Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

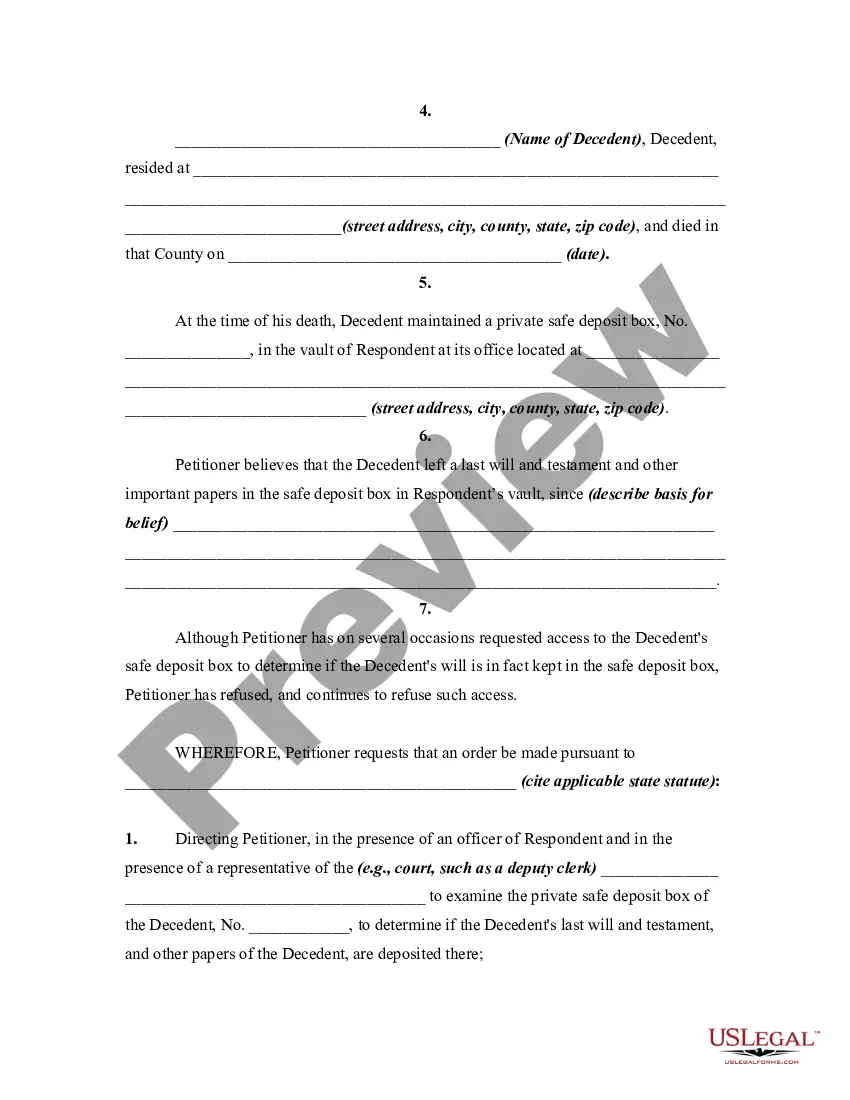

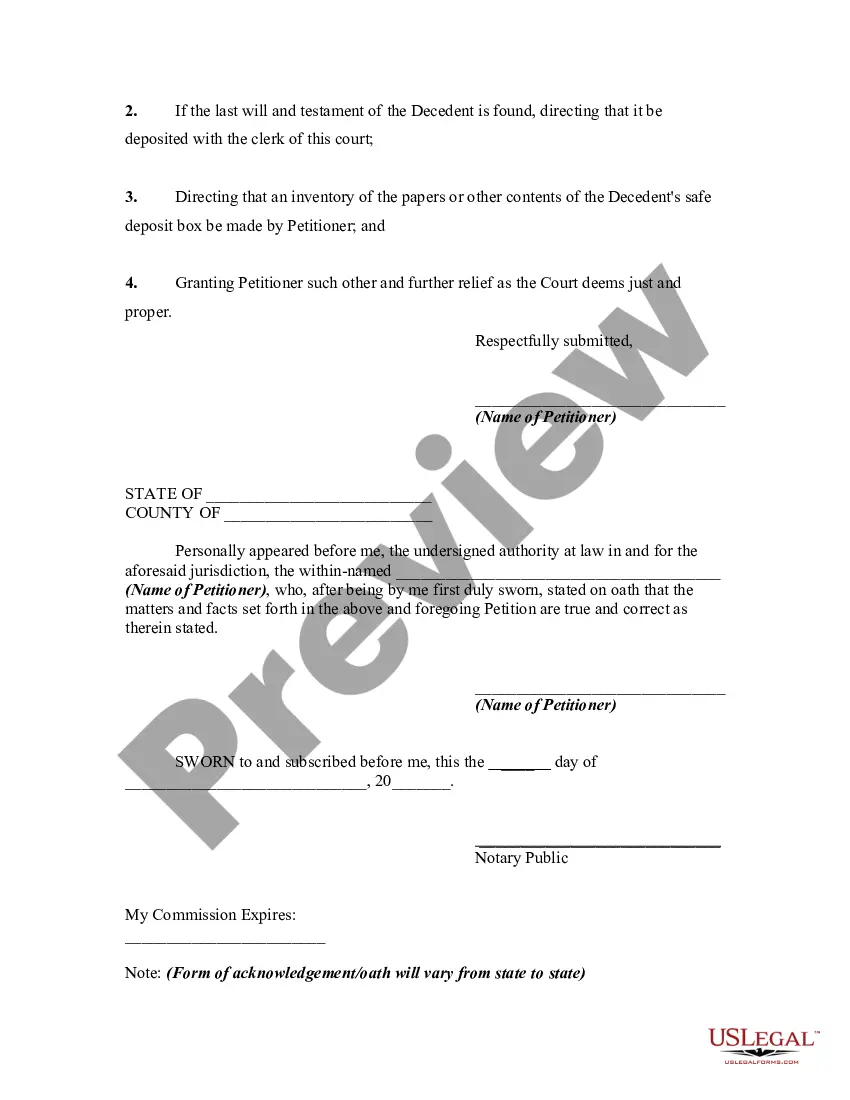

Wake North Carolina Petition For Order to Open Safe Deposit Box of Decedent

Description

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

Drafting documents for business or personal requirements is always a significant obligation.

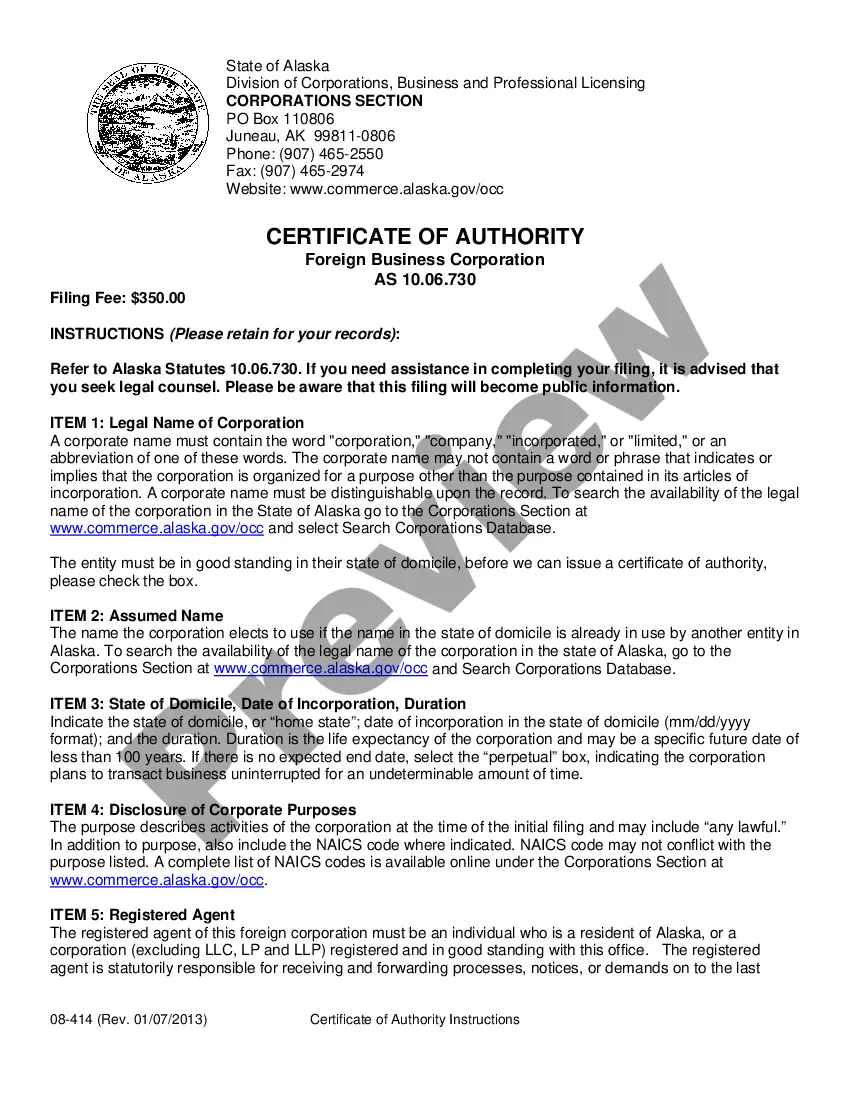

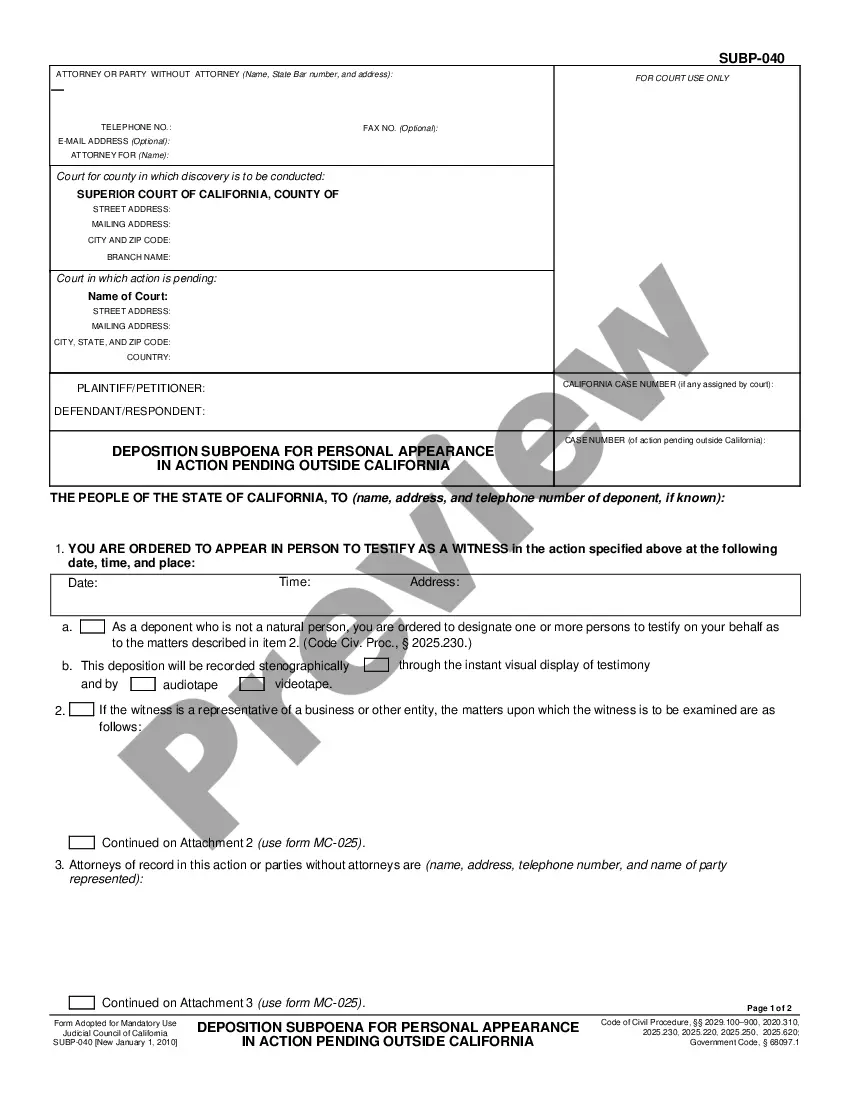

When formulating a contract, a public service application, or a power of attorney, it is crucial to take into account all federal and state laws of the designated area.

However, smaller counties and even municipalities also have legislative regulations that must be considered.

To find the form that meets your requirements, make use of the search tab in the header. Ensure that the sample conforms to legal standards and click Buy Now. Choose a subscription plan, then Log In or create an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the chosen document in your preferred format, print it out, or complete it electronically. The unique feature of the US Legal Forms library is that all the documents you've ever purchased remain retrievable - you can find them in your profile under the My documents section whenever needed. Register on the platform and swiftly acquire verified legal templates for any situation with just a few clicks!

- All these factors contribute to making it tedious and time-consuming to create a Wake Petition For Order to Open Safe Deposit Box of Decedent without expert assistance.

- It's simple to circumvent attorney fees for drafting your paperwork and produce a legally acceptable Wake Petition For Order to Open Safe Deposit Box of Decedent independently, using the US Legal Forms online library.

- It is the most extensive online repository of state-specific legal documents that are professionally verified, ensuring their legitimacy when selecting a sample for your locality.

- Previously subscribed users only need to Log In to their accounts to retrieve the needed form.

- If you are yet to obtain a subscription, follow the step-by-step guidelines below to secure the Wake Petition For Order to Open Safe Deposit Box of Decedent.

- Browse through the webpage you've accessed and verify if it contains the necessary document.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Yes, you can give someone access to your safe deposit box by adding them as a joint tenant or authorized user at your bank. This requires visiting the bank together to complete the necessary paperwork. Keep in mind that changes in access may need to be updated if you decide to change the arrangement later. If you're administering a decedent's box, and need to grant access, consider filing a Wake North Carolina Petition For Order to Open Safe Deposit Box of Decedent.

Finding out if a deceased loved one has a safe deposit box may involve checking their personal documents, such as bank statements and wills. You can also contact the banks where they held accounts to inquire about any safe deposit box ownership. If necessary, pursuing a Wake North Carolina Petition For Order to Open Safe Deposit Box of Decedent can legally allow you to uncover this information. This ensures that you can manage your loved one’s estate effectively.

Accessing a safety deposit box after death in Canada typically requires you to contact the bank where the box is held. You'll need to provide identification and legal documentation, such as a death certificate and proof of your relationship with the deceased. It's important to follow local laws regarding access, as requirements can differ by province. If you encounter complexities, consider seeking legal assistance through platforms like US Legal Forms for better guidance.

However, courts do have the authority to issue an order requiring a bank to freeze, or open, a person's safe deposit box. When it comes to collecting delinquent unpaid taxes, the IRS has quite a bit of leeway, but cannot act to seize assets without court approval, or other particular circumstances being met.

The reason being a deputy or agent role, much like a Power of Attorney, can be granted or revoked at any time, and this role is automatically terminated if you die. So, appointing a deputy or agent in the presence of bank employee offers proof that this decision is current and valid.

In New York, banks will seal a safe deposit box following the death of an owner or co-owner. The bank will then only allow the safe deposit box to be opened after a Court issues an order to that effect.

Why They 'Can' Drill. According to the Office of Comptroller of Currency, which regulates safe deposit boxes, banks may drill a box without permission due to a court order, search warrant, delinquent rental fees, requests from estate administrators or if the bank is closing a branch.

What Items Should Not Be Stored in a Safe Deposit Box? Cash money. Most banks are very clear: cash should not be kept in a safe deposit box.Passports.An original will.Letters of Intent.Power of Attorney.Valuables, Jewelry or Collectibles.Spare House Keys.Illegal, Dangerous, or Liquid Items.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.

If you need the money in an emergency but the bank is closed, you're out of luck. The idle cash loses buying power over time due to the effects of inflation. It's better to put the money in an interest-bearing account or certificate of deposit. Some banks expressly forbid storing cash in a safe deposit box.