An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

Franklin Ohio Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate

Description

How to fill out Affidavit Of Heirship, Next Of Kin Or Descent - Decedent Died Intestate?

A documentation routine invariably accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring possession, and numerous other life situations necessitate you to prepare formal records that vary across the nation. Hence, having everything organized in one location is incredibly advantageous.

US Legal Forms is the most extensive online repository of current federal and state-specific legal templates. Here, you can effortlessly locate and download a document for any personal or business purpose used in your area, including the Franklin Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate.

Finding forms on the platform is exceedingly straightforward. If you already hold a subscription to our service, Log In to your account, search for the template through the search field, and click Download to save it on your device. After that, the Franklin Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate will be available for future use in the My documents section of your profile.

Employ it as needed: print it or fill it out electronically, sign it, and submit where required. This is the easiest and most reliable method to obtain legal documents. All the samples offered by our library are professionally prepared and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters efficiently with the US Legal Forms!

- Make sure you have accessed the correct page with your localized form.

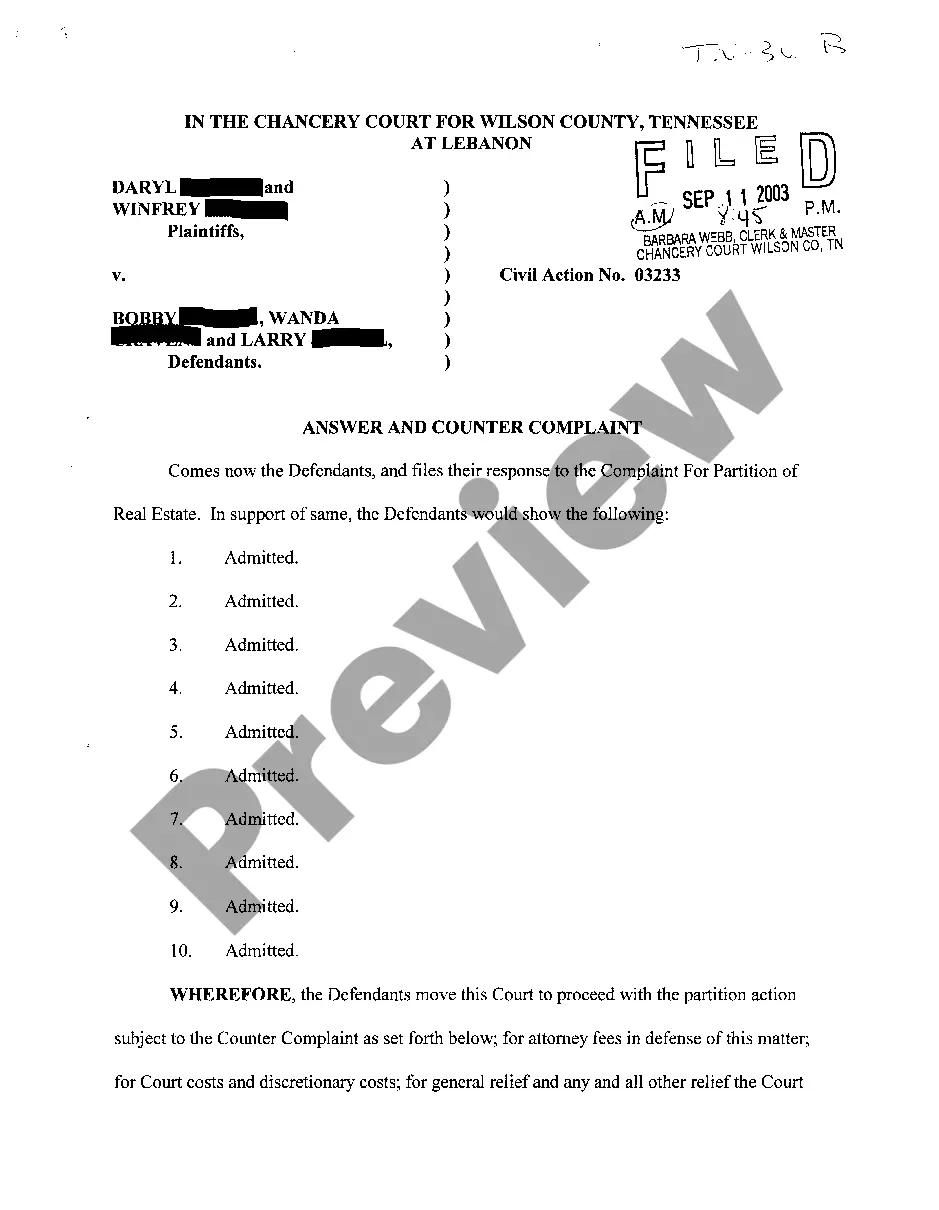

- Utilize the Preview mode (if available) and view the sample.

- Read the description (if available) to confirm the form meets your requirements.

- Search for another document using the search tab in case the sample is unsuitable.

- Click Buy Now once you find the necessary template.

- Choose the suitable subscription plan, then Log In or create an account.

- Select the preferred payment method (credit card or PayPal) to advance.

- Choose file format and save the Franklin Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate on your device.

Form popularity

FAQ

To inherit under intestate succession laws, an heir may have to live a certain amount of time longer than the deceased person. In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of timetheoretically, one second would do.

Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

Illegitimate Children are compulsory heirs entitled to their legitime. Article 887 of the Civil Code provides: Article 887.

Simply stated, there will be legal or intestate succession if the decedent dies without leaving any last will and testament. Thus, the law will step in to distribute, based on the deceased's presumed will, the inheritance in favor of his or her compulsory heirs.

According to the UPC, close relatives always come first in the order of inheritance. Generally speaking, the surviving spouse is first in line to inherit, with children and grandchildren next in line. If the surviving spouse has any minor children, they may inherit the whole estate.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

The compulsory heirs are the spouse, legitimate children and their legitimate descendants, and proven illegitimate children and their descendants, whether legitimate or illegitimate. In the absence of legitimate children, the legitimate parents/ascendants become compulsory heirs.

If the deceased doesn't leave a will (intestate proceeding), the estate will have no free portion and will be divided equally among the surviving spouse and legitimate children. If there are illegitimate children, they are entitled to the equivalent of ½ the share of the legitimate children.

Did you inherit a Real Estate Property? Under the Philippine law of intestate succession, (the decedent left no will), the compulsory heirs (spouse and children) will automatically inherit the estate of the decedent at the time of death.