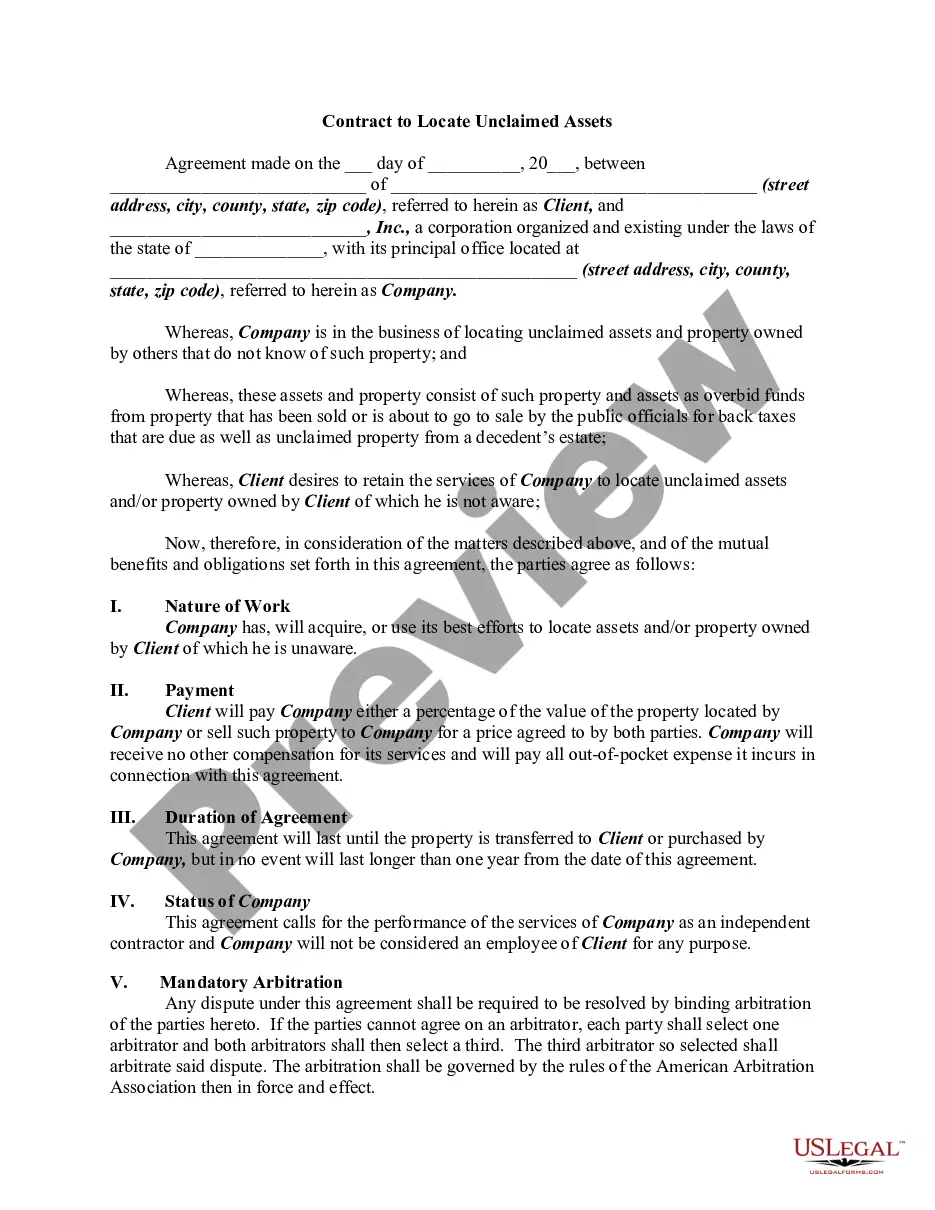

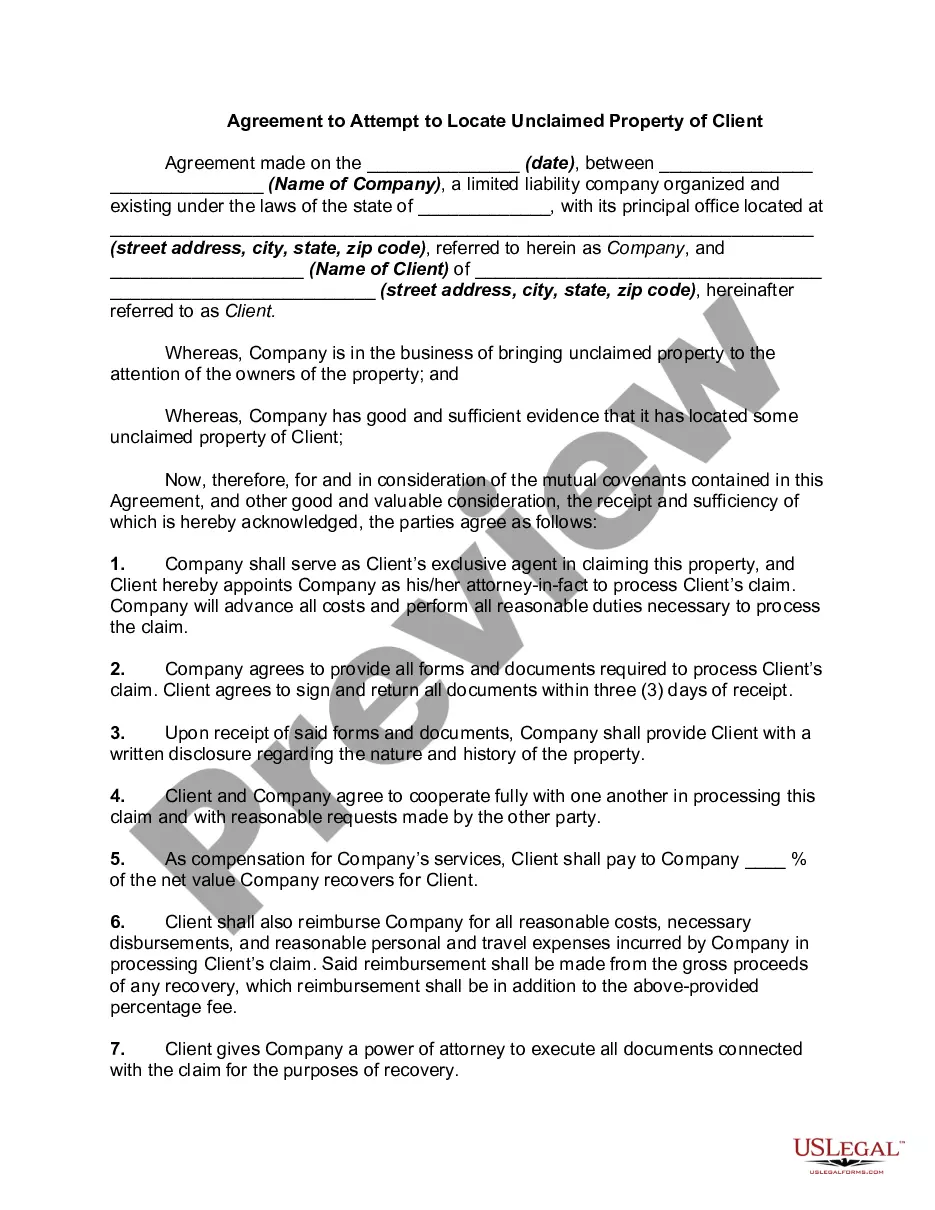

Harris Texas Contract to Locate Unclaimed Assets

Description

How to fill out Contract To Locate Unclaimed Assets?

Whether you intend to launch your enterprise, engage in an agreement, request your identification update, or tackle family-related legal matters, it is essential to prepare specific documentation that complies with your local statutes and regulations.

Locating the appropriate forms can require considerable time and effort unless you utilize the US Legal Forms library.

The service offers users over 85,000 expertly crafted and verified legal documents for any personal or business situation. All documents are categorized by state and purpose, making it quick and easy to select a copy such as the Harris Contract to Locate Unclaimed Assets.

Documents supplied by our platform are reusable. With an active subscription, you can access all previously acquired documents at any time from the My documents section of your account. Stop spending time on a perpetual quest for current formal documentation. Join the US Legal Forms platform and keep your documents organized with the most comprehensive online form library!

- Ensure the template fulfills your personal requirements and complies with state legal standards.

- Examine the form description and review the Preview if it's available on the webpage.

- Utilize the search bar above, specifying your state to find an alternative template.

- Click Buy Now to acquire the sample once you identify the suitable one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and remit payment using a credit card or PayPal.

- Download the Harris Contract to Locate Unclaimed Assets in your desired file format.

- Print the document or complete it and sign it digitally using an online editor to conserve time.

Form popularity

FAQ

Even though the government assumes the ownership of unclaimed money after the dormancy period, the assets are still available for claiming. Once the rightful owners find out they are entitled to these funds, they can always file a claim and get their money.

There is no statute of limitations for unclaimed property. Funds reported will remain here indefinitely until returned to their rightful owner. The Texas Comptroller has authority to manage the State of Texas Unclaimed Property Program under Title 6 of the Texas Property Code (opens in a new tab).

To Search for companies or individuals who have unclaimed funds deposited with the County Treasurer please use the Search for Unclaimed Funds tool below. If you find your name in the search, please contact the Treasurer's Office at (832) 927-6865.

States have established processes whereby legal owners of assets can reclaim unclaimed funds. When claiming unclaimed funds that have risen in value, taxes may be assessed at the time. If you claim property, it will be treated as ordinary income and taxed accordingly unless the property is related to a tax refund.

ClaimItTexas.org remains online to request property searches, file claims, submit documentation and file unclaimed property reports. Our staff is also available to answer questions by calling 1-800-321-2274, Monday-Friday a.m. p.m.

Dormancy periods range from one to 15 years depending upon property type.

What is Unclaimed Property? Unclaimed property can be any financial asset or safe deposit box contents that has been abandoned by the property owner for one or more years.

Sometimes an owner dies and his or her heirs fail to claim assets left to them because they don't know about the inheritance. To search for these assets, go to , which you can also reach by typing and clicking on the MissingMoney.com link.

Since 1963, Texas has required institutions, businesses and governmental entities to report to the state any personal property that has been unclaimed for up to five years, depending on the property in question. Unclaimed property can be abandoned assets.