Memphis Tennessee Revocable Trust for House

Description

Form popularity

FAQ

To put your house in a trust in Tennessee, you will need to create the trust document that specifies the trust's terms. For a Memphis Tennessee Revocable Trust for House, include the details about the property and your beneficiaries. The next step involves executing a new deed that transfers ownership from yourself to the trust. Many people find it helpful to utilize services like US Legal Forms to ensure proper documentation and compliance.

While placing your house in a trust can have advantages, there are also disadvantages to consider. Firstly, you may incur costs for legal assistance to establish a Memphis Tennessee Revocable Trust for House. Additionally, if you decide to sell the property, you must navigate the process through the trust, which can add complexity. Lastly, not every estate plan requires a trust, so assessing your situation is crucial.

One downside of a revocable trust is that it does not provide asset protection from creditors. A Memphis Tennessee Revocable Trust for House allows for flexibility, but it leaves assets vulnerable during your lifetime. Additionally, setting up a trust requires time and legal fees, which some may find burdensome. Understanding these factors is essential as you plan your estate.

To set up a revocable trust for your house, start with drafting a trust document that outlines the terms and conditions. In the case of a Memphis Tennessee Revocable Trust for House, it is wise to include details about the property and beneficiaries. Next, transfer the title of your house into the trust, which involves changing the deed. This process can be facilitated through platforms like US Legal Forms, ensuring everything is legally sound.

Yes, you can put your house in a trust in Tennessee. Establishing a Memphis Tennessee Revocable Trust for House allows you to manage your property during your lifetime, and it can simplify the transfer of ownership upon your passing. This type of trust provides flexibility, as you can change its terms as needed. By using a revocable trust, you maintain control while ensuring your assets are protected.

While a revocable trust offers many benefits, there are some downsides to consider. For instance, assets in a Memphis Tennessee Revocable Trust for House do not receive tax benefits or protection from creditors. Moreover, establishing a trust requires time and some financial investment. It's important to weigh these factors against the benefits to determine if a revocable trust is right for your situation.

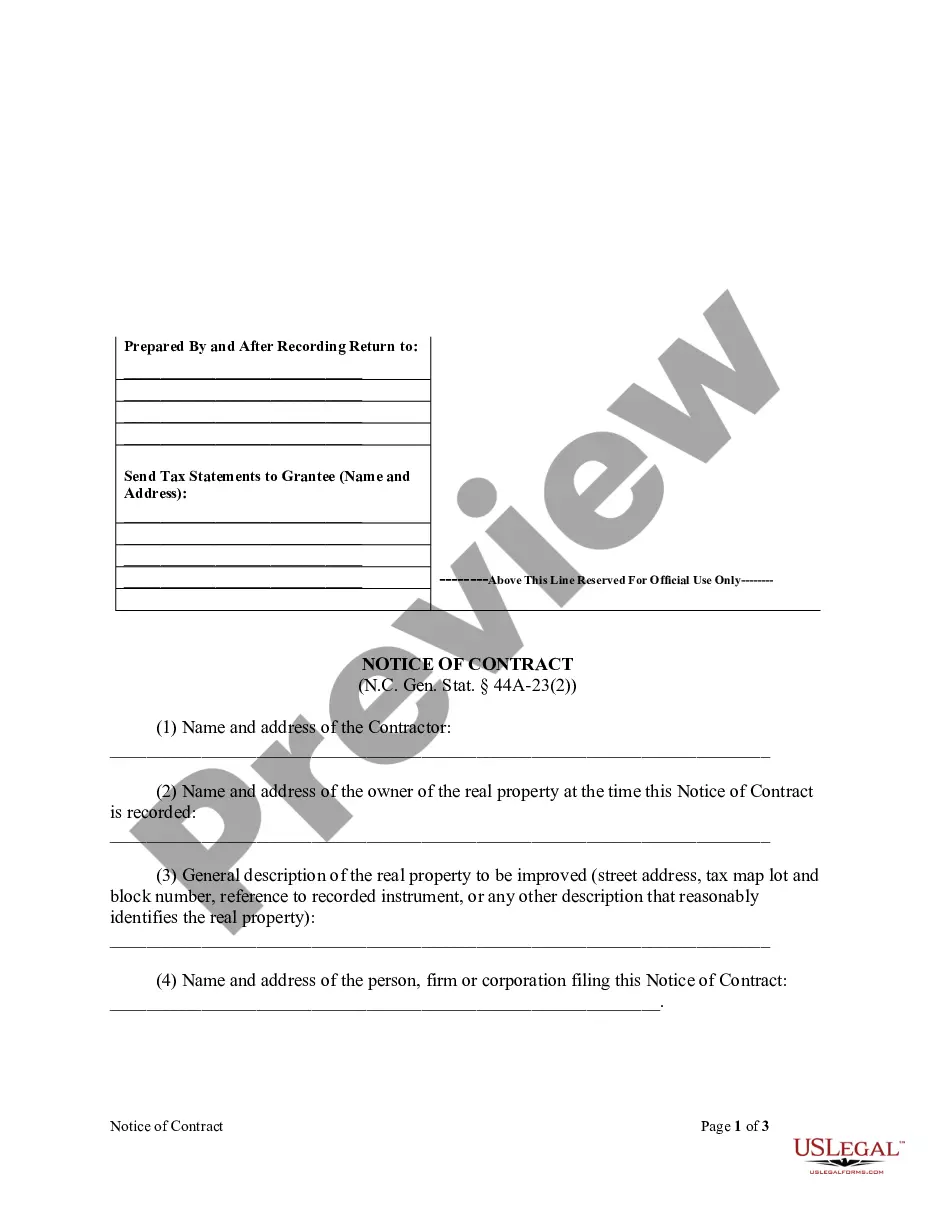

Setting up a Memphis Tennessee Revocable Trust for House involves several key steps. First, gather all relevant property details, including your house, to include in the trust. Next, draft a trust document that outlines the terms and conditions of your trust, specifying who will manage it and the beneficiaries. Finally, work with a legal professional or use a reliable platform like uslegalforms to ensure that your trust complies with Tennessee laws and effectively protects your assets.