Sacramento California Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

Laws and statutes in every domain vary throughout the nation.

If you’re not an attorney, it’s simple to become confused by numerous standards when it comes to composing legal documents.

To prevent expensive legal counsel when preparing the Sacramento Option of Remaining Partners to Acquire, you need an authenticated template valid for your jurisdiction.

That’s the most straightforward and economical method to access current templates for any legal requirements. Find them all with just a few clicks and maintain your documentation organized with the US Legal Forms!

- That’s when utilizing the US Legal Forms platform is particularly beneficial.

- US Legal Forms is a reliable online repository of over 85,000 state-specific legal templates used by millions.

- It serves as an outstanding solution for professionals and individuals seeking DIY templates for various personal and business circumstances.

- All the documents can be reused multiple times: once you select a template, it stays available in your account for additional use.

- Therefore, if you have an account with an active subscription, you can just Log In and re-download the Sacramento Option of Remaining Partners to Acquire from the My documents section.

- For new users, a few additional steps are required to obtain the Sacramento Option of Remaining Partners to Acquire.

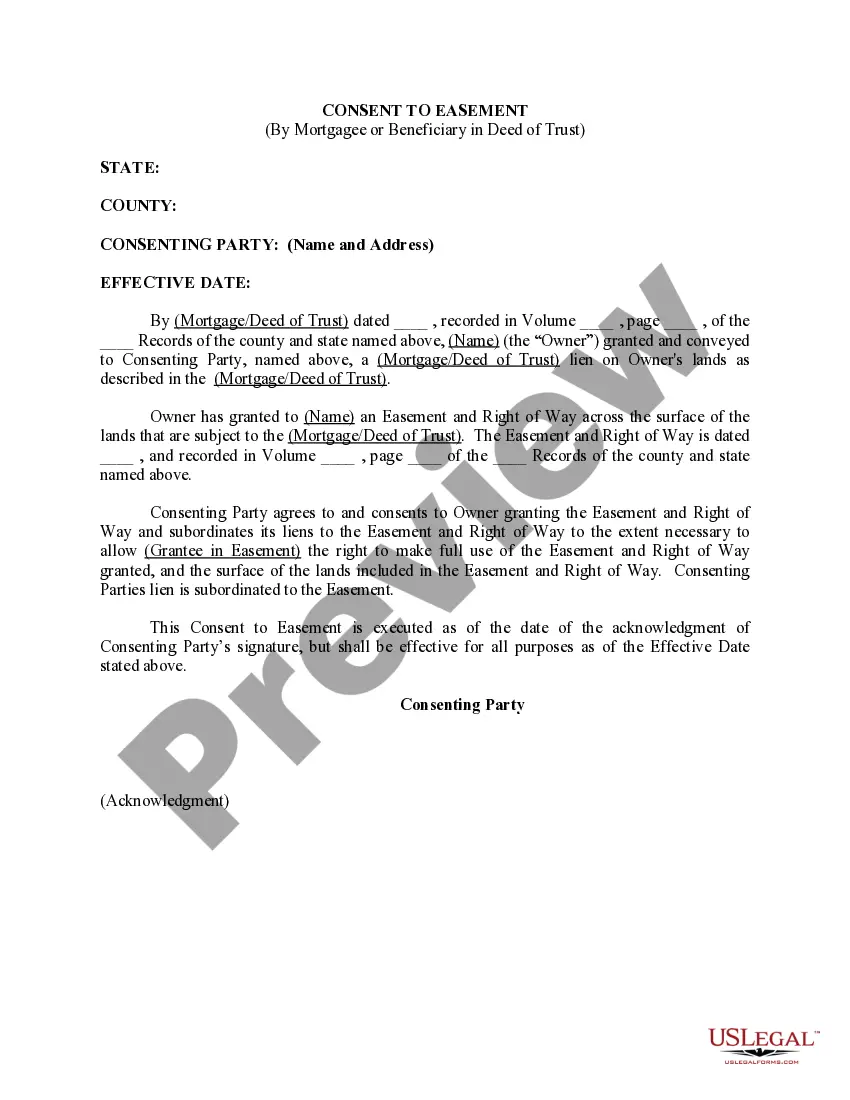

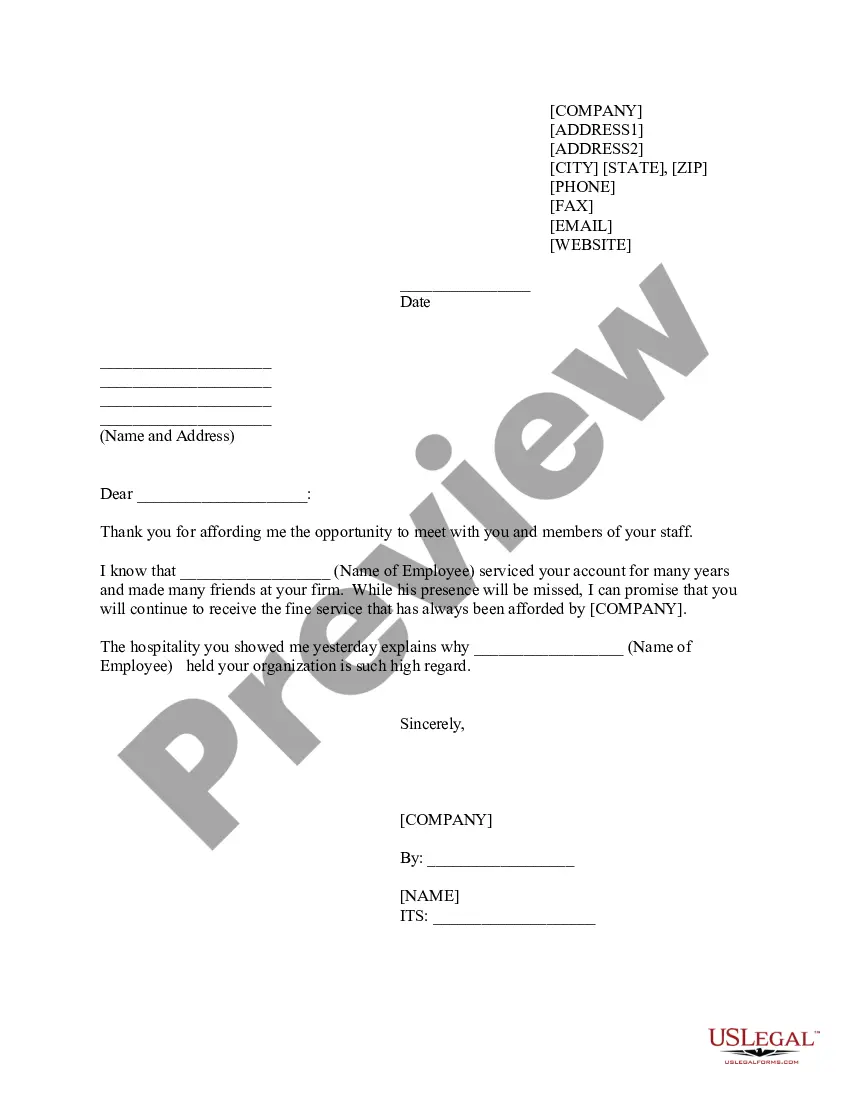

- Review the page content to confirm you’ve identified the appropriate template.

- Make use of the Preview feature or examine the form description if available.

Form popularity

FAQ

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

A married couple that acquires a home loan during the marriage is equally obligated on the loan and both names are usually on title. When financing is used for a home in California, a trust deed is recorded. It involves holding title in a trust.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

After you purchased your property, chances are, you will receive some official-looking mails selling you the services of obtaining grant deed for your property. They normally charge anywhere between $50 to $100.

Before you can transfer property ownership to someone else, you'll need to complete the following. Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Take the deed to the recorder's office in the county where the property is located. Complete a Preliminary Change of Ownership Report, available in the recorder's office and online, by providing the names of the grantor and grantee, the type of transfer, the terms of transfer and the transfer price.

California doesn't require the inclusion of the date, or of money paid, or of a notarization of the transferor's signature on the grant deed, and a grant deed is valid even if it's not recorded in the local land records.

In order to accomplish this, you can't just pen in the name on your deed. You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.