Collin Texas Revocable Living Trust for Married Couple

Description

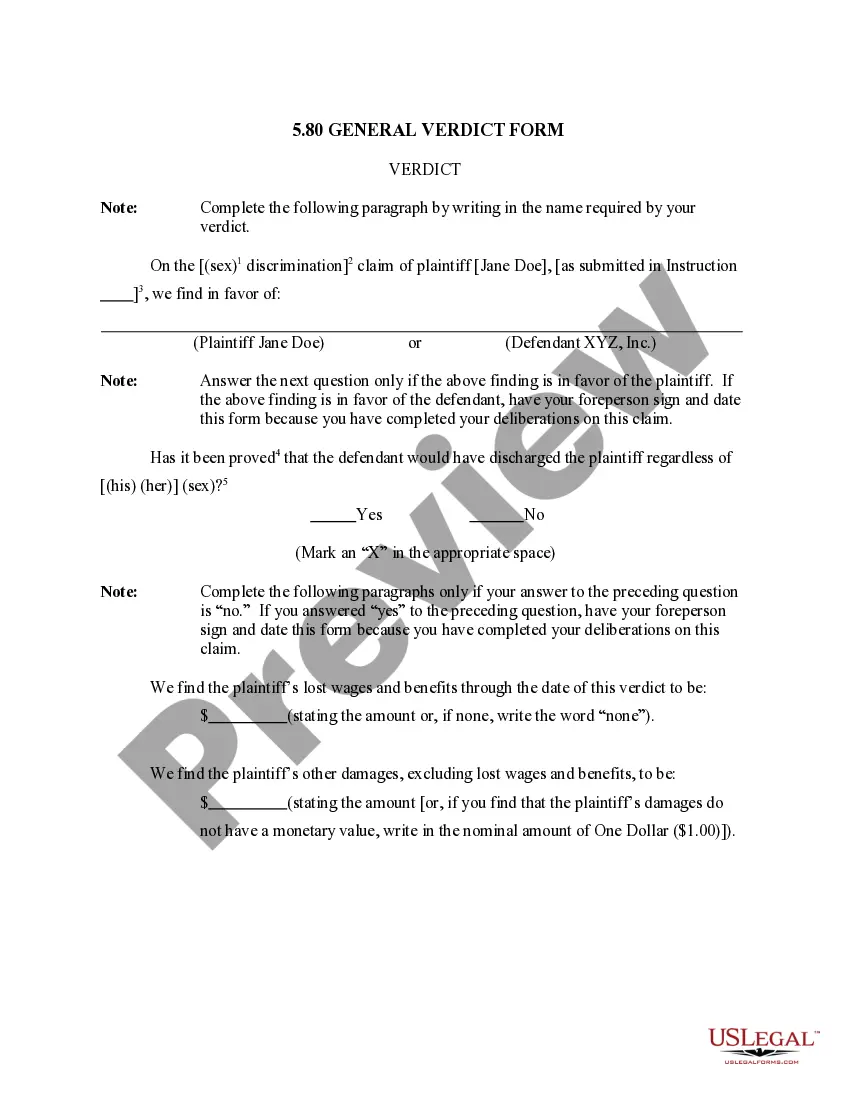

How to fill out Revocable Living Trust For Married Couple?

How long does it usually take you to create a legal document.

Since each state has its own laws and regulations for every life circumstance, finding a Collin Revocable Living Trust for Married Couple that meets all local criteria can be challenging, and obtaining it from a professional attorney is often expensive.

Many online services provide the most commonly used state-specific documents for download, but using the US Legal Forms library is the most advantageous.

Create an account on the platform or Log In to move on to payment options. Make a payment through PayPal or with your credit card. Alter the file format if necessary. Click Download to save the Collin Revocable Living Trust for Married Couple. Print the template or use any preferred online editor to complete it digitally. Regardless of how many times you need to use the purchased template, you can find all the documents you've ever saved in your profile by accessing the My documents section. Give it a go!

- US Legal Forms is the largest online repository of templates, categorized by states and areas of application.

- In addition to the Collin Revocable Living Trust for Married Couple, you can find any specific form to manage your business or personal matters, adhering to your county regulations.

- Experts verify all templates for their relevance, ensuring you can prepare your paperwork correctly.

- Utilizing the service is extremely straightforward.

- If you already have an account on the platform and your subscription is active, you just need to Log In, select the desired template, and download it.

- You can retrieve the file in your profile at any later time.

- If you are new to the site, there will be a few additional steps to complete before acquiring your Collin Revocable Living Trust for Married Couple.

- Review the content of the page you’re currently on.

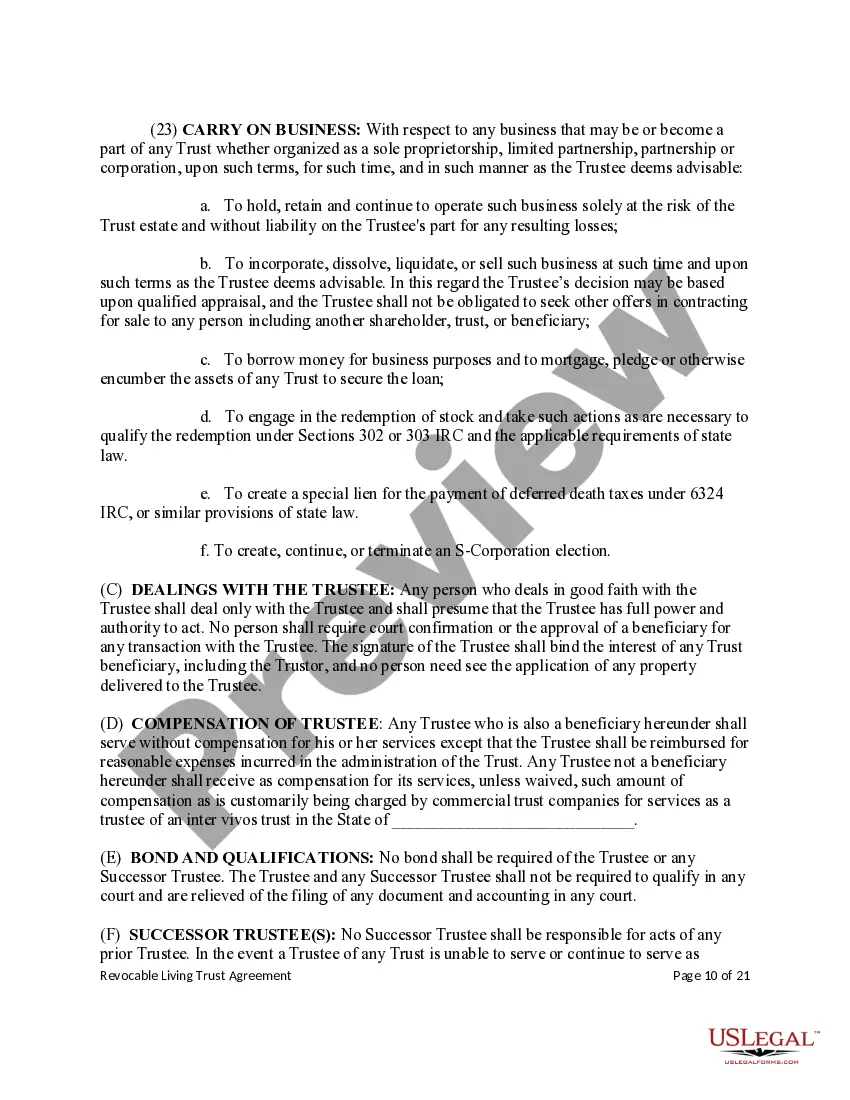

- Examine the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re confident in your selected file.

- Choose the subscription plan that fits you best.

Form popularity

FAQ

Joint Revocable Trusts can be a solid option when a married couple has a generally simple estate and when total assets (combined) don't meet the estate tax limit threshold, which is $11.58m in 2020. Keep in mind, though, that a Joint Revocable Living Trust, when not set up properly, may result in estate tax issues.

Trusts for Spouses California follows the law of community property, which means that each spouse owns a half interest in community property and a full interest in any separate property. Each spouse is allowed to decide who receives their half of the community property when they die.

A marital trust is a type of irrevocable trust that allows one spouse to transfer assets to a surviving spouse tax free, using the unlimited marital deduction, while providing benefits not available if transferred outright.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Marital Lifetime Revocable Trusts - A clear-cut, simple Trust that can be amended or revoked by either spouse during their lifetime. Also allows for amending and revoking by surviving spouses. Marital Disclaimer Trusts - Allows for the deceased spouse's assets in the Trust to simply transfer to the surviving spouse.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

Simple Living Trusts for Married Couples Simple living trusts are often considered the easiest kinds of trusts to set up and keep. In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust.

Revocable trusts are a good choice for those concerned with keeping records and information about assets private after your death. The probate process that wills are subjected to can make your estate an open book since documents entered into it become public record, available for anyone to access.

Anyone who is single and has assets titled in their sole name should consider a revocable living trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship, and to allow your beneficiaries to avoid the costs and hassles of probate.