Cuyahoga Ohio Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

Whether you intend to launch your enterprise, engage in a contract, request your ID renewal, or address family-related legal matters, you must prepare particular documentation in accordance with your local laws and regulations.

Locating the right documents may require significant time and effort unless you utilize the US Legal Forms library.

The platform offers more than 85,000 expertly crafted and validated legal templates suitable for any personal or business scenario.

Log in to your account and pay the service using a credit card or PayPal. Download the Cuyahoga Miller Trust Forms for Assisted Living in your preferred file format. Print the document or complete and sign it electronically using an online editor to save time. Documents available from our library are reusable. With an active subscription, you can access all of your previously purchased documents at any time via the My documents tab in your profile. Cease wasting time on an endless search for current official documents. Join the US Legal Forms platform and maintain your paperwork in order with the most comprehensive online form collection!

- All documents are categorized by state and application area, making it quick and straightforward to select a copy like Cuyahoga Miller Trust Forms for Assisted Living.

- Users of the US Legal Forms library only need to Log In to their account and click the Download button next to the desired template.

- If you are a newcomer to the service, you will need to follow a few additional steps to secure the Cuyahoga Miller Trust Forms for Assisted Living.

- Ensure the sample meets your individual requirements and complies with state laws.

- Review the form description and check the Preview if available on the page.

- Use the search tab to specify your state above to discover another template.

- Click Buy Now to acquire the document once you locate the correct one.

- Select the subscription plan that best meets your needs to proceed.

Form popularity

FAQ

Ohio uses section 1634 of the Social Security Act (codified at 42 USC 1383c) to determine eligibility for medicaid. These means that individuals can no longer "spend down" their income to become eligible. Instead, individuals having too much money, will have to set up a Miller Trust.

Qualified Income Trusts (QIT), also referred to as Miller Trusts, are intended for those who have an income greater than qualifications for Medicaid allow, yet don't have enough income to pay for long term care. With QIT's, an individual's excess income is directly deposited each month into a restricted funds account.

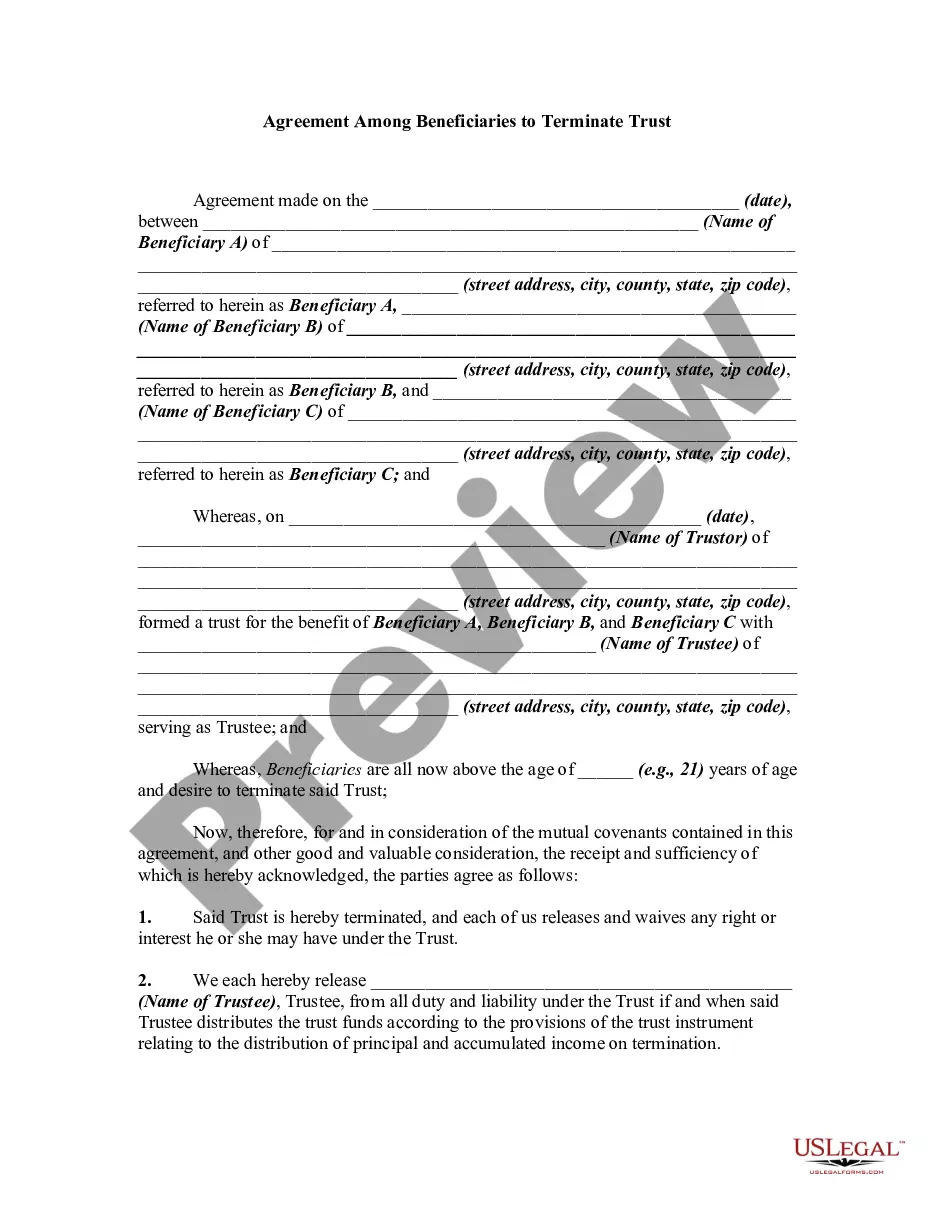

A Qualified Income Trust (QIT), also known as a Miller Trust, is a special legal arrangement for holding a person's income. A QIT is a written trust agreement for which the trustee establishes a dedicated bank account.

A Qualified Income Trust (QIT), also known as a Miller Trust, is a special legal arrangement for holding a person's income. A QIT is a written trust agreement for which the trustee establishes a dedicated bank account. Banks that can set up QIT accounts are Chase, Huntington and Key Bank if needed.

A Qualified Income Trust is set up to lower a Medicaid applicant's income, not their assets. If the applicant dies and the Qualified Income Trust holds the applicant's assets, the remaining assets will all be going to the State of Florida to pay back medical expenses.

Miller Trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid. Unlike other types of trusts, there are very few restrictions on who can establish a Miller Trust to qualify for government benefits.

The trust account will be used to pay the Medicaid income spend down and any other medical expenses not covered by Medicaid or other insurance. For example, payment of a health insurance premium, such as a Medicare supplemental insurance premium, is allowed.

Qualified Income Trusts (QIT), also referred to as Miller Trusts, are intended for those who have an income greater than qualifications for Medicaid allow, yet don't have enough income to pay for long term care. With QIT's, an individual's excess income is directly deposited each month into a restricted funds account.

Upon Death, Assets in a QIT Will be Given to the State Any funds that remain after the state has been reimbursed will be paid to other trust beneficiaries. Normally, all deposited income is spent each month, so most QITs are usually empty at the time of the applicant's death.