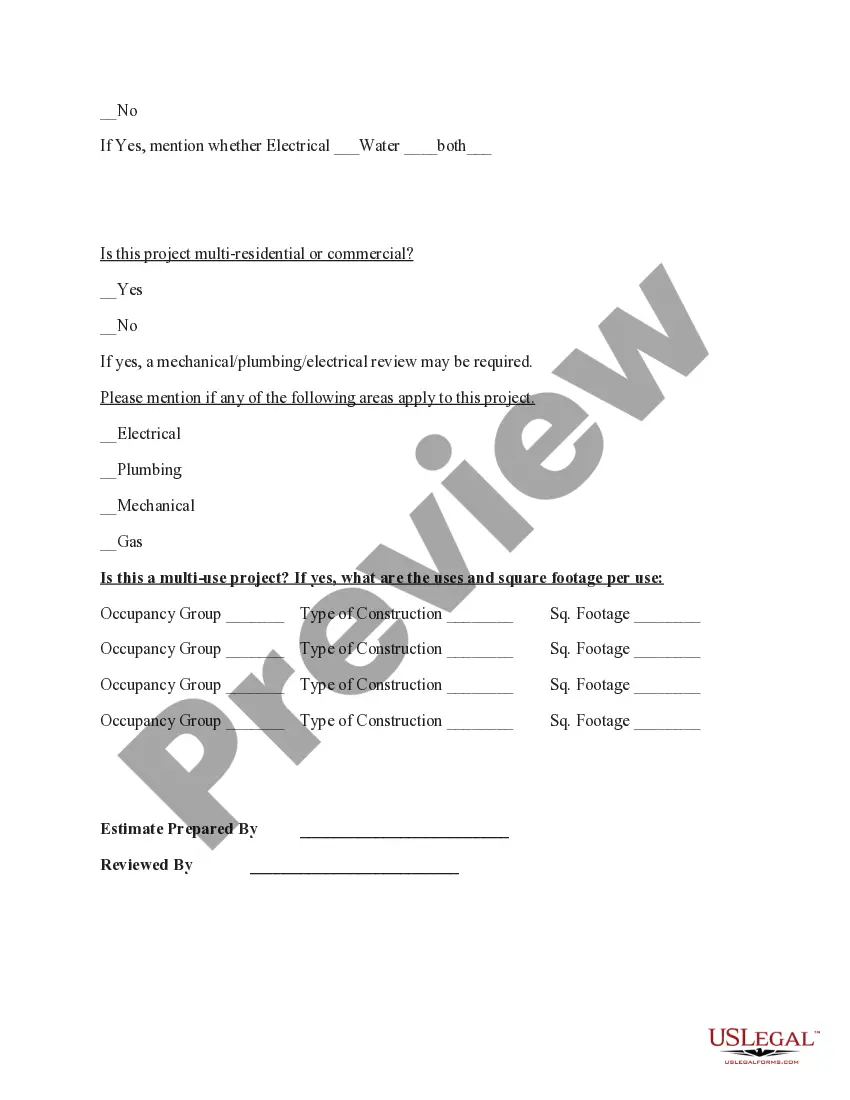

Mesa Arizona Fee Estimate Worksheet

Description

Form popularity

FAQ

To find your Arizona tax liability, you can calculate it based on your income and deductions using the Arizona tax tables provided by the state. Additionally, tools like the Mesa Arizona Fee Estimate Worksheet can help simplify this process, giving you an idea of what you will owe before the tax season arrives.

Yes, Arizona requires most taxpayers to make quarterly estimated tax payments if they expect to owe $1,000 or more in taxes for the year. These payments help taxpayers stay on track and avoid penalties. By using a Mesa Arizona Fee Estimate Worksheet, you can figure out your quarterly obligations more accurately and easily.

To make an estimated tax payment in Arizona, you can use the Arizona Department of Revenue's online payment system. You will need to provide your personal information along with your payment details. For assistance in estimating your payment amounts, consider using a Mesa Arizona Fee Estimate Worksheet to help determine what you owe.

In Arizona, the penalty for underpayment of estimated taxes is generally calculated as a percentage of the underpaid tax. This penalty can accumulate if the underpayment is not corrected by the time the tax return is filed. Utilizing a Mesa Arizona Fee Estimate Worksheet can help you avoid underpayment by providing a clearer view of your estimated tax obligations.

To make an Arizona PTE payment, visit the official Arizona Department of Revenue website. You can complete the payment online using their secure portal. If you’re preparing a Mesa Arizona Fee Estimate Worksheet, this resource will help ensure your calculations are accurate, making your payment process smoother.

Line 29a on Arizona Form 140 is used to report your tax refund from the previous year that you applied to your current tax return. It is important to note this amount, as it directly affects your total tax due. Using the Mesa Arizona Fee Estimate Worksheet can help you track such details and prepare your taxes efficiently.

Arizona state tax is calculated based on your taxable income and the tax rates set by the state. The process includes identifying your income, applying deductions, and using the appropriate tax brackets. To simplify this, individuals can rely on the Mesa Arizona Fee Estimate Worksheet for an accurate calculation of their estimates and liabilities.

The Transaction Privilege Tax (TPT) in Mesa, Arizona, is a tax on the privilege of doing business in the city. It applies to various types of business activities, including retail sales and contracting services. Understanding TPT is crucial, and using the Mesa Arizona Fee Estimate Worksheet allows businesses to estimate their tax obligations clearly.

Yes, Arizona requires many taxpayers to make quarterly estimated tax payments. If you expect to owe more than a certain amount in state taxes, you must send estimated payments throughout the year. Utilizing the Mesa Arizona Fee Estimate Worksheet can help you calculate your quarterly obligations accurately.

If you underpay your estimated tax payments in Arizona, you may face a penalty. This penalty typically accrues if you do not meet the required amount or if your payments are late. It's essential to manage your estimates wisely using tools like the Mesa Arizona Fee Estimate Worksheet to avoid penalties and ensure compliance.