Harris Texas Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

How long does it typically require for you to generate a legal document.

Considering that each state has its laws and regulations for various life circumstances, finding a Harris Revocable Trust for Estate Planning that fulfills all local criteria can be exhausting, and obtaining it from a qualified attorney is frequently costly.

Many online services provide the most prevalent state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Create an account on the platform or Log In to proceed to payment options. Pay via PayPal or with your credit card. Modify the file format if necessary. Click Download to save the Harris Revocable Trust for Estate Planning. Print the document or utilize any desired online editor to complete it electronically. Regardless of how many times you need to utilize the obtained document, you can find all the samples you’ve ever saved in your profile by accessing the My documents tab. Give it a shot!

- US Legal Forms is the most comprehensive online repository of templates, categorized by states and areas of application.

- In addition to the Harris Revocable Trust for Estate Planning, here you can discover any specialized form to manage your business or personal affairs, adhering to your county standards.

- Experts validate all samples for their accuracy, ensuring that you can prepare your documentation correctly.

- Using the service is quite straightforward.

- If you already possess an account on the site and your subscription is current, you just need to Log In, choose the necessary form, and download it.

- You can keep the document in your profile at any time in the future.

- On the other hand, if you are new to the website, there will be a few additional steps to finalize before you acquire your Harris Revocable Trust for Estate Planning.

- Review the content of the page you’re on.

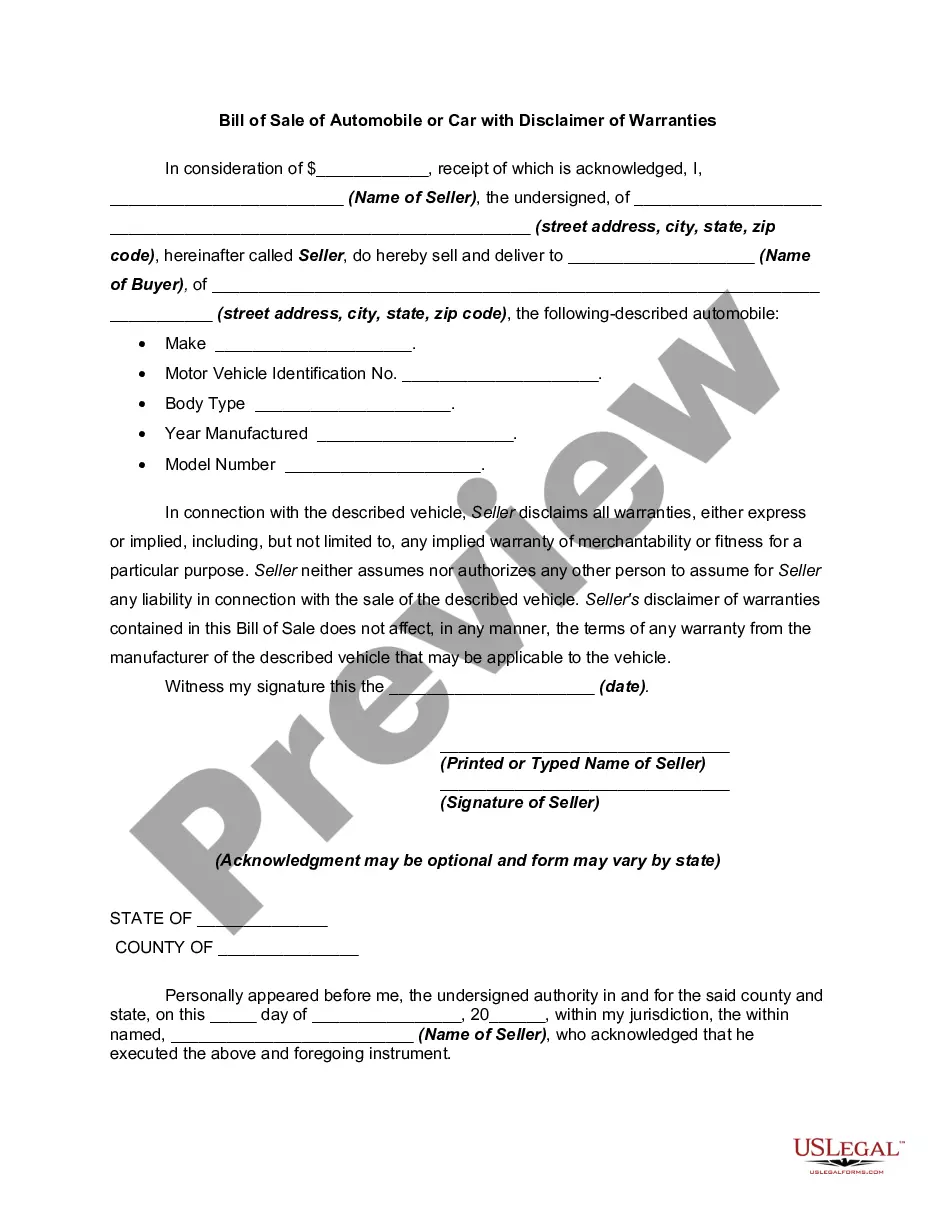

- Go through the description of the template or Preview it (if available).

- Search for other forms using the related option in the header.

- Click Buy Now once you are confident in the chosen document.

- Select the subscription plan that fits you best.

Form popularity

FAQ

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

What are the benefits of a revocable trust? Transferring out-of-state assets to a trust to avoid probate in other states.Managing assets if you're incapacitated.Privacy of your assets.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

The primary benefit of creating a revocable trust is that it provides a prearranged mechanism that will ensure the continued management and preservation of your assets, should you become disabled. It can also set forth all of the dispositive provisions of your estate plan.

Assets That Can And Cannot Go Into Revocable Trusts Real estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.