Long Beach California Revocable Trust for Grandchildren

Description

Form popularity

FAQ

While it is possible to set up a Long Beach California Revocable Trust for Grandchildren without a lawyer, it is generally recommended to seek professional assistance. Creating a trust involves navigating legal language and requirements, which can be complex. Services like uslegalforms can provide user-friendly templates and guidance to help you establish the trust correctly. Ultimately, ensuring your trust is set up properly will provide the best outcome for your grandchildren.

A Long Beach California Revocable Trust for Grandchildren is one of the most effective options for passing on wealth to your grandchildren. This type of trust offers flexibility in managing your assets and can be tailored to meet your family's unique needs. By establishing this trust, you can dictate terms for accessing funds and provide for future generations responsibly. Moreover, it can help protect your grandchildren's inheritance from creditors or external issues.

Setting up a Long Beach California Revocable Trust for Grandchildren is one of the best ways to ensure a smooth inheritance. This trust allows you to specify how and when your grandchildren receive their inheritance. You can include stipulations such as education or other milestones, ensuring responsible usage of the assets. Additionally, using a trust can help minimize taxes and avoid probate.

In California, a Long Beach California Revocable Trust for Grandchildren does not need to be recorded. Unlike wills, which must go through probate, revocable trusts operate outside of the court system. However, it's advisable to keep all trust documents secure and accessible. This approach guarantees that your intentions for the trust are clear and properly administered.

Yes, you can establish a Long Beach California Revocable Trust for Grandchildren to secure your grandchildren's financial future. This type of trust allows you to manage assets while maintaining flexibility during your lifetime. By placing funds into the trust, you ensure that your grandchildren will benefit according to your wishes. Additionally, you can adjust the trust terms as needed, providing peace of mind.

The major disadvantage of a trust is that it often requires ongoing management and may involve administrative costs. You must ensure that all assets are titled properly, which can be a time-consuming process. Moreover, while creating a trust, legal fees may arise, which can add up quickly. Therefore, consulting with professionals experienced in Long Beach California Revocable Trust for Grandchildren can help you navigate these complexities efficiently.

One notable disadvantage of a revocable living trust in California is that it does not provide protection from creditors. Assets placed in a revocable living trust can still be accessed by creditors during your lifetime. Additionally, in order to avoid probate, all assets must be correctly transferred into the trust, which sometimes requires significant effort or legal help. Therefore, when considering a Long Beach California Revocable Trust for Grandchildren, it's essential to weigh these factors carefully.

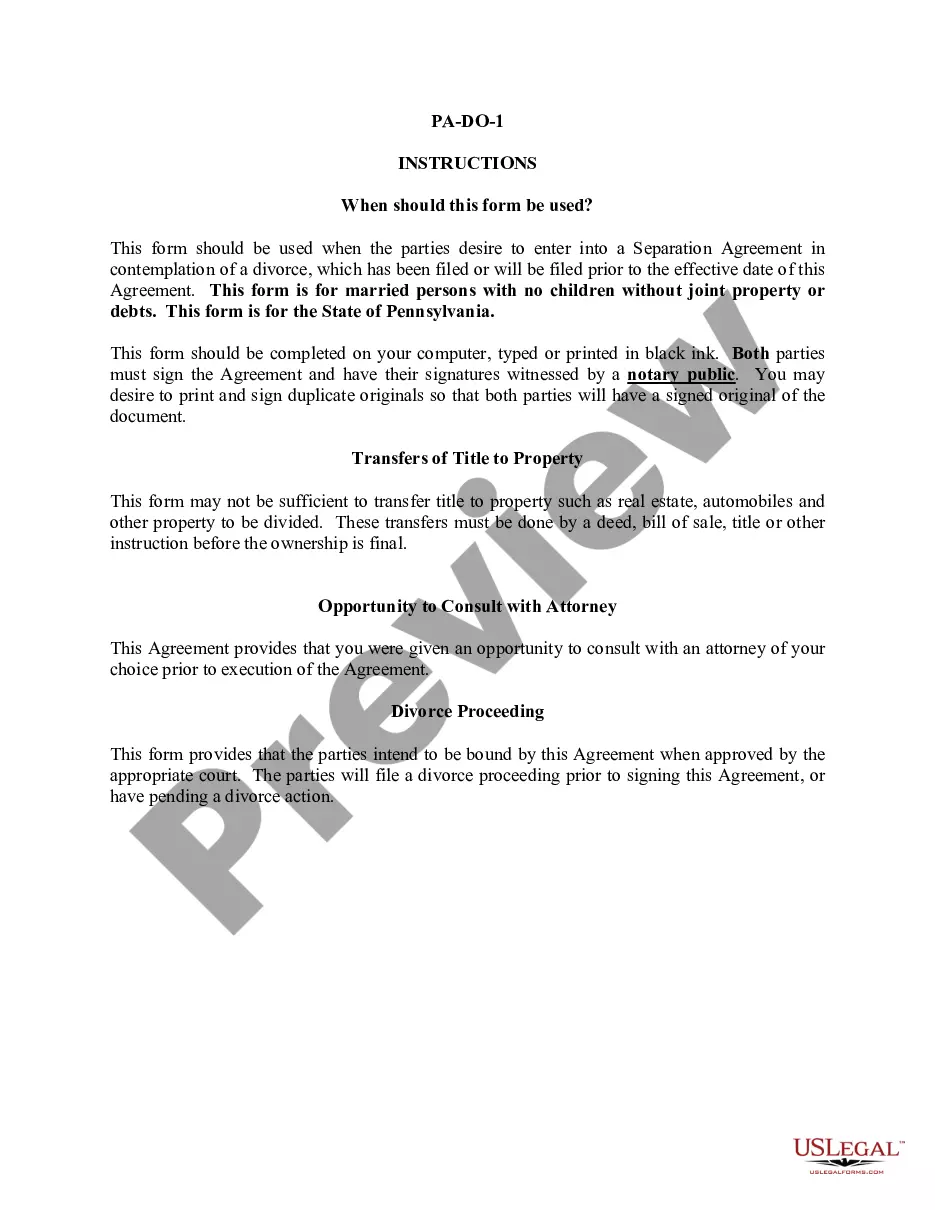

To set up a Long Beach California Revocable Trust for Grandchildren, start by determining the assets you want to place in the trust. Next, choose a reliable trustee, who can be a family member or a professional, to manage the trust on your behalf. You will then draft the trust document, which outlines the terms and conditions for how your assets will be distributed to your grandchild. It is often beneficial to consult a legal expert or use platforms like US Legal Forms to guide you through creating this trust efficiently.

The best account for grandparents to consider is a 529 education savings plan, which provides tax benefits for education expenses. A Long Beach California Revocable Trust for Grandchildren can also serve as a useful vehicle for managing funds that may contribute to a grandchild's future education or other significant milestones. This kind of trust allows for flexible distributions as needed. It is advisable to review your options with a financial advisor to find the best fit.

The 2-year rule for trusts refers to the regulation that limits asset transfers to trusts to qualify for Medicaid benefits. If you place assets in a trust less than two years before applying for Medicaid, those assets may be considered countable against eligibility. Therefore, it is wise to establish a Long Beach California Revocable Trust for Grandchildren well ahead of any anticipated need for assistance. Consulting with an estate planning attorney can provide clarity on this rule.