Fulton Georgia Sample Letter for Binding First Security Interest

Description

How to fill out Fulton Georgia Sample Letter For Binding First Security Interest?

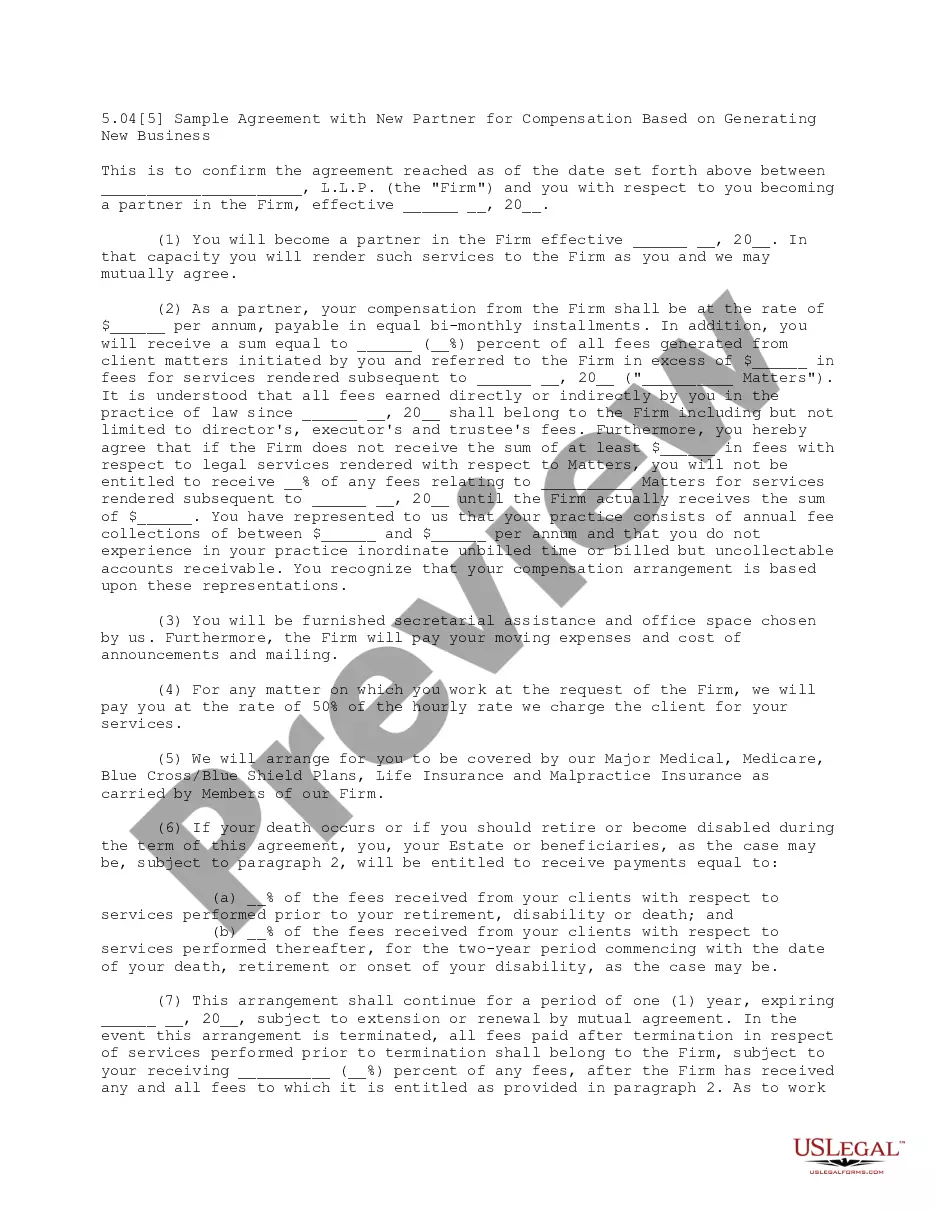

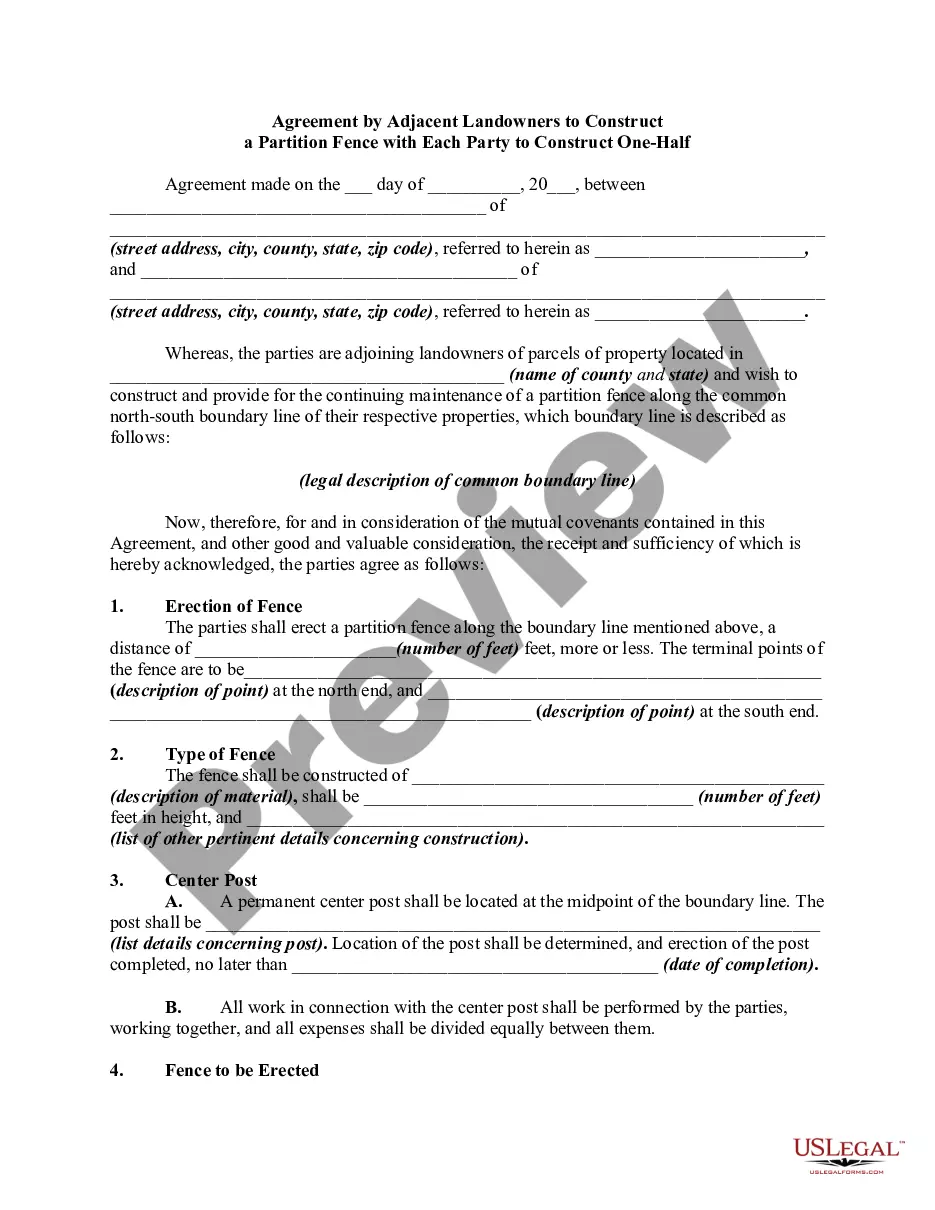

Do you need to quickly create a legally-binding Fulton Sample Letter for Binding First Security Interest or maybe any other form to take control of your personal or business affairs? You can select one of the two options: contact a legal advisor to draft a valid paper for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Fulton Sample Letter for Binding First Security Interest and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Fulton Sample Letter for Binding First Security Interest is adapted to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fulton Sample Letter for Binding First Security Interest template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the documents we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

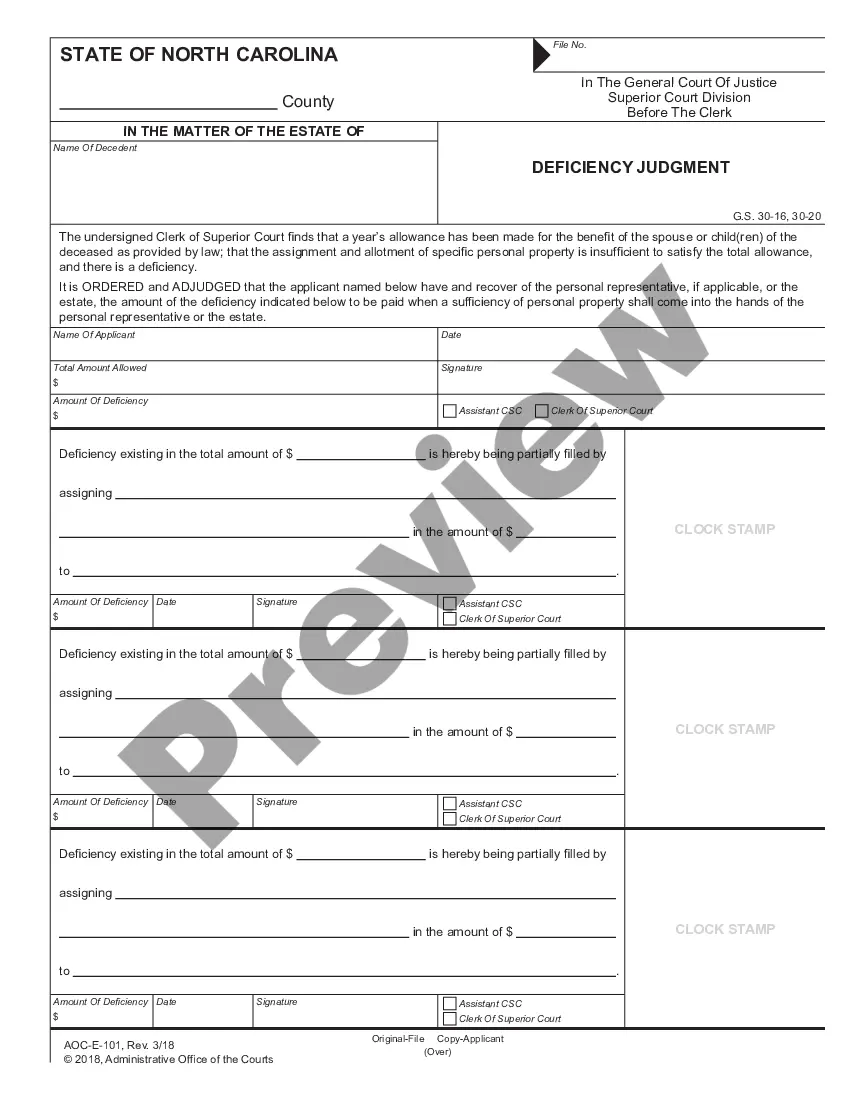

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

The only way that a secured party may perfect its security interest in money is by possession. Instruments. A lender may perfect a security interest in an instrument either by filing or possession.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

The most common way to perfect a security interest is through filing a financing statement. A financing statement is filed with the Secretary of State and it puts other creditors on notice of the secured party's security interest in the collateral.

2022 In order for a creditor's security interest to attach (i.e., to become enforceable): (1) The debtor must have rights in the collateral; and. (2) The secured party must give value (e.g., extension of credit, consideration) in exchange for an interest in the collateral; and either.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically upon attachment of the security interest.

A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment.

More info

The Clerk shall, upon receiving notification by the debtor, send an acknowledgment of the forgery or alteration to the debtor within thirty days after the date of mailing of the notice of forgery or alteration to the debtor or a copy of the forgery or alteration to the debtor. If notification is not returned to the thirty-day period, and the court finds, by clear and convincing evidence, that the forgery or alteration constitutes a material fact and is material as a matter of law, the court shall order the court not to allow access to documents required under the Georgia Uniform Superior Fraud and Deception Act (Article 6-1, Chapter 19, Georgia Code). 3) The process is to provide for a copy of the court order and a mailing receipt. This would allow the debtor to challenge the claim should a forgery be found. I believe that the process for obtaining a stamp would be to have some stamp making company mail out one for each item received to the debtor.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.