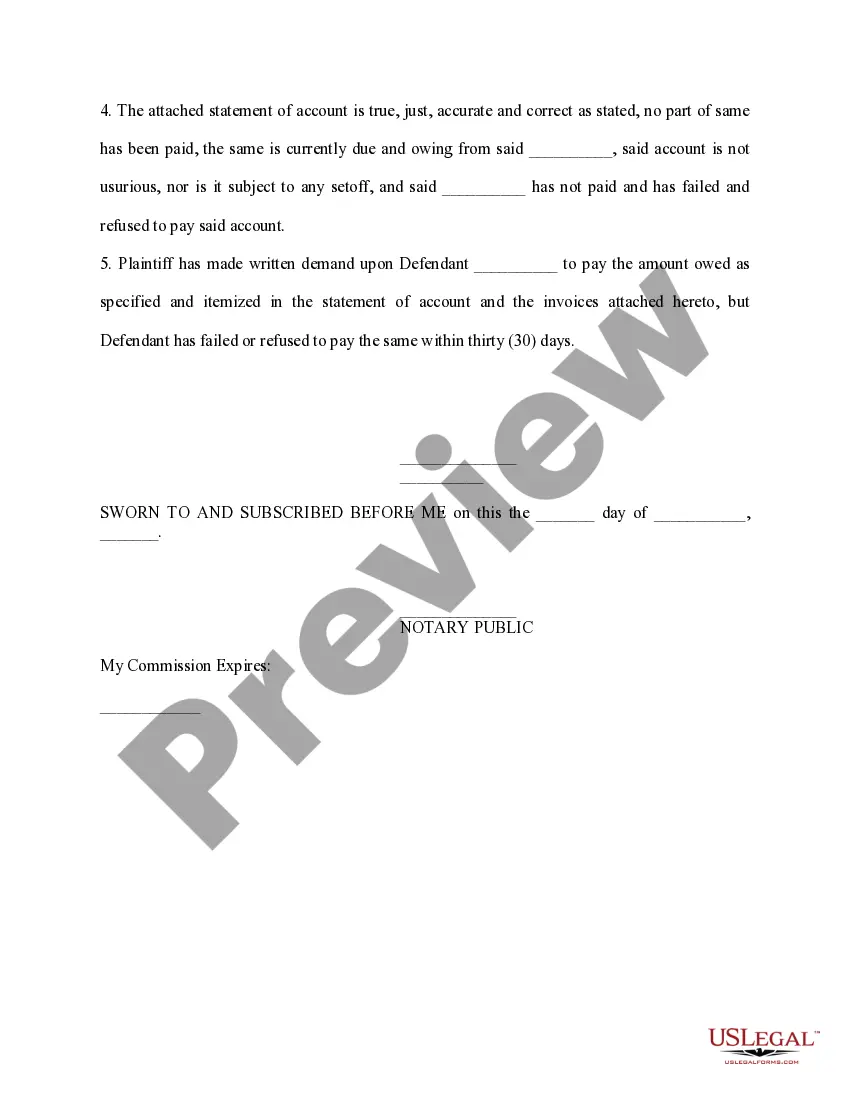

The Lima Arizona Affidavit of Amount Due on Open Account is a legal document used in Lima, Arizona, to establish the unpaid balance on an open account. This affidavit is generally provided by a creditor or a party claiming an outstanding amount due from a debtor. The Affidavit of Amount Due on Open Account serves as evidence of the outstanding balance and details the nature of the debt, its origin, and the due amount. It is typically used when attempting to collect a delinquent debt and serves as supporting documentation in legal proceedings. Key terms related to the Lima Arizona Affidavit of Amount Due on Open Account: 1. Lima, Arizona: Refers to the specific jurisdiction where this affidavit is used. Lima is a town located in Graham County, Arizona. 2. Affidavit: A written statement made under oath, mainly used as evidence in legal proceedings. 3. Amount Due: Represents the outstanding balance of a debt owed by the debtor to the creditor. 4. Open Account: Refers to an account between a debtor and a creditor where the debtor can make purchases or receive services on credit, usually accompanied by periodic payments. Different types of Lima Arizona Affidavit of Amount Due on Open Account may include: 1. Business-to-Business Affidavit: This type of affidavit is used when the debt is owed by one business to another on an open account. 2. Consumer Affidavit: This variant of the affidavit is used when the debt is incurred by an individual consumer and remains outstanding on an open account. 3. Medical Services Affidavit: This specific affidavit may be utilized when the debt is related to medical services received on an open account, where a healthcare provider seeks to recover the amount due. 4. Retail Affidavit: This type of affidavit is used in cases where a retail business seeks to recover the unpaid balance from a customer who has not paid for goods received on credit. It is crucial to consult with appropriate legal counsel to ensure accurate completion of the Lima Arizona Affidavit of Amount Due on Open Account, as well as to understand the specific requirements and implications associated with its usage in Lima, Arizona.

Pima Arizona Affidavit of Amount Due on Open Account

Description

How to fill out Pima Arizona Affidavit Of Amount Due On Open Account?

If you need to get a trustworthy legal form supplier to get the Pima Affidavit of Amount Due on Open Account, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to locate and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Pima Affidavit of Amount Due on Open Account, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Pima Affidavit of Amount Due on Open Account template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Pima Affidavit of Amount Due on Open Account - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Check via this Web Site. The Treasurer accepts eCheck payments through this Web site with no service fee charged to you. You may make payments up to $2,000,000.00. Please allow 13 business days for the payment to post to the Treasurer's database.

Please include your state code or reference number on your check. All other correspondence should be sent to 240 N. Stone Ave, Tucson, Arizona, 85701.

(520) 724-7770 Monday - Friday a.m. - p.m.

Once signed and notarized, the affidavits must be filed with the probate court in the county where the property is physically located. A certified copy of the death certificate and a copy of the will, if any, must be attached to each affidavit, along with title documents for real estate and other large assets.

Accepted forms of payment online are: Visa, Master Card, Discover credit and debit cards, Paypal, eChecks and other digital wallets for your convenience. The minimum acceptable payment is the greater of $10 or 10% of the installment due. Certificate payments or redemptions CAN NOW be made using our online vendor.

Contact Board of Supervisors Rex Scott, District 1. (520) 724-2738. email district1@pima.gov. Matt Heinz, District 2. (520) 724-8126. email district2@pima.gov. Sharon Bronson, District 3. (520) 724-8051. email district3@pima.gov. Steve Christy, District 4. (520) 724-8094. email district4@pima.gov. Adelita Grijalva, District 5.

We also accept credit and debit card payments made in person in the Treasurers office at the Pima County Public Service Center, 240 N. Stone Ave., Tucson, Arizona 85701. There is a 2% service fee for using credit or debit cards.

Property Taxation Contact the County Treasurer where the property is located for payment options and online services.

Health and Community Services Medical Examiner.Behavioral Health.Pima Animal Care Center.Community & Workforce Development (CWD)Attractions & Tourism Office.Kino Sports Complex.Pima County Wireless Integrated Network (PCWIN)Office of Emergency Management.

The due date for the first half tax is October 1. The first half installment becomes delinquent after p.m. on November 1 for Tax Bills over $100. If Nov 1 falls on a Saturday, Sunday, or legal holiday, the time of the delinquency is pm on the next business day.