Plano Texas Fee Estimate Worksheet

Description

Form popularity

FAQ

In San Antonio, permits can be obtained through the City’s Development Services Department. They offer an online portal for convenience, allowing you to apply, check the status, and find additional resources effortlessly. If you are unsure about the permitting process or need guidance on your project, the Plano Texas Fee Estimate Worksheet can serve as a useful tool to streamline your planning.

The size of a building you can construct without a permit varies by local regulations, but generally, structures under 200 square feet may not need a permit. However, exemptions can differ across municipalities in Texas, so it's best to verify local codes. To make informed decisions regarding your construction plans, consider completing a Plano Texas Fee Estimate Worksheet.

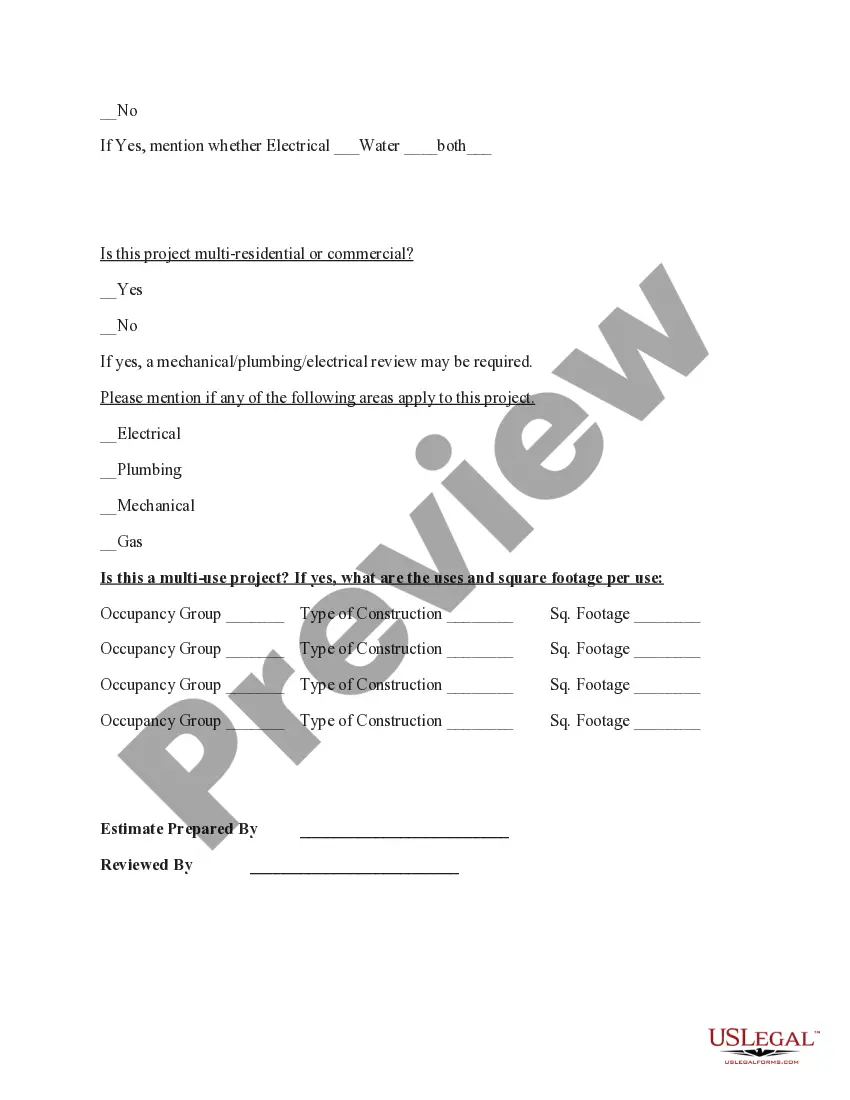

In Texas, you need a building permit for significant construction projects like new homes, large additions, or commercial buildings. Renovations that affect structural elements or require electrical and plumbing modifications also require permits. Staying informed about these requirements is essential, and utilizing the Plano Texas Fee Estimate Worksheet can provide clarity on your project’s needs.

Texas allows homeowners to build certain structures without a permit. Typically, you can construct fences, small storage sheds, and play structures without needing official approval. However, it’s wise to check local regulations, as they may vary, especially for larger projects. For anything more complex, a Plano Texas Fee Estimate Worksheet could help you assess your needs effectively.

In Plano, TX, you do not need a permit for a garage sale as long as you adhere to the city's regulations. You can hold up to two garage sales per year without a permit, and each sale can last for no more than three consecutive days. To ensure a smooth process, consider using the Plano Texas Fee Estimate Worksheet for any other projects that may require permits.

In Texas, property taxes are based on the appraised value of a property, which is determined by the local appraisal district. This value may differ from market value due to various factors, including condition and location. For clarity on how these values impact your taxes, the Plano Texas Fee Estimate Worksheet is a practical tool to utilize.

Plano, Texas, is located primarily in Collin County, but it also extends into Denton County. Understanding your county can affect tax calculations and local regulations. Use the Plano Texas Fee Estimate Worksheet to ensure you are considering the correct parameters for your property.

To estimate property taxes in Texas, find your property’s appraised value and the local tax rate. Multiply these figures together and consider any exemptions that might apply. The Plano Texas Fee Estimate Worksheet can simplify this process, providing a user-friendly way to gauge your future tax obligations.

Property taxes in Texas are calculated by multiplying the assessed value of your property by the local tax rate. It's essential to factor in exemptions that may apply to you, which can lower your overall tax bill. For a detailed breakdown, consider using the Plano Texas Fee Estimate Worksheet to guide your calculations.

To determine your property taxes in Texas, check the county appraisal district’s website or contact them directly. These resources provide information about assessed values and tax rates. Additionally, using the Plano Texas Fee Estimate Worksheet can streamline your search, helping you calculate your estimated property taxes with ease.