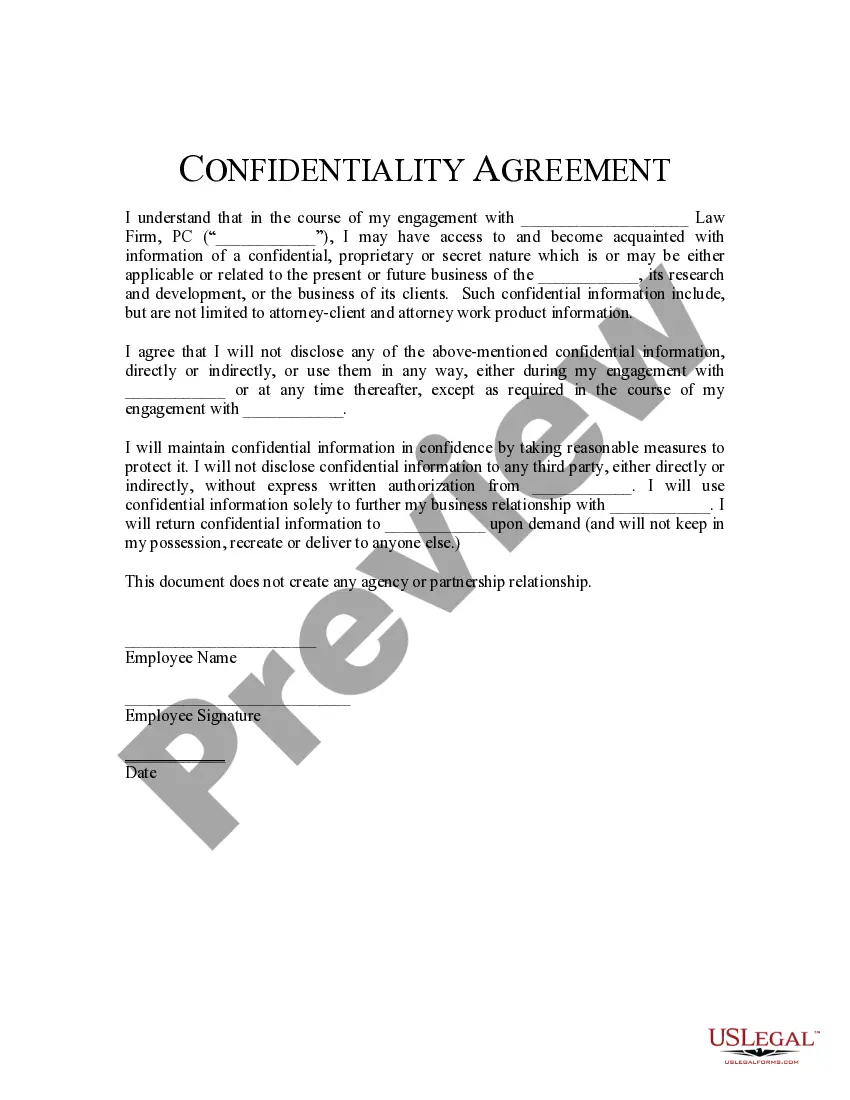

The various notices that must be given to establish a mechanic's lien usually have to be verified or authenticated in some other manner. This form is a generic example that may be referred to when preparing such a form for your particular state.

Harris Texas General Form for Verification of Lien Notice

Description

How to fill out General Form For Verification Of Lien Notice?

Whether you intend to establish your business, enter into an agreement, request a revision of your identification, or address family-related legal matters, you must assemble specific documentation that aligns with your local statutes and regulations.

Locating the appropriate documents can consume significant time and effort unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 expertly crafted and verified legal documents suitable for any individual or corporate scenario. All documents are organized by state and utilization area, making the selection of a specific document like the Harris General Form for Verification of Lien Notice quick and straightforward.

Forms available in our library can be reused multiple times. With an active subscription, you can access all your previously acquired documents at any time under the My documents section of your profile. Stop expending time on incessant searches for current official documents. Enroll in the US Legal Forms platform and maintain your paperwork organized with the most extensive online form library!

- Ensure the sample fulfills your personal requirements and complies with state laws.

- Examine the form description and review the Preview if available on the page.

- Utilize the search feature specifying your state above to find another template.

- Click Buy Now to obtain the file once you identify the correct one.

- Choose the subscription plan that best fits your needs to continue.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Harris General Form for Verification of Lien Notice in the file format you prefer.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

To remove a lien recorded on a paper title, you will need: the vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)

You would need to provide that person with the following: Form MV-454 (Letter of Authorization) This form must be completed and signed by the vehicle owner.Form MV-440 (Request for Texas Motor Vehicle Information) This form must be completed and signed by the vehicle owner.

To start the lien process a person must properly file a claim with the County Clerk's Office in the county where the property is located. The lien then will create an encumbrance or a burden on the property's title. This will give notice to any potential buyers that a debt is owed.

To e-file through the State of Texas' electronic portal EFileTexas.gov, you must first select an electronic filing service provider (EFSP). To view a list of electronic filing providers (EFSP) that have been approved by the State visit .

In Texas, the lien period is described as on the 15th day of the month three months after the last month the claimant performs work. (Three months for residential, four for non-residential) The deadline to file a lien is not extended if the 15th falls on a Saturday, Sunday, or legal holiday.

For specific instructions, please call the Harris County office at (713)755-6439. For Fee Schedule, go to . Liens Contact Information.

To attach the lien, the creditor files the judgment with the county clerk in any Texas county where the debtor has real estate now (a home, land, etc.) or may have real estate in the future.

Where can I file my Release of Lien? Releases of Liens can be filed in person or by mail in the Real Property Department. The nine annex offices can accept them for filing, however it may take 5 -7 business days to be filed based upon delivery of the work to the downtown office.

For the most part, all contractors, subcontractors, laborers, materials suppliers, and equipment suppliers who provide labor or materials to a property in Texas are not required to have a written contract (a verbal contract is sufficient) to qualify for the right to file a lien.

How is it sent, and to whom? In Texas, the notice of intent to lien must be sent by USPS via Return Receipt Requested (RRR), which will provide a receipt for your mailing (keep the receipt for your records). The notice must go to both the owner of the property and the general contractor.