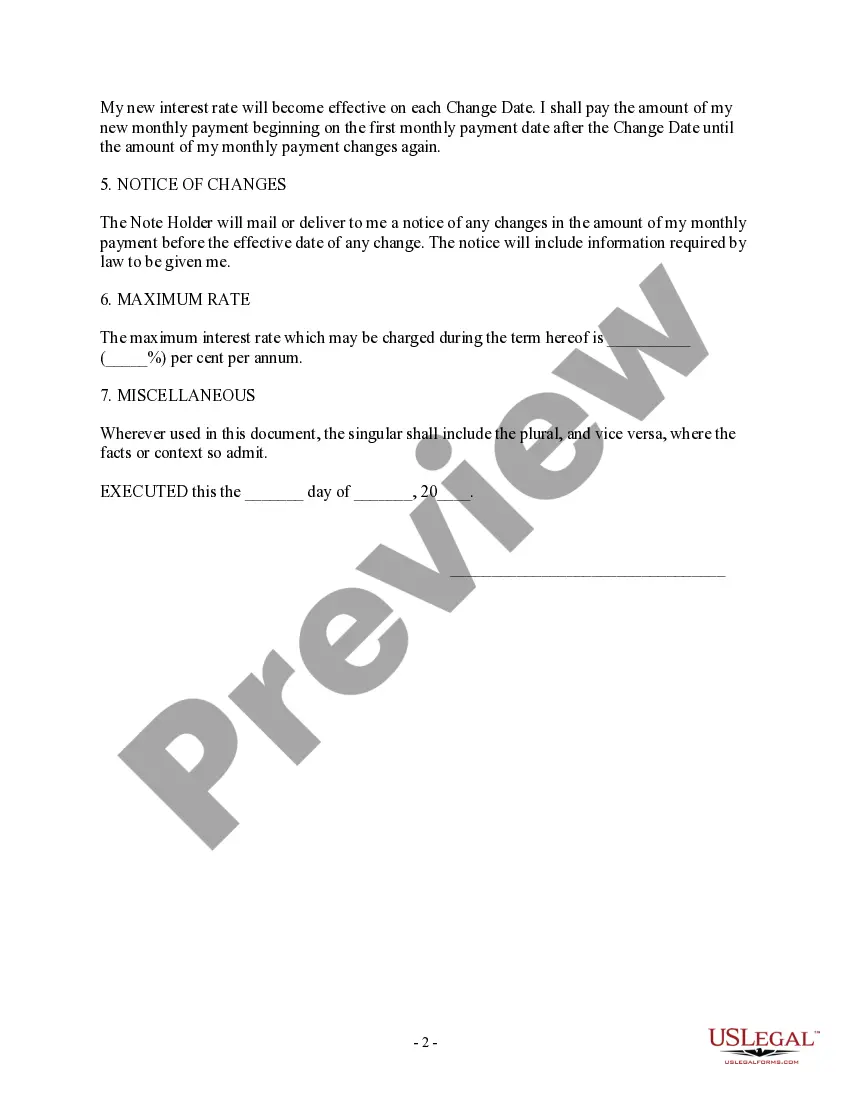

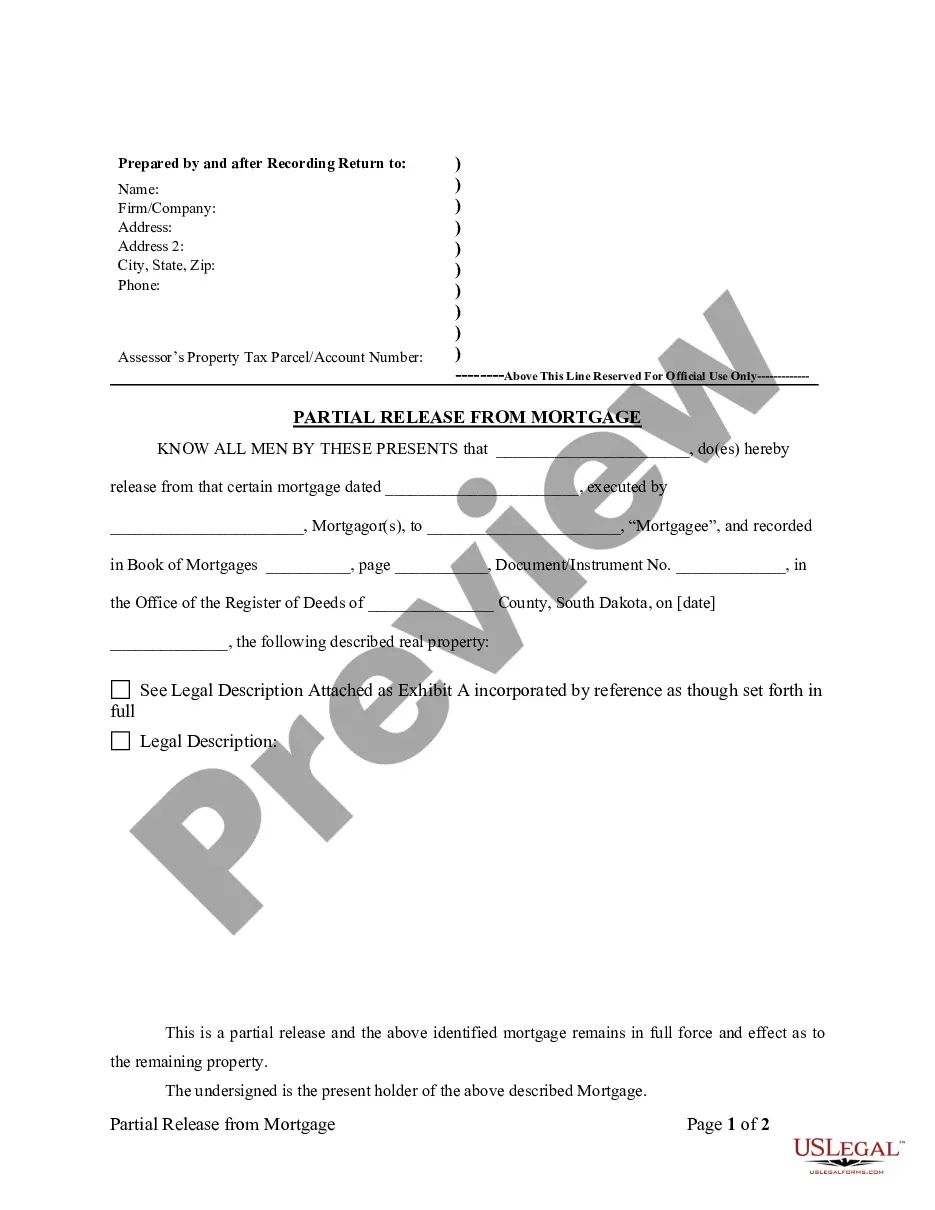

The Harris Texas Adjustable Rate Rider — Variable Rate Note is a legal document that outlines the terms and conditions of adjustable-rate mortgage loans in the state of Texas. This rider is attached to the main mortgage agreement and provides specific guidelines regarding the variable interest rates associated with the loan. The Harris Texas Adjustable Rate Rider — Variable Rate Note comes into effect when a borrower opts for an adjustable-rate mortgage (ARM) rather than a fixed-rate mortgage. Unlike fixed-rate loans, ARM shaves an interest rate that fluctuates based on market conditions, making it an appealing option for borrowers seeking flexibility and potential interest savings. The variable interest rates indicated in the Harris Texas Adjustable Rate Rider are usually tied to an index, such as the United States Treasury Securities or the London Interbank Offered Rate (LIBOR). These indexes represent the general movement of interest rates in the financial market. The rider specifies how the interest rate is calculated by adding a margin to the chosen index. It is important to note that the Harris Texas Adjustable Rate Rider — Variable Rate Note has different versions, each tailored to specific loan programs or lenders. Some common types of this rider include: 1. Standard Adjustable Rate Rider: This is the most basic version of the rider, outlining the standard terms and conditions of an adjustable-rate mortgage. It provides details on the initial interest rate, adjustment frequency, interest rate caps, and payment adjustment limits. 2. Interest-Only Adjustable Rate Rider: This type of rider allows the borrower to make interest-only payments for a specific period, typically ranging from 3 to 10 years. After this period, the borrower is required to make principal and interest payments, and the interest rate may adjust annually or at an agreed-upon interval. 3. Hybrid Adjustable Rate Rider: This rider combines elements of both fixed-rate and adjustable-rate mortgages. It typically offers a fixed interest rate for an initial period, usually 3, 5, 7, or 10 years, after which the rate will adjust annually. The adjustment frequency and interest rate caps are clearly defined in this type of rider. Overall, the Harris Texas Adjustable Rate Rider — Variable Rate Note provides borrowers with a clear understanding of their adjustable-rate mortgage terms, ensuring transparency and protection for both the lender and borrower. It is essential for borrowers to carefully review and comprehend the rider before signing the mortgage agreement to make informed decisions about their loan.

Harris Texas Adjustable Rate Rider - Variable Rate Note

Description

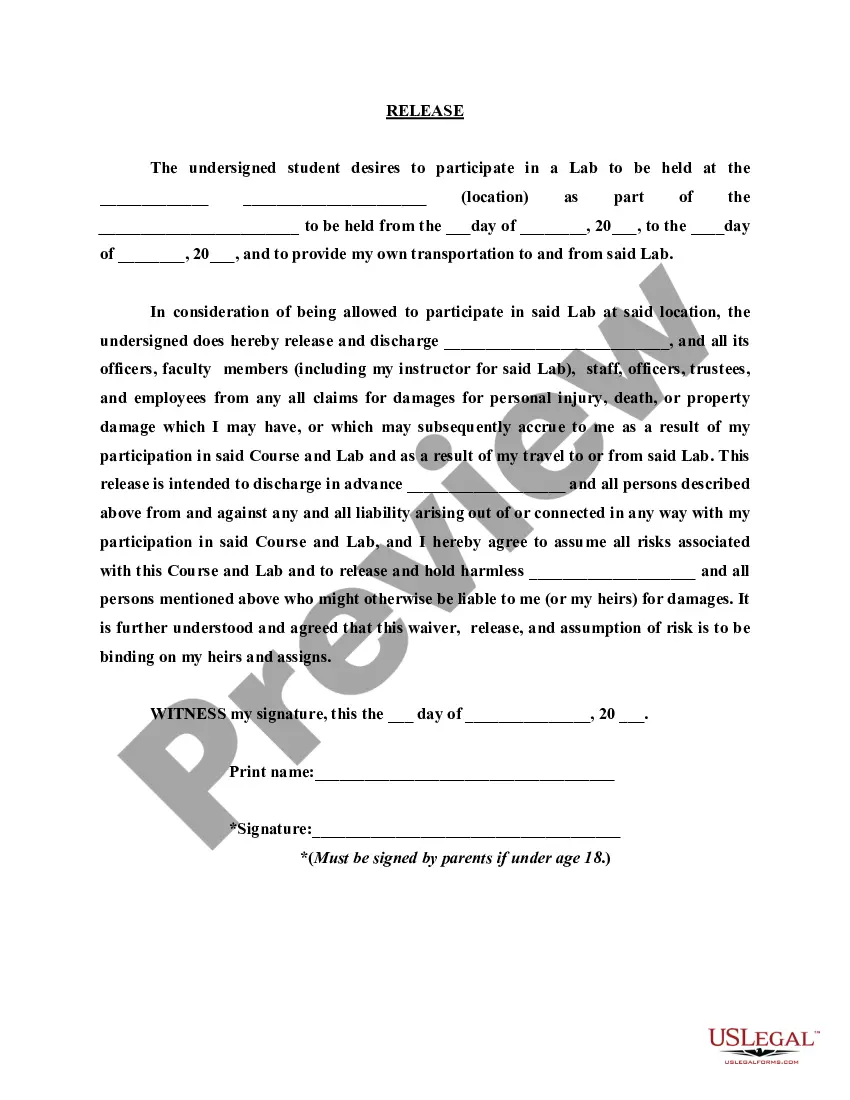

How to fill out Harris Texas Adjustable Rate Rider - Variable Rate Note?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Harris Adjustable Rate Rider - Variable Rate Note without expert help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Harris Adjustable Rate Rider - Variable Rate Note on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Harris Adjustable Rate Rider - Variable Rate Note:

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.

Pitfalls of Adjustable-Rate Mortgages While you may benefit from a lower payment, you still have the risk that rates will rise on you. If that happens, your monthly payment can increase dramatically.

Below are the risks most commonly encountered with adjustable rate mortgages. Rising monthly payments and payment shock.Negative amortization.Refinancing your mortgage.Prepayment penalties.Falling housing prices.

An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

While it may seem beneficial at first glance, an ARM payment cap could actually prevent your mortgage payment from fully covering future interest increases. This results in negative amortization, which means your loan balance would go up instead of down with each payment.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

Adjustable-Rate Mortgage Benefits The bank (usually) rewards you with a lower initial rate because you're taking the risk that interest rates could rise in the future. 2feff Contrast the situation with a fixed-rate mortgage, where the bank takes that risk.

An adjustable-rate mortgage, or ARM, is a home loan with an interest rate that can change periodically. This means that the monthly payments can go up or down. Generally, the initial interest rate is lower than that of a comparable fixed-rate mortgage.

Cons of Adjustable-Rate Mortgages You could be left with a much higher payment. You might buy more house than you can afford. Budget and financial planning is more difficult. You might end up owing more than your house is worth.