Bronx New York Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

A documentation process invariably accompanies any legal endeavor you undertake.

Establishing a business, applying for or accepting a job offer, transferring ownership, and many other life circumstances require you to prepare formal documentation that differs from state to state.

That’s the reason having everything gathered in one location is incredibly advantageous.

US Legal Forms is the largest online repository of up-to-date federal and state-specific legal templates.

This is the simplest and most reliable method to acquire legal documents. All the samples available in our repository are professionally crafted and confirmed for compliance with local laws and regulations. Organize your documentation and manage your legal matters efficiently with US Legal Forms!

- Here, you can effortlessly find and obtain a document for any personal or business purpose utilized in your area, including the Bronx Receipt as Payment in Full.

- Finding forms on the platform is remarkably straightforward.

- If you currently possess a subscription to our repository, Log In to your account, locate the sample using the search bar, and click Download to save it on your device.

- After that, the Bronx Receipt as Payment in Full will be accessible for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this simple guideline to acquire the Bronx Receipt as Payment in Full.

- Ensure you have accessed the correct page with your local form.

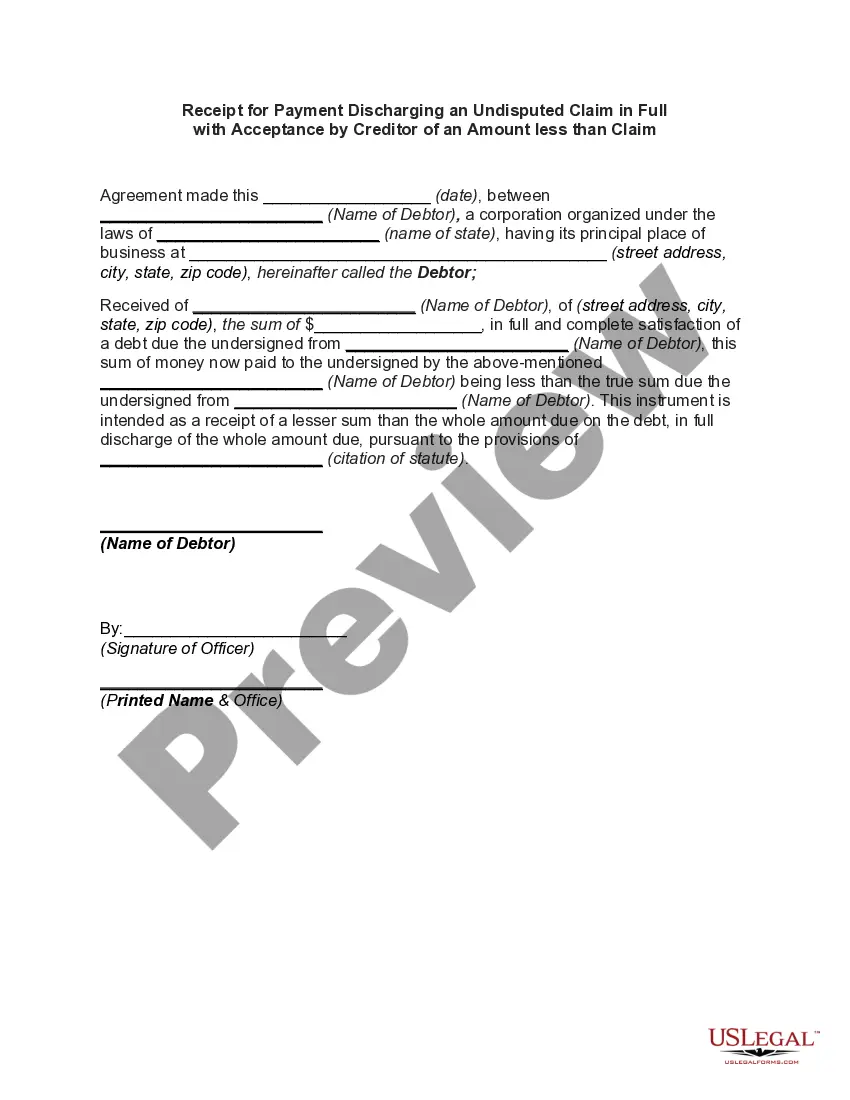

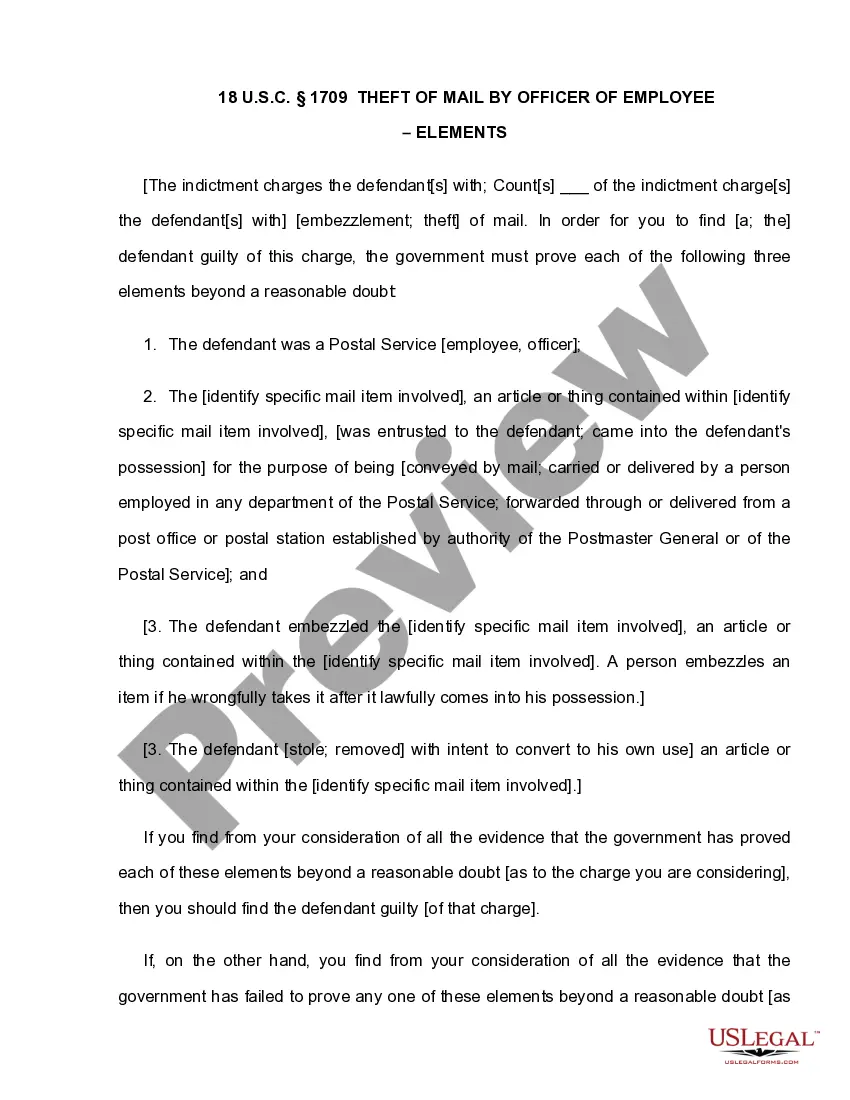

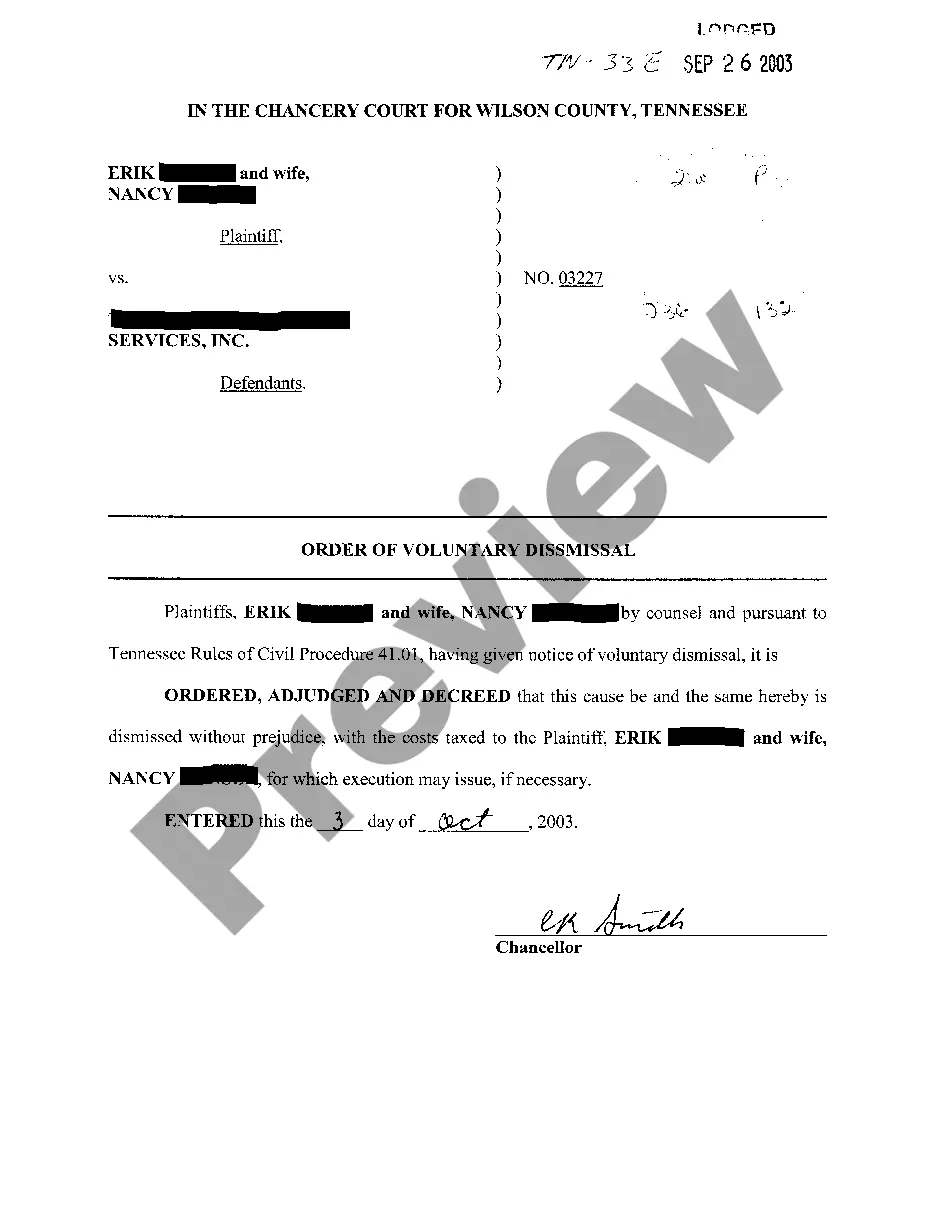

- Use the Preview mode (if available) and scroll through the template.

- Review the description (if available) to confirm the form meets your requirements.

- Search for an alternative document using the search option if the sample does not suit you.

- Click Buy Now when you find the needed template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose a preferred payment method (with credit card or PayPal) to continue.

- Select the file format and download the Bronx Receipt as Payment in Full onto your device.

- Utilize it as necessary: print it or fill it out electronically, sign it, and send it where required.

Form popularity

FAQ

NYS property taxes are due March 1st of each year.

Monthly Advance Payment Option. You can sign up to pay your property tax bill monthly through auto-payment. You will be paying your upcoming property taxes in advance of their due date. Once you enroll, your payments will start on the first day of the following month.

You can pay your property taxes using CityPay. CityPay supports Mozilla Firefox, Apple Safari, Google Chrome, and Internet Explorer version 9.0 and higher. You can pay online using: Credit card (Visa, MasterCard, American Express, Discover, or foreign cards with CVVs)

You can make an estimated income tax payment with an Individual or Fiduciary Online Services account. Pay directly from your bank account, or by credit card for a fee. If you need to make an estimated tax payment for a partnership, see Partnership information.

You either pay your property taxes two or four times a year, depending on the property's assessed value. Bills are generally mailed and posted on our website about a month before your taxes are due. If your payment due date falls on a weekend or a federal holiday, your payment is due the next business day.

Pay Tax Online200b200b Step-1. To pay taxes online, login to > Services > e-payment : Pay Taxes Online or click here on the tab "e-pay taxes" provided on the said website.Step-2. Select the relevant challan i.e.Step-3.Step-4.Step-5.Step-6.Step-7.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the state's tax system, NYC's local tax rates are progressive and based on income level and filing status.

To estimate your annual property tax: Multiply the taxable value of your property by the current tax rate for your property's tax class. Property tax rates change each year, as well as the value of exemptions and abatements. The actual taxes you pay in July might be different.

If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment.

Most small properties in NYC are now billed on metered usage as measured by the water meter in their property. Water meters are read once every four hours by an automated meter reading device and bills are generated once every three months for most customers.