Queens New York Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

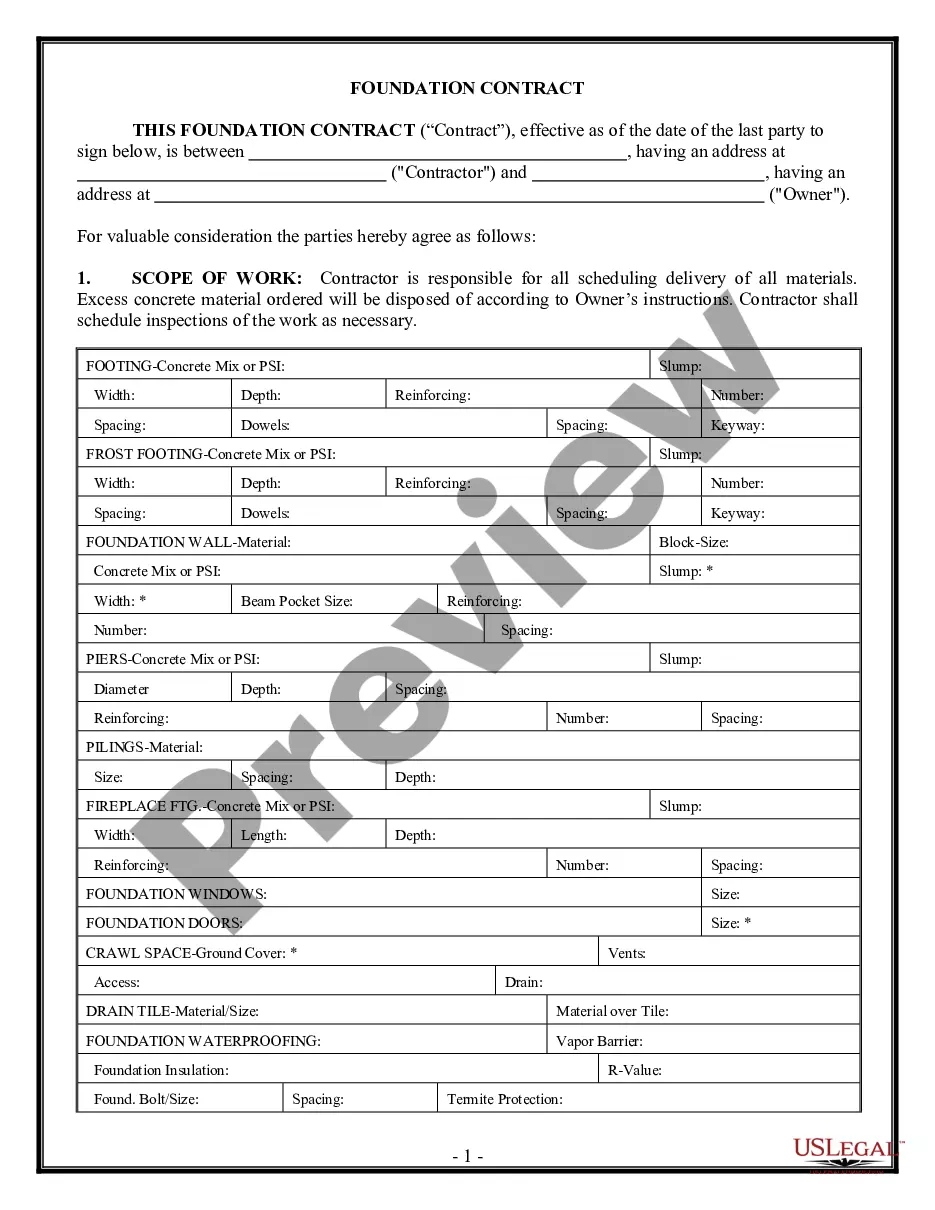

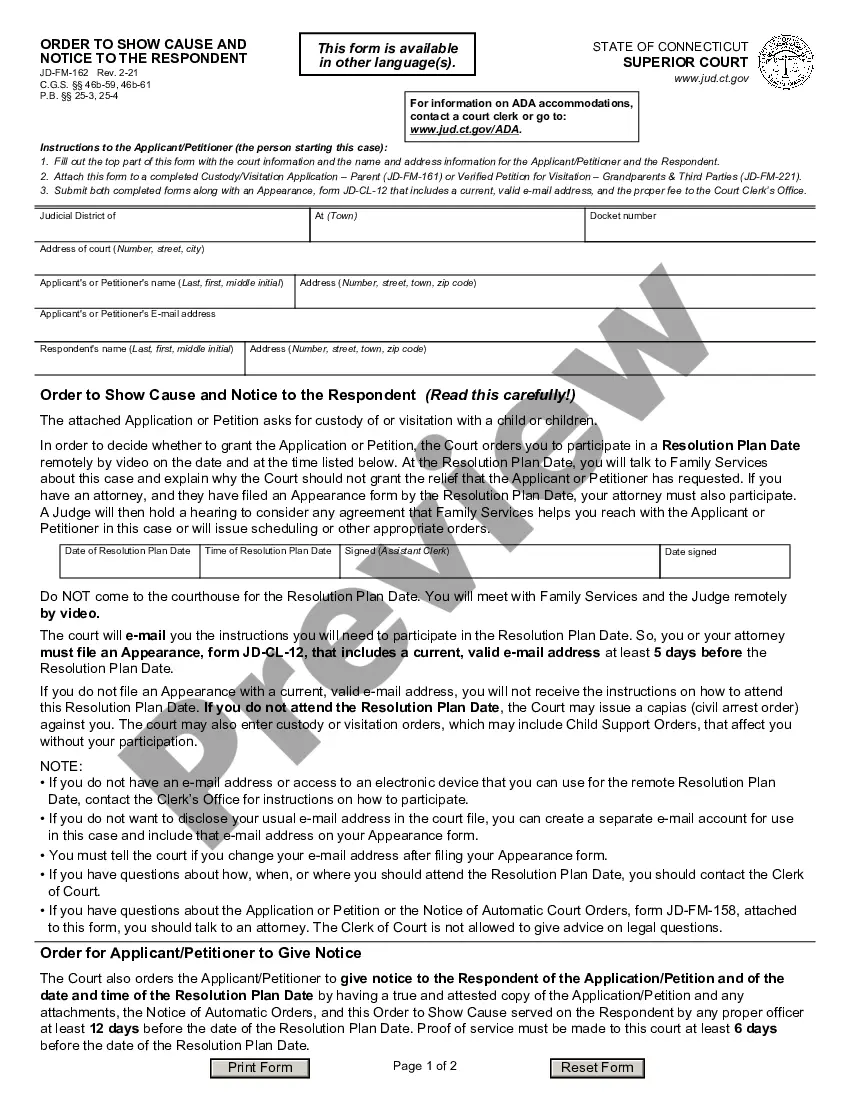

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

How long does it typically require for you to create a legal document.

Considering that each state has its own laws and regulations for every life scenario, finding a Queens Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate that adheres to all regional stipulations can be exhausting, and obtaining it from a qualified attorney is often costly.

Many online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Regardless of how often you need to use the acquired template, you can find all the documents you’ve ever downloaded in your profile by accessing the My documents tab. Give it a try!

- US Legal Forms is the largest online collection of templates, organized by states and types of use.

- In addition to the Queens Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you can acquire any particular document to manage your business or personal matters, meeting your county requirements.

- Professionals validate all samples for their accuracy, ensuring you can prepare your documents correctly.

- Using the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, select the required form, and download it.

- You can access the document in your profile at any time afterwards.

- If you are new to the website, there will be additional steps to follow before obtaining your Queens Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Review the content of the page you’re on.

- Examine the description of the sample or Preview it (if accessible).

- Search for another document using the related option in the header.

- Press Buy Now when you are confident in the selected document.

- Choose the subscription plan that fits you best.

- Set up an account on the platform or Log In to move on to payment options.

- Complete payment via PayPal or your credit card.

- Alter the file format if required.

- Press Download to save the Queens Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Print the document or utilize any preferred online editor to fill it out electronically.

Form popularity

FAQ

Calculate gross rental yield Sum up your total annual rent that you would charge a tenant. Divide your annual rent by the value of the property. Multiply that figure by 100 to get the percentage of your gross rental yield.

Some leases may be purely percent based and have no base component, but such cases are not common. Percent rent is normally considered an additional rent term.

A percentage lease is a type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises. It is a term used in commercial real estate.

A percentage lease is a type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises. It is a term used in commercial real estate.

A percentage lease is a type of lease where the tenant pays a base rent plus a percentage of any revenue earned while doing business on the rental premises. It is a term used in commercial real estate.

Percentage leases are commonly executed in retail mall outlets. This type of lease agreement is most common for businesses with notoriously large sales volumes, but even a small business that wants to set up shop in a mallto take advantage of the high volume of foot trafficmay be subject to it.

A percentage rent provision provides that if the tenant achieves a certain amount of gross sales in a given year, they will pay a percentage of such gross sales to the landlord as additional rent.

Triple Net Lease: The triple net lease encompasses property taxes, insurance, and common area maintenance, with the tenant paying for some or all of the cost of these three things on top of their base rent. It is one of the most common lease types.

And, how the most common retail leases are structured: Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes. You as the landlord must pay for routine maintenance, any necessary repairs, along with insurance.

Under this scenario, the Percentage Rent in a letter of intent is written as Tenant to pay Landlord ten percent (10%) of Tenant's Gross Sales at the Property. For example, if the tenant leases 5,000 square feet and first year annual Gross Sales were $1,500,000, tenant would pay landlord $150,000 in Percentage Rent ($