Cook Illinois Declare None — Resolution For— - Corporate Resolutions are legal documents used by corporate entities registered in Cook County, Illinois, to officially declare no resolutions adopted during a specific period. These forms are essential in maintaining accurate records and ensuring compliance with legal requirements. The Cook Illinois Declare None — Resolution Form helps corporations communicate with relevant authorities, shareholders, and stakeholders. Keywords: Cook Illinois, Declare None, Resolution Form, Corporate Resolutions, Cook County, legal documents, corporate entities, period, records, compliance, authorities, shareholders, stakeholders. Different types of Cook Illinois Declare None — Resolution Forms can include: 1. Annual Declaration of No Resolutions Form: This type of form is typically submitted annually by corporations registered in Cook County, Illinois, to declare that no resolutions were adopted during the previous year. It ensures transparency and accountability in corporate governance. 2. Quarterly Declaration of No Resolutions Form: Certain corporations may be required to submit quarterly declarations to declare that no resolutions were adopted during each quarter. This form assists in maintaining accurate and up-to-date records for regulatory purposes. 3. Amendments to Declaration of No Resolutions Form: In case a corporation needs to modify or correct any information provided in a previously submitted Cook Illinois Declare None — Resolution Form, an Amendments Form can be used. It helps corporations rectify any errors or omissions promptly. 4. Annual General Meeting (AGM) Resolution Form: This type of form is used to record resolutions adopted during an Annual General Meeting. It differs from the Cook Illinois Declare None — Resolution Form as it focuses on the resolutions passed rather than declaring none. However, both forms are essential in maintaining detailed corporate records. 5. Extraordinary General Meeting (EGG) Resolution Form: Eggs are called for specific purposes that require resolutions to be adopted. This form assists corporations in documenting the resolutions passed during such meetings. It is distinct from the Cook Illinois Declare None — Resolution Form as it contains resolutions instead of declaring none. These different types of Cook Illinois Declare None — Resolution Forms cater to varying corporate requirements, helping companies fulfill their legal obligations and maintain accurate records related to resolutions adopted during specific periods.

Cook Illinois Declare None - Resolution Form - Corporate Resolutions

Description

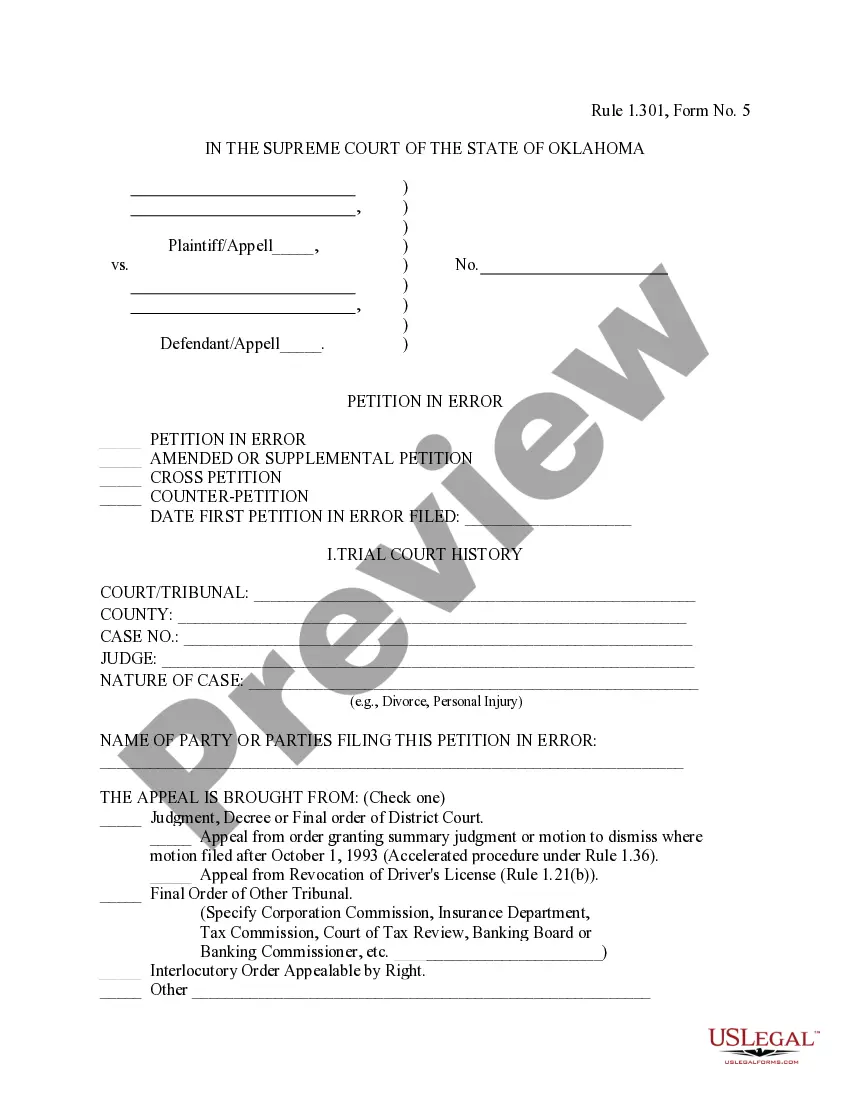

How to fill out Cook Illinois Declare None - Resolution Form - Corporate Resolutions?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Cook Declare None - Resolution Form - Corporate Resolutions.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Cook Declare None - Resolution Form - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Cook Declare None - Resolution Form - Corporate Resolutions:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Cook Declare None - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The obligation to file resolutions with the Registrar of Companies is primarily covered by Chapter 3 of Part 3 of the Companies Act 2006. This checklist gives an overview of the resolutions that must be filed with the registrar of companies.

MGT-14 needs to be filed by a company with the Registrar of Companies (RoC) in accordance with section 94(1) and 117(1) of the Companies Act 2013 and the rules made thereunder. However, the private companies are exempted from filing Board Resolutions.

aspect ratio resolutions: 640×480, 800A600, 960A720, 1024A768, 1280A960, 1400A1050, 1440A1080 , 1600A1200, 1856A1392, 1920A1440, and 2048A1536.

Company resolutions are legally binding decisions made by the members (shareholders or guarantors) or directors of a limited company.

Three forms of resolutions are available: ordinary resolution, special resolution, and unanimous resolution.

Which resolutions must be filed with Companies House? While all special resolutions must be filed with the registrar of companies, comparatively few ordinary resolutions need to be filed with them. Only the following ordinary resolutions are required: Authorising directors to allot shares.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

Any shareholders' resolution, other than an ordinary resolution dealing with routine business is likely to require filing at Companies House. Board resolutions do not need to be filed at Companies House. Most resolutions must be filed within 15 days.

What is Resolution? The resolution is a plan sent to the meeting for discussion and approval. If the motion is approved by the members present at the meeting unanimously, it is referred to as a resolution. Three forms of resolutions are available: ordinary resolution, special resolution and unanimous resolution.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16 June 2021