Minneapolis Minnesota Financing Statement

Description

Form popularity

FAQ

You should file a Minneapolis Minnesota Financing Statement with the Minnesota Secretary of State's office. This filing can often be done electronically, making it more accessible for you. Additionally, ensuring that your financing statement is filed correctly is essential to securing your interest in the collateral. Services like USLegalForms provide step-by-step guidance to help you navigate the filing process seamlessly.

A Minneapolis Minnesota Financing Statement typically lasts for five years from the date it is filed. After this period, it may expire unless a continuation statement is filed to extend its validity. It is crucial for you to monitor the status of your financing statements to ensure that your security interest remains protected. Using a reliable service, like USLegalForms, can help you manage and extend your financing statements efficiently.

Filing a property lien in Minnesota involves submitting the appropriate form to the county recorder or registrar of titles. You will need to complete a Minneapolis Minnesota Financing Statement to formally document your lien and provide official notice. Using platforms like US Legal Forms can simplify the process, offering easy access to forms and guidance to ensure your filing meets all legal requirements, thus protecting your interest.

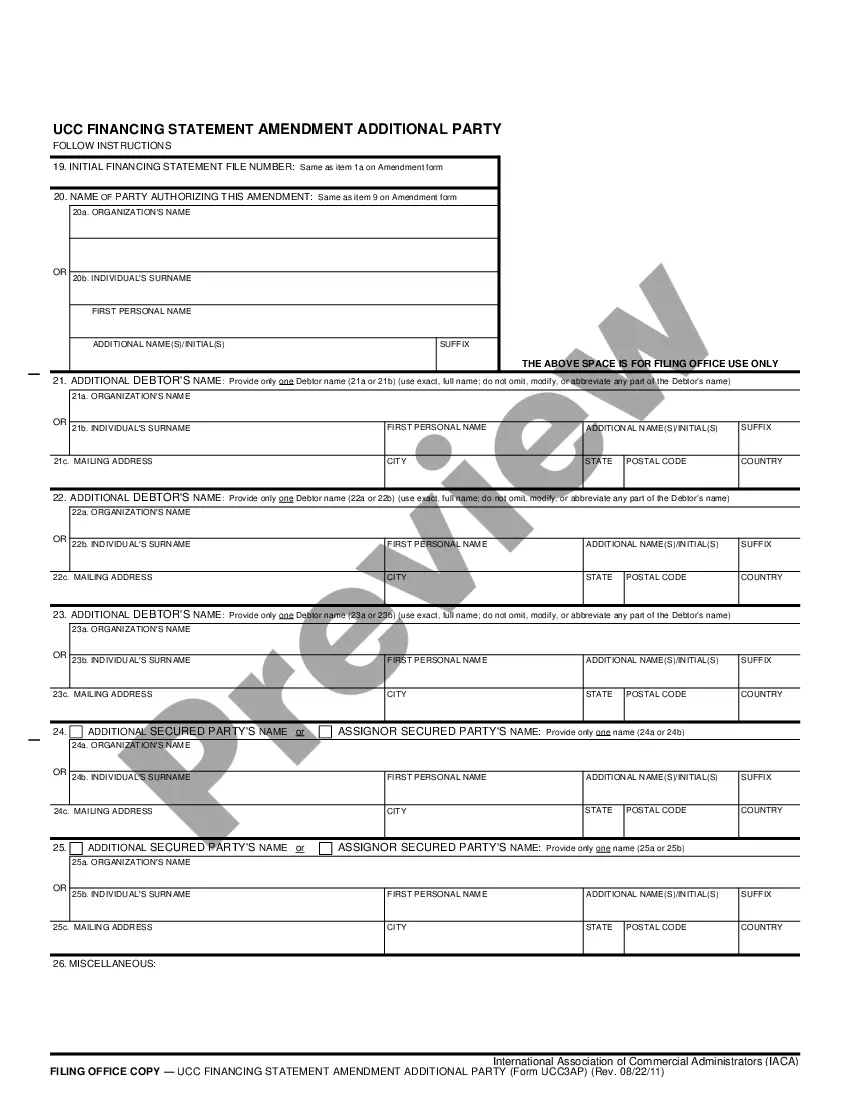

The UCC financing statement document is a legal form that provides notice to creditors about a debtor's collateral in financing agreements. Specifically, in Minneapolis, Minnesota, this document plays a crucial role in securing loans by establishing a public record of the lender's interest. By filing the Minneapolis Minnesota Financing Statement, you can protect your rights as a creditor and ensure your claim takes priority over other claims against a debtor's assets.

The lien process in Minnesota involves filing a Minneapolis Minnesota Financing Statement to establish a creditor's interest in a debtor's property. This filing creates a public record, making the lien enforceable against third parties. After filing, it is crucial to understand the timeline and renewal requirements to maintain your lien status. US Legal Forms can provide valuable resources to help you navigate this process smoothly.

To file a Minneapolis Minnesota Financing Statement, you need to submit it to the Minnesota Secretary of State's office. Typically, this can be done online or through mail, depending on your preference. It's essential to ensure that you complete all required fields correctly to avoid any filing issues. If you use US Legal Forms, you can easily access templates and guidance for submitting your financing statement.

To determine if a lien exists on a property in Minnesota, you can search public records through the county recorder's office where the property is located. A Minneapolis Minnesota Financing Statement will often detail any liens filed against that property. You can also utilize online databases or services, like US Legal Forms, which simplify this process by providing access to necessary forms and guidance. Understanding the lien status is essential before making any investment in real estate.