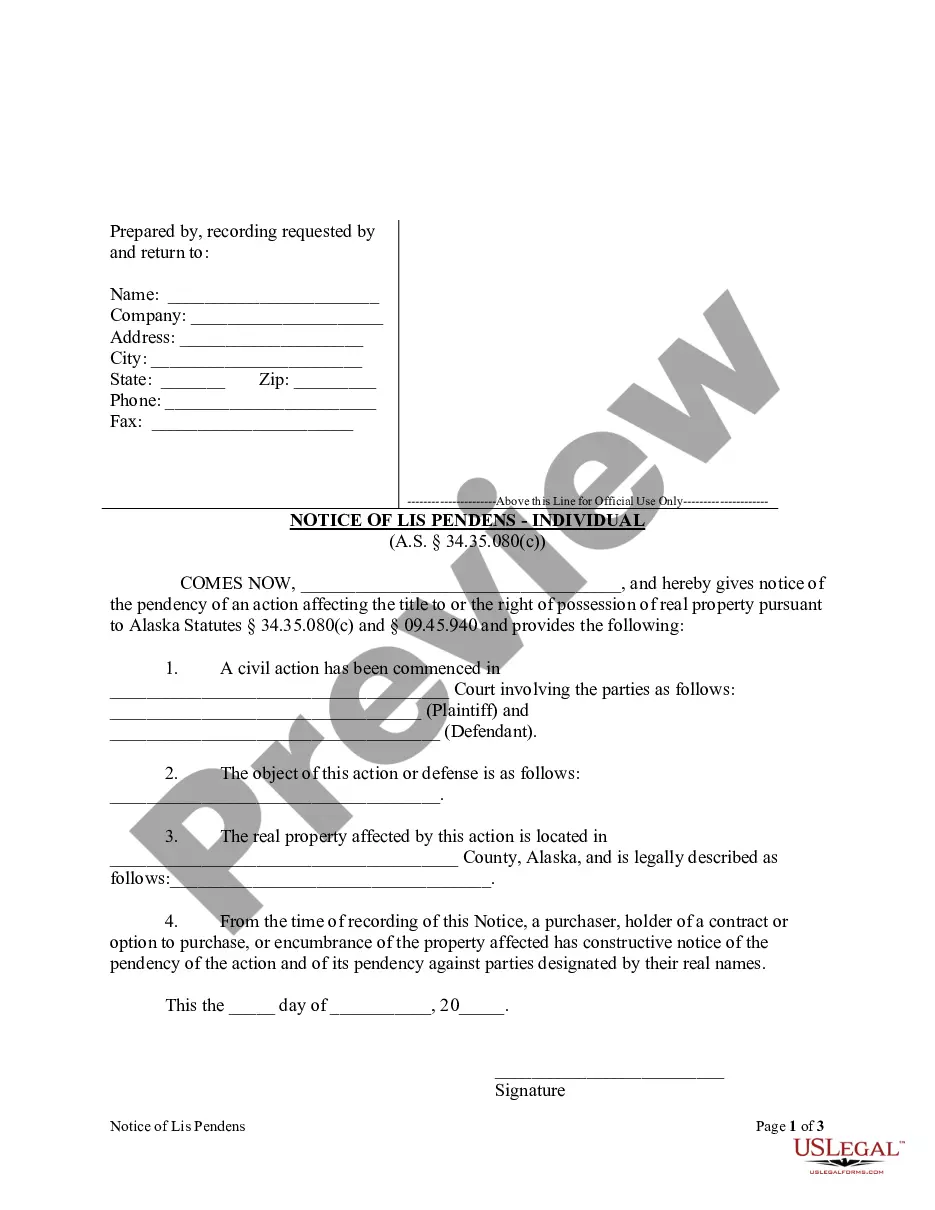

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau New York Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

A documentation process consistently accompanies any legal proceedings you undertake. Launching a business, applying for or accepting a job offer, transferring assets, and numerous other life circumstances necessitate the preparation of formal paperwork that varies across the nation. That’s why having everything gathered in a single location is incredibly advantageous.

US Legal Forms is the biggest online repository of current federal and state-specific legal documents. Here, you can swiftly find and obtain a document for any individual or business objective relevant to your region, including the Nassau Release by Trustee to Beneficiary and Receipt from Beneficiary.

Finding documents on the site is remarkably easy. If you already possess a subscription to our library, Log In to your account, search for the template using the search bar, and click Download to save it on your device. Subsequently, the Nassau Release by Trustee to Beneficiary and Receipt from Beneficiary will be accessible for further use in the My documents section of your account.

If you are utilizing US Legal Forms for the first time, follow this straightforward guide to acquire the Nassau Release by Trustee to Beneficiary and Receipt from Beneficiary: Make sure you have accessed the correct page with your local form. Use the Preview mode (if available) and browse through the template. Review the description (if any) to ensure the template meets your needs. Look for another document using the search function if the sample does not suit you. Click Buy Now once you find the necessary template. Select the appropriate subscription plan, and then Log In or create an account. Choose the preferred payment option (using a credit card or PayPal) to continue. Select the file format and download the Nassau Release by Trustee to Beneficiary and Receipt from Beneficiary to your device. Utilize it as needed: print it or fill it out electronically, sign it, and send it to the required destination.

- This is the most straightforward and dependable method to acquire legal documentation.

- All the templates present in our library have been professionally created and validated for compliance with local statutes and regulations.

- Organize your documentation and handle your legal matters effectively with US Legal Forms!

Form popularity

FAQ

A receipt of the beneficiary of a trust is a document confirming that a beneficiary has received their share of trust assets. In a Nassau New York Release by Trustee to Beneficiary and Receipt from Beneficiary, this receipt is essential for establishing accountability and transparency. This document can be instrumental in future legal processes, ensuring all parties are aware of the distributions made.

A release provides an important benefit to the trustee. A release provides protection to the trustee in a scenario where the beneficiary later decides to sue the trustee. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring.

The trustee is bound by a fiduciary duty to act in the best interest of the trust and its beneficiaries. This means the trustee can't just use the money or assets in the trust any way they want. But they do have some leeway in when they can take money out of the trust.

The answer to can an executor withhold money from a beneficiary UK is 'yes', though only for certain reasons. Executors can withhold monies from beneficiaries, though not arbitrarily. Beneficiaries may be unable or unwilling to receive a gift by a will.

To request a withdrawal from the trust, put the request in writing, so you'll have a record of it. The trustee is required to fulfill his fiduciary duty, which includes complying with the trust terms and acting fairly and honestly.

Share on: Executors cannot do things which are contrary to the benefit of heirs, beneficiaries, and the estate. This means if you suspect an executor is withholding your inheritance distributions, you would have the right to sue the estate, or litigate to suspend, remove and replace the executor.

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

A beneficiary is someone you assign as the inheritor of particular assets, including bank accounts. Regardless of whether there's a will and what's in the will, the beneficiary automatically inherits the designated account's funds upon the signer's death.

A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.

What Power Does a Trustee Have Over a Trust Buying and selling of Assets. Determining distributions to the beneficiaries under the trust instrument. Hiring and firing advisors. Making income distributions. Power to lease. Power to Administer the Trust. Duty to defend the Trust. Duty to Report.