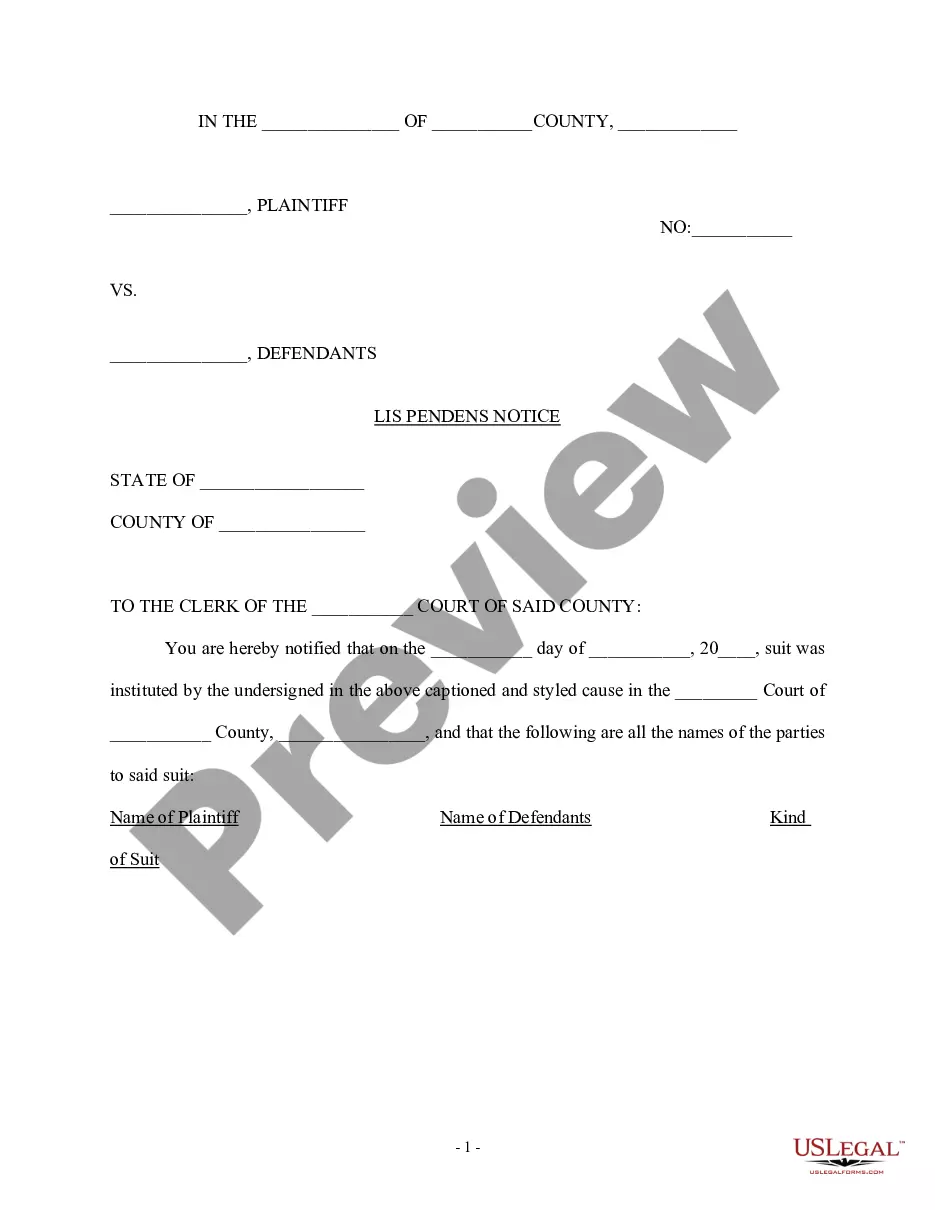

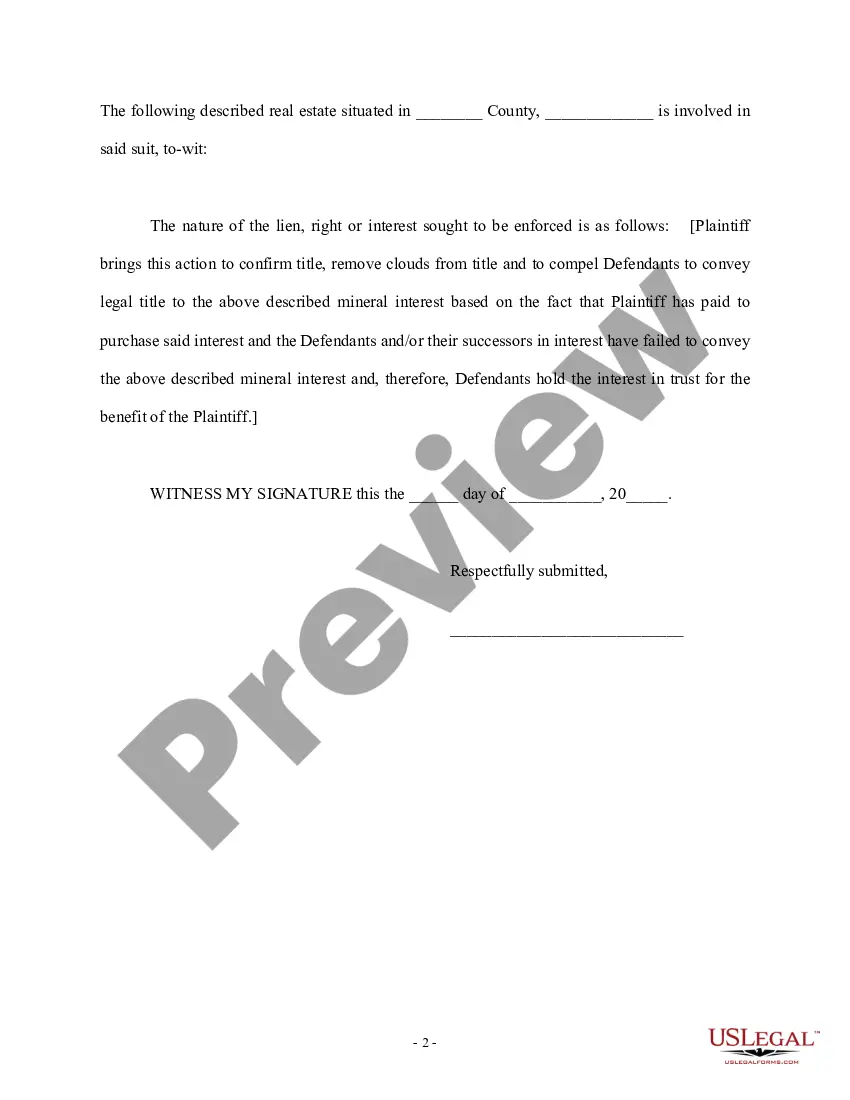

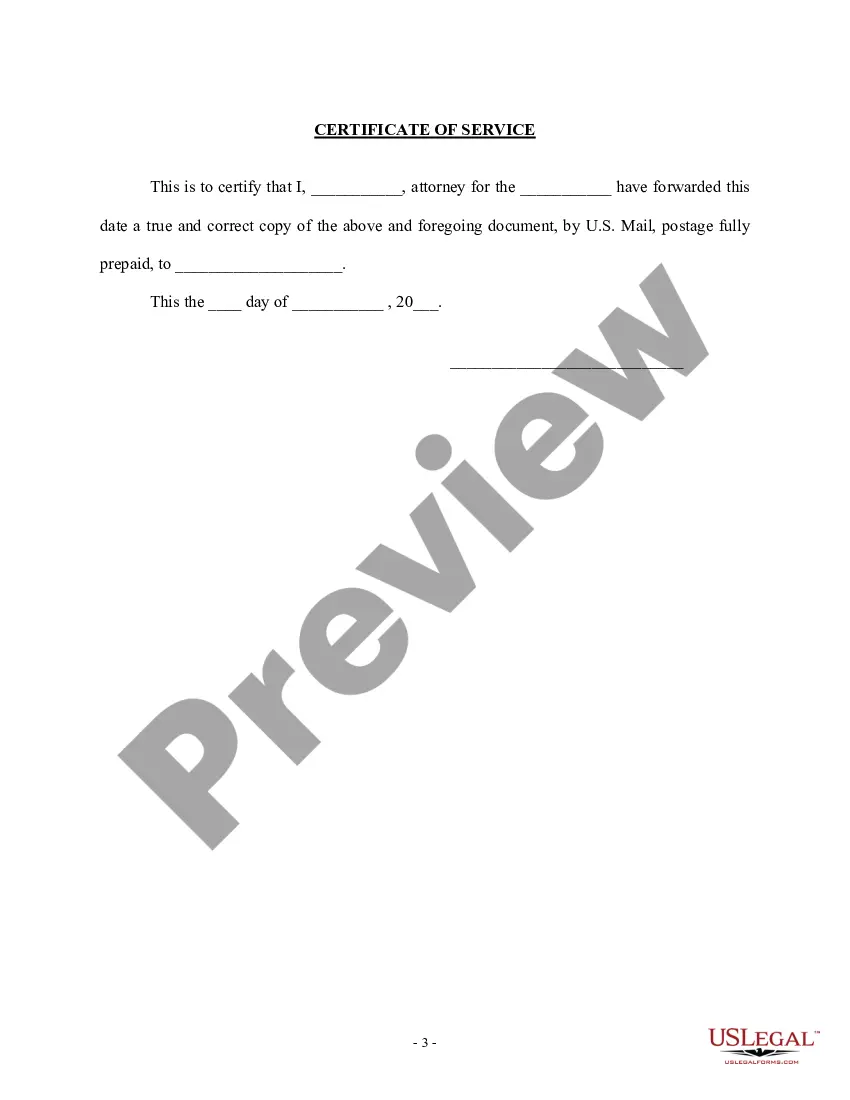

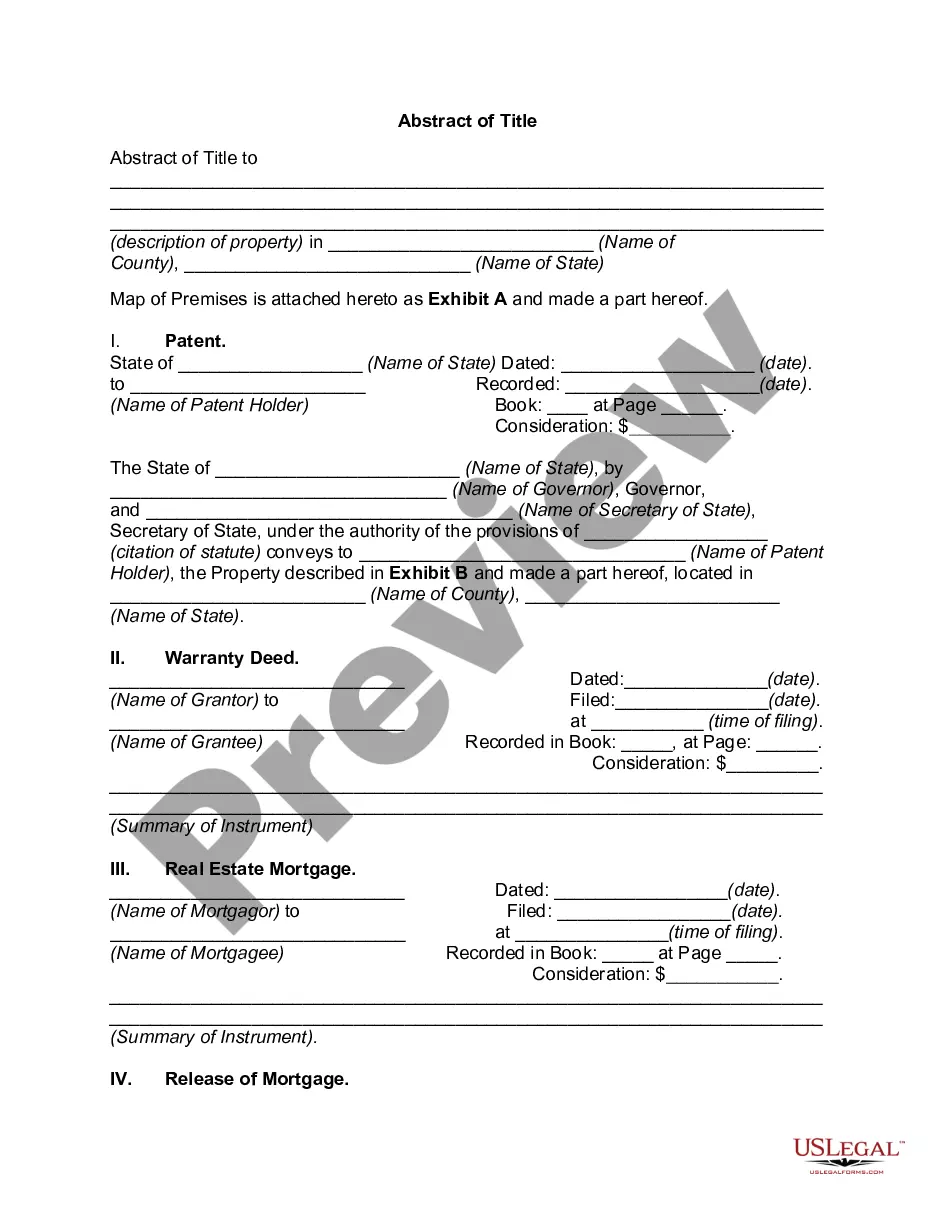

Alameda California Lis Pendens Notice

Description

How to fill out Lis Pendens Notice?

How long does it typically take you to draft a legal document.

Considering that each state has its own laws and regulations for every aspect of life, locating an Alameda Lis Pendens Notice that meets all local criteria can be exhausting, and obtaining it from a qualified attorney is frequently costly.

Numerous online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms repository is the most beneficial.

Select the subscription plan that best fits your needs.

- US Legal Forms hosts the largest online collection of templates, organized by states and areas of application.

- In addition to the Alameda Lis Pendens Notice, you can discover any specific form needed for managing your business or personal matters, in accordance with your local regulations.

- Professionals validate all samples for their accuracy, ensuring you can prepare your documents correctly.

- Navigating the service is quite simple.

- If you already possess an account on the site and your subscription is active, you just need to Log In, select the required sample, and download it.

- You can keep the document in your profile anytime in the future.

- If you're a newcomer to the platform, there will be additional steps to finalize before getting your Alameda Lis Pendens Notice.

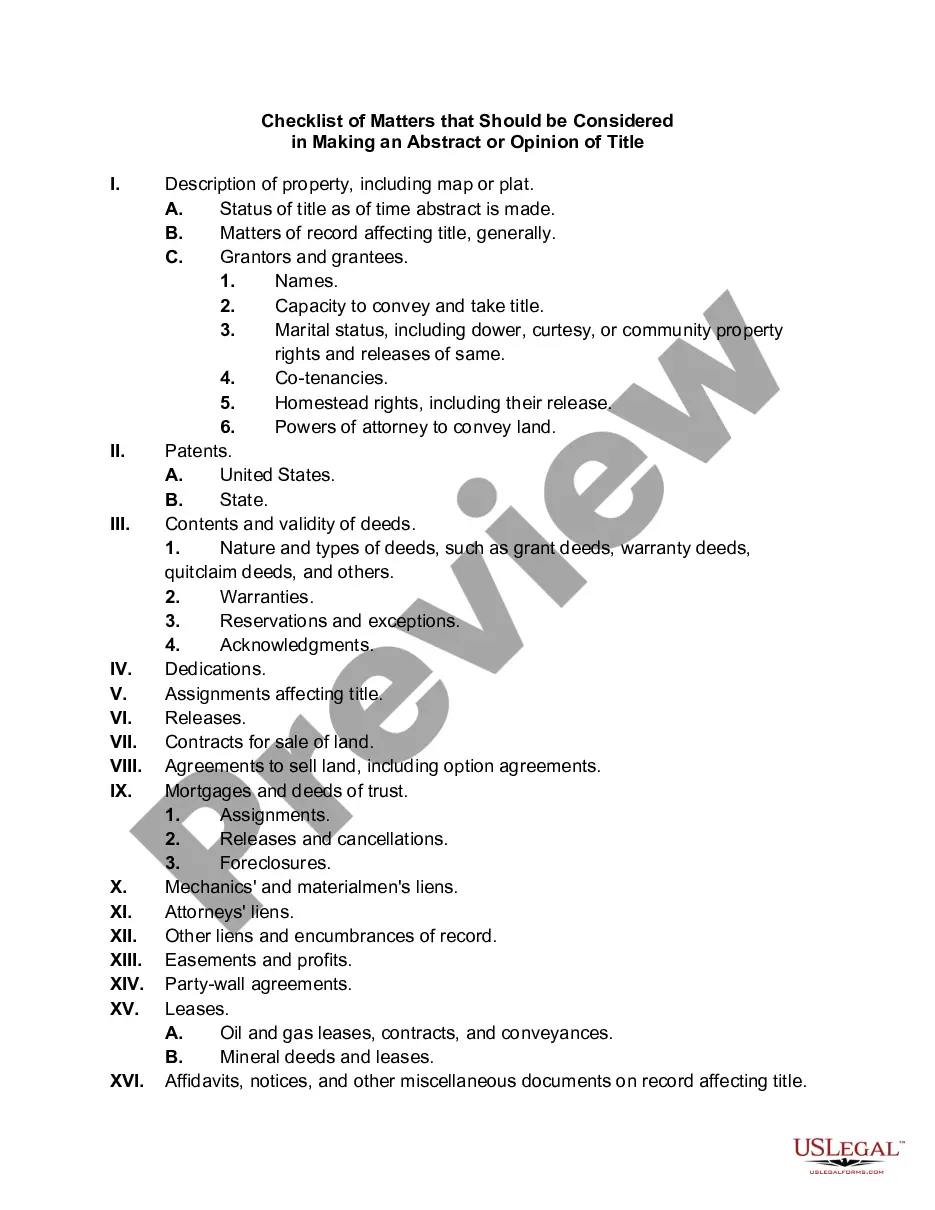

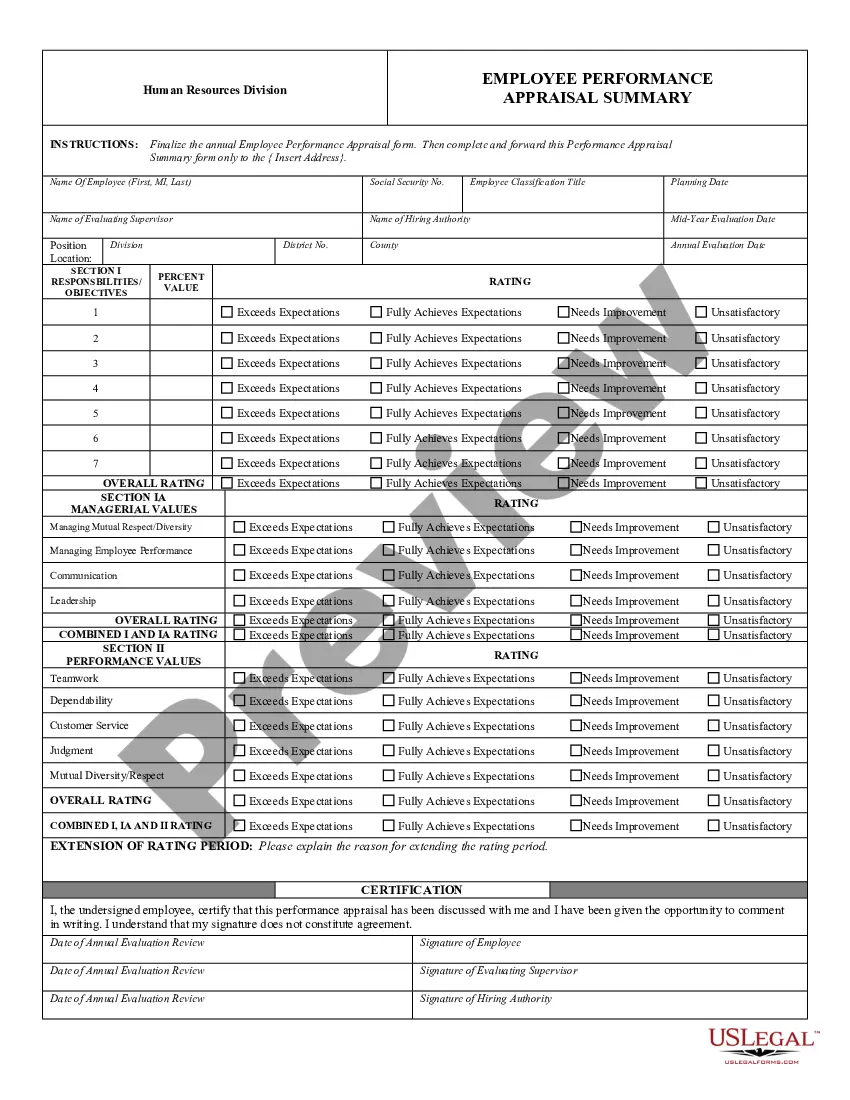

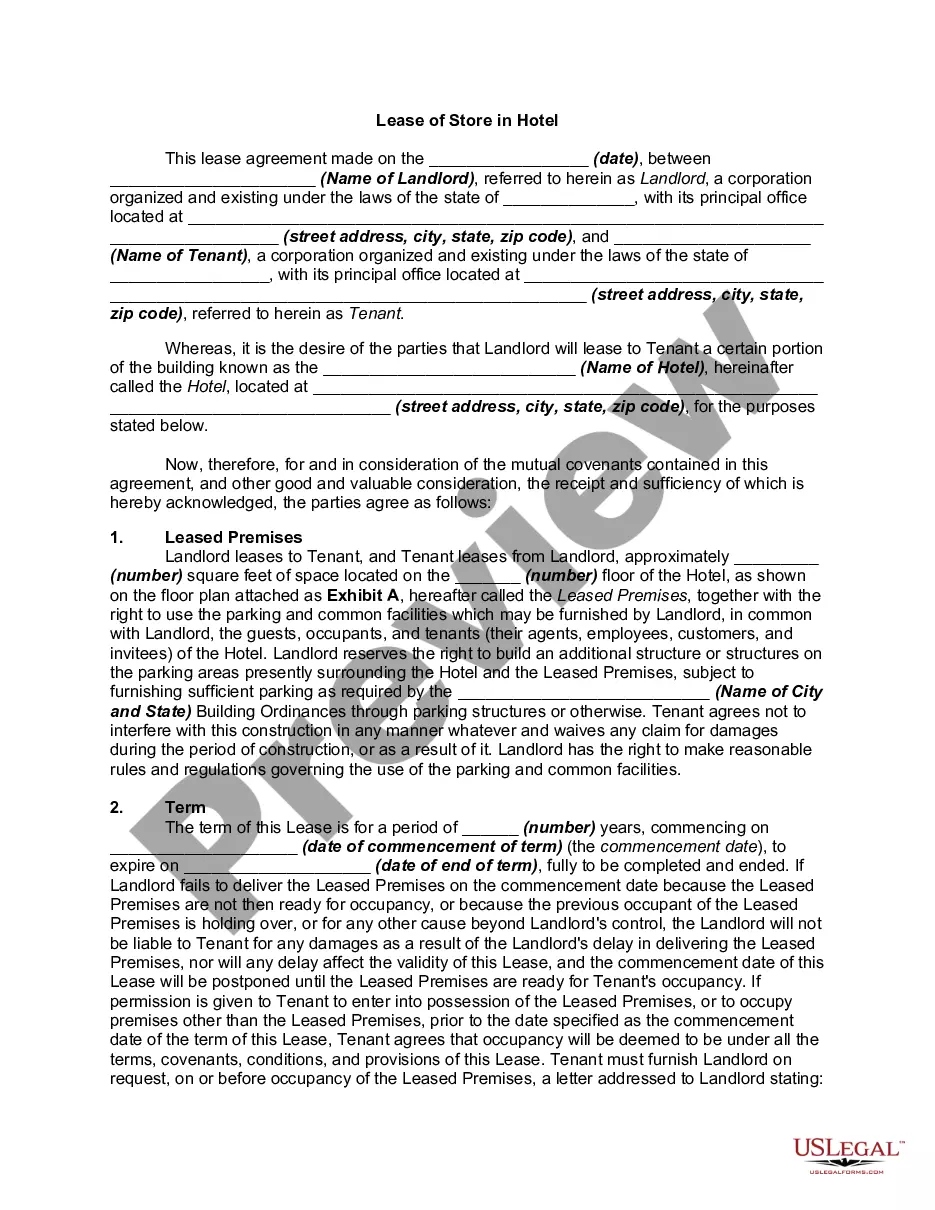

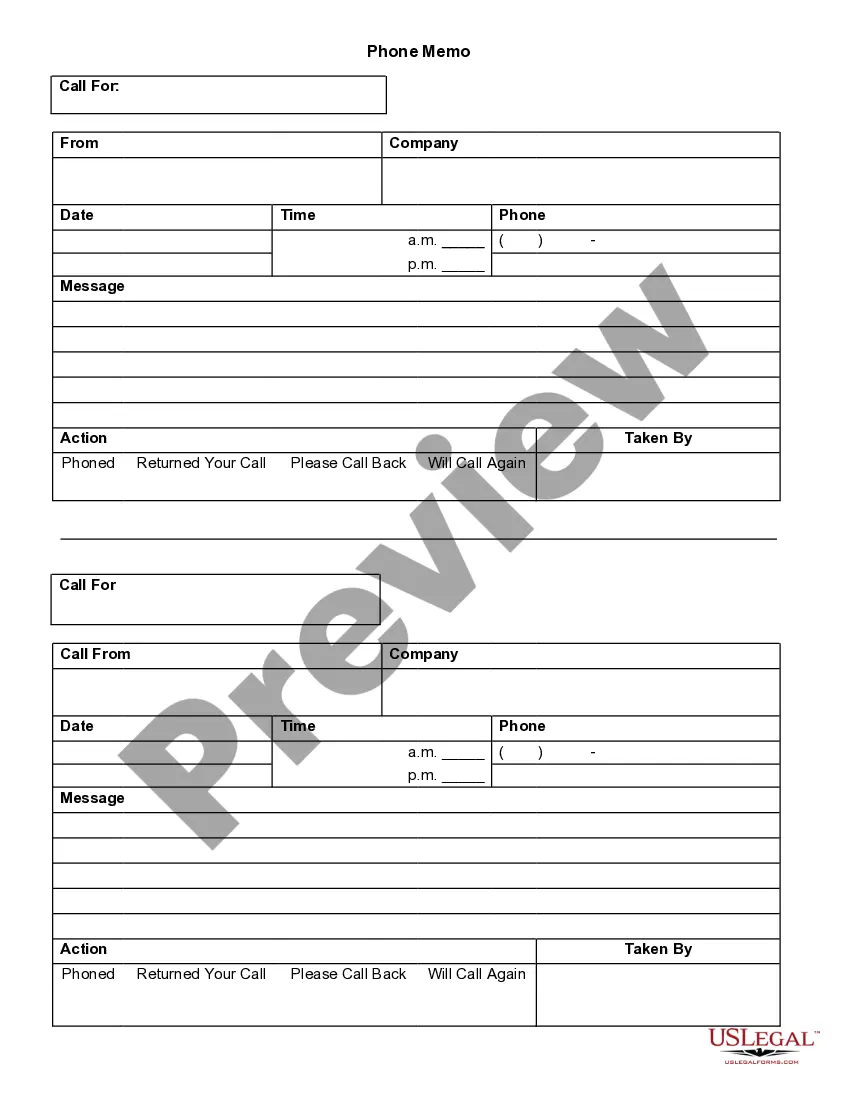

- Review the content of the page you are viewing.

- Examine the description of the template or Preview it (if it's accessible).

- Search for another form using the related option in the header.

- Press Buy Now when you are certain about the chosen document.

Form popularity

FAQ

It requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice, except those expressly exempted from payment of recording fees, per each transaction per parcel of real property, not to exceed $225 per single transaction.

Liens are public records in California. Therefore, anyone who wants to check for liens recorded in the state can contact or visit the relevant government office. For real estate liens, a resident can go to the county clerk/recorder's office in the county where the property is situated to request a title deed search.

If you need a copy of the current deed, contact or visit the Alameda County Recorder's Office. Copies of deeds are not available off the internet. There is an online name index. Copies of the document itself must be obtained from the Recorder's Office Public Records Room.

When property changes owners, the County Assessor's Office has a form that must be filed to update the tax records. You can submit this form when you go to record your deed at the Alameda County Clerk-Recorder's Office. It is forwarded to the Assessor's Office. The Alameda County PCOR form can be downloaded HERE.

In addition to the basic recording fee of $89.00 for the first page and $3.00 for each page thereafter, there are other fees which may be due on deeds and leases. Collection of fees include: Documentary Transfer Tax.

Time Limits California law gives judgment liens a 10-year life-cycle. Once the judgment is declared it may take weeks before the creditor finally gets the lien officially recorded in the county registry of deeds. The 10-year run starts from when the court issues its judgment.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State.

Los Angeles County Registrar-Recorder/County Clerk website at lavote.net/home/records/real-estate-records/general-info or calling (800) 201-8999.

If you need to payoff a lien or assessment you must: Complete the Citywide Liens Demand Request Form. Send a check for $150.00 to Citywide Liens at 150 Frank Ogawa Plaza, Oakland, CA 94612. If you need a copy of your lien(s) contact the Alameda County Recorder's Office, 1106 Madison St.

How to remove a property lien Make sure the debt the lien represents is valid.Pay off the debt.Fill out a release-of-lien form.Have the lien holder sign the release-of-lien form in front of a notary.File the lien release form.Ask for a lien waiver, if appropriate.Keep a copy.