Wayne Michigan Equipment Lease - General

Description

How to fill out Equipment Lease - General?

Laws and statutes in different domains differ across the nation.

If you aren't an attorney, it's simple to become overwhelmed by numerous standards when it comes to creating legal documents.

To prevent expensive legal fees while drafting the Wayne Equipment Lease - General, you require a validated template that is authentic for your area.

This is the simplest and most economical method to obtain current templates for any legal situations. Find them all with just a few clicks and keep your paperwork organized with US Legal Forms!

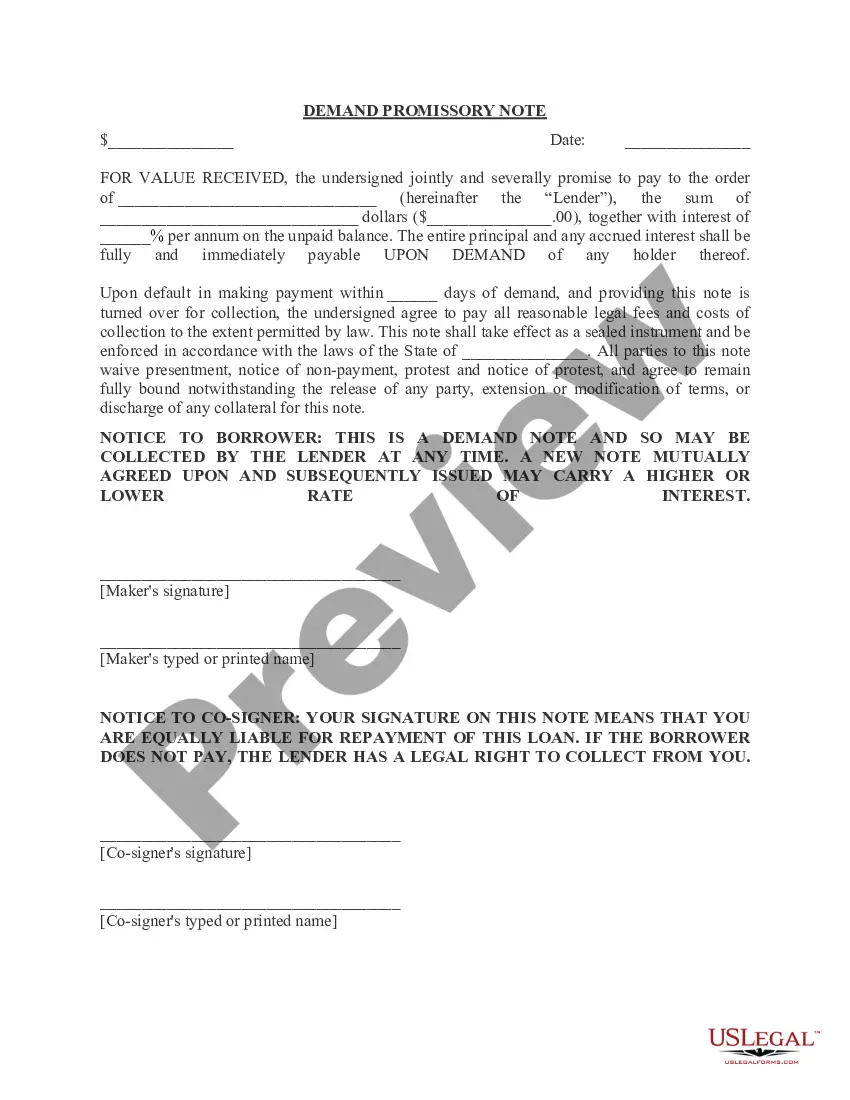

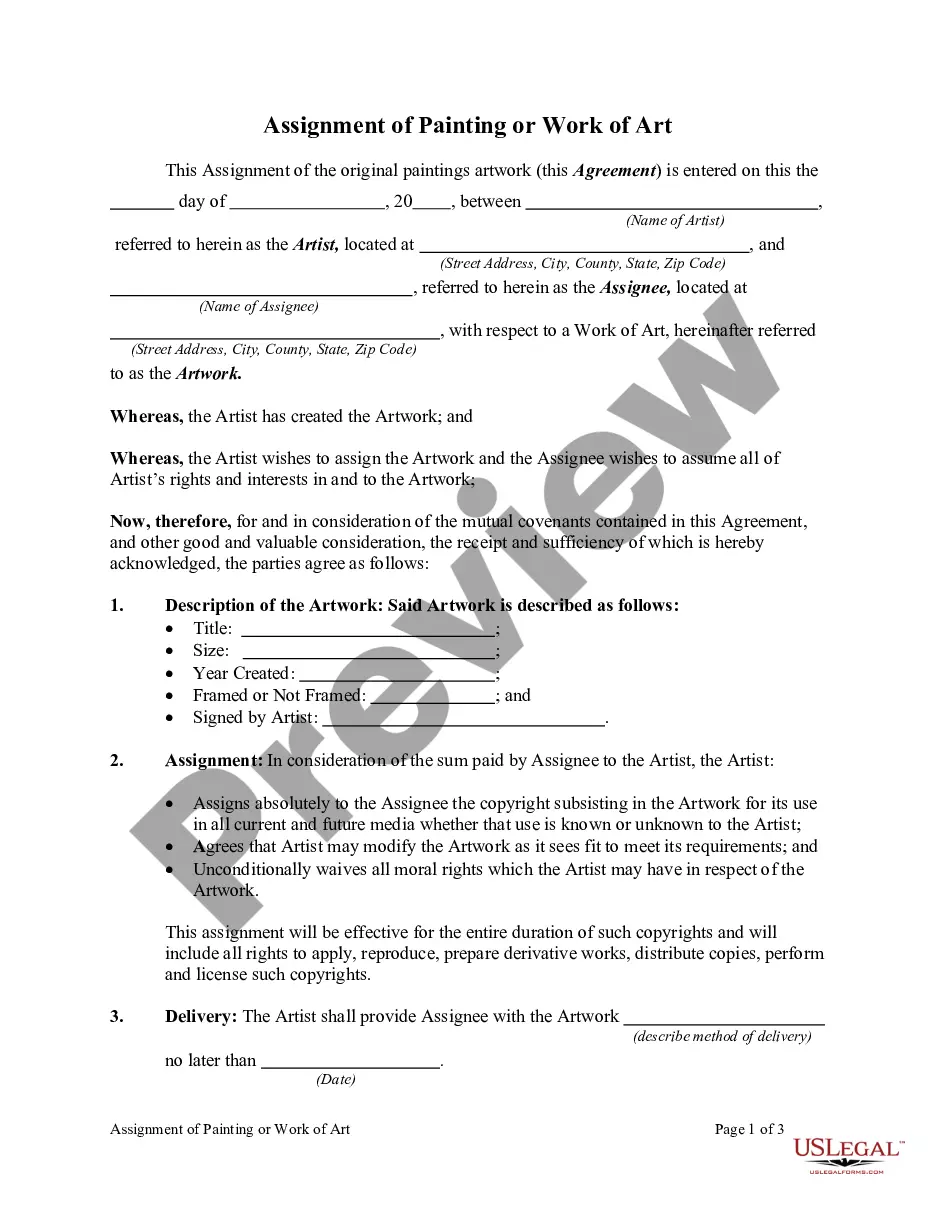

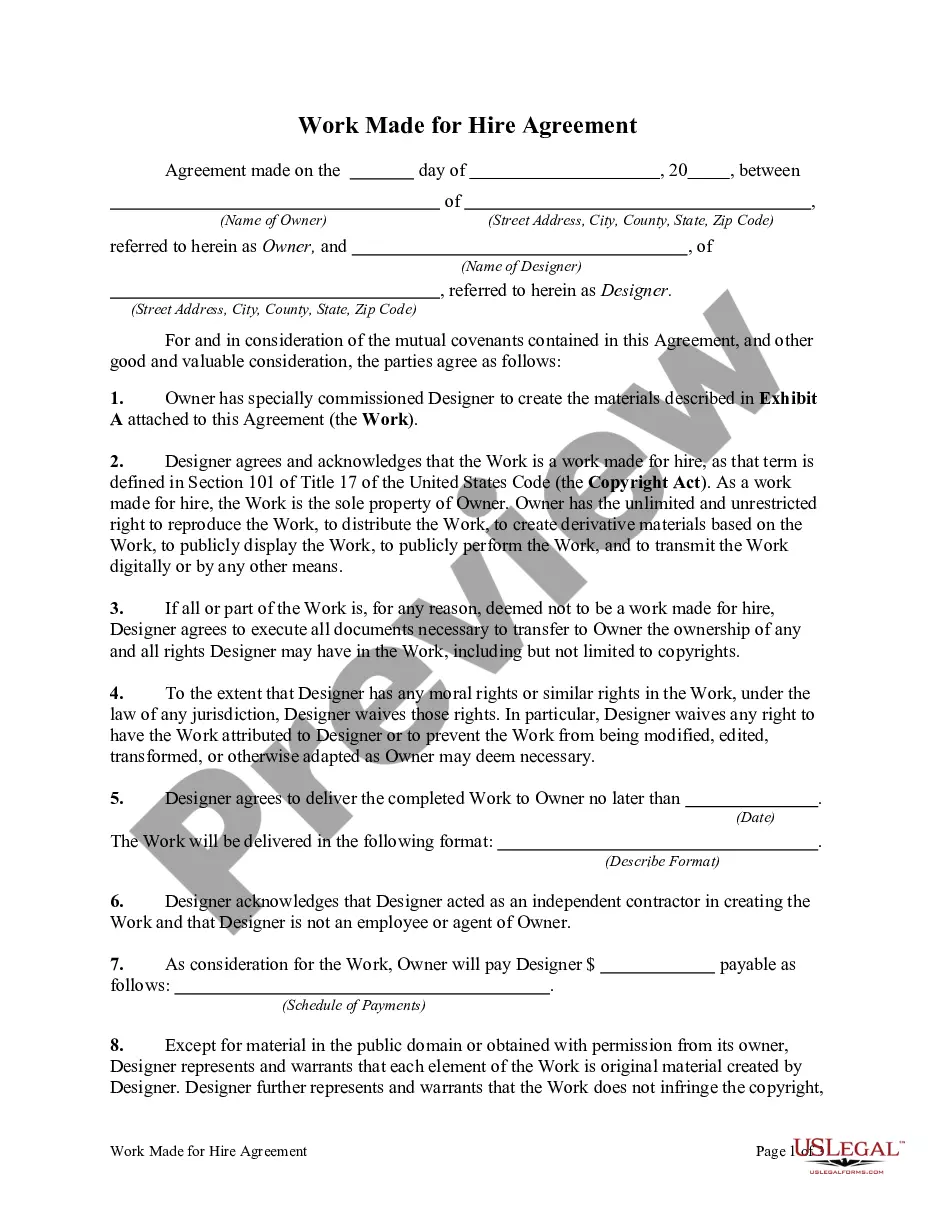

- Examine the webpage content to verify that you have located the suitable sample.

- Utilize the Preview feature or review the form description if it’s provided.

- Look for an alternative document if there are discrepancies with any of your requirements.

- Employ the Buy Now button to acquire the template once you identify the accurate one.

- Select one of the subscription plans and log in or establish an account.

- Decide how you wish to pay for your subscription (using a credit card or PayPal).

- Choose the format you want to save the document in and click Download.

- Finish and sign the template in writing after printing it or handle everything electronically.

Form popularity

FAQ

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

IFRS 16 requires a lessee to include lease incentives in the measurement of both the right-of-use asset and the lease liability. Therefore all forms of lease incentive should be considered when determining the carrying amount of the lease liability and the right-of-use asset.

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Initial recordation. Calculate the present value of all lease payments; this will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account.

A Leased Asset is an asset leased by the owner to another party in return of money or any other favor. While leasing an asset, the owner enters into a contract allowing the other party the temporary use of an asset.

The company can make the finance lease journal entry by debiting the lease asset account and crediting the lease liability account. In this journal entry, the amount of lease asset or lease liability recorded is the fair value of total lease payments.