Fulton Georgia Sample Letter for Free Delivery Limitations Change

Description

How to fill out Sample Letter For Free Delivery Limitations Change?

Drafting legal paperwork can be challenging. Furthermore, if you opt to engage a legal expert to compose a business contract, documents for ownership transfer, prenuptial agreement, divorce forms, or the Fulton Sample Letter regarding Free Delivery Restrictions Change, it may result in significant expenses.

So, what is the most effective method to conserve time and funds while generating legitimate documents that fully comply with your state and local regulations.

- US Legal Forms is a fantastic option, regardless of whether you're looking for templates for personal or business purposes.

- US Legal Forms boasts the largest online repository of state-specific legal papers, offering users access to current and professionally verified documents for any scenario all consolidated in one location.

- Therefore, if you require the most recent version of the Fulton Sample Letter regarding Free Delivery Restrictions Change, you can effortlessly find it on our site.

- Acquiring the documents requires minimal time.

- Users with an existing account should ensure their subscription is active, Log In, and select the template using the Download button.

- If you are not yet subscribed, here’s how you can obtain the Fulton Sample Letter regarding Free Delivery Restrictions Change.

- Browse the page and confirm that there is a template suitable for your area.

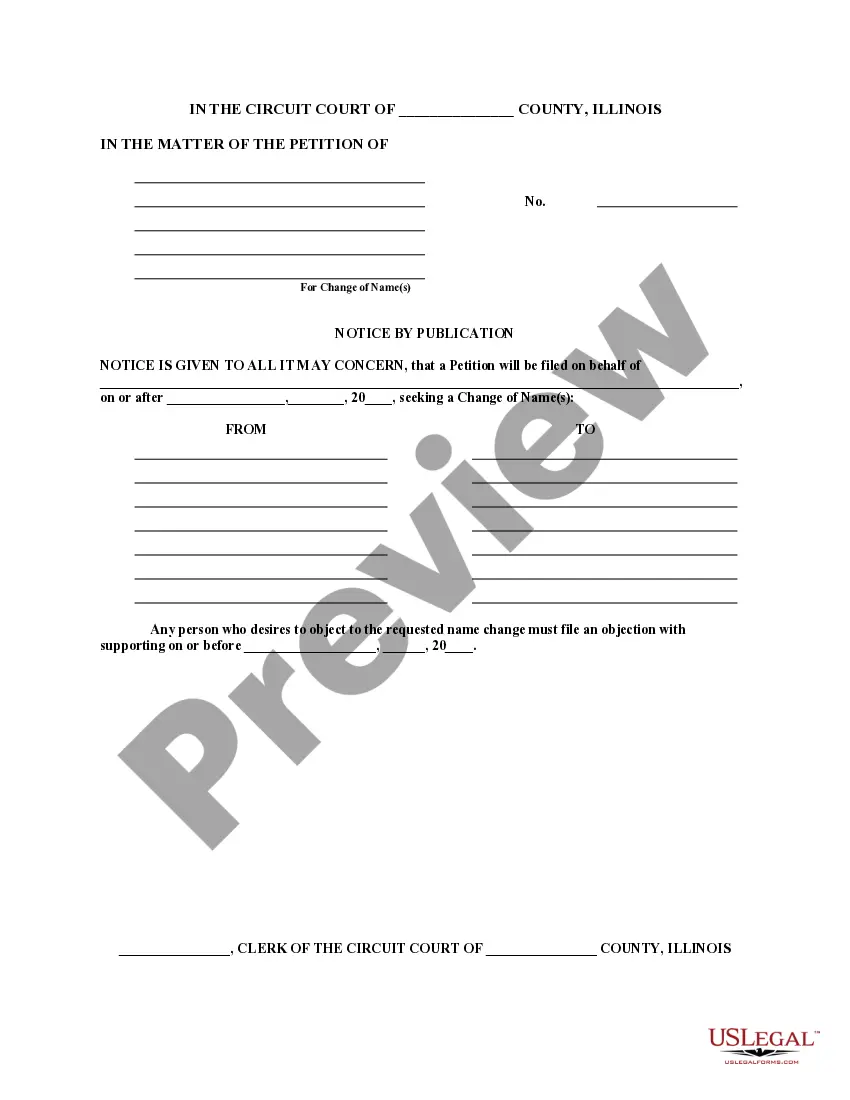

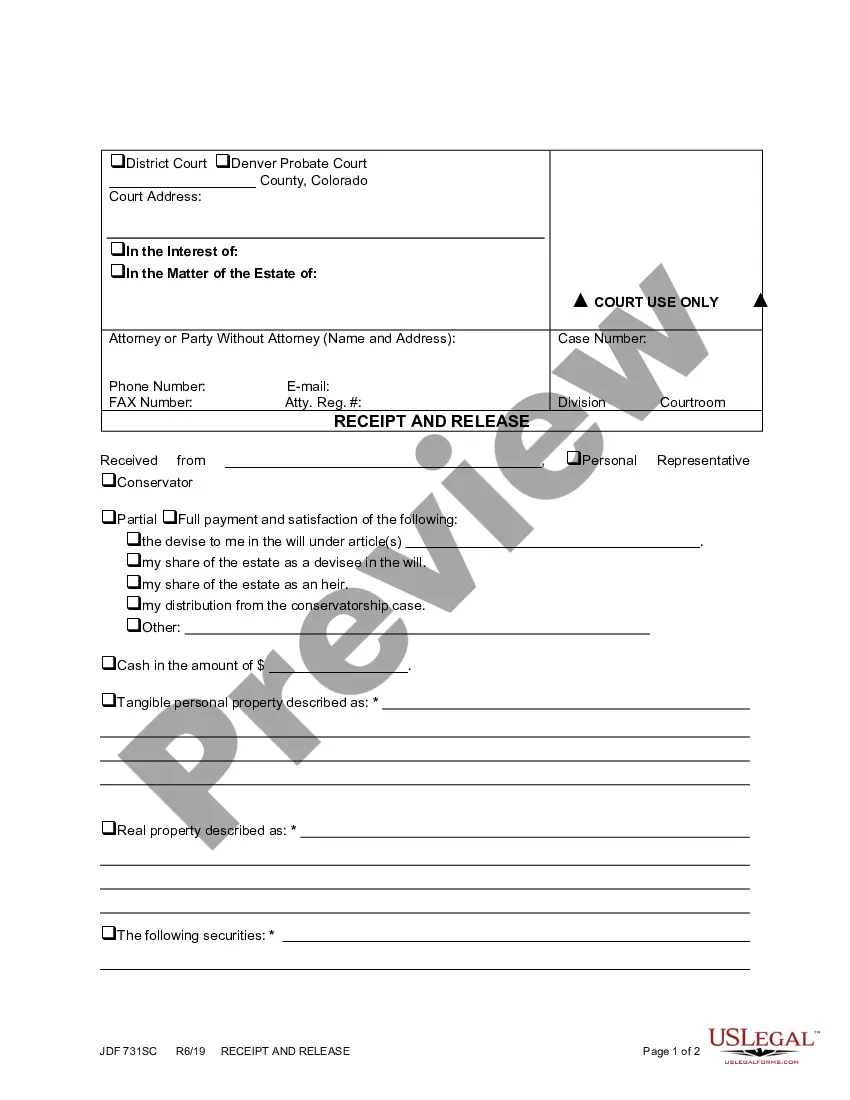

- Review the form description and use the Preview option, if available, to make sure it’s the template you want.

- Don't stress if the form doesn't meet your needs – search for the appropriate one using the header.

- Click Buy Now once you locate the necessary sample and choose the most suitable subscription.

- Log in or create an account to process your subscription payment.

- Complete the transaction using a credit card or PayPal.

- Select your preferred file format for the Fulton Sample Letter regarding Free Delivery Restrictions Change and save it.

- When done, you can print it out and fill it in on paper, or import the template into an online editor for quicker and easier completion.

- US Legal Forms allows you to utilize all the documentation you have ever purchased multiple times – you can locate your templates in the My documents tab within your account.

- Try it out today!

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Dear debt collector: I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. You can contact me about this debt, but only in the way I say below.

While email may be easy, it's not recommended if you need to send a debt validation letter. Instead, send the letter via certified mail with a return receipt so you have proof the creditor received the letter. Or, you can fax it, as long as you keep a copy of the confirmation receipt for your records.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

3 steps for overcoming objections in collections: Validate the consumer's feelings. Debt can be a touchy subject, and if they haven't paid yet, it's probably for a reason.Beat them to the punch. The best way to overcome an objection is to beat them to the punch and take it right out of their arsenal.Give options.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer. The name of the creditor to whom the debt is owed.The account number associated with the debt (if any)

Sample letter requesting debt validation If a debt collector has contacted you and you want to determine whether the debt is yours or not, you can also send a letter to the company by mail or email mail requesting a validation of debt.

10 Best Practices for More Effective Collections Calls Smile during the call.Use the person's name during the call, but don't overdo it. Speak confidently, concisely, and never emotionally.Listen carefully but also use silence when necessary to keep control of the call. Stay calm, even if the customer gets upset.

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.