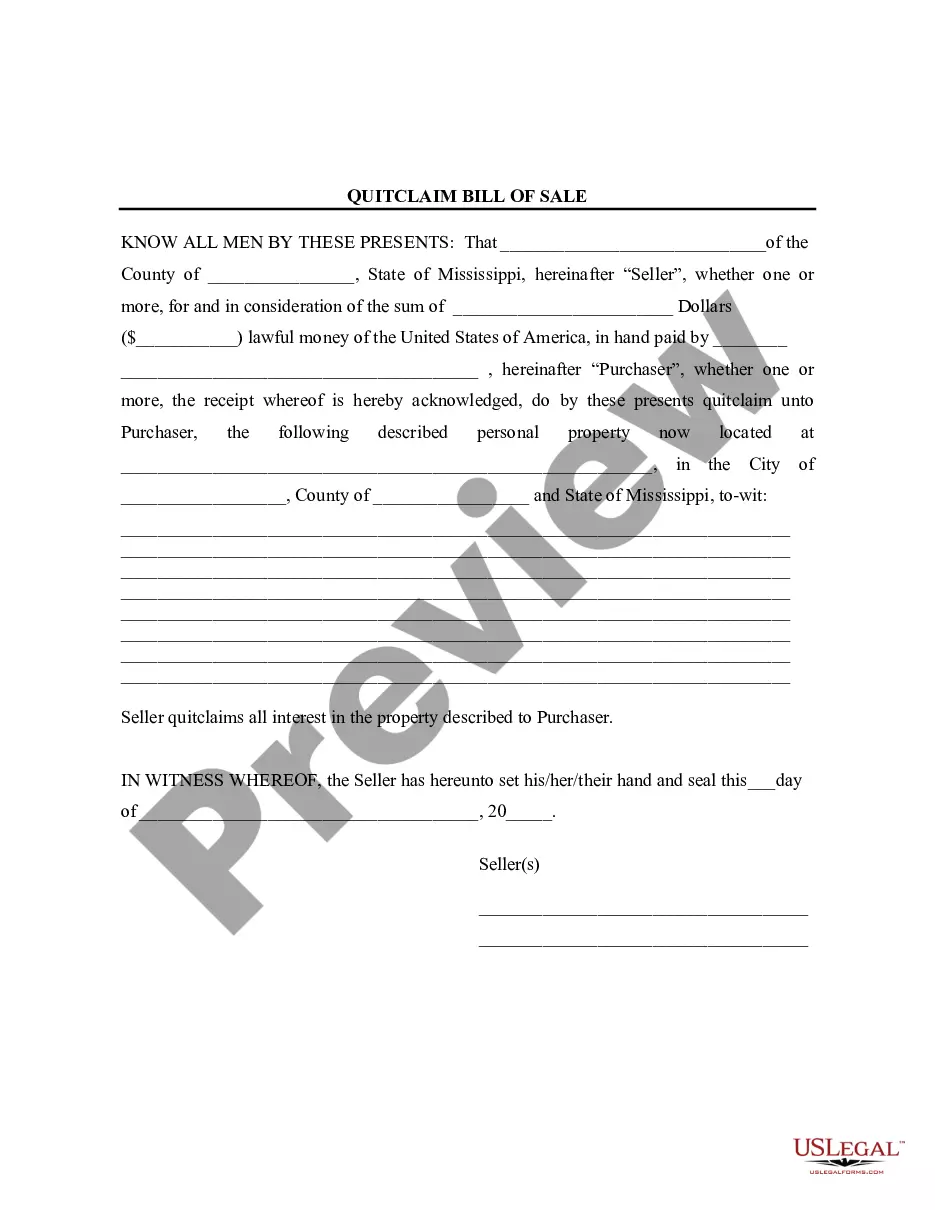

- Review the document's preview and description (if available) to grasp a general understanding of what you will receive after obtaining the form.

- Confirm that the document you select is suitable for your state/county/region as state laws may influence the legitimacy of certain records.

- Examine the related document templates or restart your search to identify the correct document.

- Click Buy now and set up your account. If you already possess one, opt to Log In.

- Choose the desired option, then a suitable payment method, and acquire Palm Beach Affidavit of Death of Joint Tenant.

- Decide to save the form template in any format available.

- Navigate to the My documents tab to re-download the document.

Form popularity

FAQ

Banks, realtors, title companies, etc., correspondingly, all recognize Florida real estate held as joint tenants with right of survivorship as being the sole property of the surviving tenant when one of the owners passes away.

Generally speaking, removing a deceased person's name from a deed requires recording in the public records three documents: A certified copy of the deceased property owner's Death Certificate.Tax forms from the State of Florida Department of Revenue (DOR).

A joint tenant with the right of survivorship is a legal ownership structure involving two or more parties for an account or another asset. Each tenant has an equal right to the account's assets and is afforded survivorship rights if the other account holder(s) dies.

Where a property is owned as joint tenants, when one of the owners die the property automatically pass to the surviving owner, regardless of what the Will of the deceased owner says. This is known as a 'right of survivorship'. This is the most common way a property is owned by husband and wife or civil partners.

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.

The survivor of the joint owners automatically owns 100% of the asset when the other joint owner passes away. Many deeds recorded in our real estate records will identify the owners as joint tenants with right of survivorship.

By Gary M. Singer - South Florida Sun Sentinel When your spouse passes away, you stay the owner now the sole owner of the property. To prove this to the world and effectively remove your deceased spouse from the title, you simply have to record their death certificate in the public records.

The dangers of joint tenancy include the following: Danger #1: Only delays probate.Danger #2: Probate when both owners die together.Danger #3: Unintentional disinheriting.Danger #4: Gift taxes.Danger #5: Loss of income tax benefits.Danger #6: Right to sell or encumber.Danger #7: Financial problems.

However, in the case of death of a spouse, the property can only be transferred in two ways. One is through partition deed or settlement deed in case no will or testament is created by the deceased spouse. And second is through the will deed executed by the person before his/her last death.