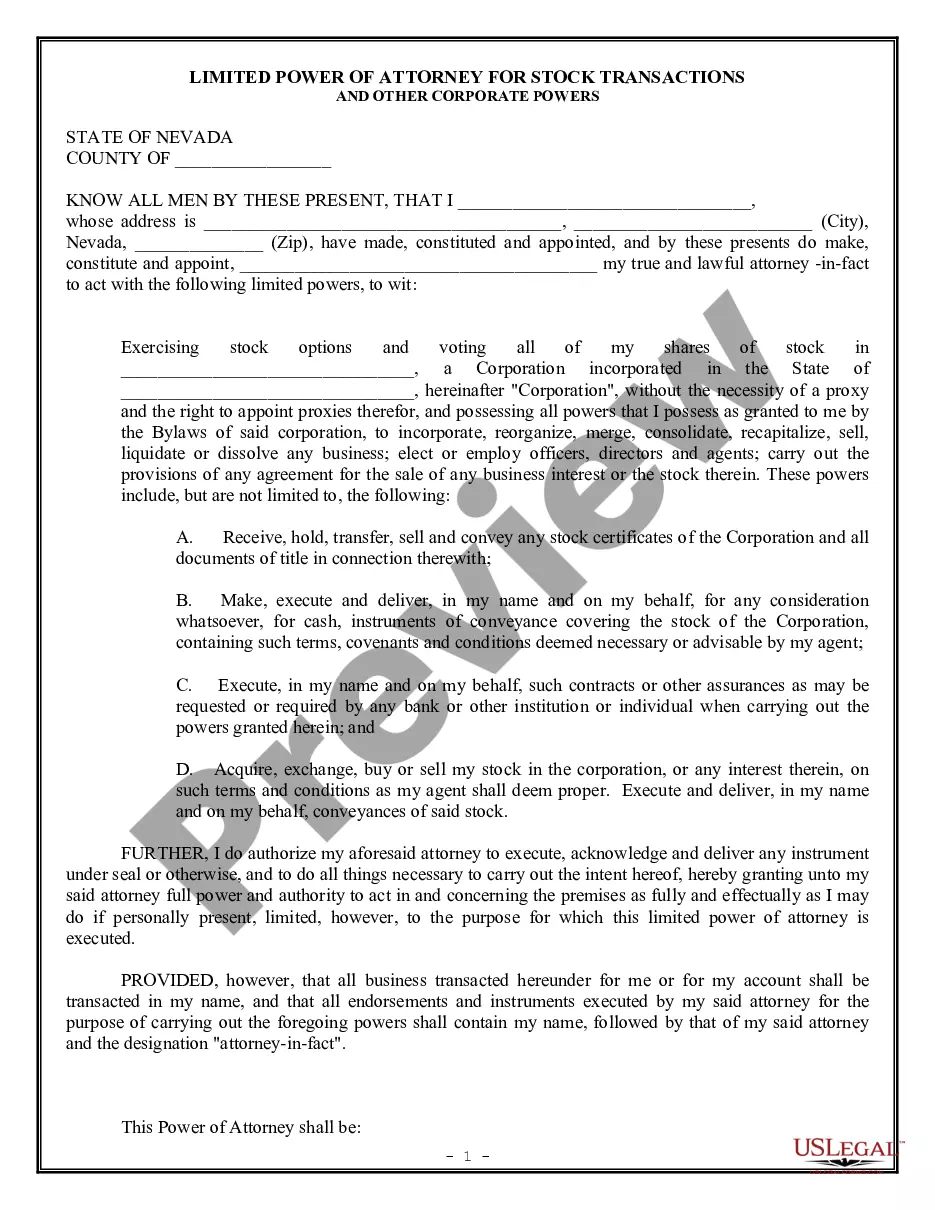

Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust without the necessity of court supervision in the event of the trustor's incapacity or death. Other provisions of the trust document include: trust assets, disposition of income and principal, and administration of the trust assets after the death of the trustor.

Bexar Texas Living Trust - Revocable

Description

How to fill out Living Trust - Revocable?

Drafting documents for business or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is vital to consider all federal and state regulations of the specific area.

However, small counties and even municipalities also have legislative measures that you need to keep in mind.

The wonderful aspect of the US Legal Forms library is that all the documents you've ever acquired are never lost – you can retrieve them in your profile under the My documents tab whenever you need. Enroll in the platform and conveniently acquire verified legal forms for any purpose with just a few clicks!

- All these elements make it daunting and labor-intensive to create a Bexar Living Trust - Revocable without professional assistance.

- It's simple to sidestep the expense of attorneys drafting your documents and establish a legally binding Bexar Living Trust - Revocable independently, utilizing the US Legal Forms online library.

- This is the most comprehensive internet repository of state-specific legal templates that are professionally verified, ensuring their legitimacy when selecting a template for your county.

- Previous subscribers only need to Log In to their accounts to obtain the required form.

- If you do not yet hold a subscription, follow the step-by-step instructions below to acquire the Bexar Living Trust - Revocable.

- Review the page you've accessed and confirm if it contains the document you need.

- To achieve this, utilize the form description and preview if those features are present.

Form popularity

FAQ

Some of the Cons of a Revocable TrustShifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

The Pros and Cons of Revocable Living TrustsProbate can be avoided.Ancillary probate in another state can also be avoided.Protection in case of incapacitation.No immediate tax benefits.No asset protection.It requires some administrative work.More items...

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

You can protect your assets and achieve your goals through the use of a living trust. In simple terms, a trust functions as an intermediary between you and your intended beneficiariesa conduit used throughout your lifetime and/or after your death.

The primary benefit of creating a revocable trust is that it provides a prearranged mechanism that will ensure the continued management and preservation of your assets, should you become disabled. It can also set forth all of the dispositive provisions of your estate plan.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Anyone who is single and has assets titled in their sole name should consider a revocable living trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship, and to allow your beneficiaries to avoid the costs and hassles of probate.