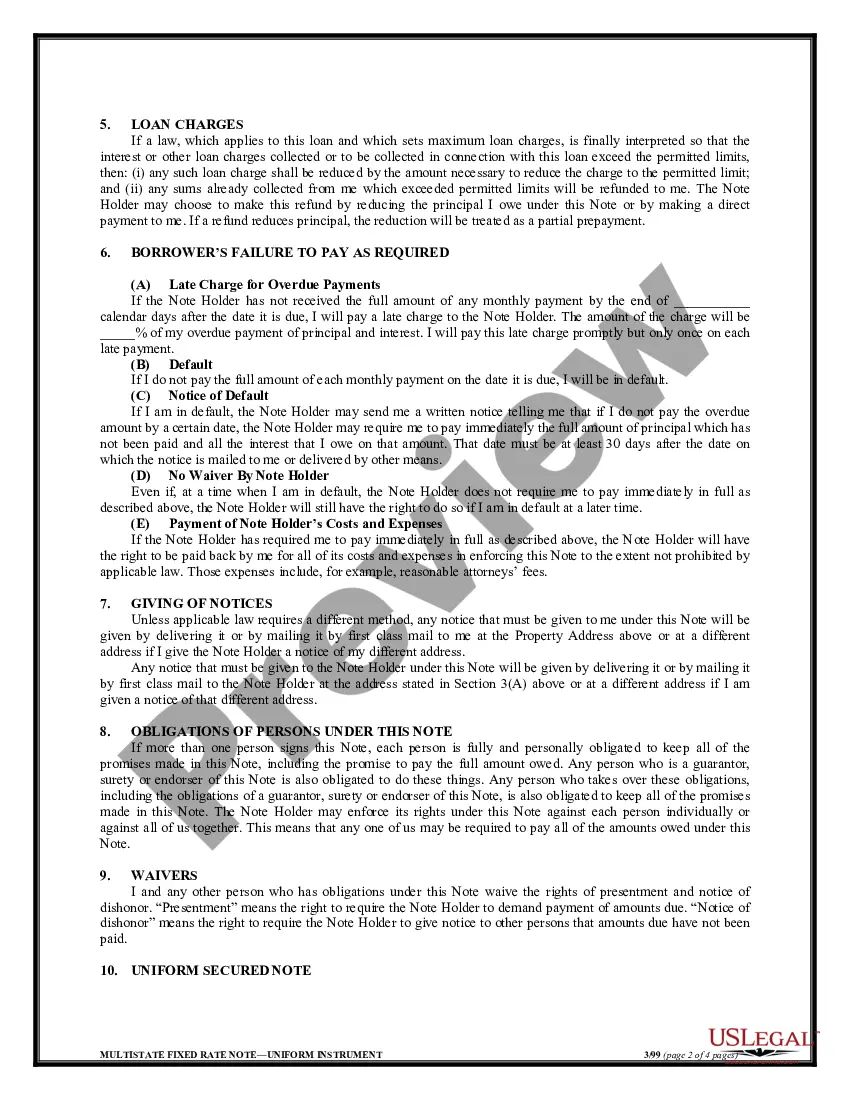

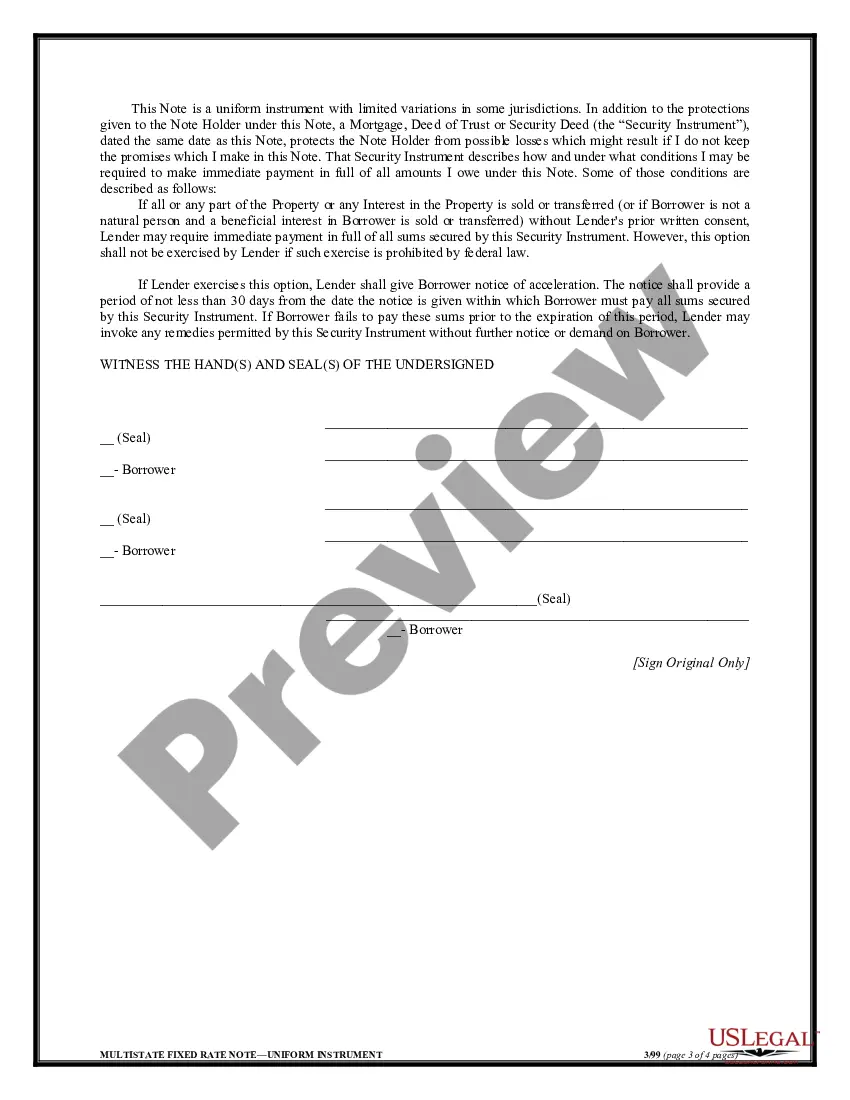

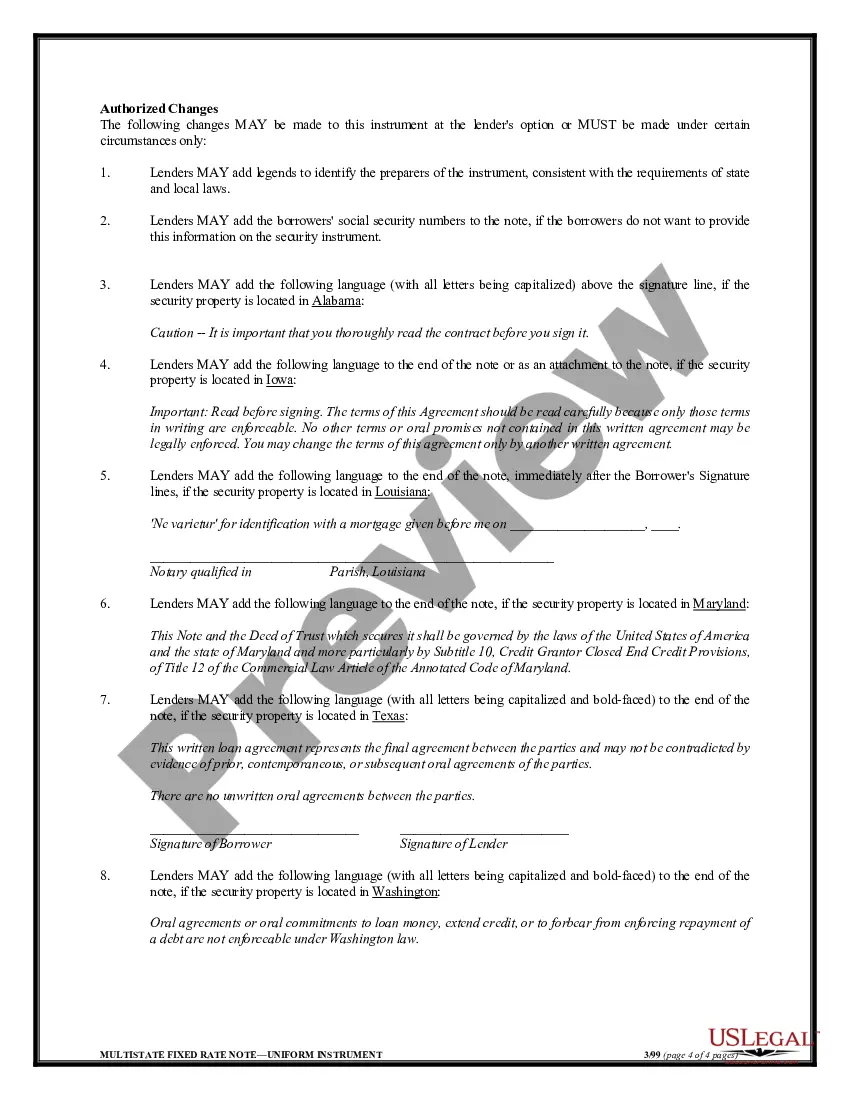

Oakland Michigan Balloon Secured Note

Description

How to fill out Balloon Secured Note?

How long does it generally take you to create a legal document.

Since each state has its own laws and regulations for various life circumstances, locating an Oakland Balloon Secured Note that satisfies all local criteria can be exhausting, and obtaining it from a qualified attorney is often expensive.

Numerous online platforms provide the most requested state-specific documents for download, but utilizing the US Legal Forms repository is the most advantageous.

Register for an account on the site or Log In to proceed to payment choices. Complete the payment using PayPal or your credit card. Adjust the file format if needed. Click Download to save the Oakland Balloon Secured Note. Print the document or utilize any preferred online editor to fill it out electronically. Regardless of how many times you need to utilize the purchased document, you can access all the files you have ever saved in your account by opening the My documents section. Give it a shot!

- US Legal Forms is the most extensive online collection of templates organized by states and areas of application.

- Besides the Oakland Balloon Secured Note, you can access any particular form to manage your business or personal matters, adhering to your county regulations.

- Experts validate all templates for their relevance, ensuring you can prepare your paperwork accurately.

- Using the service is quite straightforward.

- If you already possess an account on the site and your subscription is active, you simply need to Log In, select the required sample, and download it.

- You can retrieve the file in your account at any future time.

- If you are new to the site, you will need to complete some additional steps before acquiring your Oakland Balloon Secured Note.

- Review the content of the page you’re visiting.

- Examine the description of the sample or Preview it (if available).

- Search for alternative forms using the related option in the header.

- Press Buy Now once you are certain about the selected file.

- Choose the subscription plan that fits your needs best.

Form popularity

FAQ

To reduce your balloon payment, you will need to check the terms of your financing agreement and then specifically advise your bank that any additional repayments are to be used to reduce the balloon amount.

If you don't have the funds to settle your balloon payment and if you don't qualify for credit for refinancing, then you risk repossession. This could also get you blacklisted. It's more expensive.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan. The Federal TRUTH IN LENDING ACT (15U. S.C.A.

Generally, a balloon payment is more than two times the loan's average monthly payment, and often it can be tens of thousands of dollars. Most balloon loans require one large payment that pays off your remaining balance at the end of the loan term.

You pay more interest on your loan when you have a balloon payment. That's because you're effectively paying interest on the value of the residual value or balloon payment for the entire term of the loan. A key benefit of having a RV or balloon payment is lower monthly repayments.

Often, when a borrower has paid as agreed, but is unable to make the balloon payment, the bank will convert the loan to full amortization. This means it will become a full 25-year loan as opposed to coming due in five years.

What Happens When the Balloon Payment Is Due? When your balloon payment is due, you have two choices to pay it off: You can take out another mortgage for the amount of the balloon payment or you can sell your home and use the proceeds to pay it off.

Is a balloon loan a good idea? A balloon loan comes with both potential benefits and drawbacks. The one main benefit is the reduced monthly loan payments. A balloon loan allows you to finance a car with monthly payments that are usually lower than the payments you'd make with a traditional auto loan.

Lenders will typically allow you to negotiate your balloon payment amount, which alters the percentage of the total loan amount that the balloon payment comprises.